Flexible Battery Market Size & Overview

Get more information on Flexible Battery Market - Request Sample Report

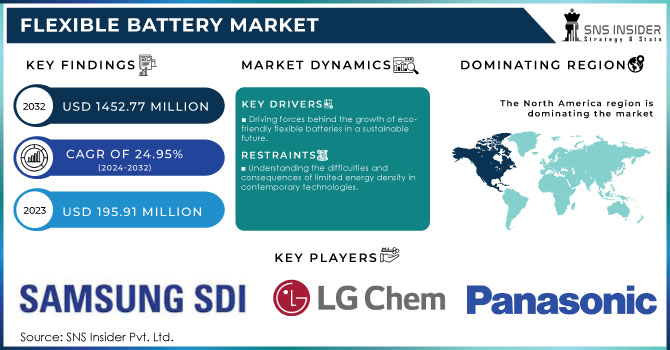

The Flexible Battery Market Size was valued at USD 195.91 Million in 2023. It is estimated to reach USD 1452.77 Million by 2032, growing at a CAGR of 24.95% during 2024-2032.

The growing need for creative, lightweight, and portable energy solutions is driving the emergence of the flexible battery market as a crucial sector within the overall energy storage industry. Flexible batteries can bend, roll, or fold without losing their energy storage capacity. This characteristic makes them perfect for being incorporated into small and adaptable electronic gadgets, wearables, and various IoT (Internet of Things) uses. IoT applications in the United States have seen significant expansion, with an expected 14.4 billion connected devices in 2023, and forecasts suggesting a potential increase to 30.9 billion by 2025. It is projected that the IoT market will grow to around USD 1.1 trillion by 2026, fueled by rising funding in the smart home, healthcare, and industrial IoT sectors. The growth of the flexible battery market is primarily driven by its ability to overcome the constraints of conventional, inflexible batteries. Traditional batteries, commonly used in various applications, can limit the design options for devices, especially in industries such as consumer electronics, healthcare, and automotive. Flexible batteries, however, enable more imaginative and ergonomic designs that cater to the preferences of contemporary users who value portability, convenience, and connectivity.

Flexible batteries are transforming wearable medical devices like continuous glucose monitors, ECG patches, and other diagnostic tools in the healthcare industry. These gadgets need a consistent and trustworthy power supply that can adjust to the motion and bends of the human body. For instance, BrightVolt manufactures thin, flexible batteries for medical wearables that can be incorporated into smart bandages or patches. The improvements in flexible battery technology improve patient comfort and compliance, as well as enabling more advanced real-time monitoring and diagnostics, ultimately leading to better healthcare results. Flexible batteries can fulfill these criteria by being light and discreet, improving patient comfort while also guaranteeing reliable performance. This is especially crucial in advancing the next-gen wearable technologies that offer real-time health monitoring and diagnostic features.

Flexible Battery Market Dynamics

Drivers

-

Driving forces behind the growth of eco-friendly flexible batteries in a sustainable future.

Environmental concerns and growing demand for sustainable ecology solutions foster the appearance of eco-friendly flexible batteries. Traditional batteries include hazardous chemicals and metals, and as a result, depositary processing of such items causes environmental issues. Meanwhile, flexible batteries may contain biodegradable or recyclable elements, reducing the environmental impact of their disposal.

Another factor facilitating the rapid development of the flexible battery market is the growing emphasis on sustainability in consumers’ and businesses’ behavior. As companies are willing to introduce Greentech elements to their products, flexible batteries become an essential part of this initiative. In addition, governments implement regulations for decreasing electronic waste and overall toxic pollution, which also results in massive demand for batteries with such characteristics. High-quality batteries, valuable for their materials, are more likely to be recycled. In the European Union, for example, recycling is a priority, and the development of flexible batteries made of recyclable materials will be in high demand.

Overall, the environmental concern and the growing tendency towards renewable energy sources, e.g. solar or wind, significantly impact the flexible battery market since only flexible items can store such energy more effectively and sustainably than traditional batteries, which can be recharged a low number of cycles.

-

The rise of flexible batteries in the expanding Internet of Things industry.

The Internet of Things is a rapidly growing industry that connects millions of devices, starting from smart home appliances and industrial sensors to medical instruments. Most of these devices require efficient, lightweight, and enduring sources of power, and a flexible battery could be used as one. As the majority of IoT devices are relatively small and often embedded in locations, where a conventional battery does not fit, flexible ones seem to provide an ideal solution. They are thin and lightweight that can be customized to meet the demands of IoT applications. Thus, IoT devices installed in smart homes, such as smart locks, thermostats, or cameras are likely to be placed in small spaces, meaning that a conventional battery would be too massive to fit the space. Furthermore, flexible batteries are vital for industrial IoT solutions, where sensors are placed in rough or small locations to monitor machinery. In such cases, the devices should be heavily resistant, and flexible batteries are more endure, probably because of their material and design. Moreover, they are likelier to be in demand as the IoT industry develops for no less than another reason. As it transpires, with the rise of the IoT industry, there is a growing need for a sustainable source of energy, and flexible batteries can be made of eco-friendly materials. This meeting of the demand for sustainability, stipulated by the green technology trend characteristic of the majority of industries these days, and the quest for a compact and efficient source of energy is probably going to be a key issue that will ensure further growth of the flexible battery market.

