Anomaly Detection Market Report Scope & Overview:

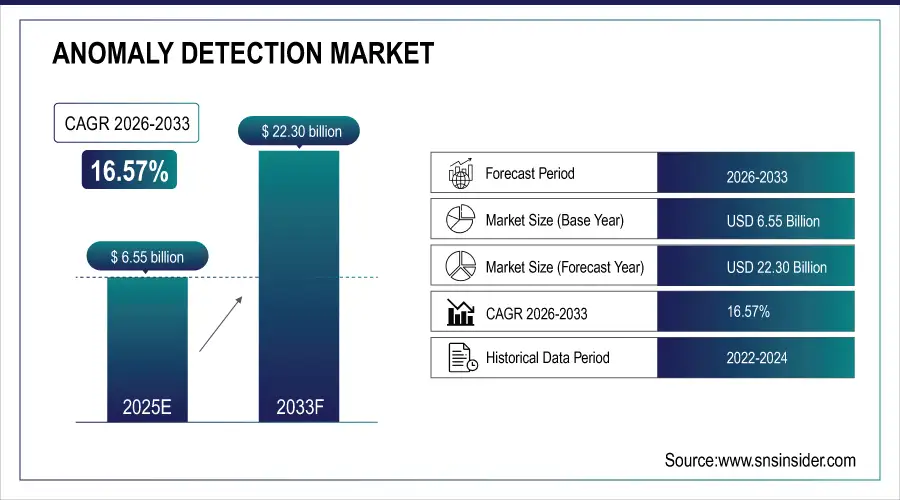

The Anomaly Detection Market size is valued at USD 6.55 Billion in 2025E and is projected to reach USD 22.30 Billion by 2033, growing at a CAGR of 16.57% during 2026-2033.

The Anomaly Detection Market analysis highlights the increasing reliance on AI and machine learning to decipher suspicious patterns across various sectors. Growing data volume, security threats and need for real time monitoring is increasing market demand. Cloud solutions have been catching on because of its scalability and cost benefits.

By 2025, global anomaly detection market revenue is projected to exceed $7.5 billion, driven by AI adoption, rising cyber threats, and increased cloud-based real-time monitoring across industries.

Market Size and Forecast:

-

Market Size in 2025E: USD 6.55 Billion

-

Market Size by 2033: USD 22.30 Billion

-

CAGR: 16.57% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Anomaly Detection Market - Request Free Sample Report

Anomaly Detection Market Trends

-

Growing demand for the AI (artificial intelligence) and ML (machine learning) technologies in automation in anomaly detection.

-

Enterprises are looking for scalable, cost-effective cloud solutions that offer monitoring of anomalies in real-time and meet their requirements for data protection.

-

Rising threat of cyber-attacks is propelling the demand for anomaly detection solutions for intrusion detection, fraud prevention, and network security.

-

Growing IoT deployments drive the need for anomaly detection to prevent equipment failures and ensure continuous operations.

-

Invasion discovery models are more accurate and responsive if feeding on diverse data sources and analysis methods.

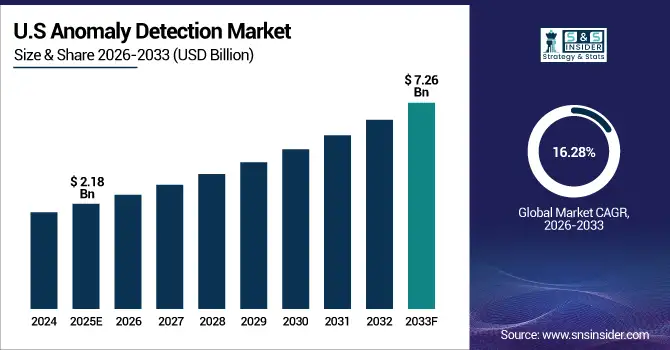

The U.S. Anomaly Detection Market size is valued at USD 2.18 Billion in 2025E and is projected to reach USD 7.26 Billion by 2033, growing at a CAGR of 16.28% during 2026-2033. Anomaly Detection Market growth is driven by increasing threat of cyber security breaches and digital transformation in almost every industry sector. Growing use of AI-based analytics and big data solutions facilitates real-time threat identification. Organizations are thus spending heavily on cloud-based anomaly detection software for scalability and cost effectiveness.

