Arrhythmia Monitoring Devices Market Report Scope And Overview:

Get More Information on Arrhythmia Monitoring Devices Market - Request Sample Report

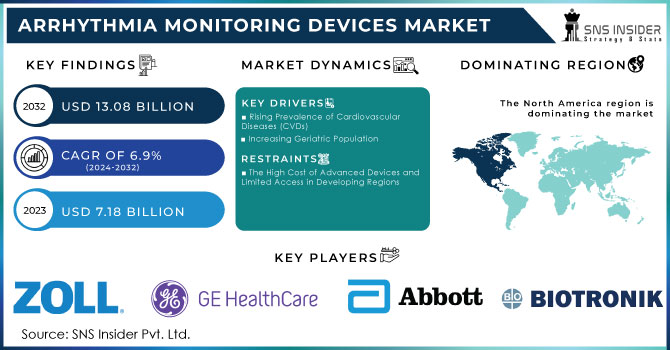

The Arrhythmia Monitoring Devices Market Size was valued at USD 7.18 billion in 2023 and is expected to reach USD 13.08 billion by 2032 and grow at a CAGR of 6.9% over the forecast period 2024-2032.

The Arrhythmia Monitoring Devices Market is experiencing significant growth, driven by the increasing prevalence of cardiac arrhythmias, advancements in monitoring technologies, and rising healthcare expenditures. The market is primarily driven by the demand for non-invasive, convenient, and accurate monitoring solutions.

The demand for arrhythmia monitoring devices is fueled by the growing number of individuals with heart conditions, particularly those at risk of atrial fibrillation (AF), a common arrhythmia associated with stroke and other complications. The increasing availability of wearable devices, such as the SmartCardia ScaAI patch, has further contributed to the market growth, as these devices offer greater convenience and flexibility for patients. As reported by Johnson & Johnson Services, Inc. in February 2024, more than 37.5 million people worldwide are affected by atrial fibrillation, underscoring its global prevalence. The risk of developing AFib is significant, with approximately one in four adults over 40 experiencing this condition at some point in their lives. This escalating prevalence highlights the urgent need for effective management and prevention strategies. The number of AFib cases is anticipated to increase by over 60% between 2024 and 2060, indicating a substantial rise in the global burden of this disease.

The supply of arrhythmia monitoring devices is robust, with a wide range of options available to meet the diverse needs of patients and healthcare providers. Major players in the market include Medtronic, Abbott Laboratories, Philips Healthcare, and Boston Scientific. These companies are investing in research and development to introduce innovative monitoring technologies and expand their market presence. Additionally, regulatory approvals, like FDA clearances, are pivotal in ensuring the availability of new products in the market, as seen with InfoBionic’s MoMe ARC device and Samsung’s Health Monitor app.

Governments worldwide are investing in healthcare infrastructure and promoting preventive care to address the rising burden of heart disease. Regulatory bodies, such as the FDA and CE, ensure the safety and efficacy of monitoring devices through rigorous testing and approval processes. Increased awareness campaigns and government-led screening programs for early detection of arrhythmias are contributing to market growth by ensuring more patients receive timely diagnosis and treatment. According to the 2023 guidelines from the American College of Cardiology, American Heart Association, American College of Chest Physicians, and the Heart Rhythm Society, initial detection and treatment of atrial fibrillation are crucial for reducing the risk of stroke and other serious complications. These guidelines advocate for regular pulse checks and electrocardiogram screenings, especially in high-risk groups like older adults.

The efficiency of targeted screening programs for atrial fibrillation is contributing to market growth. A review in cardiology published in June 2024 by Springer Nature underscores the findings of multicentre studies like AF-SCREEN and STROKESTOP, which demonstrate the significant impact of targeted screening on early detection of AF, especially in older adults. This evidence supports the implementation of national screening initiatives to address the increasing burden of AF-related complications through early detection and intervention.

Overall, the Arrhythmia Monitoring Devices Market is poised for continued growth, driven by technological advancements, increasing prevalence of cardiac arrhythmias, and favorable regulatory environments.

Market Dynamics

Drivers

-

Rising Prevalence of Cardiovascular Diseases (CVDs)

Cardiovascular diseases are the leading cause of death worldwide. The World Health Organization (WHO) estimates that 17.9 million people die each year from CVDs, representing 32% of all global deaths. A significant portion of these cases involves arrhythmias, which necessitates continuous monitoring to prevent severe outcomes.

In the United States alone, about 12.1 million people are projected to have atrial fibrillation (AFib) by 2030, a common type of arrhythmia that increases the demand for monitoring devices

-

Increasing Geriatric Population

The global population is aging, with the United Nations projecting that by 2050, 16% of the world’s population will be aged 65 years or older. Older adults are more prone to arrhythmias, thus driving the need for effective monitoring solutions. This demographic shift is expected to suggestively boost the demand for arrhythmia monitoring devices.

For instance, in the United States, adults aged 65 and older are projected to account for over 20% of the population by 2030, further increasing the prevalence of arrhythmias and the subsequent need for monitoring.

-

Growing Awareness and Early Diagnosis

There is increasing awareness about the importance of early diagnosis and management of arrhythmias, which can prevent complications such as stroke and heart failure. Healthcare initiatives and educational campaigns are promoting the use of monitoring devices, which is accelerating market growth.

Restraints

-

The High Cost of Advanced Devices and Limited Access in Developing Regions

The arrhythmia monitoring devices market faces significant challenges, primarily due to the high cost of advanced devices and limited access in developing regions. Advanced monitoring devices, such as implantable monitors and mobile cardiac telemetry, are expensive, limiting their adoption, especially in low- and middle-income countries where healthcare budgets are constrained.

