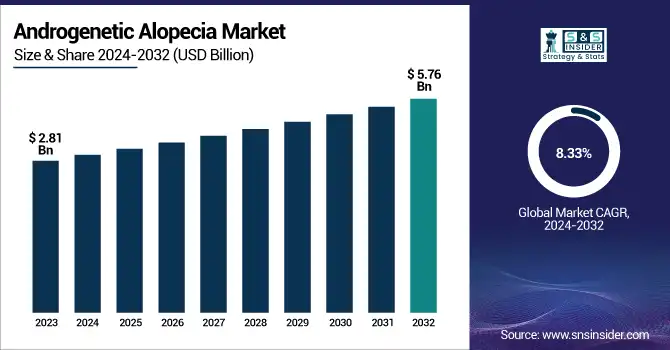

Androgenetic Alopecia Market Size Analysis:

The Androgenetic Alopecia Market size was valued at USD 2.81 billion in 2023 and is expected to reach USD 5.76 billion by 2032, growing at a CAGR of 8.33% from 2024-2032.

This Androgenetic Alopecia Market report provides fresh, data-driven insights that surpass traditional growth analysis. It encompasses a thorough assessment of the patient population and gender-specific prevalence patterns, allowing for a granular perspective of demographic susceptibility. The report further examines treatment choice and regional prescription volumes, providing insight into market behavior. In addition, it compares OTC and prescription sales trends, pinpointing changes in consumer strategy. Further, it discusses regional spending habits and reimbursement situations, uncovering inequities in access and affordability to health care, making this analysis particularly relevant to strategic planning and entry decisions.

To Get more information on Androgenetic Alopecia Market - Request Free Sample Report

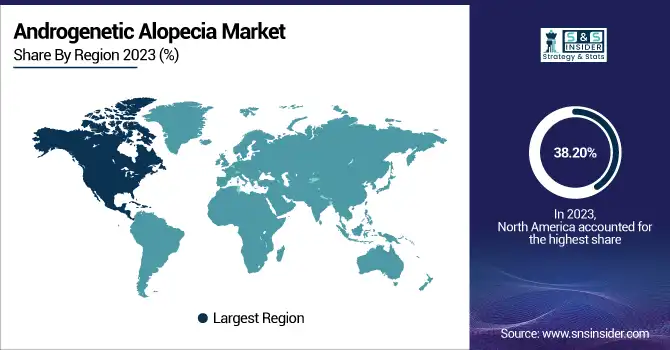

The U.S. Androgenetic Alopecia Market was valued at USD 0.84 billion in 2023 and is expected to reach USD 1.67 billion by 2032, growing at a CAGR of 7.95% from 2024-2032. North America is dominated by the U.S. in terms of the androgenetic alopecia market as a result of extensive awareness, high-end treatments being available, and high establishment of key drug companies. Increasing demand for both prescription and OTC hair growth products further substantiates its leading position. The wide popularity of beauty treatments and ease of access to dermatology centers have ensured earlier diagnosis and control. Also, increasing consumer demand for grooming and wellness has broadened the use of hair loss solutions among various age segments.

Androgenetic Alopecia Market Dynamics

Drivers

-

Increasing Awareness and Acceptance of Hair Loss Treatments are driving the market growth.

Increasing recognition of treatment options for androgenetic alopecia is a primary market growth driver. As consumers are increasingly informed about hair loss and its psychological effects, they are more likely to seek solutions to remedy it. Social media and endorsements by celebrities have also diminished the stigmatization of hair restoration treatments, which are now more socially acceptable. Based on recent research, approximately 50% of people suffering from hair loss are actively pursuing treatment, with the most sought-after being topical minoxidil and oral finasteride. Increased availability of treatments combined with more sophisticated devices such as low-level laser therapy (LLLT), has increased adoption, especially in markets such as North America and Europe.

-

Technological Advancements in Treatment Options are propelling the market growth.