Anomaly Detection Market Growth Drivers:

-

Rising Cybersecurity Threats and Growing Need for Real-Time Data Monitoring Across Enterprises

Rising number and complexity of cyber-attacks are encouraging demand for advanced anomaly detection solutions. Companies are leveraging AI and machine learning-enabled platforms that detect abnormal network activity in real time to halt data breaches. As businesses process large amounts of data through digital channels, the demand for proactive threat detection and operational monitoring is increasing rapidly, driving the global market of anomaly detection in multiple domains.

By 2025, over 60% of enterprises will deploy AI-driven anomaly detection to counter escalating cyber threats, with real-time monitoring adoption surging by 45% across finance, healthcare, and critical infrastructure sectors.

Anomaly Detection Market Restraints:

-

High Implementation Costs and Lack of Skilled Professionals Limiting Market Adoption

Expensive next-generation anomaly detection systems and the lack of AI and data analytics skills are some factors that limit its growth among small businesses. Several businesses have problems implementing these systems into their current IT set-up. Furthermore, the lack of available expertise to interpret complex outputs from data also stifles deployment. All these together are restraining the market to grow even though there is increasing awareness technology’s potential benefits and application.

Anomaly Detection Market Opportunities:

-

Expanding Integration of AI, IoT, and Cloud Technologies Creating New Market Possibilities

The integration of artificial intelligence, IoT and cloud technologies is creating new possibilities for anomaly detection. IoT devices produce copious amounts of real-time data that when combined with AI-powered analytics can enhance predictive maintenance and operational efficiency. The flexibility, scalability and cost-effectiveness of cloud-based ADPs appeals to enterprises whose activities intersect with digital transformation. This technology alliance is anticipated to drive new use cases and boost the worldwide market growth.

By 2025, over 70% of industrial firms will use AI-IoT-cloud-integrated anomaly detection for predictive maintenance, with cloud-based ADP adoption growing by 50% amid accelerating digital transformation initiatives globally.

Anomaly Detection Market Segment Analysis

-

By technology, Machine Learning and Artificial Intelligence led the market with a 52.30% share in 2025, while Big Data Analytics was the fastest-growing segment with a CAGR of 12.50%.

-

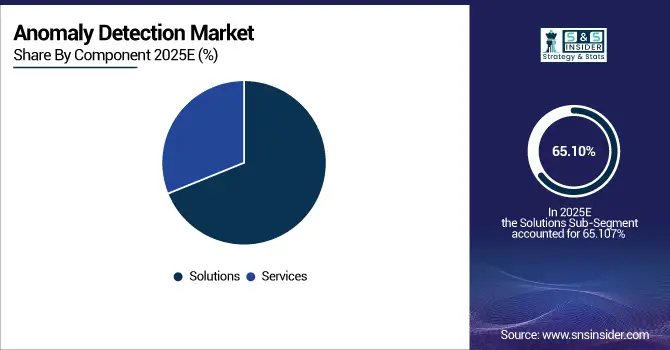

By component, Solutions dominated with a 65.10% share in 2025, while Services recorded the fastest growth with a CAGR of 11.80%.

-

By end-user, IT and Telecom led with a 28.70% share in 2025, while Healthcare was the fastest-growing segment with a CAGR of 23.20%.

-

By deployment, the Cloud segment held a 60.40% share in 2025, while On-Premise grew fastest with a CAGR of 10.90%.

By Component, Solution Dominate While Services Shows Rapid Growth

Solution segment of the anomaly detection market holds the majority market share, as it has widespread use of software tools such as fraud detection and prevention, network monitoring, among others. End-to-end platforms that can be easily integrated with your existing systems are very popular amongst companies. Meanwhile, services are growing very quickly as companies look to consulting, deployment and maintenance assistance. Growing demand across managed service and professional service segments all over the world is driving the requirement for customized deployment and constant surveillance.

By Technology, Machine Learning & Artificial Intelligence Leads Market While Big Data Analytics Registers Fastest Growth

By technology Machine Learning and AI hold major share of the anomaly detection market as it has more accurate way of identifying complex patterns and predicting anomalies across wide variety of datasets. These are the technologies that foster real-time detection, automation and self- learning and they’re key tools for cybersecurity, fraud prevention and operations. While, Big Data Analytics is growing the quickest with the exponential proliferation of data and corresponding need for deeper understanding into business operations and security derivatives.