Key Segmentation

By Product

The ECG segment dominated the market in 2023, holding a significant share of over 33.9%, driven by continuous product advancements, strategic initiatives by key companies, new product launches, and increasing adoption rates. Innovations in ECG technology, particularly the development of portable and wearable devices, have greatly simplified heart health monitoring for patients, contributing to higher consumer adoption.

Meanwhile, the implantable cardiac monitors (ICMs) segment is anticipated to experience the fastest growth during the forecast period. This growth is largely attributed to ongoing technological innovations, which have resulted in the creation of smaller, more efficient devices with enhanced functionalities.

By Application

The atrial fibrillation (AFib) segment led the market in 2023, accounting for the largest share of 36.7%. This dominance is attributed to the global increase in AFib cases, driven by an aging population, rising obesity rates, and the prevalence of hypertension. Technological advancements, particularly in diagnostic technologies, have also played a crucial role in the growth of this segment. The widespread use of wearable health monitoring devices has facilitated early detection and continuous monitoring of heart rhythms, leading to higher diagnosis rates.

On the other hand, the ventricular fibrillation (VF) segment is expected to experience the fastest growth during the forecast period. The surge in research surrounding VF is driving innovation in diagnostics, therapeutics, and patient management strategies, significantly impacting the arrhythmia market.

By End-use

The hospital segment dominated the market in 2023, capturing the largest share of 62.6%. This significant share is driven by the global rise in cardiovascular diseases, which necessitates advanced monitoring solutions within hospital settings to effectively manage patient care.

Conversely, the diagnostic centers segment is expected to witness the fastest growth during the forecast period. This growth is accelerated by the rising prevalence of cardiac arrhythmias, increased demand for advanced diagnostic tools, and the growth of healthcare infrastructure. The complexity of cardiac arrhythmias, such as atypical atrial flutter, drives the need for specialized diagnostic options in these centers.

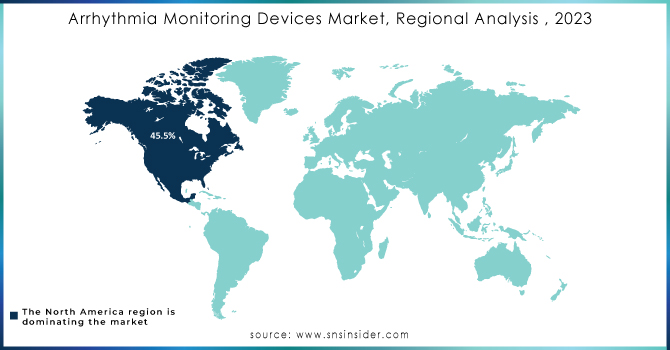

Regional Analysis

North America leads the market with a 45.5% share in 2023, primarily driven by the United States. The high incidence of atrial fibrillation and other arrhythmias, coupled with advanced healthcare infrastructure and regulatory support, has fueled demand for monitoring devices.

Europe holds the second-largest market share, with Germany dominating due to a high number of cardiac surgery patients. The UK and France also contribute significantly to market growth, driven by rising CVD-related deaths and increasing arrhythmia cases.

Asia Pacific is the fastest-growing region, driven by factors such as increasing research and development investments, a rising geriatric population, and advancements in cardiac care technologies. China and Japan are key markets in this region, with China experiencing rapid growth due to its large population and increasing burden of CVD. India is also witnessing significant growth due to growing awareness of advanced cardiac care and technological advancements.

Need any customization research on Arrhythmia Monitoring Devices Market - Enquiry Now

Key Players

The Key Players are Zoll Medical Corporation (Asahi Kasei Corporation), GE HealthCare, Abbott Laboratories, Biotronik, iRhythm Technologies, Inc., Koninklijke Philips N.V., Fukuda Denshi Co., Ltd., Medtronic, Baxter, Spacelabs Healthcare (OSI Systems, Inc.), Nihon Kohden Corporation, Boston Scientific Corporation and others.

Recent Developments

In January 2024, Biotricity announced the FDA's 510(k) clearance of its Biotres Cardiac Monitoring Device. This wearable Holter patch provides continuous ECG monitoring with enhanced accuracy, marking a critical advancement in non-invasive arrhythmia monitoring.

In September 2023, Medtronic's LINQ II Insertable Cardiac Monitor (ICM) system became the first ICM to receive FDA clearance for use in pediatric patients over two years old. This milestone allows for long-term monitoring of heart rhythm abnormalities in younger populations, significantly expanding the device's application.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.18 billion |

| Market Size by 2032 | US$ 13.08 Billion |

| CAGR | CAGR of 6.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (ECG, Implantable Cardiac Monitors, Holter Monitors, Mobile Cardiac Telemetry) • By Application (Bradycardia, Tachycardia, Atrial Fibrillation, Ventricular Fibrillation, Premature Contraction, Others) • By End-use (Hospitals, Diagnostic Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zoll Medical Corporation (Asahi Kasei Corporation), GE HealthCare, Abbott Laboratories, Biotronik, iRhythm Technologies, Inc., Koninklijke Philips N.V., Fukuda Denshi Co., Ltd., Medtronic, Baxter, Spacelabs Healthcare (OSI Systems, Inc.), Nihon Kohden Corporation, Boston Scientific Corporation |

| Key Drivers | • Rising Prevalence of Cardiovascular Diseases (CVDs) • Increasing Geriatric Population • Growing Awareness and Early Diagnosis |

| Restraints | • The High Cost of Advanced Devices and Limited Access in Developing Regions |