Anti-Piracy Protection Market Report Scope & Overview:

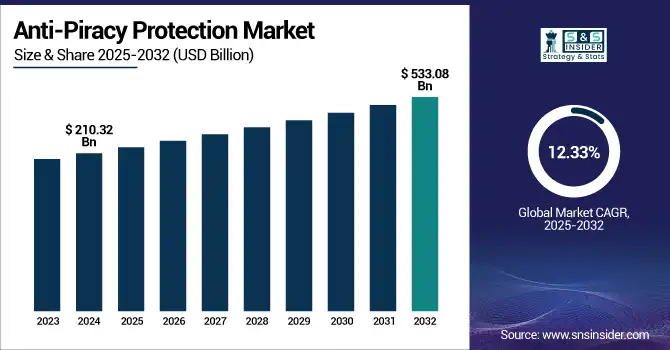

The Anti-Piracy Protection Market size was valued at USD 210.32 billion in 2024 and is expected to reach USD 533.08 billion by 2032 and grow at a CAGR of 12.33% over the forecast period of 2025-2032.

To Get more information on Anti-Piracy Protection Market - Request Free Sample Report

This market provides with technologies and services that are utilized to fight piracy in the digital landscape of different products, such as the entertainment, software and the gaming industry. As content streaming and online piracy increase, the need for reliable anti-piracy services is on a steady rise globally. The growth of content consumption, sophisticated piracy techniques, and the subsequent need for such advanced solutions as AI-based monitoring and real-time enforcement are driving the industry investment.

In regions with increased naval presence and private security, pirate attacks have declined by as much as 80%. The Abduction of Human Rights Workers in the Gulf of Aden and the Strait of Malacca makes up 80% of the sound global acts of piracy. AI-based platforms supply automated piracy alerts, which improve response times, and Track-Before-Detect (TBD) radar, which sees those small boats. Vessels with integrated anti-piracy systems, such as high-pressure water jets, show 90% deterrence, while the use of anti-climb barriers cuts boarding attempts by 75%, proving that anti-piracy technologies work.

The U.S. anti-piracy protection market size was USD 46.23 billion in 2024 and is expected to reach USD 96.36 billion by 2032, growing at a CAGR of 9.60% over the forecast period of 2025-2032. The rise of streaming platforms and the advances in anti-piracy technologies, such as AI-based solutions and DRM motivated by piracy concerns. The U.S. is policing North America as it has a strong technology and content base, and a lot of content is being consumed, and a lot of money is spent to prevent its loss.

Anti-Piracy Protection Market Dynamics:

Key Drivers:

-

Rising Piracy Threats in Digital Content Drive Growth of Anti-Piracy Protection Market

The increasing threat of digital piracy significantly drives the anti-piracy protection market growth. As piracy methods evolve, industries, such as entertainment, gaming, and software face mounting challenges from illegal streaming, key theft, and content distribution through pirated channels. Pirated video material garners over 230 billion views annually, with more than 80% of global piracy linked to illegal streaming services. This escalating piracy rate is costly, with the U.S. economy losing between USD 29.2 billion and USD 71 billion per year, while the global movie industry suffers revenue losses of between USD 40 billion and USD 97.1 billion annually. This widespread impact, which consumes 24% of global internet bandwidth, highlights the urgent need for robust anti-piracy solutions. The U.S. and Europe, with their content-driven economies, are especially vulnerable, leading to a surge in demand for Digital Rights Management (DRM) systems, watermarking technologies, and AI-based surveillance solutions.

Restraints:

-

High Costs and Legal Concerns Limiting Widespread Adoption of Anti-Piracy Solutions

The anti-piracy protection market faces the high cost of implementing robust anti-piracy solutions. Small and medium-sized businesses (SME’s) in the gaming and media sector commonly come up against the high cost of investment for anti-piracy security, from DRM, Watermarking, or AI-based monitoring systems. Second, legal and liability issues arising from measures to control piracy may dissuade businesses from implementing them. Many more companies find themselves overwhelmed trying to navigate regional and international laws, such as the GDPR and other data privacy regulations, and they find themselves needing to spend their representatives' time to deploy anti-piracy measures. Although the demand for such services has been growing, the cost of adoption, both in terms of installation and maintenance, and potential legal implications, can be prohibitive, especially for smaller companies and companies with fewer resources.

