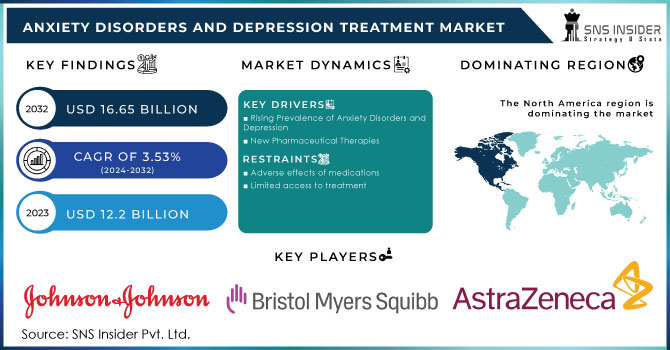

Anxiety Disorders and Depression Treatment Market Report Scope & Overview:

Get More Information on Anxiety Disorders and Depression Treatment Market - Request Sample Report

The Anxiety Disorders and Depression Treatment Market size was USD 12.2 billion in 2023 and is expected to Reach USD 16.65 billion by 2032 and grow at a CAGR of 3.53% over the forecast period of 2024-2032.

The Anxiety Disorders and Depression Treatment Market is witnessing robust growth with the growth in incidences of anxiety and depression among young adults along with efforts to increase research and development activities. Among the young ones aged 18 to 30, who are the most susceptible ages to anxiety and depression, excessive usage of social networking sites, very high academic demands, and financial stress continue to be agents spreading mental illness. Since the mid-20th century, the world has witnessed the increasing prevalence of these conditions, which thus influence the realization of objectives of young adults in academics and careers, to extreme cases of substance abuse and even suicide.

Governments and health organizations are also contributing actively to the market's growth by undertaking extensive research and development that has led to new treatments being approved for these psychoses. Partnerships between pharmaceutical majors, mental health organizations, NGOs, and government initiatives have heightened awareness among people, making them proactive in seeking early medical attention. Mental health disorders already form a burden on the GDP of high-income countries ranging between 3% and 4%. This thus points out that anxiety and depression disorders carry quite a heavy economic and emotional toll. Governments are now looking to these respective authorities to bring this down, which is likely to stimulate demand for solutions that can treat the problem of anxiety and depression.

Between 2021, roughly 280 million people suffered from depression worldwide, and this represented 3.8% of the world population, at 5.0% among adults and 5.7% among people aged more than 60 years. Anxiety disorders were estimated to affect about 264 million people in 2021. The growth rate of mental health disorders will work to further expand the market. Approval for products, such as the FDA approval given to Alembic Pharmaceuticals for Desipramine Hydrochloride Tablets in 2021, has also boosted the market. The significant impetus provided by funding research and development--mental health receives USD 18.5 billion in grants from 345 funders in 38 countries between 2015 and 2020 is likely to drive additional growth in the market over the next few years.

Anxiety Disorders and Depression Treatment Market Dynamics

Drivers

-

Rising Prevalence of Anxiety Disorders and Depression

Anxiety disorders and depression are among the most common mental illnesses in the world. Millions of people are afflicted with these two conditions. According to WHO estimation, about 284 million individuals suffer from anxiety disorders, while about 264 million people are affected by depression. These conditions are widely prevalent, primarily because of modern stressors like urbanization high expectations from society, and a fast-paced lifestyle. Increasingly, the need for treatment is critical in underpinning growth in the global anxiety disorders and depression treatment market.

-

New Pharmaceutical Therapies

Recent advancements in pharmaceutical therapies have made a significant shift in the treatment algorithm for anxiety and depression. Antidepressants like SSRIs and SNRIs simplified the management of depression, while antidepressants dramatically improved the effectiveness of treatment. Similarly, benzodiazepines and buspirone emerged as reliable treatments for anxiety disorders. Further scope is evident in such areas of research and development, which will enhance the drug's efficacy in treatment and subsequently accelerate market growth.

-

Increasing Awareness and Destigmatization

Historically, anxiety disorders and depression had stigma and discrimination attached to them, and people avoided discussing them. However, growing public awareness and increased sensitivity toward mental health issues are changing people's perceptions. Public campaigns, media representation, and efforts of NGOs have all contributed to levels of reduced stigma. The increasing awareness of the nation regarding the proper management of mental health and the need for regular check-ups is expected to raise the demand for treatments, thereby boosting the growth of the global anxiety disorders and depression treatment market.

Restraints

-

Adverse effects of medications

-

Limited access to treatment

Anxiety Disorders and Depression Treatment Market - Key Segmentation

By Drugs

In 2023, the antidepressants segment accounted for the largest share in terms of revenue at 32.6%. Primarily driven by the growing incidence of conditions including major depressive disorder, obsessive-compulsive disorder, generalized anxiety disorder, and panic disorder, the growth of this segment is also fueled by rising awareness about mental health and depression through government campaigns and NGO initiatives, thereby propelling more instances of treatment using antidepressant medications prescribed by healthcare professionals.

The atypical antipsychotics segment accounted for 19.64% in the year 2023 because the drugs have fewer cases of extrapyramidal side effects than traditional antipsychotic drugs. Additionally, the increasing prevalence of anxiety, depression, and bipolar disorders further propel the growth of this segment. Mental health awareness continues to increase; many patients approaching treatment want to start with atypical antipsychotics that are safer and as effective as traditional antipsychotic drugs.

By Indication

The anxiety segment dominated the market in 2023, accounting for 55.2% of the market share. This is mainly because the prevalence of diseases such as phobias, social anxiety disorders, and others is increasingly becoming a problem in developed and emerging economies. This increases competition among people, and eventually, they end up setting impossible goals. Failure to achieve these targets leads to anxiety and depression. Apart from this, growing awareness of anxiety and treatment options is also fuelling the growth of this segment.