Constant innovation in treatment techniques has driven the Androgenetic Alopecia Market considerably. New technologies in both pharmaceuticals and device-based treatments, including newer laser treatments and stem cell therapies, are providing patients with more effective and less invasive options. For instance, the FDA-approved HairMax LaserComb has been highly successful in reversing balding through stimulation of hair follicles. Moreover, advances in techniques used in hair transplants, such as robotic hair transplantation, have minimized recovery times and enhanced outcomes. The market has also witnessed the launch of FDA-approved topical treatments such as minoxidil and finasteride, with newer formulations being more effective for specific forms of hair loss, leading to wider patient adoption.

Restraint

-

The Limited Efficacy of Available Treatments is restraining the market growth.

One major constraint in the Androgenetic Alopecia Market is the limited effectiveness of existing treatments, especially for patients at an advanced stage of hair loss. Although treatments such as minoxidil, finasteride, and hair transplantation are effective to varying extents, they are not effective across all patients. For instance, minoxidil is effective for patients with initial-stage hair loss, but its effectiveness is often low for those with extreme hair thinning. Although finasteride can retard hair loss, it will not cause notable regrowth in all users. In addition, hair transplant surgery is costly and may involve multiple sessions to achieve the best results. These drawbacks can result in patient dissatisfaction and prompt some to pursue other, frequently untested, treatments, inhibiting market growth potential.

Opportunities

-

Rising Demand for Non-Invasive Treatment Options is creating the opportunity for market growth.

As patients increasingly desire less invasive, more convenient forms of treatment for androgenetic alopecia, demand for less invasive treatments such as low-level laser therapy (LLLT) and topical medications is on the rise. They offer patients easily accessible and safer alternatives to more invasive treatments like hair transplants. The attractiveness of products such as the HairMax LaserComb and the emergence of topical drug delivery systems present a major growth opportunity in the market. Furthermore, the growing population of those suffering from early-stage hair loss prefers home treatment methods, further propelling the scope for growth within this segment. Firms concentrating on creating and increasing such non-invasive treatment modalities can benefit from this rising demand, especially in advanced economies with a greater inclination toward preventive medicine.

Challenges

-

High Treatment Costs and Accessibility Issues are challenging the market growth.

One of the biggest challenges to the Androgenetic Alopecia Market is the exorbitant price of treatments, and especially sophisticated ones such as hair transplants and laser treatments. They can be very costly, and insurance claims for hair loss treatments are usually minimal or nonexistent. Consequently, many people cannot pay for the treatment they require, especially in the emerging markets where people have less disposable income. This cost barrier limits the market's overall scope, inhibiting extensive adoption, particularly in areas of poor healthcare access. Businesses attempting to gain more of the market share need to overcome these expense concerns, possibly by providing more affordable treatments or increasing insurance.

Androgenetic Alopecia Market Segmentation Analysis

By Gender

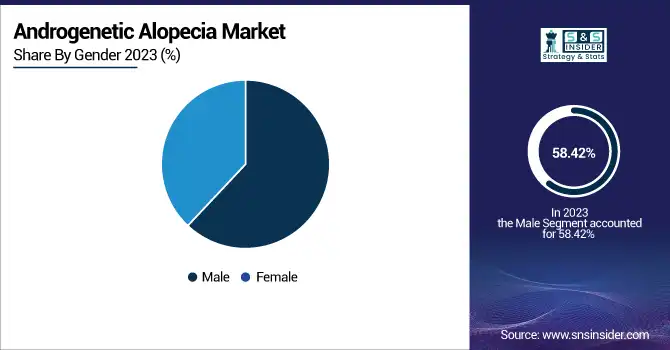

The male segment dominated the androgenetic alopecia market with 58.42% market share in 2023, because pattern baldness is more common in men than in women. Dihydrotestosterone (DHT) and other hormonal and genetic variables are major contributors to male pattern hair loss, also known as androgenetic alopecia. By the age of 50, it affects about half of men, making it one of the most prevalent hair-related disorders in men. The need for therapies like minoxidil, finasteride, and hair restoration operations has increased as a result of this prevalent occurrence. The dominance of this market in 2023 will also be strengthened by the fact that many men are seeking early intervention and investing in both pharmaceutical and cosmetic remedies due to social pressure and aesthetic concerns.