Restraints

-

Understanding the difficulties and consequences of limited energy density in contemporary technologies.

Flexible batteries are associated with significant advantages in terms of flexibility and form factor but often demonstrate lower energy density compared to traditional lithium-ion batteries. This drawback is particularly critical as an obstacle to the wider use of such kinds of storage devices. The phenomenon is easily explainable: even though a flexible battery is suitable for being integrated into various devices if its capacity is considerable, its service life would not meet industry standards. This way, the energy capacity of such options would not be suiting for large storage facilities or electric vehicles. By and large, although it is more than enough for small IoT devices and wearables, the idea is realized in practice, which is a pleasant surprise. Moreover, as big companies are broadly promoting these moveable gadgets, there does not impede the technology’s market penetration. Nevertheless, the energy capacity of such batteries prevents them from being used further, for instance, in smartphones and laptops. It is also a sufficient factor to inhibit its use in tones and ships which are currently being engaged in the shift toward electric power sources.

Flexible Battery Market Segmentation

By Type

Thin-film batteries were leading the market in 2023 with a market share of 56%, because of their light weight, flexibility, and suitability for contemporary electronic devices. Constructed with a slender layer of electrodes and electrolytes, these batteries are thin, flexible, and power-efficient. Their compact size makes them perfect for use in small devices like wearable electronics, medical implants, and RFID tags. Major companies such as Samsung SDI and Panasonic have integrated thin-film batteries into their product ranges, with a specific emphasis on IoT devices and portable electronics.

The printed batteries segment is to grow at the fastest CAGR during 2024-2032, because of their new manufacturing process, which includes printing battery materials on flexible substrates. These batteries are cost-effective and simple to produce, which makes them ideal for large-scale manufacturing in uses such as smart cards, disposable medical devices, and environmental sensors. Imprint Energy and Enfucell are leading the way in creating printed batteries for low-power, disposable electronics.

By Voltage

The below 5V segment held a market share of over 55% in 2023 and led the Flexible Battery Market because of the increasing need for compact, portable, and light electronic devices. These flexible batteries with low voltage are ideal for wearables, medical devices, and IoT sensors, where energy efficiency and compact size are important. The flexible design of these devices enables smooth integration, improving functionality and reducing size limitations. For example, Panasonic and Samsung SDI utilize these batteries in smart health monitors and fitness bands, taking advantage of the increasing popularity of personalized health tracking and small electronics.

The 5V to 20V segment is the fastest-growing segment with a rapid CAGR during 2024-2032. It is designed for slightly bigger electronic devices like smartphones, tablets, and portable medical devices that need extra power. These batteries are versatile enough to meet the varied requirements of electronics that require moderate power supply and portability. Companies such as LG Chem and Blue Spark Technologies have incorporated these batteries into a range of consumer electronics, including foldable smartphones and advanced medical diagnostic tools.

By Rechargeability

The primary segment dominated in 2023 with a market share of 56% market share. These batteries are often used in low-power situations where regular replacement is not a concern. The compact and lightweight nature of primary flexible batteries makes them well-suited for wearable devices, medical implants, and sensors. Primary flexible batteries are also appreciated for their extended shelf life, delivering constant power for long periods without requiring recharging. For example, Ultralife Corporation provides primary flexible batteries for disposable medical devices and smart labels.

The secondary segment is expected to have the fastest growth rate during 2024-2032. These are becoming increasingly popular because of their eco-friendly nature and reusability. These batteries are commonly used in scenarios that need constant power supply, like smartphones, bendable screens, and IoT gadgets. Their capacity for multiple recharges cuts down on the need for frequent replacements, which ultimately saves money in the long term. Panasonic and Samsung SDI manufacture flexible rechargeable batteries for smartwatches, medical wearables, and flexible electronics.

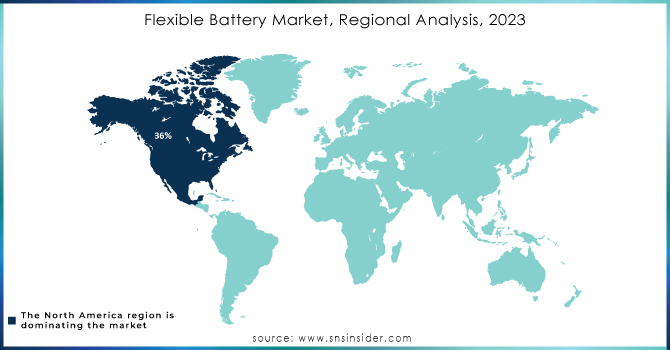

Flexible Battery Market Regional Analysis

North America led the Flexible Battery Market in 2023 with a market share of 36% as it has top companies, advanced technology, and a high demand for new products. Rising investments in flexible electronics, wearables, and medical devices are fueling the growth of the area. Big companies such as Apple, LG Chem, and Samsung SDI are playing a huge role in the market by incorporating bendable batteries in products like smartwatches, medical implants, and foldable smartphones. North America's emphasis on energy-efficient solutions and electric vehicles (EVs) is driving the need for flexible batteries, positioning the region as a major player in market dominance.

