Simultaneous Localization and Mapping (SLAM) Market Size:

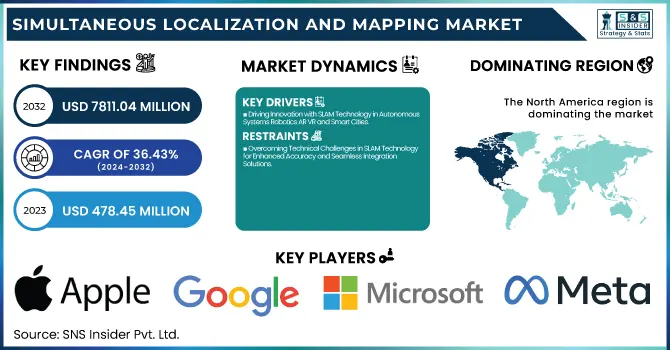

The Simultaneous Localization and Mapping Market Size was valued at USD 478.45 million in 2023 and is expected to reach USD 7811.04 million by 2032, growing at a CAGR of 36.43% over the forecast period 2024-2032. The Simultaneous Localization and Mapping (SLAM) market is largely gaining from technological advancements as well as increased demand across the industries. Strengthened robotics, self-governing machines, and expanded technological practice in AR diversify its use.

To Get more information on Simultaneous Localization and Mapping Market - Request Free Sample Report

Earth-on-satellite innovations such as AI-driven mapping algorithms, sensor fusion, and visual-inertial odometry help augment the accuracy and efficiency of these systems. Operational performance is improving due to accurate navigation allowing SLAM solutions to be deployed in dynamic environments. Furthermore, the growing complexity of data requires the real-time processing of increasingly powerful processors and cloud computing. This evolution drives the mass application of SLAM technology to different industries.

The U.S. SLAM market represented USD 136.29 million in 2023 and is anticipated to depict a 36.16% CAGR between 2024-2032. It is witnessing growth with rising adoption in autonomous vehicles, robotics, and AR/VR applications. The region's market growth is further propelled by robust investments in AI, IoT, and digital mapping solutions.

Simultaneous Localization and Mapping (SLAM) Market Dynamics

Key Drivers:

-

Driving Innovation with SLAM Technology in Autonomous Systems Robotics AR VR and Smart Cities

The growth of the Simultaneous Localization and Mapping (SLAM) market can be attributed to the increase in demand for autonomous systems such as autonomous drive cars, drones, delivery robots, etc. One of the major factors contributing to the market growth is the rising implementation of SLAM technology in robotics to automate warehouses, assist with healthcare, and perform certain manufacturing processes. Furthermore, Augmented Reality (AR) and Virtual Reality (VR) advancements boost SLAM utilization as it continues to advance spatial sensing and quality of user immersive experience. Increasing use of SLAM in smart cities in various applications such as urban planning and infrastructure expansion also drives market growth. Advancements in computer vision, AI algorithms, and sensor fusion are helping SLAM systems achieve higher accuracy, thus making them suitable for such dynamic environments.

Restrain:

-

Overcoming Technical Challenges in SLAM Technology for Enhanced Accuracy and Seamless Integration Solutions

Technical complexity and accuracy constraints are prominent challenges in the global Simultaneous localization and mapping (SLAM) market Even SLAM systems that boast impressive mapping performance can be terrible in certain environments with low light, moving obstacles, and textureless or complex surfaces leading to poor mapping accuracy. Algorithms that guarantee all data from the sensors to the cameras and the platforms we allow to process that data, all have real-time synchronicity this is ultimately a very computationally expensive task. On top of that, integrating SLAM solutions with existing robotic systems, augmenting reality/virtual reality platforms, and driverless cars may also require domain expertise, making it harder for low-tech companies.

Opportunity:

-

Emerging Opportunities in SLAM Technology Driven by 5G AI Digital Twins and Interactive Experiences

Trends such as 5G connectivity and edge computing are opening up new avenues for SLAM, such as faster data processing and real-time mapping. Industries such as agriculture, logistics, and defense are increasingly adopting AI-driven navigation systems, creating a million-dollar growth opportunity. Furthermore, growing investments in digital twin technology for industrial automation and smart factory management are likely to drive the demand for SLAM. Support of applications in areas such as retail, gamification, education, and others for better interactive experiences, also creates substantial opportunities for the market. There is a potential for lower-cost and scalable SLAM solutions in the future, following this many companies are going to invest in R&D to make this happen and companies who are going to create this will create a competitive advantage.

Challenges:

-

Addressing Data Security Operational Challenges and Reliability in SLAM Technology for Diverse Applications

A major challenge is data security and privacy, especially in applications mapping sensitive environments such as residential environments, workplaces, and public spaces. Operational challenges SLAM is usually complex to implement in large-scale environments such as smart cities or industrial facilities. Moreover, maintaining optimal performance by frequent calibration and upkeep of SLAM-based systems generates downtime, limiting their adoption in time-critical industries. Disclosure: This article is written by a content scientist for TraxCube and thus explains the technical challenges involved, the need for sensor fusion and cloud-based mapping solutions that can help overcome SLAM design flaws, and learning to make them more adaptable and reliable for a wide range of applications.

SLAM Technology Market Segments Analysis

By Offering

The market for 2D SLAM accounted for the biggest share, at 56.6% in 2023, which can be attributed to the rising demand for 2D SLAM in applications such as robotics, warehouse automation, and indoor mapping. Its low cost, relative ease of implementation, and ability to map well in structured scenarios have allowed it to dominate the market. This makes 2D SLAM systems popular for applications that require high-accuracy navigation but low computational requirements, thus making their usage ideal for robots in retail, healthcare, and manufacturing industries.