The female segment is anticipated to grow at the fastest rate over the forecast years with 8.64% CAGR, due to rising knowledge, de-stigmatization, and a greater emphasis on aesthetic wellness among women. Despite being less prevalent than in men, a considerable percentage of women suffer from female androgenetic alopecia, especially those who have gone through menopause because of hormonal changes. Female hair loss, which has historically gone undiagnosed and untreated, is now receiving clinical attention and product innovation that is specifically suited to the requirements of women. Higher treatment acceptance is being facilitated by the growing availability of over-the-counter topical medicines, cosmetic camouflage products, and targeted internet marketing activities aimed at female consumers. Additionally, the psychological and emotional effects of female hair thinning are becoming more widely acknowledged, which promotes early diagnosis and accelerates market expansion in this area.

By Treatment

The pharmaceuticals segment dominated the androgenetic alopecia market with 97.16% market share in 2023, because pharmacological treatments are widely available, clinically validated, and cost-effective. Products such as minoxidil (a topical vasodilator) and finasteride (a 5-alpha reductase inhibitor) have long been the standard of care for treating androgenetic alopecia. Both sexes have consistently expressed a desire for them due to their demonstrated ability to decrease hair loss and encourage regeneration. These drugs are also supported by robust prescription trends and are available in both over-the-counter (OTC) and prescription forms, enhancing their accessibility. Pharmaceutical companies continue to innovate within this category—developing newer formulations, combination therapies, and convenient delivery systems—further reinforcing their dominance. The segment's dominant position in 2023 was also influenced by its regulatory approval, long-term safety profiles, and reimbursement coverage in specific areas.

By End-Use

The Dermatology Clinics segment dominated the Androgenetic Alopecia Market with 72.26% market share in 2023, because of the increasing demand for expert-guided, personalized treatment regimens and access to cutting-edge therapeutic choices. These clinics frequently function as specialist facilities with qualified dermatologists on staff who can assess the degree of hair loss, suggest suitable medication or device-based treatments, and carry out treatments including low-level laser therapy (LLLT) and platelet-rich plasma (PRP). For safe and efficient therapies, particularly in situations that are progressing or unresponsive, patients are increasingly seeking expert counsel. Additionally, dermatological clinics improve customer convenience and results by providing a one-stop shop with integrated diagnostic tools, prescription services, and follow-ups. The segment's dominant position in 2023 was also influenced by consumers' confidence in medically supervised care as opposed to self-treatment.

By Sales Channel

The Prescriptions segment dominated the Androgenetic Alopecia Market with 66.08% market share in 2023, due to the clinical efficacy and regulatory approval of several pharmacological therapies that require a doctor's prescription. Commonly given by dermatologists and general practitioners, medications like finasteride and minoxidil have shown great effectiveness in reducing hair loss and promoting regrowth. Because of the medically proven results and ongoing expert supervision that guarantees the right dosage and a lower chance of side effects, patients frequently rely on prescription medicines. Additionally, more people are seeking physician-recommended remedies rather than depending just on over-the-counter (OTC) medicines as a result of increased awareness of treatment alternatives through dermatology clinics and telehealth consultations. One of the main factors that put the prescription channel at the top of the market in 2023 was the guarantee that patients would receive evidence-based therapy.

Regional Insights

North America dominated the androgenetic alopecia market with 38.20% market share in 2023, mainly because of strong awareness levels of hair loss therapies, extensive distribution of cutting-edge therapeutics, and high healthcare spending. It is inhabited by top pharmaceutical and cosmetic firms aggressively involved in the R&D of hair restoration drugs. In addition, the incidence of androgenetic alopecia is also considerably high in men and women of the U.S. and Canada, pushing demand for both prescription and over-the-counter drugs further. Strong coverage of dermatology clinics, increased acceptance of aesthetic procedures, and direct-to-consumer telehealth platforms with the availability of hair loss medication are also boosting the region's leading position in the market.

