Atrial Fibrillation Devices Market Report Scope & Overview:

Get more information on Atrial Fibrillation Devices Market - Request Free Sample Report

The Atrial Fibrillation Devices Market was valued at USD 10.30 billion in 2023 and is expected to reach USD 30.47 billion by 2032, growing at a CAGR of 12.85% from 2024-2032.

The report on atrial fibrillation devices provides data-driven insights with data-driven analysis of key market dynamics. It includes an in-depth analysis of the incidence and prevalence level (2023-2032) to estimate the growing burden of atrial fibrillation in the major regions. Furthermore, this report analyzes regional prescription trends (2023), giving a comparative analysis of treatment adoption patterns. The report additionally includes a device volume forecast by region that tracks the growth in the markets and could work as a tool to accommodate device digestion.

Market dynamics

Drivers

-

Atrial fibrillation (AF) is one of the most common and fastest-growing cardiac arrhythmias worldwide, driven by an aging population and the increasing prevalence of risk factors such as hypertension, diabetes, and obesity.

Atrial fibrillation (AF) is one of the most common and rapidly progressive cardiac arrhythmias globally and is primarily due to associated factors such as the population’s elderly aging and the growing burden of cardiovascular risk factors, including hypertension, diabetes mellitus, and obesity. With prevalence increasing in tandem with the aging global population, particularly in developed nations, the number of patients diagnosed with AF is multiplying and establishes a great need for effective treatment options. The American Heart Association estimates the population of AF patients in the U.S. will double to 12.1 million by 2050. Increasing prevalence directly impacts the demand for AF devices like ablation catheters, pacemakers, and monitoring systems to manage and treat the condition.

Recent innovations like Abbott Laboratories Volt Pulsed Field Ablation (PFA) System are addressing this gap by offering better therapies for heart rhythm disorders like AF. Although it has been used only in clinical trials conducted in Australia and a few other locations, the Volt PFA System readiness is a hallmark of continued progress to enhance the treatment landscape for AF. Devices that address this patient population include the Micra Transcatheter Pacing System (Medtronic), which exemplifies this trend toward smaller, less invasive approaches to treatment.

-

Technological progress in ablation therapies is revolutionizing the treatment of atrial fibrillation.

Novel developments in ablation technologies are changing the landscape of treatment for atrial fibrillation. Advances in cryoablation, radiofrequency ablation, and pulsed-field ablation technologies allow the placement of more propriety and less invasive techniques. This results in enhanced patient outcomes via reduced recovery times and lower procedural risks. Getting a less-invasive means to treat AF is driving acceptance of ablation devices, especially in patients who would have used to need open-heart surgery. As a result, these technologies are becoming increasingly efficient in treating, managing, and potentially curing AF, thereby driving the growth of the AF devices market.

Ablation procedures such as Medtronic's Arctic Front Advance CryoAblation Catheter maintain high success rates, with literature reviews reporting an 80-90% success rate in patients undergoing cryoablation for AF. For instance, one-year data from highly efficient tools such as Affera's HD-mapping and dual-energy ablation catheter, which was recently cleared by the FDA in 2024, is a testament to how technology continues to propel accuracy in treatment. These advanced technologies offer better mapping and treatment choices to patients with persistent AF and atrial flutter and are another major driving factor behind the high demand for advanced treatment solutions in the AF devices market.

Restraint

-

High cost associated with the treatment devices for cases of advanced atrial fibrillation (AF) is a key restraint for the market growth

Pulsed-field ablation systems, cryoablation catheters, and high-precision mapping technologies are thus extremely advanced but very expensive, deterring healthcare providers in price-sensitive areas from purchasing them. Although these devices provide superior treatment and fewer complications, the initial cost often restricts their use, especially in developing nations with tighter healthcare budgets.

For example, products such as Abbott's Volt-Pulsed Field Ablation (PFA) System and Medtronic's Arctic Front Advance CryoAblation Catheter necessitate considerable investment in the device as well as in infrastructure required to perform the procedures. Such high price points can limit the widespread adoption of these devices in hospitals and clinics, especially in low-to-middle-income nations, thus hampering the overall growth of the devices market.

