Lumbar Spine Cages Market Report Scope & Overview:

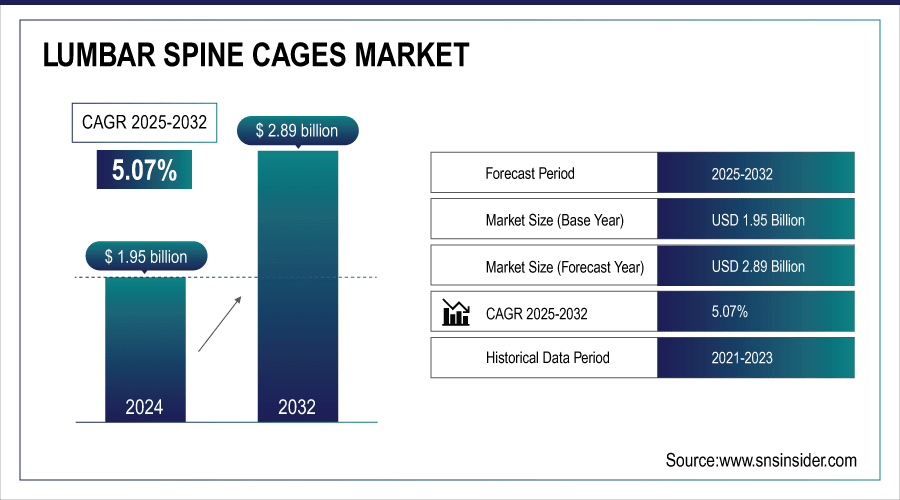

The Lumbar Spine Cages Market was valued at USD 1.95 billion in 2024 and is expected to reach USD 2.89 billion by 2032, growing at a CAGR of 5.07% over the forecast period of 2025-2032.

The global lumbar spine cages market is increasing because of an increasing number of degenerative spinal disorders that are triggered by rising numbers of elderly individuals, inactive lifestyles, the incidence of strain at work, and injury. Improved diagnostics and better knowledge lead to increased detection. The key lumbar spine cages market trends are a movement towards the minimally invasive, expandable, and 3D printed cages, commensurate with the surgical demand, with better outcomes, particularly in the elderly population and urban population, in both established and emerging health care systems.

For instance, in April 2025, over 35% of newly approved lumbar spine cages were 3D-printed or expandable, highlighting a major Lumbar Spine Cages Market trend toward personalized, minimally invasive solutions.

To Get More Information On Lumbar Spine Cages Market - Request Free Sample Report

Key Lumbar Spine Cages Market Trends

-

Minimally invasive and image-guided placement is gaining traction. Techniques including robotic-assisted and fluoroscopy-guided lumbar cage insertion reduce surgical errors, enhance recovery, and increase adoption in outpatient and ambulatory surgical centers.

-

Material innovations are shaping demand. PEEK, titanium, and bioresorbable cages with coatings for enhanced osseointegration are increasingly preferred for improved fusion rates and reduced post-operative complications.

-

Patient-specific and 3D-printed cages are emerging. Customized implants support complex spinal anatomies, reduce operative time, and improve outcomes, particularly in revision surgeries and degenerative spinal conditions.

-

Expanding aging population drives demand. The rising prevalence of spinal disorders, degenerative disc disease, and spondylolisthesis among elderly patients boosts the need for lumbar spine cage procedures globally.

-

Healthcare infrastructure growth in emerging regions. Asia-Pacific, Latin America, and the Middle East are witnessing rapid hospital expansion, government-backed spine care programs, and local manufacturing, accelerating market adoption.

-

Focus on cost-effectiveness and outpatient procedures. Minimally invasive cages, shorter hospital stays, and reduced post-op complications are driving adoption in cost-sensitive healthcare settings.

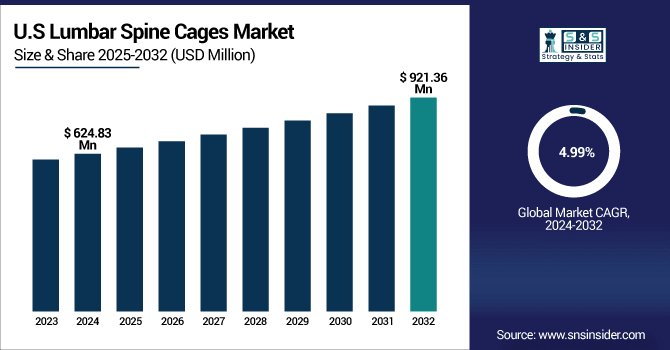

The U.S. Lumbar Spine Cages Market was valued at USD 624.83 million in 2024 and is expected to reach USD 921.36 million by 2032, growing at a CAGR of 4.99% over 2025-2032.

