Application Processor Market Size & Growth Trends:

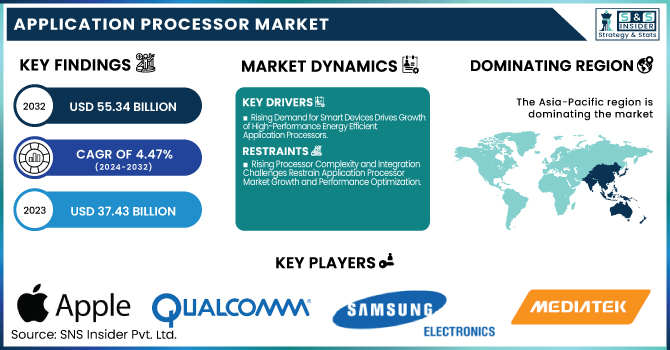

The Application Processor Market was valued at USD 37.43 billion in 2023 and is expected to reach USD 55.34 billion by 2032, growing at a CAGR of 4.47% over the forecast period 2024-2032.

To Get More information about Application Processor Market - Request Free Sample Report

The Application Processor Market is moving towards an advanced level of process node distribution with a growing focus on process nodes such as 5nm and 3nm, targeting improved performance and power efficiency. Mainstream AI-integrated APs to boost on-device intelligence for smartphones and IoT devices. Increasing adoption of security features such as secure enclaves and trusted execution environments to secure delicate data. On the other hand, fab capacity utilization stays in the spotlight as the big foundries are securing enough wafers to meet the increasing demand for high-performance chips. 2024 Major advancements for U.S. semiconductor industry Under the CHIPS Act, Intel also secured USD 8.5 billion for four additional fabs that are being built in Arizona and Ohio, and for the upgrades of Oregon and New Mexico facilities. As part of that program, TSMC was granted USD 6.6 billion to build its third fab in Arizona which is expected to accommodate the 2nm process. The New York fab expense is part of a more detailed global operations plan GlobalFoundries raised USD 1.5 billion to build a new fab in New York and expand its Vermont plant. The initiatives seek to increase chip production on home soil, aiming to be less dependent on foreign producers.

The U.S. Application Processor Market is estimated to be USD 7.02 Billion in 2023 and is projected to grow at a CAGR of 4.10%. Demand for AI-enabled devices, 5G innovations, and government support through the CHIPS Act are benefiting the U.S. application processor market. Domestic chip development and innovation have also been propelled by rising demand transformations, including increased smartphone penetration, edge computing needs, and further automotive electronics expansion.

Application Processor Market Dynamics

Key Drivers:

-

Rising Demand for Smart Devices Drives Growth of High-Performance Energy Efficient Application Processors

High-performance smartphones, wearables, and IoT demand are the major market driving factors of the application processor market. The combination of a saturation point of 5G, almost instant connections and real-time data processing and response is pushing consumers towards higher-end processors than ever before such as the Qualcomm Snapdragon Elite Platform and Apple A-series chips. Moreover, device makers are integrating features around AI, offering voice assistants in phones or fitness tracking in wearables, all of which demand capable computation on-device only propagating processor upgrades. The rise of edge computing as well as the growing penetration of smart home products have also driven manufacturers toward adding energy-efficient, high-performance processors into sub-compact devices.

Restrain:

-

Rising Processor Complexity and Integration Challenges Restrain Application Processor Market Growth and Performance Optimization

An increase in the complexity of processor design and integration is one of the key restraints in the application processor market. Chip architectures are becoming more complex as there is increased demand for additional features such as AI acceleration, graphics, and low power consumption. This raises challenges for maintaining compatibility as well as performance and heat management across devices. Second, there are software and firmware optimizations that are tightly coupled to a varied set of devices and operating systems (e.g., android, iOS, automotive-grade Linux) which can slow down product timelines, and contribute to performance variability.

Opportunity:

-

Automotive Innovation and Emerging Markets Unlock New Growth Avenues for Versatile Application Processors

The automotive industry is a multibillion-dollar opportunity, with the transition to electric and self-directed cars on the rise. Application processors are even being utilized to power infotainment systems and advanced driver-assistance systems (ADAS), as well as to make real-time decisions in self-driving cars. As an example, systems like Tesla's Full Self-Driving (FSD) computer and NVIDIA's DRIVE platform both use high-performance SoCs to process a large amount of sensor data. Emerging markets also present a key growth opportunity, as greater smartphone penetration and a continuing wave of digital transformation push new segments into the smartphone spirit, allowing processor vendors to offer low-cost yet functional APs into price-sensitive end markets. The focus on Industry 4.0 also paves the way for the TCGD805 and similar application processors across industries where automation and connection are paramount, creating a significant demand for versatile processors.

Challenges:

-

Supply Chain Risks and Security Concerns Challenge Stability and Innovation in Application Processor Industry

Another great risk to the application processor industry is volatility in the supply chain and geopolitical climates. The world relies on a small number of advanced node foundries, primarily TSMC and Samsung, to manufacture cutting-edge chips, creating chokepoints in times of peak demand or during disasters or export controls. Additionally, as processors manage more sensitive data, particularly in automotive and wearable devices, security vulnerabilities and data privacy concerns are increasing. Chipmakers are facing an increasing challenge to provide robust hardware-level security features while maintaining processing efficiency. To preserve the pace of innovation facing these issues, the hardware, software, and OEM partners must collaborate to offer robust, scalable processor solutions that meet the diverse needs of end-use verticals.

Application Processor Market Segmentation Outlook

By Device Type

Mobile phones continued to maintain a solid 60.8% place in application processor market share in 2023. This dominance is fueled by huge global smartphone demand, the ongoing rapid pace of innovation in mobile chipsets, and the push for new features (like AI, 5G, and high resolution) integrated into smartphones. Top processors for flagship and mid-range smartphones (like Qualcomm, Apple, and MediaTek) are periodically released by leading manufacturers in this segment, contributing to the growth of this segment.