By End-User, IT & Telecom Lead While Healthcare Registers Fastest Growth

The IT and Telecom is the largest market in applying anomaly detection to track large-scale data traffic, improve cybersecurity and maintain network stability. Strong demand is supported by perpetual digitalization, cloud penetration and the massive Connection of Things. The healthcare segment is projected to be the fastest growing end-user segment as it is more and more being applied in patient data monitoring, fraud detection amongst insurance providers and predictive diagnostics to improve efficiency of medical operations and systems for better compliance towards patient safety.

By Deployment, Cloud Lead While On-Premise Grow Fastest

By deployment, cloud dominates in terms of market as it is scalable, flexible and cost effective for monitoring real-time abnormalities. Businesses opt for cloud solutions as they can be easily integrated, alleviating the demand of premises infrastructures, and enable a set point to store data. While, on-premise deployment is expected to increase at the fastest rate, especially with industries that emphasizes utmost security of data and compliance. Organizations dealing with confidential financial or healthcare information are investing more in the on-premise approach in order to maintain control and make customizations to their anomaly detection systems.

Anomaly Detection Market Regional Analysis:

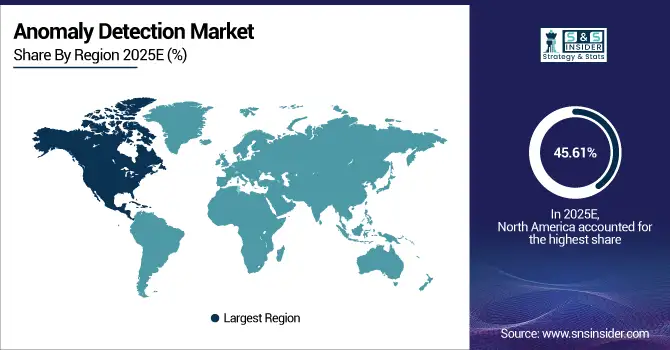

North America Anomaly Detection Market Insights

In 2025 North America dominated the Anomaly Detection Market and accounted for 45.61% of revenue share, this leadership is due to this region are early adopters of emerging technologies, such as AI technology, big data and cloud analytics. A mature IT environment and a high level of investment in cybersecurity are driving big deployment across verticals. Ongoing technology advancements and government attention on cyber resilience also fuel adoption. Strong players and R&D Excellent infrastructure[edit] makes the economy more competitive.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Anomaly Detection Market Insights

U.S. anomaly detection market is witnessing robust growth driven by increasing cyber threats and business device penetration. AI-powered analytics tools are now being utilized by organizations to help them protect their data and instantly detect network issues. Market dominance is upheld by high cloud uptake and investments in sophisticated TI (threat intelligence) solutions.

Asia-pacific Anomaly Detection Market Insights

Asia-pacific is expected to witness the fastest growth in the Anomaly Detection Market over 2026-2033, with a projected CAGR of 17.20% due to rising digital transformation and increasing cyber security concerns. Nations like Japan, India and South Korea are investing heavily in AI and analytics powered monitoring systems. Rising adoption of IoT devices as well cloud technologies is driving the demand for real-time data analytics. Companies in BFSI, manufacturing, and telecom form the major market players.

Japan and India Anomaly Detection Market Insights

Japan and India are poised to account for sizeable shares in the regional anomaly detection market, owing to robust IT infrastructures as well as digitalization efforts. Japan’s own focus on automation, IOT (internet of things) and industrial efficiency found a strong complement in India’s rapid cloud adoption and burgeoning start-up culture. Both countries are blowing AI for security and data analytics to deal with the rising cyber threats.

Europe Anomaly Detection Market Insights

In 2025, Europe emerged as a promising region in the Anomaly Detection Market, due to rigorous data protection laws such as GDPR and increasing cyber threats. Organizations in industries such as manufacturing, BFSI and energy are embracing intelligent monitoring solutions for compliance and optimization. The area will have a focus on ethical AI use and secure data management. Germany, UK and France have taken the lead in adoption due to advanced industrial infrastructure.

Germany Anomaly Detection Market Insights

Germany is among Europe’s most developed anomaly detection markets due to its high industry base and Industry 4.0 programs. The nation taps analytics enabled by AI for predictive maintenance, cyber protection and operational optimization. Manufacturing and automotive industries are leading adopters of anomaly detection solutions.

