Global Aptamers Market Size Overview

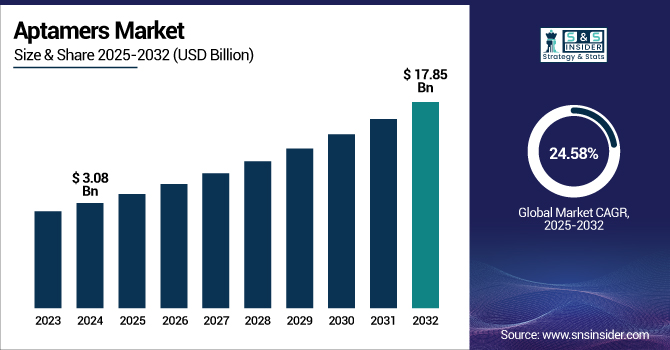

The Aptamers Market size was valued at USD 3.08 billion in 2024 and is expected to reach USD 17.85 billion by 2032, growing at a CAGR of 24.58% over the forecast period of 2025-2032.

To Get more information on Aptamers Market - Request Free Sample Report

Advances in aptamer drug discovery and developments in aptamer-based medicines are driving expansion in the aptamer market. Because diagnostics may identify biomarkers with great specificity, demand for them has soared. An important technology that helps to maximize aptamer choice for both diagnostic and therapeutic uses is SELEX technology (Systematic Evolution of Ligands by Exponential Enrichment). With DNA aptamers and RNA aptamers leading the charge in many uses, including targeted drug delivery and molecular diagnostics, this has greatly helped the nucleic acid aptamers market to develop.

Investments in the aptamers market are increasing, especially as aptamer-based therapies enter clinical trials and demonstrate the potential to transform treatment options for cancer, viral infections, and autoimmune diseases. With significant R&D and clinical validation dedicated to aptamers, their development has expanded the range of the therapeutic oligonucleotides market. The U.S. aptamers market remains a major player in promoting invention and adoption as global aptamers market dynamics change; therefore, valued at USD 1.21 billion in 2024 and is expected to reach USD 6.36 billion by 2032, growing at a CAGR of 23.10% over the forecast period of 2025-2032. Further supported by continuous innovations in RNA and the continuous expansion of the DNA aptamers market, the future aptamers market analysis forecast suggests a compound growth trajectory.

A breakthrough in SELEX technology was revealed in March 2024, allowing a more effective choice of RNA aptamers for medication delivery systems and diagnostics. This invention is expected to increase the aptamers' precision and specificity employed in applications of molecular recognition.

Aptamers Market Drivers

-

Aptamers in Precision Medicine Fueling Market Expansion and Research Investments

Among other aspects, the increased need for aptamer drugs in precision medicine and advancements in RNA aptamers propel the aptamer industry forward. Aptamer drug discovery expenditure is quite impressive, as pharmaceutical companies have precision medicine and targeted therapies in their pipeline. With 18% in 2024, global spending on aptamer research reflects strong investor confidence in this technology. Most especially in cancer and viral infections, aptamers used for the diagnosis will increasingly be employed in the identification of diseases based on their extreme sensitivity, specificity, and popularity. Additionally, more research and development expenditures are propelling the use of aptamers for treatments, most notably in cancer and autoimmune diseases, where few therapeutic options are available. Increased clinical studies, as well as FDA approval of aptamer-based treatment, have also promoted the aptamers market growth.

Aptamers Market Restraints

-

Regulatory and Production Challenges Hindering Aptamers Market Growth

One main constraint is the difficulty of synthesizing aptamers, which usually demands time-consuming and expensive techniques. Regulatory obstacles still exist for aptamer medicines, most notably in manufacturing scale and repeatable quality control. This has led to delays in FDA approvals and postponed market launches for many promising treatments. Furthermore, the lack of established procedures for using diagnostic aptamers in diagnostic kits somewhat limits their market expansion. Moreover, complicating global market expansion is the disconnected regulatory framework. Although investment in aptamer drug development has increased, the demand for greater clinical trial data to show long-term safety and efficacy limits expansion even in this regard.

Aptamers Market Segmentation Analysis

By Type

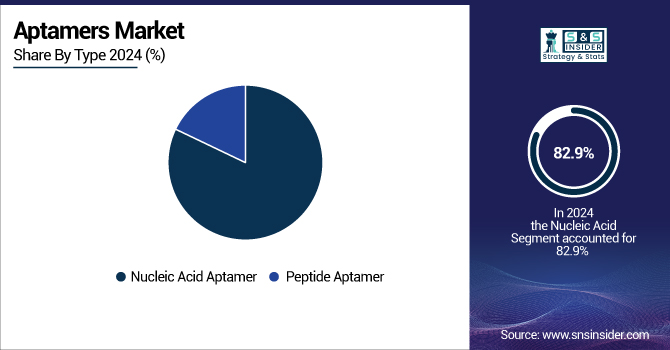

The nucleic acid aptamer segment dominated with 82.9% aptamers market share in the year 2024. The high share is primarily because the demand for RNA and DNA aptamers is increasing, as they are highly adaptable and can target specific diseases such as cancer, autoimmune diseases, and infections. Aptamers composed of nucleic acid have various benefits compared to conventional antibodies, including greater stability, simplicity of synthesis, and reduced immunogenicity, due to which they have found widespread usage in therapy and diagnostics. Ongoing research and development in aptamer-based drug discovery and diagnostics will further reinforce the market leadership of this during the forecast period.

