3D and 4D Technology Market Size & Growth:

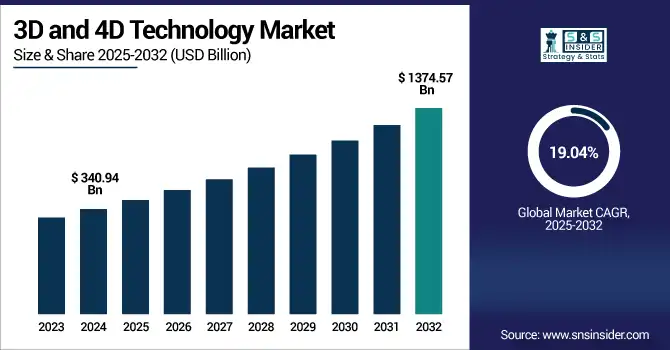

The 3D and 4D Technology Market size was valued at USD 340.94 Billion in 2024 and is projected to reach USD 1374.57 Billion by 2032, growing at a CAGR of 19.04% during 2025-2032. The 3D and 4D technology market is witnessing significant growth is driven by growing requirement of 3D and 4D technology in autonomous vehicles, industrial automation, and various immersive experiences over the forecast timeframe. Aeva, for instance, is one of several companies advancing 4D LiDAR solutions that feature the ability to record real-time velocity and maintain precise 3D position for the most relevant targets and multiple different systems, which might improve safety and intelligence of autonomous systems.

To Get more information on 3D and 4D Technology Market - Request Free Sample Report

From automotive to healthcare, robotics and consumer electronic, adoption is in fast track, with principles such as Lidar-on-Chip, ultra-resolution imaging and long-range sensing making ground. These technologies facilitate scene segmentation, object detection, and decision-making in real-time. With the ongoing fundamental transformation from analog to digital in industries, 3D and 4D sensing technology are expected to increasingly be critical enablers of next-generation applications in a wide range of market segments, paving the way for mass-market commercial deployments.

Aeva to Showcase Advanced 4D LiDAR for Commercial Vehicles at IAA 2024 Aeva will demonstrate its high-performance 4D LiDAR solutions, including Atlas and Aeries II, featuring real-time velocity and position detection, at IAA Transportation 2024. The event will also highlight Aeva’s latest Lidar-on-Chip innovations and its collaboration with Torc Robotics for autonomous trucking deployment.

The U.S 3D and 4D Technology Market size was valued at USD 60.97 Billion in 2024 and is projected to reach USD 257.90 Billion by 2032, growing at a CAGR of 19.74% during 2025-2032. 3D and 4D Technology Market Growth is driven by rising demand across automotive, healthcare, industrial automation, and entertainment sectors. Increasing integration of 4D LiDAR, 3D printing, and advanced imaging systems supports enhanced real-time perception, automation, and immersive experiences across commercial and consumer applications.

The 3D and 4D technology market trends include growing adoption of 4D LiDAR in autonomous vehicles, rapid expansion of 3D printing in manufacturing and healthcare, and increased use of 3D displays and sensors in consumer electronics. Advancements in silicon photonics, AI-driven imaging, and real-time spatial mapping are enhancing precision and performance. Cross-industry integration and demand for immersive, data-rich environments are accelerating the market’s evolution.

3D and 4D Technology Market Dynamics:

Drivers:

-

Rising Demand for Precision and Automation Drives Rapid Growth in 3D and 4D Technology Market

The 3D and 4D technology market is experiencing rapid growth, driven by increasing demand across sectors such as automotive, healthcare, consumer electronics, industrial automation, and construction. These technologies enable enhanced visualization, precision, and functionality, revolutionizing how products are designed, tested, and deployed. 3D printing is transforming manufacturing and prototyping, while 4D technologies like LiDAR offer real-time spatial data critical for advanced driver assistance systems and robotics. Advancements in sensor integration, material science, and AI-driven perception are expanding the capabilities and scalability of 3D/4D solutions. As industries prioritize automation, efficiency, and immersive experiences, the adoption of these technologies is accelerating, making them integral to digital transformation and intelligent system development in both enterprise and consumer markets.

