Dermal Fillers and Botulinum Toxin Market Report Scope & Overview:

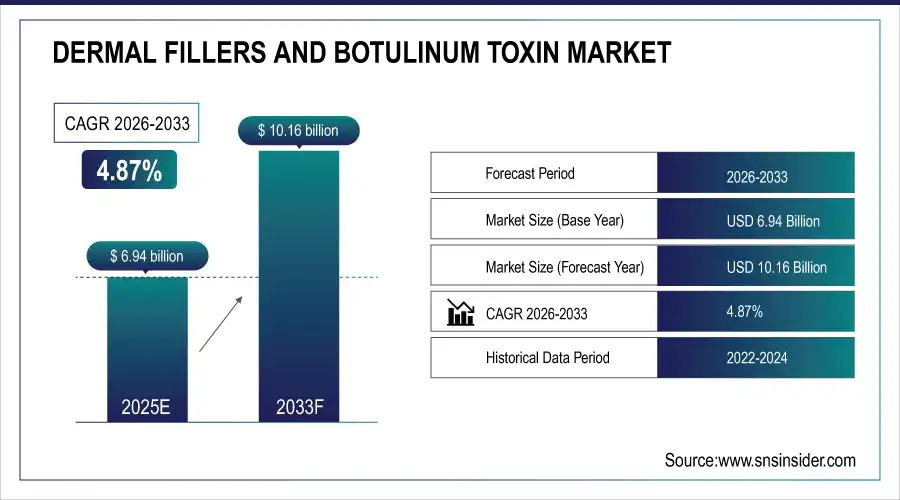

The Dermal Fillers and Botulinum Toxin Market Size was valued at USD 6.94 billion in 2025E and is expected to reach USD 10.16 billion by 2033, growing at a CAGR of 4.87% over the forecast period of 2026-2033.

To Get more information On Dermal Fillers and Botulinum Toxin Market - Request Free Sample Report

The Dermal Fillers and Botulinum Toxin Market is witnessing robust growth, fueled by rising demand for minimally invasive cosmetic procedures and anti-aging treatments. Increasing consumer awareness, technological advancements in injectable formulations, and growing acceptance of aesthetic enhancements are driving market expansion. Clinics and medical spas are rapidly adopting these solutions for natural, youthful appearance restoration.

Market Size and Forecast:

-

Dermal Fillers and Botulinum Toxin Market Size in 2025E: USD 6.94 Billion

-

Dermal Fillers and Botulinum Toxin Market Size by 2033: USD 10.16 Billion

-

CAGR: 4.87% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Key Dermal Fillers and Botulinum Toxin Market Trends

-

Growing demand for minimally invasive aesthetic procedures is driving the adoption of dermal fillers and botulinum toxin for wrinkle reduction and facial rejuvenation.

-

Increasing preference for personalized, natural-looking results is boosting the use of advanced injectable formulations and combination treatments.

-

Rapid technological advancements in filler composition—such as hybrid and long-lasting HA-based fillers—are enhancing treatment outcomes and safety profiles.

-

Expansion of medical spas and dermatology clinics is increasing accessibility and consumer adoption across urban and semi-urban areas.

-

Rising male participation in aesthetic procedures and shifting beauty standards are broadening the consumer base.

-

Integration of AI-based facial mapping and digital consultation tools is improving precision and patient experience.

-

Strategic partnerships, M&A, and product launches by key players are accelerating market penetration and global expansion.

-

Growing popularity of preventive aesthetics among younger consumers is fueling early adoption and recurring demand for injectables.