The peptide aptamer segment is likely to experience strong growth during the forecast period due to its exclusive binding properties and the capacity to target specific proteins or cells. The increasing potential of this segment in targeted therapeutic applications makes it a promising area of investment. While the peptide aptamer segment is presently smaller in size, it is anticipated to grow at the fastest rate as developments in peptide synthesis technologies and targeted drug delivery systems continue to advance.

By Application

The research & development (R&D) segment dominated the market in 2024 with a share of 39%. This is mainly because of the rising investment in aptamer-based therapeutics and RNA, especially in cancer treatments and diagnostic tools. The R&D segment is supported by continued research collaborations among research centers, pharma companies, and academic institutions geared towards discovering new aptamer applications in drug discovery, diagnostics, and biotechnology. As continued improvement occurs, the R&D category will continue its leadership position since major players launch new technologies in response to unrecognized medical necessities.

The therapeutics market is likely to experience high growth in the years to come due to the increased need for aptamer-based therapeutics in personalized medicine and targeted drug delivery. Aptamers have demonstrated potential in disease treatment, such as cancer, viral infections, and autoimmune diseases, given that they are more targeted compared to conventional treatments. The segment is expected to expand as clinical trials of aptamer-based drugs continue to yield encouraging results, further boosting the use of aptamer technology in therapeutic applications.

Aptamers Market Regional Outlook

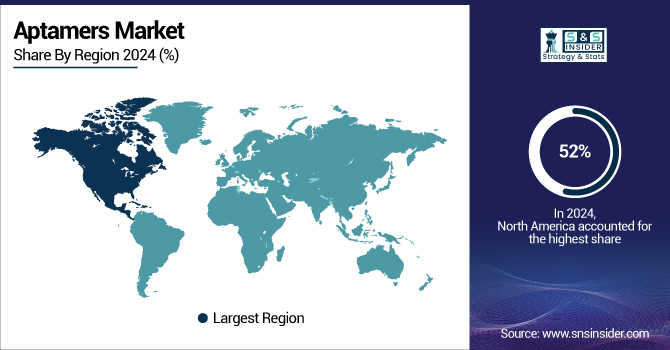

North America dominated the aptamers market in 2024 with a 52% market share, and the U.S. as the dominant country. The U.S. has a considerable share owing to its advanced biotechnology base, robust R&D investment, and positive regulatory framework. It's a leader in clinical trials, therapeutics based on aptamers, and diagnostic technologies, powering much of the regional growth. Canada comes next with an emphasis on diagnostic and therapeutic use in research as well as clinical environments. Mexico has also witnessed growth due to increased partnerships and government backing of the biotech industry. The U.S.'s leadership is fueled by its strong healthcare infrastructure, large-scale research centers, and top-ranked biotech firms, making it the world's leader in aptamer technology.

Europe is the second-largest area in the aptamers market, with Germany topping the list in 2024. The pharmaceutical sector of Germany, along with huge investments in biotech research, makes it the leader in market development. The UK and France are next in line, with continuous research on aptamers for targeted drug delivery and diagnostic purposes. The UK's increasing investment in biotechnology and therapeutic development adds to the aptamers market growth. Spain and Italy are also emerging economies that are interested in aptamer-based drug discovery and diagnostic technologies. Support from the EMA on the regulatory side has also added to the processes of approval of aptamer-based therapies, thus stimulating innovation and market growth.

Asia Pacific is the region that is growing at the fastest pace in the aptamers market, with China leading the way in 2024. China's large government investments in biotechnology and R&D in pharmaceuticals, especially in drug discovery using aptamers and therapeutic uses, are the leading market in the region. The increased emphasis by the country on clinical trials and biotech advancements drives its high-speed market growth. India comes next, fueled by growing demand for diagnostic and targeted drug delivery systems, aided by an expanding healthcare industry and increasing research capacity. The Asia Pacific region will also witness strong growth owing to growing healthcare needs and continued biotechnology research in the aptamer field.

The LAMEA region is a developing market in 2024, with growth led by South Africa and the UAE. Diagnostic and biotech research in South Africa is gaining more focus, making it an important market player. Likewise, the UAE has been continuously investing in biotechnology research and building partnerships to drive aptamer-based solution development. Even though the area has challenges, such as restricted access to advanced technologies and fragmented regulatory environments, government-led healthcare reforms and global cooperation are likely to spur growth in the aptamers industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Aptamers Market

Companies involved in the aptamers market include SomaLogic, Aptamer Group, Aptadel Therapeutics, Base Pair Biotechnologies, Noxxon Pharma, Vivonics Inc., Aptagen LLC, TriLink Biotechnologies, Altermune LLC, and AM Biotechnologies.

Recent Developments in the Aptamers Industry

-

In April 2025, Zentek received a USD 1.1 million contract from Innovative Solutions Canada to develop an avian influenza (H5N1) countermeasure using its multivalent aptamer technology. This collaboration highlights the growing interest in aptamers for infectious disease solutions, further advancing their application in public health.

-

In January 2023, Aptamer Group collaborated with BaseCure Therapeutics to build Optimer-targeted therapies. The partnership is likely to open new avenues of growth for the use of aptamers in therapeutics.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.08 Billion |

| Market Size by 2032 | USD 17.85 Billion |

| CAGR | CAGR of 24.58% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Nucleic Acid Aptamer, Peptide Aptamer) • By Application (Diagnostics, Therapeutics, Research and Development, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SomaLogic, Aptamer Group, Aptadel Therapeutics, Base Pair Biotechnologies, Noxxon Pharma, Vivonics Inc., Aptagen LLC, TriLink Biotechnologies, Altermune LLC, and AM Biotechnologies. |