China Plans Moon Soil to 3D-Print Bricks on Moon by 2028 Chinese Chang’e 8 mission April 11, 2025 Moon bases that use bricks from lunar soil have been tested with concentrated sunlight, no materials supplied from Earth.

Restraints:

-

High Implementation Barriers and Skill Gaps Slow 3D and 4D Technology Market Expansion

The primary restraints affecting the penetration of 3D and 4D technologies are high cost of development, challenges related to integration, low standardization, and the dearth of skilled professionals. Scalability across industries is also limited by complex hardware-software integration, significant power consumption, and high precision continuous calibration. Market penetration is also slowed down by privacy concerns around imaging applications and regulatory uncertainties in autonomous systems. Meanwhile, the combination of these factors also affect SMEs, and hampering commercialization notwithstanding the increasing requirement and demand for immersive and precision technologies.

Opportunities:

-

Surging Demand for Efficiency and Customization Spurs Growth in 3D and 4D Technology Adoption

The 3D and 4D technology market is witnessing expanding opportunities owing to growing need for rapid, low-cost and sustainable applications of manufacturing and construction sector. These technologies allow targeted tailoring, less material wastage, and automation, and are well suited for infrastructure, such as bridges, smart manufacturing, healthcare products, aerospace parts, and consumer electronics. Digital transformation is accelerating the trend toward widespread adoption in private and public sectors, and advances in additive manufacturing and materials science are spurring their improved performance. Leverage of AI, robotics and IoT integration is further boosting features and potential next-gen applications. More industries are looking for resilient and scalable solutions, and 3D and 4D technologies have created a strategic opportunity for vendors by allowing breakout innovations, partnerships, and scalability across emerging and developed economies.

Japan completed the world-first 3D-printed train station featuring Hatsushima Station, Arida, with walls, in as little as two hours overnight on March 26, 2025. JR West and Serendix plan to minimize labor and time needed for maintenance or replacement of structures on non-frequent railway lines.

Challenges:

-

Complex Integration and High Costs Hinder Broad Deployment of 3D and 4D Technologies

Despite transformative potential, the 3D and 4D technology market faces significant challenges that impede widespread adoption. High upfront costs of advanced hardware, software, and expert labor, which is especially a challenge for small and mid-sized enterprises, is one key hurdle to widespread adoption. Moreover, embedding these technologies into legacy systems can be challenging, frequently necessitating extensive customization and re-engineering of workflows. End-unification hurdles include low compatibility with materials, lower production speed, and lack of a standardization leading to massive deployment difficulties. Additionally, 4D printing is even more nascent and pose problems of scalability and reliability in dynamic environments. Adoption in sensitive sectors such as defense and healthcare is further complicated by security concerns surrounding data handling and IP protection. All of which together delay moving things from any form of initial usages to full-scale commercialization.

3D and 4D Technology Market Segmentation Overview:

By Input Device

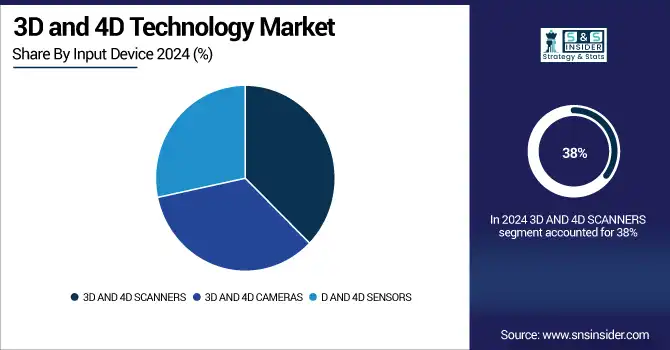

In 2024, the 3D AND 4D SCANNERS segment accounted for approximately 38% of the 3D and 4D Technology Market share, owing to their widespread application in various fields such as industrial design, healthcare imaging, and quality inspection. With accurate, spatially referenced data provided by these scanners, cost-effective modeling, and simulation becomes possible, which is essential for prototyping and reverse engineering. The improvements in the attributes like scanning speed, resolution and portability where they are going to be the main part of the manufacturing, construction, and automotive sector, to name a few will help in the progressive drive.

