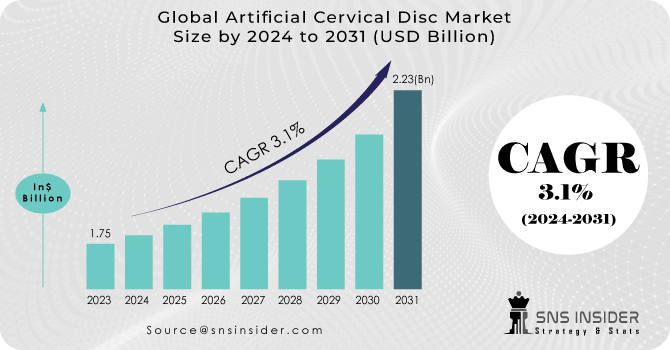

The Artificial Cervical Disc Market Size was valued at USD 1.75 billion in 2023 and is expected to reach USD 2.23 billion by 2031, and grow at a CAGR of 3.1% over the forecast period 2024-2031.

The dynamics are expected to be positively affected by increasing incidences of degenerative disc disease in the world. According to Medicare, the rate of prevalence of spine degeneration is more than 25% in the U.S., with a higher incidence rate in women as compared to men. The growing elderly population, driven by musculoskeletal ageing, represents a large patient population with unmet medical needs related to back pain. The costs of these products are increased by the increasing sophistication of the technologies used in medical devices and implants. For example, cervical total disc replacement CTDR implant costs between USD 9,000 and USD 12,000. However, the scope of this industry will be enhanced by developments in CTDR devices for treating cervical diseases and appropriate training to surgeons regarding proper handling of medical equipment.

Get more information on Artificial Cervical Disc Market - Request Sample Report

MARKET DYNAMICS

DRIVERS

Increased incidence of degenerative spine diseases worldwide

The ageing of the population in both developed and developing countries' economies

Increased Awareness among People

The existence and benefits of Artificial Cervical Discs are becoming more widely known to patients and healthcare providers. More and more people are recognizing the potential benefits of these instruments to treat Cervical spine disorders, as awareness increases. The expansion of the artificial cervical disc market has been driven by this increased awareness and recognition. The demand for and use of the Artificial Cervical Discs is increasing, giving rise to a greater market presence and growth potential as more people and healthcare professionals take advantage of this innovation.

RESTRAINTS

The price of the product is high

Inconsistent reimbursement procedures

The lack of consistency and coherence in the policies and criteria determining how healthcare providers will be paid for services or treatments. Differences in the guidelines, coverage decisions and payment rates of various healthcare systems, insurance companies or public programmes can lead to this inconsistency. Providers may find it difficult to receive equitable compensation for the services they provide, while patients might face unequal access to some treatments or interventions on the basis of reimbursement policies currently in place. In order to ensure a fair and efficient delivery of healthcare, this issue highlights the need for transparency and standardised payment procedures.

OPPORTUNITIES

Additional clinical trials with artificial discs will be carried out

In particular within the medical and scientific community, there is growing interest in conducting research and studies involving artificial discs. These tests are intended to assess the effectiveness, safety and potential benefits of artificial discs in a variety of medical applications such as spinal surgery. Commitment to further investigating the performance and outcomes of disc implants, which could ultimately result in advances in medicine and better care for patients, has contributed to an increase in laboratory tests.

CHALLENGES

A major challenge for market participants is the risk associated with surgery and medical procedures

Russia-Ukraine conflict may interrupt supply chains may be interrupted by the Russia Ukraine conflict, resulting in shortages of components for artificial cervical discs, and patient demand for artificial cervical disc surgery may be reduced. Regulatory delays may be a barrier to the introduction of fresh products. Medical supply prices may increase due to the dependency of healthcare organisations on common resources. Investment in R&D may decrease as a result of geopolitical uncertainty. Global market volatility could have an impact on investor confidence and healthcare spending related to artificial cervical disc procedures. The capacity for early artificial cervical disc procedures may be limited by the burden on healthcare infrastructure. Public awareness and education on ACDs may weaken in times of crisis. The artificial cervical disc market may be affected by permanent changes in healthcare policy and funding priorities as a result of the conflict.