The U.S. is the dominant player in the lumbar spine cages market due to the high number of cases of spinal disorders, advanced healthcare infrastructure, high reimbursement coverage, and rising adoption rate of new cage technologies. Supply and innovation are driven by big players, including Medtronic and Stryker. Competition will be supported by favorable FDA regulations and clinical awareness, with the U.S. playing a pivotal role in the lumbar spine cages market analysis and leadership.

Lumbar Spine Cages Market Growth Drivers:

-

Growing Adoption of Minimally Invasive Spine Surgery is Driving the Lumbar Spine Cages Market Growth

Growing utilization of minimally invasive spine surgery (MISS) is a key factor for the increase in the lumbar spine cages market share. MISS has the benefits of being less invasive for the patient and surgeon, and is the most popular among them. This trend drives the need for next-generation lumbar cages, expandable and 3D-printed in particular, increasing the precision and effectiveness of spine fusion.

For instance, in March 2025, minimally invasive techniques accounted for 58% of U.S. lumbar fusions, boosting the lumbar spine cages market share significantly.

Lumbar Spine Cages Market Restraints:

-

Lack of Skilled Spine Surgeons in Some Regions is a Significant Restraint on the Lumbar Spine Cages Market Growth

The shortage of trained spine surgeons, particularly in the underdeveloped or rural areas, may limit the lumbar spine cages market growth. Delivery of lumbar cages would be precise, especially for a minimally invasive surgical approach, and is dependent on advanced education and training. However, a lack of trained individuals reduces procedure volumes and the adoption of new cage systems, particularly in growth healthcare markets.

Lumbar Spine Cages Market Opportunities:

-

Technological Innovation in Materials Creates Lucrative Opportunities for Innovative Testing Equipment

Technological innovation in materials, the advent of advanced lumbar spine implants, including those with anti-microbial coatings, bioresorbable polymers, and titanium-PEEK hybrid implants. These developments increase osseointegration and reduce post-op infections, and improve patient results. By correcting issues including implant-associated infections and low rates of fusion, companies can distinguish their devices, capture premium sections of the market, and satisfy PEEK (Polyether ether ketone)’ increasing focus on infection control and quality.

For instance, in June 2025, minimally invasive lumbar cage procedures increased 23% in the U.S. compared to 2023, driven by faster recovery, fewer complications, and higher outpatient surgery adoption.

Lumbar Spine Cages Market Segment Analysis

-

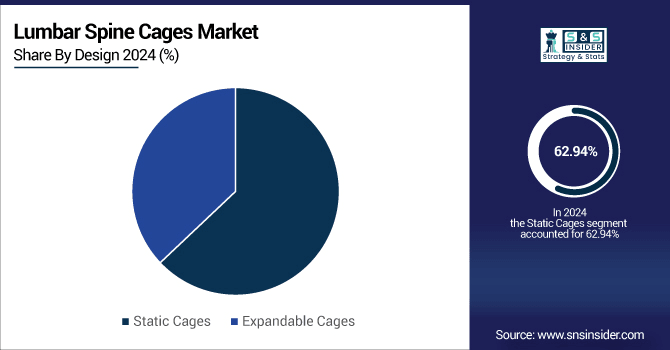

By design, static cages led the lumbar spine cages market with a 62.94% share in 2024, while expandable cages are the fastest-growing segment with a CAGR of 5.35%.

-

By technique, the TLIF dominated the market with a 51.80% share in 2024, whereas the OLIF kit segment is expected to grow fastest with a CAGR of 6.94%.

-

By type, corpectomy cages led the market with 55.96% share in 2024, while vertebrectomy cages are registering the fastest growth with a CAGR of 5.33%.

-

By material, PEEK (Polyether Ether Ketone) held a 45.86% share in 2024, while titanium is growing the fastest with a CAGR of 5.72%.

By Design, Static Cages Lead Market While Expandable Cages Register Fastest Growth

In 2024, static cages lead the lumbar spine cages market, holding the largest share owing to their well-established clinical efficacy, lower cost, and versatility of implantation in TLIF, PLIF, and ALIF. They’re favored by surgeons because they are simple and easy to put in, and because they’ve long been approved by regulators. Expandable cages are registering the fastest growth, driven by their adjustability concerning anatomical shape and more successful disc height restoration. There is a preference by surgeons, less invasive procedures and reduced risk of nerve damage, and better postoperative results.