The Asia Pacific is predicted to be growing at the fastest rate with 8.69% CAGR over the forecast period, owing to increasing disposable income, the development of the middle class, and growing consciousness towards hair care and personal hygiene. India, China, South Korea, and Japan are facing increasing demand for cosmetic and pharmaceutical remedies for hair loss, driven by lifestyle transitions and rising levels of stress. The growing impact of Western beauty trends, growing healthcare infrastructure, and popularity of online pharmacies are also driving market penetration in the region. Moreover, domestic manufacturers providing cheap generic options are making treatments affordable, which is leading to quick market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Androgenetic Alopecia Market Key Players

-

Johnson & Johnson (Rogaine, Neutrogena T/Gel)

-

Merck & Co., Inc. (Propecia, Proscar)

-

Cipla Ltd. (Finpecia, Tugain Solution)

-

Dr. Reddy’s Laboratories Ltd. (Mintop Forte, Finax)

-

Sun Pharmaceutical Industries Ltd. (Alopex, Finabald)

-

Hims & Hers Health, Inc. (Minoxidil Foam, Finasteride Tablets)

-

AbbVie Inc. (Botox, Qilib Hair Regrowth System)

-

Pfizer Inc. (Regaine, Xeljanz)

-

Alpecin (Dr. Wolff Group) (Alpecin Caffeine Shampoo, Alpecin Liquid)

-

L’Oréal S.A. (Serioxyl Denser Hair Serum, Aminexil Advanced)

-

Lupin Pharmaceuticals, Inc. (Finpecia, Minoxidil Topical Solution)

-

Intas Pharmaceuticals Ltd. (Morr 5%, Finast)

-

Aclaris Therapeutics, Inc. (ATI-50001, ATI-502)

-

Bayer AG (Minoxidil 5% Extra Strength, Pantogar Capsules)

-

Follica, Inc. (Hair Follicle Neogenesis Device, Minoxidil-based Topical Therapy)

-

Histogen Inc. (HST-001, Hair Stimulating Complex)

-

Cellmid Limited (Evolis Professional Activate, Advangen Jo-Ju Shampoo)

-

RepliCel Life Sciences Inc. (RCI-02, RCH-01)

-

Vichy Laboratories (L'Oréal) (Dercos Aminexil Clinical 5, Dercos Energising Shampoo)

-

Theradome Inc. (Theradome EVO LH40, Theradome PRO LH80)

Suppliers (These suppliers commonly provide active pharmaceutical ingredients (APIs) such as minoxidil and finasteride, as well as functional excipients, botanical extracts, and bioactive compounds used in hair regrowth formulations and topical scalp therapies across the androgenetic alopecia market.) In the Androgenetic Alopecia Market

-

BASF SE

-

Croda International Plc

-

Ashland Inc.

-

Evonik Industries AG

-

Clariant AG

-

Givaudan Active Beauty

-

Symrise AG

-

DSM Nutritional Products

-

Lonza Group AG

-

Lubrizol Corporation

Recent Developments in the Androgenetic Alopecia Market

-

June 2023 – Dr. Reddy's Laboratories Ltd. announced the launch of RgenX, a new generics business division in India. This move is intended to offer wider ranges of affordable treatments to patients, including those with conditions such as androgenetic alopecia.

-

December 2023 – Sun Pharmaceutical Industries Ltd. made a strategic collaboration with Aclaris Therapeutics, obtaining exclusive rights for the development and commercialization of deuruxolitinib, a JAK inhibitor, and other isotopic versions of ruxolitinib, for alopecia areata and androgenetic alopecia.

Androgenetic Alopecia Market Report Scope

Report Attributes Details Market Size in 2023 US$ 2.81 Billion Market Size by 2032 US$ 5.76 Billion CAGR CAGR of 8.33% From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Gender (Male, Female)

• By Treatment (Pharmaceuticals, Devices)

• By End-Use (Dermatology Clinics, Homecare Settings)

• By Sales Channel (Prescriptions, OTC)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles Johnson & Johnson, Merck & Co., Inc., Cipla Ltd., Dr. Reddy’s Laboratories Ltd., Sun Pharmaceutical Industries Ltd., Hims & Hers Health, Inc., AbbVie Inc., Pfizer Inc., Alpecin (Dr. Wolff Group), L’Oréal S.A., Lupin Pharmaceuticals, Inc., Intas Pharmaceuticals Ltd., Aclaris Therapeutics, Inc., Bayer AG, Follica, Inc., Histogen Inc., Cellmid Limited, RepliCel Life Sciences Inc., Vichy Laboratories (L'Oréal), Theradome Inc., and other players.