Latin America (LATAM) and Middle East & Africa (MEA) Anomaly Detection Market Insights

The Anomaly Detection Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the high public security attention to deploy the advanced surveillance systems in big cities. Increasing need for cybersecurity and fraud detection contributes to regional market growth. Finance, telecom and government organizations are the main users of AI detection systems. Growing cloud adoption and IT infrastructure spending boost market opportunity.

Anomaly Detection Market Competitive Landscape:

Amazon Web Services (AWS) provides state-of-the-art anomaly detection with its AI-based cloud offerings such as Amazon Lookout or CloudWatch. These are used to find outliers in data, improve performance and security processes. AWS’s scalable and automated detection capabilities allow continuous real-time monitoring throughout sectors such as finance, IT or manufacturing.

-

In July 2025, AWS made multivariate anomaly detection generally available in its IoT SiteWise service, enabling industrial customers to detect anomalies across multiple correlated equipment parameters. This enhancement strengthens predictive maintenance capabilities, helping industries minimize downtime and improve operational efficiency through advanced AI-driven analytics.

Anodot Ltd. is a provider of AI and machine-learning powered business-observability service that detects incidents in real time across IT and business systems. Its platform allows for monitoring and analysis of revenue, performance and operational metrics in real-time to identify unusual behaviour. The company offers predictive insights to minimize risks and maximize efficiency for telecom, eCommerce & finance verticals.

-

In April 2025, Anodot Ltd. unveiled a dedicated business unit called Umbrella, focusing on its cloud cost-management (FinOps) platform for MSPs and large enterprises. The new unit includes three major feature releases and positions Anodot’s anomaly-detection capabilities at the core of its cost-optimization strategy.

Broadcom, Inc. from its robust portfolio of advanced network software and management infrastructure offerings. Its tools use machine learning and automation to detect system abnormalities and security breaches. Broadcom’s analytics-based platforms for network, security and users provide an intelligent approach to those challenges. Our best-of-breed solutions help you tackle the most dangerous threats with less effort.

-

In April 2025, Broadcom introduced “Incident Prediction,” an AI-driven security capability under its Symantec Endpoint Security Complete offering, designed to forecast attacker behaviours and disrupt living-off-the-land style cyberattacks.

Cisco Systems, Inc. provides full-fledged anomaly detection with its network security and analytics products. utilizing artificial intelligence (AI) and machine learning, Cisco’s platforms detect anomalous behavior, make intelligent network decisions, and stop evade cyber-attacks. Its portfolio, which includes Cisco Secure and AppDynamics products, provides enterprises with resilience, visibility and real-time protection across their IT environment from applications and data to devices.

-

In May 2024, Cisco launched a new AI-powered virtual appliance for its AppDynamics On-Premises observability solution that automates anomaly detection, root-cause analysis, and application security for on-premises SAP and enterprise environments.

Anomaly Detection Market Key Players:

Some of the Anomaly Detection Market Companies are:

-

Amazon Web Services, Inc.

-

Anodot Ltd.

-

Broadcom, Inc.

-

Cisco Systems, Inc.

-

Dell Technologies, Inc.

-

Dynatrace, LLC

-

GURUCUL

-

Happiest Minds

-

Hewlett Packard Enterprise Company

-

International Business Machines Corp.

-

LogRhythm, Inc.

-

Microsoft Corp.

-

SAS Institute, Inc.

-

Splunk, Inc.

-

Trend Micro, Inc.

-

Verint Systems Inc.

-

WSO2 Inc.

-

Wipro Limited

-

Securonix Inc.

-

Guardian Analytics Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 6.55 Billion |

| Market Size by 2033 | USD 22.30 Billion |

| CAGR | CAGR of 16.57% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Machine Learning & Artificial Intelligence, Big Data Analytics, Business Intelligence & Data Mining) • By Component (Solution, Services) • By End-User (BFSI, Retail, IT & Telecom, Healthcare, Manufacturing, Government & Defense, Others) • By Deployment (Cloud, On-Premise) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amazon Web Services, Inc., Anodot Ltd., Broadcom, Inc., Cisco Systems, Inc., Dell Technologies, Inc., Dynatrace, LLC, GURUCUL, Happiest Minds, Hewlett Packard Enterprise Company, International Business Machines Corp., LogRhythm, Inc., Microsoft Corp., SAS Institute, Inc., Splunk, Inc., Trend Micro, Inc., Verint Systems Inc., WSO2 Inc., Wipro Limited, Securonix Inc., Guardian Analytics Inc. |