U.S. Dermal Fillers and Botulinum Toxin Market Insights

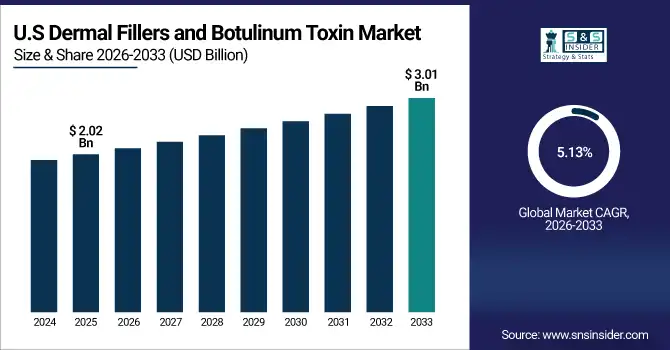

The U.S. market is valued at USD 2.02 billion in 2025E and is expected to reach USD 3.01 billion by 2033, growing at a CAGR of 5.13% over the forecast period of 2026-2033. The growth is fueled by rising demand for minimally invasive cosmetic procedures, causing more dermatology clinics and medical spas to expand services. Increasing consumer preference for natural-looking results has led to higher adoption of hyaluronic acid-based fillers, while technological advancements in formulations are improving safety and treatment outcomes, attracting a broader patient base.

Dermal Fillers and Botulinum Toxin Market Growth Driver

-

Rising Preference for Minimally Invasive Cosmetic Procedures Increasing Demand for Dermal Fillers and Botulinum Toxin Worldwide

The growing preference for minimally invasive cosmetic procedures is driving the Dermal Fillers and Botulinum Toxin Market. Consumers increasingly seek treatments that provide natural, youthful appearances without surgery, causing clinics and medical spas to expand service offerings. This has led manufacturers to innovate hyaluronic acid-based and botulinum toxin formulations with enhanced safety profiles and longer-lasting results. The rising awareness of aesthetic treatments among men and younger demographics further amplifies demand. Consequently, healthcare providers are investing in training, marketing, and infrastructure to meet patient expectations, fostering market expansion across North America, Europe, and Asia-Pacific regions. Technological advancements in injectable delivery systems, digital facial mapping, and customized formulations are also contributing to higher adoption rates and treatment repeatability, reinforcing growth trends across multiple segments.

In January 2024, Allergan Aesthetics launched a next-generation hyaluronic acid filler with improved cross-linking technology, enabling smoother injections and longer-lasting results, enhancing patient satisfaction and clinic adoption rates globally.

Dermal Fillers and Botulinum Toxin Market Restraint

-

High Treatment Costs and Limited Insurance Coverage Restrict Widespread Adoption of Dermal Fillers and Botulinum Toxin

High costs of dermal fillers and botulinum toxin treatments act as a significant market restraint. The expenses associated with premium injectable products, consultation fees, and follow-up sessions discourage price-sensitive consumers from opting for these procedures. Limited or non-existent insurance coverage for cosmetic interventions further exacerbates this issue, causing lower adoption rates in emerging economies. Consequently, smaller clinics may hesitate to invest in advanced formulations or training for staff. The cost barrier also limits frequency of repeat treatments, affecting market revenue generation. Consumers often defer procedures or choose lower-priced alternatives, creating a disparity in access to high-quality products. This combination of high upfront costs and inadequate reimbursement mechanisms slows down market penetration, particularly in regions with moderate purchasing power or less-developed healthcare infrastructure.

Dermal Fillers and Botulinum Toxin Market Opportunity

-

Expanding Male Consumer Base and Younger Demographics Creating New Revenue Streams in Dermal Fillers and Botulinum Toxin Market

The rising interest in aesthetic procedures among men and younger age groups is opening new growth opportunities for the Dermal Fillers and Botulinum Toxin Market. Traditionally dominated by female consumers aged 35–60, the demographic shift has increased demand for wrinkle reduction, jawline contouring, and preventive anti-aging treatments. Clinics and product manufacturers are responding by developing gender-specific marketing strategies, lighter formulations, and tailored consultation services. Cosmetic clinics are expanding locations and service offerings to capture this emerging segment. Technological advancements in product formulation, digital consultation tools, and minimally invasive procedures make treatments more appealing to younger consumers, driving increased adoption and higher repeat treatment rates. This demographic expansion is expected to strengthen revenue streams and provide long-term growth potential across developed and emerging regions.