By Technique, TLIF Dominates While the OLIF Shows Rapid Growth

By Technique, the TLIF dominates the lumbar spine cages market, owing to it enable a posterior approach, superior disc space clearance, and nerve decompression while muscle injury is minimal. With good clinical efficacy in the treatment of DDD, instability, and stenosis and a short recovery time, the SRQR is the most widely chosen among spine surgeons and patients. The OLIF is showing rapid growth driven by its less-invasive and less-muscle dissection, less blood loss, and faster recovery time. OLIF is preferred by surgeons for improved restoration of lumbar lordosis and indirect decompression.

By Type, Corpectomy Cages Lead While Vertebrectomy Cages Register Fastest Growth

By Type, corpectomy cages lead the lumbar spine cages market, driven by the management of vertebral body fractures, tumors, and infectious lesions. They provide good spinal support and maintain alignment while facilitating fusion across multiple levels. While vertebrectomy cages are registering the fastest growth, propelled by the increase of spinal tumors, trauma, and infections, for which a total vertebral body resection is necessary. These cages allow strong anterior column reconstruction, increase the stability of the spinal column, and promote bone fusion.

By Material, PEEK (Polyether ether ketone) Leads While Titanium Grows Fastest

By Material, PEEK (Polyether ether ketone) leads the lumbar spine cages market, owing to its biocompatibility, radio-transparency, and elastic modulus similar to that of bone, which mitigates against stress shielding. Given the opportunity for post-operative imaging. Whereas Titanium is growing the fastest, which is known for excellent strength, biocompatibility, and osseointegration. 3D-printed titanium cages are being developed with improved porosity, facilitating bone in-growth.

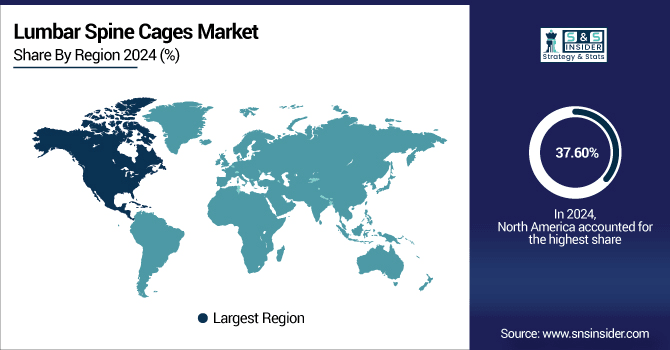

Lumbar Spine Cages Market Regional Analysis:

North America Lumbar Spine Cages Market Insights

In 2024, North America dominated the lumbar spine cages market and accounted for 37.60% of the revenue share. owing to a well-established health care infrastructure, a large number of minimally invasive spinal procedures, and an increasing geriatric population with degenerative spinal diseases. Strong presence of key manufacturers, reimbursement initiatives, and a rise in awareness about spine health are the major drivers of the market. Moreover, the market expansion is further driven by the increasing number of spinal fusion surgeries and early access to advanced technologies.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Lumbar Spine Cages Market Insights

The U.S. is the dominant player in the lumbar spine cages market due to the high number of cases of spinal disorders, advanced healthcare infrastructure, high reimbursement coverage, and rising adoption rate of new cage technologies. Supply and innovation are driven by big players, including Medtronic and Stryker.

Asia-Pacific Lumbar Spine Cages Market Insights

Asia-Pacific is expected to witness the fastest growth in the lumbar spine cages market over 2025-2032, with a projected CAGR of 5.74% as a result of escalating spending on health care, better spinal care accessibility, and greater awareness of sophisticated treatments. There is a rising epidemic of spinal disorders occurring in countries including China, India, and South Korea, mainly due to sedentary lifestyles, aging populations, and the increase in obesity. Rising urbanization and government programs aimed at modernizing the country’s healthcare infrastructure, including bolstering the quality of medical equipment, also helped boost demand.

China Lumbar Spine Cages Market Insights

China dominates the regional lumbar spine cages market as the country has a well-developed healthcare infrastructure and increasing opportunities for low-cost spinal implants. Government programs that focus on advanced surgical procedures, infection prevention, and local facilities to manufacture this equipment are supporting adoption.