The 3D AND 4D SENSORS segment is expected to experience the fastest growth in 3D and 4D Technology Market over 2025-2032 with a CAGR of 20.00% This surge is driven by rising demand for depth-sensing technologies in AR/VR devices, autonomous vehicles, robotics, and smart consumer electronics. These sensors enhance object recognition, spatial awareness, and gesture control. Continuous innovation in LiDAR, ToF, and structured light technologies is further expanding their application across various high-growth industries.

By Output Device

In 2024, the 3D Displays segment held around 36% of the 3D and 4D Technology Market share, The drive for adoption continues by is use in entertainment, medical imaging and consumer electronics. Market leadership is bolstered by developments in autostereoscopic displays and demand for immersive visual experiences.

The 3D PRINTERS segment is expected to experience the fastest growth in 3D and 4D Technology Market over 2025-2032 with a CAGR of 23.53%. The rise is due to growing utilization in industries, such as aerospace, medical, construction and automobile, to create prototypes quickly and efficiently. Demand is also being accelerated due to government investments, material advancements, and declining production costs. Increased application in bio printing and mass production 3D printing makes this section an important growth factor.

By Application

In 2024, the Electrical & Electronic Components (IC, Transistor, Sensors, etc.) segment held around 36% of the 3D and 4D Technology Market share, This dominance is attributed to the growing integration of 3D/4D technologies in advanced chip design, microelectromechanical systems (MEMS), and sensor manufacturing. The demand for miniaturized, high-performance electronic components in wearables, consumer electronics, and automotive applications continues to rise. Advancements in semiconductor fabrication, coupled with the push for intelligent and energy-efficient devices, are further supporting growth in this segment.

The 3D Printer segment is expected to experience the fastest growth in 3D and 4D Technology Market over 2025-2032 with a CAGR of 22.69% The growing adoption across various industries including healthcare, aerospace, automotive, and construction, which are increasingly seeking rapid prototyping, customization, and cost-effective production capabilities. Segment growth is also complemented by advancements in technology, innovations in materials, and governmental support towards smart manufacturing.

By End -Use

In 2024, the Healthcare segment held around 25% of the 3D and 4D Technology Market share, due to growing use of 3D printing for prosthetics, implants, and surgical planning. The combination of these 4D imaging modalities with diagnostic, high-precision surgical, and real-time visualization techniques has fortified 4D imaging in the clinical domain. Healthcare will maintain its edge on the market by incentivizing ongoing innovation in personalized medicine and bio printing.

The Education segment is expected to experience the fastest growth in 3D and 4D Technology Market over 2025-2032 with a CAGR of 20.60%, driven by the increasing integration of immersive technologies in classrooms and training modules. The demand for interactive learning, virtual labs, and 3D content for STEM education is accelerating adoption. Government initiatives and growing investment in EdTech platforms are further fueling segment expansion across schools and higher education institutions.