Depression accounted for 44.8% of market share during the same period in 2023. As the diagnosis increases, more people are visiting hospitals to get a medical checkup because of their worsened mental well-being. Societal stress, issues associated with work-life balance, and the effects of social media also play a crucial role in raising depression, hence driving the market in this segment.

By Distribution Channel

In 2023, the retail pharmacies segment dominated the market with a share of 55.6%. This is mainly because patients prefer to buy drugs from local pharmacies as these are easily accessible and trustworthy. The growth in the segment can be further ascribed to the provision of branded and generic medicines, along with other medical products, through retail pharmacies in one place. Most retail pharmacies offer immediate help during emergencies and, in many cases, do not need a prescription. The sheer efficiency with which the company can deliver fast service helps the creation of loyal customers and thereby aids in augmenting the growth segment.

On the other side, the market of online pharmacies is expected to be highly growth-proportional, at about 8.6%. This is because of the development of e-commerce platforms and applications offering many types of medicines and pharmacy products. Online pharmacies let customers browse through catalogs comfortably and order products straight into their houses without paying a visit to stores. The subscription model offered by online pharmacies, where customers can receive prescription medicines shipped to them weekly or monthly, addresses medicine shortages and goes a long way in driving the growth of this segment.

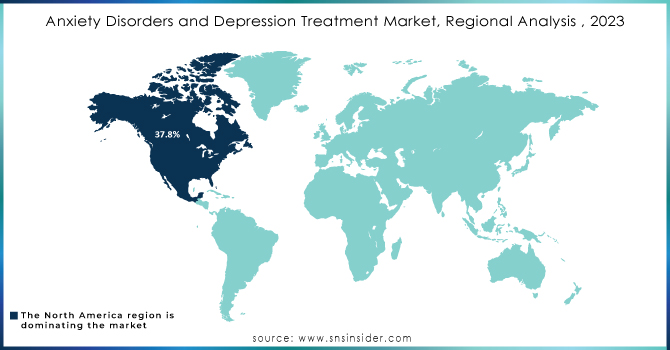

Anxiety Disorders and Depression Treatment Market Regional Analysis

North America emerged as the leading segment in the anxiety disorders and depression treatment market with a market share of 37.8% in 2023. The main reason behind this is the increasing population suffering from anxiety and mental disorders, and strong distribution networks along with key market players who have already established their presence in the market. Strong medical facilities and treatment alternatives for mental health are also aiding the progress of the market in the region. The U.S. constituted 89.3% of the North American market, led by the surge in psychological symptoms like depression, fear, and helplessness. Greater awareness created within the country, thanks to governmental and NGO efforts, has contributed a lot towards the growth of the market.

Europe became the most profitable area worldwide, occupying 29.3% of the market share in 2023. The business is driven by hefty research and development spending, majorly aimed at the development of anti-depressant drugs. A rising awareness regarding mental health also significantly contributes to the increasing demand for anxiety and depression treatment in this region, thus pushing the market upward.

In the Asia Pacific, it is 23.6% of the global share with an increase in mental health disorders. The development of infrastructure of healthcare and accessibility to treatment in those economies through economic growth helped in increasing the market growth. Increasing awareness regarding mental health being a major concern is going to make the market grow even more over these regions soon.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players in the Anxiety Disorders and Depression Treatment Market (Based on Offerings)

Antidepressants

-

Pfizer Inc. - Zoloft (sertraline)

-

H. Lundbeck A/S - Cipralex (Escitalopram)

-

GlaxoSmithKline Pharmaceuticals Ltd.-Paxil (paroxetine)

-

Merck & Co., Inc.- Remeron (Mirtazapine)

-

Eli Lilly & Company- Prozac (fluoxetine)

-

AstraZeneca-Seroquel (quetiapine)

-

Bristol-Myers Squibb-Abilify (aripiprazole)

-

Johnson & Johnson-Invega (Paliperidone)

-

AbbVie Inc.-Vraylar (Cariprazine)

-

Sanofi-Mood Stabilizers (e.g., Valproate)

-

Roche- Valium (Diazepam - also classified under anti-anxiety)

Anti-Anxiety Medications

-

Teva Pharmaceutical Industries-Lorazepam (Ativan)

-

Novartis- Xanax (Alprazolam)

-

Takeda Pharmaceutical-Buspar (Buspirone)

-

Allergan plc-Ativan (Lorazepam)

Recent Developments

In September 2023, Lundbeck shared clinical results at the International Headache Congress (IHC) 2023 in Seoul, Korea, demonstrating the efficacy and tolerability of Lu AG09222 in migraine prevention, a frequent symptom among patients with anxiety disorders. The presentations also included additional findings from a study showing that Lu AG09222 effectively prevents PACAP38-induced vasodilation and headaches.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.2 Billion |

| Market Size by 2032 | USD 16.65 Billion |

| CAGR | CAGR of 3.53% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drugs (Antidepressants, Anxiolytics, Anticonvulsants, Noradrenergic Agents, Atypical Antipsychotics) • By Indication (Depression, Anxiety) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pfizer Inc., H. Lundbeck A/S, GlaxoSmithKline Pharmaceuticals Ltd., Merck & Co., Inc., Eli Lilly & Company, AstraZeneca, Bristol-Myers Squibb, Johnson & Johnson, AbbVie Inc., Sanofi, Roche, Teva Pharmaceutical Industries, Novartis, Takeda Pharmaceutical, Allergan plc |

| Key Drivers | • Rising Prevalence of Anxiety Disorders and Depression • New Pharmaceutical Therapies • Increasing Awareness and Destigmatization |

| Restraints | • Adverse effects of medications • Limited access to treatment |