Europe Lumbar Spine Cages Market Insights

Europe is the second leading market for lumbar spine cages, being followed by the Asia Pacific region, with factors including an aging population, a rising prevalence of spinal diseases, and a supportive healthcare infrastructure. The region is driven by strong uptake of minimally invasive procedures, sophisticated spine technologies, and strong reimbursement frameworks. Moreover, strong R&D activities and product innovations by medical device manufacturers of Europe also play an important role in sustaining their market position after North America.

Germany Lumbar Spine Cages Market Insights

Germany, the country of the most demanding healthcare standards and significantly of those who put the focus on patient safety, is the lumbar cage market leader in Europe. Lumbar cages, especially minimally invasive and PEEK cages, are being used more as a cheaper, safer alternative to modalities in spinal fusion operations.

Latin America (LATAM) and Middle East & Africa (MEA) Lumbar Spine Cages Market Insights

In Latin America & the Middle East & Africa, the lumbar spine cages market is progressing at a moderate pace, and the market share is much less compared to North America and Europe. The growing prevalence of spinal disorders, developing hospital infrastructure, and a surge in the adoption of minimally invasive spine surgeries are fuelling the market growth. Government projects and domestic production are anticipated to continue to drive regional market penetration through 2025.

Lumbar Spine Cages Market for Competitive Landscape:

Medtronic Spine is the global leader in spinal implants and neurosurgical solutions. The company's lumbar spine system emphasizes minimally invasive surgery, its advanced PEEK and titanium-PEEK materials, and improved fusion results. Robust R&D, strategic acquisitions, and global distribution networks support its market leadership and innovation pipeline.

-

In March 2025, Medtronic launched its OsteoBridge PEEK lumbar cage system in Europe, designed for minimally invasive spinal fusion with enhanced osseointegration. The product aims to reduce operative time and post-operative complications.

DePuy Synthes, part of the Johnson & Johnson Medical Devices Companies, provides the most comprehensive portfolio of products for the treatment of spine disorders, including lumbar cages designed for degenerative and complex spinal pathologies. Focusing on minimally invasive and 3D-surgical solutions, the Company utilizes proprietary ion beam processing to enhance the performance of existing medical implants, while pursuing a broad pipeline of 3D-printed and patient-specific solutions.

-

In October 2024, DePuy Synthes introduced the Expedium 3D-Printed Lumbar Cage in the U.S., offering patient-specific implants for complex spinal anatomies, improving fusion rates, and supporting outpatient minimally invasive procedures.

The spine division at Stryker introduces a new expandable, standalone, and 3D-printed interbody in a lateral approach. The company is committed to enabling better patient outcomes through its state-of-the-art R&D platform and its advanced digital surgery, and through the continued development of the platform. Its significant international presence, combined with its emphasis on advanced materials, gives it a competitive edge in the spinal implant market.

-

In January 2025, Stryker expanded its MIS Spine portfolio with the ProFusion Titanium-PEEK Lumbar Cage, focusing on faster recovery, infection risk reduction, and enhanced surgeon control in outpatient and ambulatory surgical centers.

Lumbar Spine Cages Market Key Players:

Some of the lumbar spine cages market Companies

-

Medtronic plc

-

Johnson & Johnson

-

Stryker Corporation

-

Zimmer Biomet Holdings

-

Globus Medical, Inc.

-

NuVasive, Inc.

-

Orthofix Medical Inc.

-

SeaSpine Holdings Corp.

-

Alphatec Spine, Inc.

-

Xtant Medical

-

Centinel Spine

-

Spinal Elements

-

Precision Spine

-

Aurora Spine

-

Captiva Spine

-

RTI Surgical

-

CoreLink, LLC

-

K2M

-

Aesculap

-

SpineWave, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.95 billion |

| Market Size by 2032 | USD 2.89 billion |

| CAGR | CAGR of 5.07% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Design (Static Cages, Expandable Cages) • By Technique (TLIF Cages, PLIF Cages, ALIF Cages, XLIF Cages, OLIF Cages) • By Type (Vertebrectomy Cages, Corpectomy Cages) •By Material (PEEK, Titanium, Carbon Fiber Reinforced Polymer, Other Biocompatible Materials) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Medtronic plc, Johnson & Johnson, Stryker Corporation, Zimmer Biomet Holdings, Globus Medical, Inc., NuVasive, Inc., Orthofix Medical Inc., SeaSpine Holdings Corp., Alphatec Spine, Inc., Xtant Medical, Centinel Spine, Spinal Elements, Precision Spine, Aurora Spine, Captiva Spine, RTI Surgical, CoreLink, LLC, K2M, Aesculap, SpineWave, Inc., and other players. |