Economic downturns are often accompanied by reduced healthcare spending and consumer uncertainty, which can have a significant impact on the artificial cervical disc market if they result in declining elective surgery such as recession. The economic downturn often results in reduced health spending and consumer uncertainty, which can lead to a decrease in the number of elective procedures such as operations. Due to financial difficulties, patients may postpone nonurgent procedures, reducing demand for ACDs, revenue is expected to decrease by 41% in 2022.

Resources may be limited in hospitals and healthcare facilities, limiting their capacity to perform artificial cervical disc procedures. Research and development efforts in ACD may be reduced due to financial constraints. Consumer confidence, health spending and investment in medical innovation would have to be restored if the market was to recover from the recession. surgery. Patients may delay nonurgent procedures due to financial concerns, reducing demand for ACDs. The restoration of consumer confidence, healthcare spending and investments in health innovation would be essential for the market to recover from the recession.

By Type

Cervical artificial disc

Lumbar artificial disc

Cervical artificial disc segment will remain dominant the market during the forecast period. As an alternative to spine fusion, cervical disc replacement is extensively used for quicker recovery following surgery. The growing concerns associated with post-surgery risks of spinal fusion has accelerated the patient preference for cervical artificial disc replacement procedures. Compared to fusion, long lasting results, and low risk of recurrence at the same different cervical level, this type of disc replacement method offers less recovery time, better results than fusion, long lasting results, and low risk of recurrence at the same different cervical level. In addition, the demand for Artificial Discs will increase due to a rising incidence of cervicogenic headaches caused by problems in the upper neck.

By Material

Metal-on-metal

Metal-on-polymer

Others

The metal-on-metal material segment accounted for more than 36.3% share of the artificial disc market in 2023. As compared to metal-on-biopolymer, metal-on-metal devices are relatively cheaper, and thus record significant preference. Metal-based implants made up of cobalt-based alloys, stainless steel, and titanium-based alloys are extensively used to manufacture diverse orthopedic implants. These implants are cost-effective, durable, and feature excellent mechanical properties. The ongoing developments and studies conducted for the development of degradable metal-based implants will also augment the artificial disc industry.

By Indication

Spinal trauma

Degenerative spine disease

End-use

Hospitals

Specialty clinic

Others

Ambulatory surgical centers segment is projected to exhibit over 2.6% CAGR from 2024-2031. The growing number of artificial disc replacement procedures performed in ambulatory surgical centers (ASCs) can be credited to the presence of favorable reimbursement scenario. Additionally, ASCs offer convenient and affordable healthcare along with access to state-of-the-art medical equipment and implants, thus attracting a large patient pool. Moreover, the advent of outpatient spine surgery and the growing preference for minimally invasive spine treatment will boost the demand for artificial discs across these settings.

.png)

Need any customization research on Artificial Cervical Disc Market - Enquiry Now

Regional Analysis

The largest share market share of the artificial discs was held by North America. The economies of the United States and Canada, with a strong healthcare infrastructure as well as good numbers of medical facilities, are located in North America. The United States has over 6,000 hospitals registered, according to data from the American Hospital Association. The surging geriatric population, the rapid integration of advanced medical technologies and the rising disposable income will augment industry expansion across North America.

Asia Pacific is expected to have the highest growth over the forecast period, driven by rapid development of health care infrastructure and increased spending on healthcare, a high number of people and an increase in medical tourism in developed countries such as China, Japan or India.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some of the major key players are as follows: Alphatec Spine, Braun Melsungen AG, AxioMed, Centinel Spine, LLC, Aditus Medical, Globus Medical Inc, Johnson & Johnson, Orthofix Company, Medtronic PLC, Nuvasive Inc., Simplify Medical, Zimmer Biomet Holdings Inc. and Other Players.