Opportunities:

-

Growing Investment in AI-Based Anti-Piracy Solutions Presents New Growth Prospects

The growing investment in Artificial Intelligence (AI) technologies for anti-piracy protection presents significant growth opportunities for the market. AI-powered systems, especially predictive analytics, behavioral analysis, and content fingerprinting tools, are becoming increasingly effective at fending off piracy. These technologies have been deployed to sift through vast amounts of data to forecast potential acts of piracy, monitor suspicious behavior, and signal the need for human intervention. AI is a game-changer in the global anti-piracy protection market trends, particularly in predictive models, which foster a more proactive and actionable approach to content security. With the increasing sophistication of AI systems, the trend of utilizing AI in anti-piracy measures is poised to become a crucial element in addressing the new challenges of piracy.

Challenges:

-

Rapid Technological Advancements Outpacing Legal Frameworks and Enforcement Challenge Market Growth

A market that often outstrips the development of legal frameworks and enforcement mechanisms. The more advanced anti-piracy technologies become, the more advanced piracy methodologies are developed. Pirates and cybercriminals are increasingly using cutting-edge technologies, such as deepfakes and blockchain, to evade the traditional arsenal of anti-piracy tools. This leads to a “cat-and-mouse” situation, in which the law and the regulation cannot catch up with piracy, which develops in an increasingly fast spectrum. Consequently, there are enforcement gaps as the current laws and international conventions may not be able to fully capture the newer, more sophisticated varieties of digital piracy. As a result, businesses are facing an increasingly uncertain environment in which technological developments move ahead of legislative developments, making it increasingly difficult to enforce the protection of intellectual property rights globally.

Anti-Piracy Protection Market Segmentation Analysis

By End-User

In 2024, OTT platforms hold the largest revenue of 30% in the anti-piracy protection market share and represent the fastest-growing end-user segment. This surge is largely based on the exponential rise in the consumption of digital content that has left these platforms more exposed to piracy via unauthorized streaming and sharing. Such technology reduces reliance on human intervention and enhances the ability to identify and address piracy events in a timely and effective manner. DRM, watermarking, and AI behavioral analysis technology are becoming a necessity with organizations wanting to protect their rights on creative data and to avoid losing revenue. Investment in these solutions has grown as OTT services expand internationally.

This particular investment is a part of a larger trend, and in 2024, VCs invested USD 9.5 billion in cybersecurity startups, representing a 9% increase from last year. Elsewhere, there were more than 400 M&A deals in cybersecurity last year, with 68 of them revealing how much they were worth a combined total of USD 50.75 billion.

By Enterprise Type

In 2024, large enterprises captured the largest revenue share of 65% in the anti-piracy protection market, driven by their ability to invest heavily in strong security infrastructure. This segment is quickly embracing advanced technologies including DRM adoption, forensic watermarking, AI-driven surveillance, and cloud-based threat monitoring platforms to combat the intensified piracy risks. Ongoing product integration and real-time content protection system implementations have solidified their spot in protecting intellectual property. The increasing demand for scalable and robust solutions makes large enterprises the main adopters within the anti-piracy area.

SMEs are projected to witness the fastest growth in the anti-piracy protection market with a CAGR of 14.0% during the forecast period. That growth is being fueled by the increasingly accessible and low-cost nature of cloud-enabled anti-piracy tools that are tailored for law firms of all sizes. Zero-Code Mobile Protection, Automated IP Monitoring, and AI-based content tracking are enabling SMEs to implement today’s state-of-the-art piracy protection technology, with no complicated technical skills or substantial expense required. As digital weighs heavier in their business models, SMEs are becoming a strong force and is driving the need for user-friendly, scalable anti-piracy solutions.

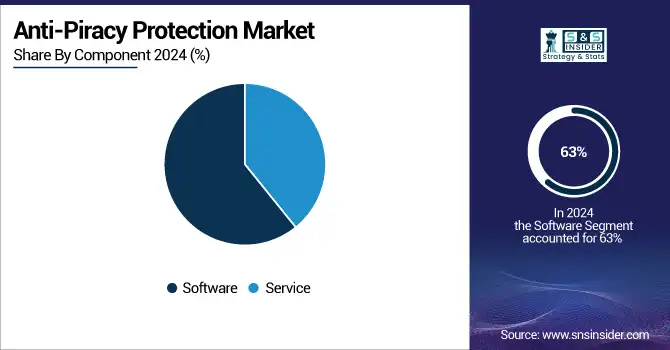

By Component

In 2024, the software segment dominates the anti-piracy protection market analysis, accounting for 63% of the total revenue. The segment’s growth is driven by the advanced software platforms that can monitor, detect, and remove pirated content in real-time. Ongoing technological advances, such as the use of AI and machine learning software to overcome digital piracy, have increased the effectiveness of these tools. This surge in the need for these kinds of strong codes is why the software sector dominates the market, as there is a fast-expanding requirement to secure digital resources for all sectors.