In November 2023, Revance Therapeutics introduced a targeted marketing campaign highlighting botulinum toxin treatments for men aged 25–40, resulting in a 15% increase in male patient consultations in U.S. dermatology clinics within six months.

Dermal Fillers and Botulinum Toxin Market Segment Highlights:

-

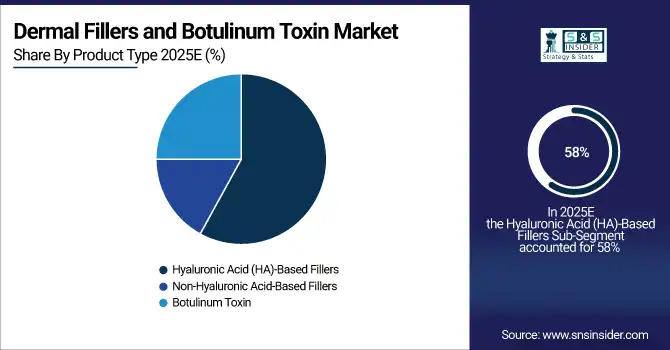

By Product Type: Hyaluronic Acid (HA)-Based Fillers – 58% share (largest); Botulinum Toxin fastest-growing at 6.2% CAGR, driven by rising demand for wrinkle reduction and preventive aesthetics.

-

By Application: Wrinkle Reduction – 68% share (largest); Aesthetic Volume Restoration fastest-growing at 5.5% CAGR, supported by increasing demand for facial contouring and volume enhancement procedures.

-

By End User: Dermatology Clinics – 52% share (largest); Medical Spas / Aesthetic Clinics fastest-growing at 4.9% CAGR due to expanding adoption of minimally invasive treatments and increasing patient access.

Dermal Fillers and Botulinum Toxin Market Segment Analysis

By Product Type

Hyaluronic Acid (HA)-Based Fillers continue to dominate the market with a 58% share in 2025, owing to their high biocompatibility, natural-looking results, and reversibility. Botulinum Toxin is the fastest-growing segment, projected at a 6.2% CAGR, driven by increasing demand for wrinkle reduction, preventive aesthetics, and expanding adoption across dermatology clinics, medical spas, and cosmetic centers worldwide. The growing popularity of combination treatments with HA fillers further supports the growth of this segment.

By Application

Wrinkle Reduction dominates the market with a 68% share in 2025, as consumers increasingly seek minimally invasive procedures to reduce facial lines and maintain a youthful appearance. Aesthetic Volume Restoration is the fastest-growing application segment at a 5.5% CAGR, fueled by rising demand for facial contouring, lip enhancement, and correction of age-related volume loss. Technological advancements in filler formulations and safer delivery systems are supporting higher adoption rates across multiple patient demographics.

By End User

Dermatology Clinics account for the largest share at 52% in 2025, driven by specialized expertise, established patient trust, and wide availability of injectable treatments. Medical Spas / Aesthetic Clinics are the fastest-growing end-user segment at 7% CAGR, as these facilities expand services, improve accessibility, and cater to younger and male demographics seeking non-surgical aesthetic enhancements. The trend of clinics offering combined filler and botulinum toxin procedures is boosting adoption and repeat treatments.