Recent Developments:

In September 2022, NuVasive, Inc. has introduced the Reline cervical fixation system for posterior cervical fusion.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.31 Billion |

| Market Size by 2031 | US$ 2.68 Billion |

| CAGR | CAGR of 9.4% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Cervical Disc, Lumbar Disc) • By Material (Metal-on-metal, Metal-on-biopolymer) • By End User (Hospitals, Ambulatory Surgical Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Alphatec Spine, Braun Melsungen AG, AxioMed, Centinel Spine, LLC, Aditus Medical, Globus Medical Inc, Johnson & Johnson, Orthofix Company, Medtronic PLC, Nuvasive Inc., Simplify Medical, Zimmer Biomet Holdings Inc. |

| Key Drivers | • Increased incidence of degenerative spine diseases worldwide |

| RESTRAINTS | • High price of the item • Inconsistent Reimbursement Procedures |

Ans. The Artificial Cervical Disc market is expected to grow at a CAGR of 9.4% over the forecast period 2024-2031

Ans: The Artificial Cervical Disc Market size is estimated to reach US$ 2.68 billion by 2031

Ans. Artificial Cervical Disc Market is divided into four segments and they are By Product Type, By Material, and By End User

Ans. North America holding the highest share of the worldwide artificial disc market.

Ans. Cervical Disc and Lumbar Disc are sub segments of by product type of the Artificial Cervical Disc Market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Artificial Cervical Disc Market Segmentation, by Type