Opportunities

-

The increasing preference for minimally invasive procedures presents a significant opportunity for the atrial fibrillation (AF) devices market.

A growing number of healthcare professionals and patients are pressing for less invasive alternatives and shorter recovery times, suggesting opportunities for catheter-based ablation systems used in minimally invasive AF treatments and advanced mapping technologies. These minimally invasive techniques usually result in fewer complications, shorter hospitalizations, and quicker recovery, making them preferable for patients and providers.

Increasing patient awareness and the trend towards outpatient procedures are driving a burgeoning market for AF devices that support these less invasive treatments. Devices such as Medtronic's Micra Transcatheter Pacing System and Abbott’s sTactiCath Contact Force Ablation Catheter, which treat AF without having to open the patient's body, are gaining traction, for example. Led by innovation in technology and patient preference, this move towards minimally invasive has offered medical device manufacturers the perfect marketing avenue for new devices.

Challenges

-

Technological complexity of the devices and the extensive training required for healthcare professionals to operate them effectively.

Complex structures behind advanced treatment devices, including electrophysiology mapping systems, catheter-based ablation systems, and pulsed-field ablation technologies, depend on skilled operators for successful outcomes. These devices require in-depth electrophysiological knowledge, appropriate device manipulation, and patient-specific therapy planning.

These systems can be complex, which can be a deterrent to adoption, as hospitals and clinics are required to place significant investment into training programs for physicians, electrophysiologists, and other staff. This, combined with the lengthy and expensive training involved, can prevent some healthcare facilities from consistently adopting these newest forms of technology. Such advanced devices are complex and require specialized training, and without the proper training and expertise, these devices could not only result in treatment complications but also lead to inexperienced staff performing suboptimal procedures, which would make some healthcare providers wary of adopting these advanced devices. Solving this issue entails actual education and training programs, as well as providing timely support for the healthcare professional in ensuring appropriate use of devices for improved patient outcomes.

Segmentation Analysis

By product

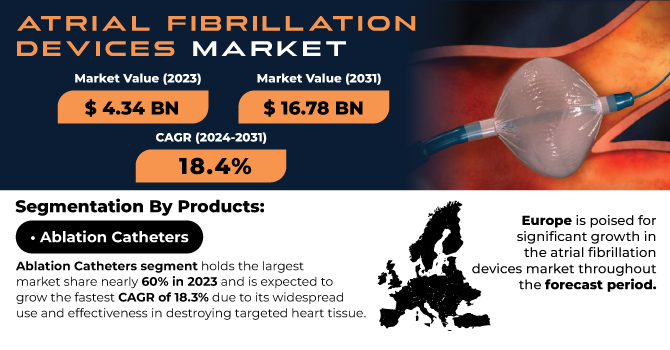

The Atrial Fibrillation (AF) devices market was dominated by the ablation catheters segment in 2023 with 54.28% of market share, owing to their effectiveness and popularity in the treatment of AF patients. Ablation catheters are needed to perform catheter-based ablation procedures, which are regarded as common and effective measures for AF treatment. These procedures destroy the part of the heart tissue that forms the rogue electrical signals, thereby restoring normal heart rhythms. Ablation has become the treatment of choice in patients who do not respond satisfactorily to medication and in AF with more advanced forms. Additional factors, such as the rising preference for minimally invasive surgeries such as previous ones, which provide rapid recovery and lesser complications, have also increased the demand for ablation catheters.

The growing burden of atrial fibrillation, particularly in the elderly, has spurred the demand for efficient and safe treatment modalities. Owing to their demonstrated ability to restore sinus rhythm and relieve symptoms linked to AF, ablation catheters have emerged as an essential element of therapeutic protocols. Moreover, developments in catheter technologies, including enhanced mapping systems, greater precision, and more efficient ablation techniques, have further facilitated their increased utilization. This is why the ablation catheters segment holds the largest overall share in the global market, as both the patients and the physicians prefer a highly effective solution to manage atrial fibrillation.