Dermal Fillers and Botulinum Toxin Market Regional Analysis

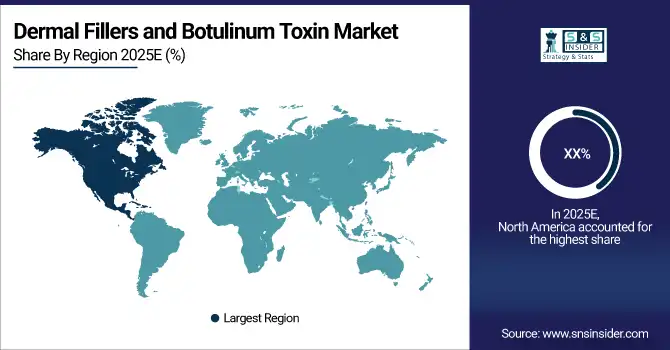

North America Dermal Fillers and Botulinum Toxin Market Insights

Increasing awareness of minimally invasive cosmetic procedures causes higher demand for dermal fillers and botulinum toxin treatments. The United States dominates the North American Dermal Fillers and Botulinum Toxin Market due to high aesthetic awareness, widespread acceptance of minimally invasive procedures, and well-established healthcare infrastructure. Rising disposable income, a large population seeking anti-aging solutions, and extensive presence of leading market players such as Allergan, Revance, and Merz contribute to strong adoption. The U.S. also benefits from advanced training programs for dermatologists and aesthetic practitioners, supporting safer and more effective treatments. Combined with marketing campaigns, digital consultations, and patient education initiatives, these factors make the U.S. the primary driver of North America’s market dominance.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific Dermal Fillers and Botulinum Toxin Market Insights

Rising beauty consciousness and disposable income drive higher adoption of cosmetic injectables across emerging Asia-Pacific economies. China leads the Asia-Pacific Dermal Fillers and Botulinum Toxin Market, driven by increasing urbanization, growing middle-class disposable income, and rising interest in aesthetic procedures among young adults. Expanding medical spa networks, dermatology clinics, and cosmetic hospitals facilitate accessibility and availability of high-quality injectables. Social media influence and the popularity of beauty standards promoting youthful appearances have further increased patient adoption. Regulatory reforms allowing safe introduction of advanced fillers and botulinum toxins also support market expansion. These factors, combined with rising awareness campaigns and the entry of global brands like Galderma and Allergan, make China the primary growth engine in the Asia-Pacific region.

Europe Dermal Fillers and Botulinum Toxin Market Insights

Europe accounts for 24.11% of the Dermal Fillers and Botulinum Toxin Market in 2025, driven by high aesthetic awareness, mature healthcare systems, and strong adoption of minimally invasive cosmetic procedures. Increasing demand for wrinkle reduction and facial contouring treatments among aging populations fuels market growth. Aging population and preference for non-surgical procedures lead to increased adoption of fillers and botulinum toxin treatments. Germany dominates due to advanced medical infrastructure, strong regulatory framework, and widespread acceptance of aesthetic treatments.

Latin America (LATAM) and Middle East & Africa (MEA) Dermal Fillers and Botulinum Toxin Market Insights

The Middle East & Africa region accounts for 9.00% of the market in 2025. Rising medical tourism, growing awareness of cosmetic procedures, and increased disposable income in countries like UAE and Saudi Arabia drive the adoption of dermal fillers and botulinum toxin treatments. The presence of luxury aesthetic clinics and expanding networks of dermatology specialists further support market growth. High social media influence and beauty consciousness also contribute to gradual but steady expansion in this emerging region. Latin America holds a 7.34% share of the Dermal Fillers and Botulinum Toxin Market in 2025. Brazil leads the region due to strong cultural emphasis on beauty, high adoption of aesthetic procedures, and the presence of experienced dermatologists and cosmetic clinics.

Competitive Landscape for Dermal Fillers and Botulinum Toxin Market:

Allergan Aesthetics (AbbVie Inc.)

Allergan Aesthetics, a subsidiary of AbbVie Inc., is a global leader in aesthetic medicine, specializing in dermal fillers and botulinum toxin treatments. With decades of experience, the company develops advanced HA-based fillers, botulinum toxin formulations, and combination therapies for wrinkle reduction, facial contouring, and volume restoration. Allergan operates through dermatologists, plastic surgeons, and medical spas worldwide, providing training, digital consultation tools, and marketing support. Its role in the dermal fillers and botulinum toxin market is critical, delivering innovative, safe, and effective solutions that enhance patient satisfaction and drive adoption.