9.1 Introduction

9.2 Trend Analysis

9.3 Cervical artificial disc

9.4 Lumbar artificial disc

10. Artificial Cervical Disc Market Segmentation, by Material

10.1 Introduction

10.2 Trend Analysis

10.3 Metal-on-metal

10.4 Metal-on-polymer

10.5 Others

11. Artificial Cervical Disc Market Segmentation, by Indication

11.1 Introduction

11.2 Trend Analysis

11.3 Spinal trauma

11.4 Degenerative spine disease

12. Artificial Cervical Disc Market Segmentation, by End-use

12.1 Introduction

12.2 Trend Analysis

12.3 Hospitals

12.4 Specialty clinic

12.5 Ambulatory surgical centers

12.6 Others

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 USA

13.2.2 Canada

13.2.3 Mexico

13.3 Europe

13.3.1 Eastern Europe

13.3.1.1 Poland

13.3.1.2 Romania

13.3.1.3 Hungary

13.3.1.4 Turkey

13.3.1.5 Rest of Eastern Europe

13.3.2 Western Europe

13.3.2.1 Germany

13.3.2.2 France

13.3.2.3 UK

13.3.2.4 Italy

13.3.2.5 Spain

13.3.2.6 Netherlands

13.3.2.7 Switzerland

13.3.2.8 Austria

13.3.2.9 Rest of Western Europe

13.4 Asia-Pacific

13.4.1 China

13.4.2 India

13.4.3 Japan

13.4.4 South Korea

13.4.5 Vietnam

13.4.6 Singapore

13.4.7 Australia

13.4.8 Rest of Asia Pacific

13.5 The Middle East & Africa

13.5.1 Middle East

13.5.1.1 UAE

13.5.1.2 Egypt

13.5.1.3 Saudi Arabia

13.5.1.4 Qatar

13.5.1.5 Rest of the Middle East

13.5.2 Africa

13.5.2.1 Nigeria

13.5.2.2 South Africa

13.5.2.3 Rest of Africa

13.6 Latin America

13.6.1 Brazil

12.6.2 Argentina

13.6.3 Colombia

13.6.4 Rest of Latin America

14. Company Profiles

14.1 Alphatec Spine

14.1.1 Company Overview

14.1.2 Financial

14.1.3 Products/ Services Offered

14.1.4 SWOT Analysis

14.1.5 The SNS View

14.2 Braun Melsungen AG

14.2.1 Company Overview

14.2.2 Financial

14.2.3 Products/ Services Offered

14.2.4 SWOT Analysis

14.2.5 The SNS View

14.3 AxioMed

14.3.1 Company Overview

14.3.2 Financial

14.3.3 Products/ Services Offered

14.3.4 SWOT Analysis

14.3.5 The SNS View

14.4 Centinel Spine, LLC

14.4.1 Company Overview

14.4.2 Financial

14.4.3 Products/ Services Offered

14.4.4 SWOT Analysis

14.4.5 The SNS View

14.5 Aditus Medical

14.5.1 Company Overview

14.5.2 Financial

14.5.3 Products/ Services Offered

14.5.4 SWOT Analysis

14.5.5 The SNS View

14.6 Globus Medical Inc

14.6.1 Company Overview

14.6.2 Financial

14.6.3 Products/ Services Offered

14.6.4 SWOT Analysis

14.6.5 The SNS View

14.7 Johnson & Johnson

14.7.1 Company Overview

14.7.2 Financial

14.7.3 Products/ Services Offered

14.7.4 SWOT Analysis

14.7.5 The SNS View

14.8 Orthofix Company

14.8.1 Company Overview

14.8.2 Financial

14.8.3 Products/ Services Offered

14.8.4 SWOT Analysis

14.8.5 The SNS View

14.9 Medtronic PLC

14.9.1 Company Overview

14.9.2 Financial

14.9.3 Products/ Services Offered

14.9.4 SWOT Analysis

14.9.5 The SNS View

14.10 Nuvasive Inc.

14.10.1 Company Overview

14.10.2 Financial

14.10.3 Products/ Services Offered

14.10.4 SWOT Analysis

14.10.5 The SNS View

14.11 Simplify Medical

14.11.1 Company Overview

14.11.2 Financial

14.11.3 Products/ Services Offered

14.11.4 SWOT Analysis

14.11.5 The SNS View

14.12 Zimmer Biomet Holdings Inc.

14.12.1 Company Overview

14.12.2 Financial

14.12.3 Products/ Services Offered

14.12.4 SWOT Analysis

14.12.5 The SNS View

15. Competitive Landscape

15.1 Competitive Benchmarking

15.2 Market Share Analysis

15.3 Recent Developments

15.3.1 Industry News

15.3.2 Company News

15.3.3 Mergers & Acquisitions

16. Use Case and Best Practices

17. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The 4D Printing in Healthcare Market Size was valued at USD 8.85 billion in 2023, and is expected to reach USD 16.31 billion by 2031, and grow at a CAGR of 7.94% over the forecast period 2024-2031.

The Dental Implants Market size was estimated USD 5 billion in 2023 and is expected to reach USD 10.64 billion by 2031 at a CAGR of 9.9% during the forecast period of 2024-2031.

Immunomodulators Market size was USD 208.86 Billion in 2022 and is expected to Reach USD 345.66 Billion by 2030 and grow at a CAGR of 6.5 % over the forecast period of 2023-2030.

Spirometer Market size is valued at USD 1.12 Bn in 2023 and is expected to reach USD 2.39 Bn by 2031 and grow at a CAGR of 10.17% over the forecast period of 2024-2031.

The Laser Hair Removal Market size is expected to reach USD 1862 Mn by 2030, the base value of the market was USD 549 Mn the CAGR growth rate will be 16.5% over the forecast period of 2023-2030.

The Flow Cytometry Market was estimated at USD 4.91 billion in 2023, and from 2024 to 2031, it is anticipated to increase at a CAGR of 7.80% by 2024-31 and predicted to reach USD 8.96 billion by 2031.

Hi! Click one of our member below to chat on Phone