By End User

The hospital segment dominated the market and accounted for a 63.22% market share in 2023, owing to the delivery of wide-ranging and advanced healthcare services at these facilities, which provide complex cardiovascular condition treatment, making a place to provide care for all AF cases. Line (e.g., health systems) have modern diagnostic and therapeutic technology (e.g., modern ablation catheters, EP lab, and also a dedicated cardiovascular department). Such institutions offer holistic space for the assessment, evaluation, and management of the AF population, particularly those with advanced or complex diseases. Multidisciplinary care teams at hospitals are also important for treating AF patients, who often need additional therapy like stroke prevention, anticoagulation therapy, and post-ablation monitoring. The complex mix of state-of-the-art technology, specialized skillsets, and coordinated care pathways put hospitals in a unique position as the preferred lead provider of AF services.

The cardiac catheterization laboratories segment is projected to grow at the fastest rate over the forecast period, owing to the rising use of less invasive methods to treat atrial fibrillation. Catheterization labs are specialized in-hospital or outpatient medical center areas where physicians perform catheter-based procedures (i.e., ablations and diagnostic angiographies). AF also needs catheter-based interventions, which drive demand for advanced catheterization lab facilities, leading to the transition to minimally invasive and non-invasive treatment. These labs offer high precision and constant monitoring, fulfilling the requirements of performing complicated procedures such as catheter ablation, the primary treatment modality for AF. The increasing number of such procedures performed across developing and developed nations, coupled with higher investments in cath lab infrastructure and technology, is poised to drive the growth of this segment in the periodic timeframe. With healthcare providers focused on improving patient outcomes and lowering recovery times, cardiac catheterization labs will remain a leading venue for innovations in AF therapy.

Regional analysis

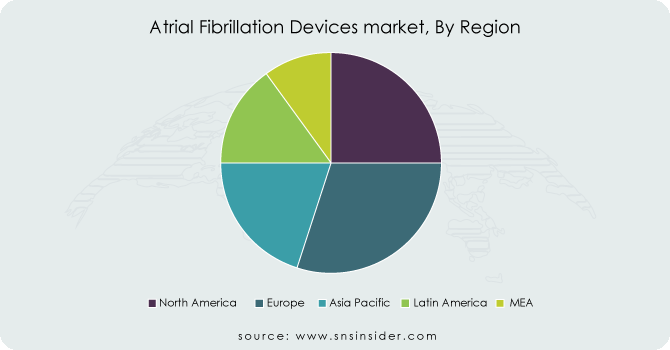

North America dominated the atrial Fibrillation (AF) devices market with a 39.46% market share, which can be credited to the presence of developed infrastructure of healthcare, heavy spending on healthcare, and the established presence of key market players in the region. The United States, especially, contributes a large share because of its existing healthcare system and widespread adoption of innovative medical technologies. Furthermore, the region has a high incidence of atrial fibrillation, as the older population is more prone to heart disease, generating a constant demand for AF-related therapies and devices. Also, the North American regulatory scene (including FDA approvals) makes sure that with huge facilities, unique and advanced treatment devices are quickly available, instigating market growth.

Europe is expected to register the fastest growth in the Atrial Fibrillation devices market with a CAGR of 15.27% in the forecast years, driven by growing investments in healthcare infrastructure, increasing awareness regarding atrial fibrillation, and growing adoption of advanced treatment alternatives in the region. The prevalence of atrial fibrillation in European countries is on the rise due to aging demographics and lifestyle factors, including obesity and hypertension. The increasing availability of advanced medical technologies, such as novel AF devices (including catheter-based ablation systems) and the latest mapping technologies, has led to an upsurge in aortic valve disease across the region. In addition, Europe experiences solid backing from regulatory agencies, resulting in swifter device approvals and a higher mandate for better treatment solutions. As these initiatives strengthen patient care and expand healthcare access, Europe is set to continue experiencing strong growth in the AF devices market in the coming years.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the major key players in the Atrial Fibrillation Devices Market