The service segment is experiencing the fastest growth in the anti-piracy protection market, with a projected CAGR of 15.1% during the forecast period. This expansion is driven by the increasing demand from customers for end-to-end services including consulting, deployment, and support, which help them better adopt and manage anti-piracy solutions. As concerns over protecting digital assets begin to hit home for the business, there is more reliance on specialist service providers. These professionals provide customized solutions based on client requirements, covering the maximum possible protection against piracy threats, and drive the growth of the industry.

Regional Analysis:

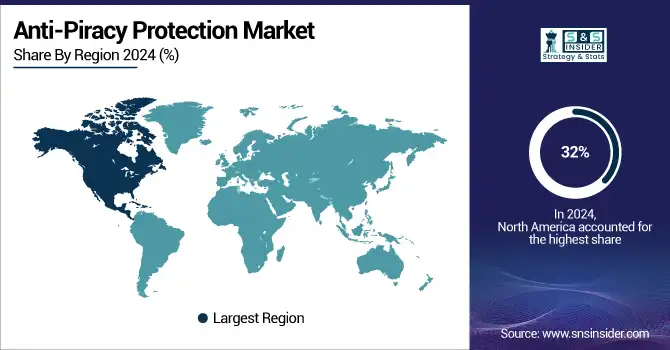

North America is estimated to hold a market share of 32% in the anti-piracy protection market in 2024. Reduction of traditional playlisting behavior, as consumers switch to digital media and content streaming services, and an increased concern for piracy and the need for comprehensive anti-piracy technology. The U.S. is the leading country in the region of Anti-Piracy Protection in North America. The U.S. faces significant threats because its industries are so content-heavy, from entertainment to software to gaming. As one of the major streaming capitals, the requirement for powerful anti-piracy techniques, such as DRM, AI-based monitoring, and digital forensics is increasing even more, leading to a significant increase in anti-piracy protection investments.

The Asia Pacific region is expected to grow at a CAGR of 15.9% in the anti-piracy protection market in 2024. The rapid digital transformation, growing consumption of online content, and the threats of piracy in countries such as India and China. China rules over Asia Pacific, and the country is the main contributor to the market expansion. With its huge market and a growing number of internet users, China has been flooded with pirated copies of entertainment and software. Growing emphasis on intellectual property protection in the country in anti-piracy solutions has further driven the growth of the region at a rapid pace.

In 2024, the Europe region is witnessing steady growth in the anti-piracy protection industry due to increasing piracy threats in the entertainment, gaming, and software sectors. The need for sophisticated anti-piracy offerings such as DRMs, AI-enabled monitoring, and watermarking solutions is growing. The U.K. is the biggest territory in the region, thanks to a varied, content-driven sector and significant economic losses from piracy. It is the U.K. that stands out thanks to the volume of digital content consumed, piracy levels, and how it protects.

In 2024, the Middle East and Africa region will still have a growing desire for anti-piracy protection solutions. Rolling internet penetration and mass adoption of digital platforms are increasing the demand for efficient piracy protection and setting the stage for market growth. Piracy is also increasing in Latin America with the rise of streaming services, causing great harm both to those who produce the content and the industries that support them. In this context, the two have stepped up efforts to curb content piracy and illegal streaming with state-of-the-art anti-piracy solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The anti-piracy protection market companies are Red Points, McAfee LLC, Irdeto, Verimatrix, Synamedia, Castlabs, Friend MTS Limited, Brightcove Inc., APP Global, Vobile, and others.

Recent Developments:

-

In 2024, Irdeto won the Anti-Piracy category in the Cybersecurity Excellence Awards for Irdeto Irdeto-developed end-to-end suite of content protection solutions. Highlights are best-in-class monitoring, watermarking, live event protection, forensic investigations, a clear proof of Irdeto’s commitment to safeguarding digital content against piracy.

-

In 2024, Verimatrix’s Counterspy anti-piracy award-winning service underscored its power to combat digital piracy. The observation of unauthorized key leakage and content distribution, and CDN leeching are observed in real-time detection of unauthorized key theft, content distribution, and leeching from CDN, along with the ability to roll out both automated and customizable countermeasures.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 210.32 Billion |

| Market Size by 2032 | USD 533.08 Billion |

| CAGR | CAGR of 12.33% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Service, Software) • By Enterprise Type (Small and Medium-sized Enterprises (SMEs), Large Enterprises) • By End User (Film and TV, Gaming, Music, OTT Platforms, Publication and Media, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Red Points, McAfee LLC, Irdeto, Verimatrix, Synamedia, Castlabs, Friend MTS Limited, Brightcove Inc, APP Global, Vobile, and Others. |