Smart wearables are anticipated to experience the highest CAGR between 2024 and 2032. The quick adoption of fitness trackers, smartwatches, and other body wearable health monitoring devices is spurring the need for compact, low-power, and high-performance application processors. Chipmakers seem to be busy designing wearable-specific processors with AI and energy-saving capabilities as consumers look for more real-time health data and easy connectivity. Smart wearables which create a bridge between personal health tech and connected lifestyle devices are the most rapidly expanding segment of the application processor market.

By Core Type

Octa-core Processors dominate the market and account for 48.1% of the share in 2023 and are projected to achieve the fastest CAGR of more than 22% from 2024 to 2032, based on Data type. This domination is because of the large-scale acceptance of these processors in high-end smartphones, tablets, and smart devices where effective multitasking and high-performance processing are a basic requirement. Octa-Core architectures provide the right balance of speed and energy efficiency for next-generation applications, including AI, gaming, 4K video, and advanced camera capabilities. As the appetite for better user experiences grows, we see octa-core designs being used not only in high-end devices, but also in several mid-range devices, and these are being integrated by manufacturers such as Qualcomm, MediaTek, and Samsung. Emerging applications in wearables, automotive systems, and edge AI devices that require more efficient multi-core performance to meet real-time processing and responsiveness needs further confirm these expectations of growth.

By Industry

In 2023, consumer electronics accounted for a remarkable 82.5% share of the application processor segment due to the proliferation of smartphones, tablets, laptops, smart wearables, and home automation devices. Application processors are continuously innovated, owing to this ever-increasing demand for faster, smarter, and more energy-efficient devices. Some companies such as Apple, Qualcomm, and MediaTek are driving new changes by embedding AI, machine learning, and 5G to processors for consumer gadgets. This segment still dominates due to the rapid growth of smart home products being launched in the market ever since as well as the mobility of the portable device.

Automotive segment is expected to grow at the highest CAGR from 2024 to 2032 owing to the increasing integration of EVs, ADAS, and infotainment platforms. Application processors are being used across a variety of functions such as real-time navigation, voice control, sensor fusion, and autonomous driving and this trend is accelerating among automakers. Such a technology change is opening a huge opportunity for automotive chipmakers.

Application Processor Market Regional Analysis

The application processor market was dominated by the Asia Pacific region with a share of 44.3% in 2023 and is anticipated to grow at the fastest CAGR throughout the forecast period (2024-2032). Trends such as key semiconductor manufacturers in the region, high smartphone penetration, and rising demand for smart devices are fuelling this regional leadership. Countries such as China, South Korea, Taiwan, and India are the main production and consumption points for application processors. Huawei and Xiaomi are two of the many tech giants in China that embed high-level processors in their smartphones and wearables. Samsung Electronics produces its own devices, but it also sells its own Exynos processors in South Korea. Taiwan's MediaTek is also a key player in mid-range and budget smartphone processors, supplying brands like Realme, Oppo, and Vivo. India's expanding consumer electronics sector and the government's "Make in India" program are spurring greater local manufacturing and chip development. Emerging applications processors for automotive, IoT, and smart infrastructure are derived from AI, 5G, and electric vehicle innovation in the region as a result, despite its smaller size, the Asia Pacific will be the largest and the fastest growing market for application processors in the world.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players Listed in the Application Processor Market are:

-

Apple Inc. (A17 Pro)

-

Qualcomm Technologies Inc. (Snapdragon 8 Gen 3)

-

Samsung Electronics Co., Ltd. (Exynos 2400)

-

MediaTek Inc. (Dimensity 9300)

-

Intel Corporation (Core Ultra 9 185H)

-

HiSilicon (Huawei) (Kirin 9006C)

-

NVIDIA Corporation (Tegra X1+)

-

Broadcom Inc. (BCM2712 - used in Raspberry Pi 5)

-

UNISOC (formerly Spreadtrum Communications) (T820)

-

Texas Instruments Incorporated (OMAP5432)

-

Rockchip Electronics Co., Ltd. (RK3588)

-

Allwinner Technology Co., Ltd. (A133)

-

Marvell Technology, Inc. (Armada 8040)

-

Ambarella Inc. (CV2)

-

NXP Semiconductors N.V. (i.MX 8M Plus)

Application Processor Market Trends

-

In May 2024, Apple introduced its new M4 chip, now powering the latest MacBook Air and MacBook Pro models with improved performance and energy efficiency. The M4 lineup includes M4 Pro and M4 Max variants for professional-grade computing.

-

In October 2024, Qualcomm unveiled the Snapdragon 8 Elite, featuring the world’s fastest mobile CPU with advanced AI capabilities. Built on a 3nm process, it’s set to power flagship smartphones from brands like Samsung and Xiaomi.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 37.43 Billion |

| Market Size by 2032 | USD 55.34 Billion |

| CAGR | CAGR of 4.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Mobile Phones, PC Tablets & E-readers, Smart Wearables, Automotive ADAS & Infotainment Devices) • By Core Type (Single-core, Dual-core, Quad-core, Hexa-core, Octa-core) • By Industry (Consumer Electronics, Automotive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Qualcomm Technologies Inc., Samsung Electronics Co., Ltd., MediaTek Inc., Intel Corporation, HiSilicon (Huawei), NVIDIA Corporation, Broadcom Inc., UNISOC, Texas Instruments Incorporated, Rockchip Electronics Co., Ltd., Allwinner Technology Co., Ltd., Marvell Technology, Inc., Ambarella Inc., NXP Semiconductors N.V. |