-

Medtronic (Micra Transcatheter Pacing System, Arctic Front Advance CryoAblation Catheter)

-

Abbott Laboratories (Xience V Coronary Stent, TactiCath Contact Force Ablation Catheter)

-

Boston Scientific (FlexAbility Ablation Catheter, Watchman Left Atrial Appendage Closure Device)

-

Biotronik (Orsiro Coronary Stent, GoldTip Ablation Catheter)

-

Johnson & Johnson (Biosense Webster Carto 3 System, Thermocool SmartTouch Catheter)

-

Siemens Healthineers (Acuson SC2000 Ultrasound System, Artis zee Floor Angiography System)

-

Philips Healthcare (Rhythmia Mapping System, Stellaris PC)

-

LivaNova (Essenz ECG, Vagus Nerve Stimulation Therapy)

-

CardioFocus (HeartLight Endoscopic Ablation System, HeartLight X3 System)

-

Abbott Medical (TactiCath Contact Force Ablation Catheter, Rhythmia Mapping System)

-

AtriCure, Inc. (Isolator Synergy Ablation System, AtriClip Left Atrial Appendage Exclusion System)

-

Stereotaxis, Inc. (Niobe ES Robotic Magnetic Navigation System, Vdrive Robotic Arm System)

-

Medico (Advantage RF Ablation System, EpiqTM Ablation System)

-

MicroPort Scientific Corporation (GlidePath Ablation Catheter, Cardiac Resynchronization Therapy Device)

-

Biomerics (Coronary Ablation Catheter, Deflectable Sheath System)

-

Gore Medical (GORE TAG Thoracic Endoprosthesis, GORE VIABAHN Endoprosthesis)

-

AtriCure Inc. (AtriClip LAA Exclusion System, AtriCure Synergy Ablation System)

-

Cook Medical (Cook Biopsy Needle, Cook Percutaneous Drainage Catheter)

-

Terumo Corporation (ThermoCool SmartTouch Catheter, Guidewire System)

-

Imricor Medical Systems (Vision-MR Ablation Catheter, MRI Compatible Pacing System)

Suppliers

-

Medtronic

-

Abbott Laboratories

-

Boston Scientific

-

Biotronik

-

Johnson & Johnson

-

Siemens Healthineers

-

Philips Healthcare

-

LivaNova

-

AtriCure, Inc.

-

Stereotaxis, Inc.

Recent development

-

In January 2025, Affera launched its innovative HD-mapping and dual-energy ablation catheter combining RF and pulsed field. OnX 4D, as the fourth-generation on-label in the OnX valve platform, received U.S. Food and Drug Administration (FDA) approval in October 2024 for addressing persistent atrial fibrillation (AFib) and cavotricuspid isthmus (CTI) dependent atrial flutter.

-

In Jan 2024, Abbott announced the first global procedures completed with its Volt Pulsed Field Ablation (PFA) System to treat patients with common irregular heartbeats, including atrial fibrillation (AFib). As part of Abbott’s Volt CE Mark study, a pre-market, multi-center clinical trial designed to evaluate the safety and efficacy of the system, more than 30 patients in Australia received treatment.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.30 Billion |

| Market Size by 2032 | US$ 30.47 Billion |

| CAGR | CAGR of 12.85 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Laboratory Devices, Ablation Catheters, Diagnostic Catheters, Access Devices) • By End User (Hospitals, Ambulatory Surgical Centers, Cardiac Catheterization Laboratories) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Abbott Laboratories, Boston Scientific, Biotronik, Johnson & Johnson, Siemens Healthineers, Philips Healthcare, LivaNova, CardioFocus, Abbott Medical, AtriCure, Inc., Stereotaxis, Inc., Medico, MicroPort Scientific Corporation, Biomerics, Gore Medical, AtriCure Inc., Cook Medical, Terumo Corporation, Imricor Medical Systems, and other players. |