The 3D SLAM segment is projected to have the largest CAGR from 2024-2032, due to the growing demand for 3D SLAM in autonomous cars, drones, and AR/VR applications. The most crucial difference, however, comes from 3D SLAM. 3D SLAM provides maps with depth perception, vital for complex and dynamic environments. The adoption of automation and immersive technologies across industries is likely to pave the way for more use of 3D SLAM, thereby facilitating innovation in all sectors.

By Type

EKF SLAM (Extended Kalman Filter SLAM) accounted for the largest market share of 36% during the year 2023 due to excellent performance in real-time navigation and localization tasks. Applications of EKF SLAM As a pioneer in SLAM, EKF SLAM is widely used in applications with continuous robot location estimation, especially mobile robots, drones, and industrial robot automation. The Kalman filter is a method for efficiently estimating linear systems as well as minimizing uncertainty in dynamic environments, making it popular in structured and semi-structured environments.

From 2024 to 2032, Graph-Based SLAM is anticipated to serve the segment with the highest CAGR due to the higher scalability and efficiency of other approaches for accurate large-scale mapping environments. As such, instead of addressing a single space of global pose, Graph-Based SLAM solves for a set of variables that serve as complex correspondences between sensor data, which allows for the effective handling of these data associations, making it attractive for applications in autonomous vehicles, smart city infrastructure, and outdoor mapping.

By Application

In 2023, Robotics commanded the largest share of the overall Simultaneous Localization and Mapping (SLAM) market, accounting for a 39.6% market share. Such dominance can be due to the growing use of SLAM technology in autonomous robots, warehouse automation, and service robots. In robotics applications, SLAM is vital for navigation, obstacle detection, and map rebuilding in real-time, especially when it comes to manufacturing, healthcare, and logistics. Robotics stood out among all technologies in the top position when it came to market demand, driven by the rising demand for smart automation solutions.

AR/VR is expected to register the highest CAGR from 2024 to 2032 Rapid adoption of immersive technologies in gaming, training simulations, and remote collaboration are other key drivers propelling demand for sophisticated SLAM solutions. By allowing accurate mapping of the physical environment, technology improves the spatial awareness of AR/VR experiences, thus ensuring that the objects placed in any real-world scenario feel more realistic. As AR/VR applications gain momentum in various verticals, SLAM technology is bound to be a key enabler for smoother and more engaging experiences.

Simultaneous Localization & Mapping Market Regional Outlook

The simultaneous localization and mapping (SLAM) market was led by North America in 2023, and it held 38.6% of the global market. This leadership is powered by massive investments in autonomous vehicles, robotics, and industrial automation development. With autonomous systems leading companies such as Tesla, Waymo, and Boston Dynamics regularly incorporate the technology into their platforms for optimal navigation and obstacle avoidance. As an example, Full Self-Driving (FSD) by Tesla utilizes the ideas of SLAM in assisting with geo-location and route optimization. The U.S. defense is also the largest application segment driven by the proliferation of military robots and drone surveillance, which also supports the regional growth of robotic mapping SLAM.

Asia Pacific is anticipated to see the highest growth rate during 2024-2032 driven by the fast-paced development of smart Manufacturing, AR/VR, and Consumer Electronics. In China, companies like DJI are using SLAM technology to help drones remain stable and find a way in commercial and industrial applications. An example of this is SoftBank Robotics, which uses SLAM in its humanoid robot Pepper for indoor navigation and customer interaction in Japan. It is also seen that the region is ramping up investment in smart city projects and automated logistics that will further accelerate the adoption of SLAM. SLAM is likely to make an impact on the evolution of automation, security, and immersive experiences as Asia Pacific continues its progress in digital transformation strategies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Simultaneous Localization and Mapping Market are:

-

Apple Inc. (ARKit)

-

Google LLC (ARCore)

-

Microsoft Corporation (Azure Spatial Anchors)

-

Meta Platforms, Inc. (Spark AR)

-

Amazon Web Services, Inc. (RoboMaker)

-

Intel Corporation (RealSense)

-

NVIDIA Corporation (Isaac SDK)

-

Qualcomm Technologies, Inc. (Snapdragon XR)

-

Magic Leap, Inc. (Magic Leap 2)

-

PTC Inc. (Vuforia Engine)

-

Maxar Technologies Inc. (Vricon)

-

Hexagon AB (Leica BLK2GO)

-

Ouster, Inc. (OS LiDAR)

-

SLAMcore Ltd. (SLAMcore SDK)

-

Cognex Corporation (In-Sight 3D-L4000)

Recent Trends

-

In November 2024, Geek+ and Intel unveiled the world's first Vision-Only AMR, integrating Intel's Visual Navigation Modules to enhance logistics navigation with precise depth vision and obstacle avoidance capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 478.45 Million |

| Market Size by 2032 | USD 7811.04 Million |

| CAGR | CAGR of 36.43% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (2D SLAM, 3D SLAM) • By Type (EKF SLAM, Fast SLAM, Graph-Based SLAM, Others) • By Application (Robotics, UAV, AR/VR, Automotive, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Google LLC, Microsoft Corporation, Meta Platforms, Inc., Amazon Web Services, Inc., Intel Corporation, NVIDIA Corporation, Qualcomm Technologies, Inc., Magic Leap, Inc., PTC Inc., Maxar Technologies Inc., Hexagon AB, Ouster, Inc., SLAMcore Ltd., Cognex Corporation. |