The APAC region is accounted to experience a rapid growth rate of 25.62% during 2024-2032, as a result of its thriving electronics sector and quick embrace of cutting-edge technologies. Nations such as China, Japan, and South Korea are making significant investments in flexible battery technology for consumer electronics, IoT devices, and renewable energy systems. Panasonic, Samsung SDI, and Murata Manufacturing are leading the way in advancements with flexible batteries, incorporating them into smartphones, wearables, and energy storage solutions, fueling the growth of the APAC market.

Need any customization research on Flexible Battery Market - Enquiry Now

Key Players

The key players in the Flexible Battery market are:

-

Samsung SDI (Samsung Flexible Lithium-ion Battery, Solid-State Flexible Battery)

-

LG Chem (Flexible Lithium Polymer Battery, Pouch Cell Battery)

-

Panasonic Corporation(Flexible Li-ion Battery, Thin Film Flexible Battery)

-

STMicroelectronics (Energy Harvesting Flexible Battery, Rechargeable Thin Film Battery)

-

Enfucell Oy (SoftBattery Single-Use, SoftBattery Rechargeable)

-

Blue Spark Technologies (Stretchable Printed Battery, Ultra-Thin Printed Battery)

-

ProLogium Technology (Flexible Solid-State Battery, PLB Flexible Battery)

-

Ultralife Corporation (Lithium Manganese Dioxide Flexible Battery, Thin Cell® Flexible Battery)

-

Jenax Inc. (J.Flex Rechargeable Battery, J.Flex Ultra-Thin Battery)

-

BrightVolt (Zinc Polymer Flexible Battery, Ultra-thin Polymer Battery)

-

Imprint Energy (ZincPoly® Battery, Printed Flexible Battery)

-

Cymbet Corporation (EnerChip™ Thin Film Battery, EnerChip™ Rechargeable Solid-State Battery)

-

VARTA Microbattery (VARTA CoinPower® Battery, VARTA Rechargeable Flexible Battery)

-

Saft Groupe S.A. (Flex’ion Battery, Thin Flexible Battery)

-

NEC Corporation (Flexible Organic Radical Battery, Bendable Thin Battery)

-

Excellatron Solid State (Thin Film Flexible Battery, Solid-State Microbattery)

-

Paper Battery Company (PowerPatch™ Battery, PowerEdge™ Flexible Battery)

-

Loxus Inc. (Loxus Flexible Supercapacitor, Loxus Rechargeable Flexible Battery)

-

Rocket Electric (Lithium Polymer Flexible Battery, Thin Film Battery)

-

Apple Inc. (Flexible Apple Watch Battery, Custom Flexible Battery for Wearables)

Recent Development

-

In May 2024, Imprint Energy presented the ZT battery, a new flexible battery for medical and wearable devices. This battery is described by its lightweight, low-profile design, and adaptable form factor to maximize device performance and improve user interaction.

-

In March 2024, Jenax reported about J.Flex battery with increased energy density and flexibility. The new battery solution will be of particular interest for the company in the segment of wearable devices, allowing it to create more powerful smart textiles and electronic skin.

-

In January 2024, BrightVolt announced flexible lithium-ion batteries for the IoT and wearable markets. However, the emphasis in the design of new products is made on weight reduction and energy capacity, which is in line with the current trends in this market sector.

-

In September 2023, Panasonic developed a new battery for wearable devices, which differs from other products in the wear market by its flexibility. This battery can be added to a wide variety of solutions, from health monitors and smart clothing to other devices.

-

In June 2023, Blue Spark Technologies also presented an eco-friendly flexible battery EcoVolt, which can be used in disposable devices and sensors.

In November 2023, Enfucell introduced a new version of SoftBattery, which can be used with consumer electronics. The battery is thinner than previous versions while more energy-efficient.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 195.91 Million |

| Market Size by 2032 | USD 1452.77 Million |

| CAGR | CAGR of 24.95% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Thin-film Batteries, Printed Batteries) • By Voltage (Below 5V, 5V to 20V, Above 20V) • By Rechargeability (Primary, Secondary) • By Application (Consumer Electronics, Smart Packaging, Smart Cards, Medical Devices, Wireless Sensors, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung SDI, LG Chem, Panasonic Corporation, STMicroelectronics, Enfucell Oy, Blue Spark Technologies, ProLogium Technology, Ultralife Corporation, Jenax Inc., BrightVolt, Imprint Energy, Cymbet Corporation, VARTA Microbattery, Saft Groupe S.A., NEC Corporation, Excellatron Solid State, Paper Battery Company, Loxus Inc., Rocket Electric, Apple Inc. |

| Key Drivers | • Driving forces behind the growth of eco-friendly flexible batteries in a sustainable future. • The rise of flexible batteries in the expanding Internet of Things industry. |

| Restraints | • Understanding the difficulties and consequences of limited energy density in contemporary technologies. |