3D and 4D Technology Market Regional Analysis:

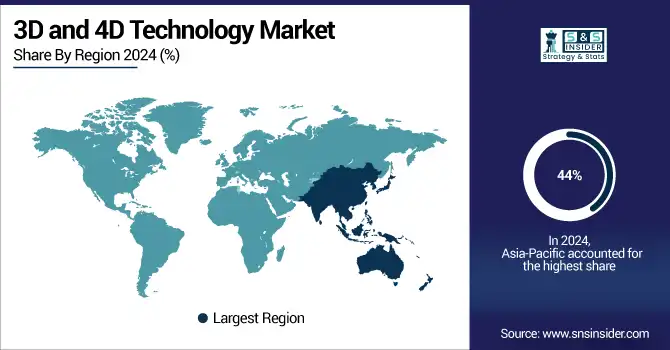

In 2024 Asia-Pacific dominated the 3D and 4D Technology market and accounted for 44% of revenue share. The dominance primarily stems from an increasing use in the consumer electronics, automotive, and healthcare sectors, and a strong manufacturing base. The region is maintaining its market leadership and growth momentum due to strong government support, fast-paced digitization, and increase in 3D/4D investments most notably in China, Japan, and Korea.

North America is expected to witness the fastest growth in the 3D and 4D Technology market over 2025-2032, with a projected CAGR of 20.90%, This rapid expansion is supported by strong technological infrastructure, high R&D spending, and increasing adoption across healthcare, defense, entertainment, and manufacturing sectors. The presence of major market players and favorable government initiatives are further accelerating innovation and deployment of advanced 3D and 4D solutions across the region.

In 2024, Europe emerged as a promising region in the 3D and 4D Technology market, driven by robust investments with industrial automation, automotive, and medical imaging technologies expected to drive the market. Strong R&D ecosystems, manufacturing infrastructure, and support for digital transformation initiatives are driving adoption in countries as Germany, France, and the U.K. Various industries are experiencing higher demand for 3D and 4D technologies, which is further amplified due to the sustainability and precision engineering focus for the region.

LATAM and MEA are experiencing steady growth in the 3D and 4D Technology market, supported by gradual digital transformation, infrastructure development, and increased adoption in sectors like healthcare, education, and consumer electronics. Government initiatives to boost innovation and local manufacturing, especially in Brazil, South Africa, and the UAE, are contributing to market traction. Though still emerging, these regions present long-term growth potential as awareness and technology access expand.

Get Customized Report as per Your Business Requirement - Enquiry Now

3D and 4D Technology Companies are:

The 3D and 4D Technology market companies are Samsung, GE Healthcare, Hexagon AB, Autodesk Inc., Sony, Dassault Systèmes, Stratasys, FARO Technologies, 3D Systems, Vicon Motion Systems, Panasonic, Philips, Qualisys, Barco, , Cognex Corporation, LG Electronics, Basler AG, DreamWorks Animation, Dolby Laboratories Inc., Matterport. and Others

Recent Developments:

-

In June 2025, Samsung launches Odyssey 3D & OLED G8 monitors in Spain Samsung debuts glasses-free 3D and AI-powered conversion tech in gaming monitors, expanding use in design, education, and entertainment.

-

In May 2025, GE HealthCare unveils CleaRecon DL for enhanced AI-based 3D imaging New deep-learning solution improves CBCT image quality for interventional procedures, gaining FDA 510(k) and CE mark approval.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 340.94 Billion |

| Market Size by 2032 | USD 1374.57 Billion |

| CAGR | CAGR of 19.04% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Input Device(3D AND 4D SCANNERS, 3D AND 4D CAMERAS and D AND 4D SENSORS) • By Output Devices(3D DISPLAYS, 3D SMARTPHONES, 3D TELEVISIONS, 3D PROJECTORS and 3D PRINTERS) • By Application(Electrical & Electronic Components, 3D Display, 3D Printer, 3D Gaming and Other Products) • By End -Use (Healthcare, Entertainment & Media, Education, Industrial, Consumer Electronics, Construction and Other End-user Industries) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The 3D and 4D Technology market companies are Samsung, GE Healthcare, Hexagon AB, Autodesk Inc., Sony, Dassault Systèmes, Stratasys, FARO Technologies, 3D Systems, Vicon Motion Systems, Panasonic, Philips, Qualisys, Barco, , Cognex Corporation, LG Electronics, Basler AG, DreamWorks Animation, Dolby Laboratories Inc., Matterport. and Others. |