-

In January 2024, Allergan Aesthetics launched its next-generation HA filler with improved cross-linking technology, enabling smoother injections, longer-lasting results, and broader adoption among dermatology clinics globally.

Galderma S.A.

Galderma S.A., headquartered in Switzerland, is a leading global provider of dermatology solutions, including botulinum toxin products and HA-based dermal fillers. The company focuses on research-driven innovation, offering treatments for wrinkle reduction, aesthetic volume restoration, and preventive anti-aging. Galderma partners with dermatologists, plastic surgeons, and aesthetic clinics, providing training, clinical support, and digital tools for precise application. Its presence in the market is significant, shaping treatment trends and patient outcomes across Europe, North America, and Asia-Pacific.

-

In March 2024, Galderma introduced a novel long-lasting botulinum toxin formulation designed for finer facial lines, improving patient satisfaction and repeat treatment rates.

Revance Therapeutics, Inc.

Revance Therapeutics, Inc., a U.S.-based innovator in aesthetic medicine, specializes in botulinum toxin and dermal filler treatments for wrinkle reduction and facial rejuvenation. The company emphasizes product efficacy, safety, and patient-centric solutions, collaborating with medical professionals to expand access and adoption. Revance invests in advanced delivery technologies, clinical research, and practitioner education, supporting market growth in North America, Europe, and Asia-Pacific. Its role in the dermal fillers and botulinum toxin market is pivotal, offering alternative formulations and treatment options that enhance patient confidence and outcomes.

-

In July 2025, Revance Therapeutics launched a targeted marketing campaign promoting its botulinum toxin treatments for male and younger demographics, driving a notable increase in aesthetic clinic consultations across the U.S.

Dermal Fillers and Botulinum Toxin Market Key Players

Some of the Dermal Fillers and Botulinum Toxin Companies

-

Allergan Aesthetics (AbbVie Inc.)

-

Galderma S.A.

-

Revance Therapeutics, Inc.

-

Merz Pharma GmbH & Co. KGaA

-

Ipsen Pharma

-

Medytox Inc.

-

Hugel, Inc.

-

Daewoong Pharmaceutical Co., Ltd.

-

Bloomage Biotechnology Corporation Limited

-

Sinclair Pharma

-

Teoxane SA

-

Suneva Medical, Inc.

-

BioPlus Co., Ltd.

-

Prollenium Medical Technologies Inc.

-

Sculpt Luxury Dermal Fillers Ltd.

-

Evolus, Inc.

-

Croma Pharma GmbH

-

Bioxis Pharmaceuticals

-

Anika Therapeutics, Inc.

-

Caregen Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 6.94 Billion |

| Market Size by 2033 | USD 10.16 Billion |

| CAGR | CAGR of4.87% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Hyaluronic Acid (HA)-Based Fillers, Non-Hyaluronic Acid-Based Fillers, Botulinum Toxin) • By Application (Wrinkle Reduction, Aes • By End User (Dermatology Clinics, Hospitals & Ambulatory Surgical Centers, Medical Spas / Aesthetic Clinics) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Allergan Aesthetics (AbbVie Inc.), Galderma S.A., Revance Therapeutics, Inc., Merz Pharma GmbH & Co. KGaA, Ipsen Pharma, Medytox Inc., Hugel, Inc., Daewoong Pharmaceutical Co., Ltd., Bloomage Biotechnology Corporation Limited, Sinclair Pharma, Teoxane SA, Suneva Medical, Inc., BioPlus Co., Ltd., Prollenium Medical Technologies Inc., Sculpt Luxury Dermal Fillers Ltd., Evolus, Inc., Croma Pharma GmbH, Bioxis Pharmaceuticals, Anika Therapeutics, Inc., Caregen Co., Ltd. |