Dental Implants Market Size Analysis and Trends:

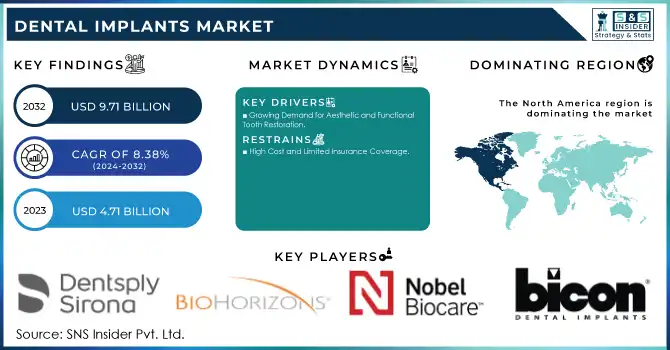

The Dental Implants Market size was valued at USD 4.71 Billion in 2023 and is expected to reach USD 9.71 Billion by 2032 with a growing CAGR of 8.38% over the forecast period of 2024-2032.

To Get More Information on Dental Implants Market - Request Sample Report

The dental implants market has witnessed substantial growth in recent years, driven by the rising demand for effective tooth replacement solutions and continuous advancements in implant technology. According to the American Academy of Implant Dentistry (AAID), more than 3 million people in the United States alone have dental implants, with this number growing by 500,000 annually. This trend highlights the increasing preference for dental implants over traditional solutions like dentures and bridges, as they offer improved functionality, comfort, and aesthetic appeal.

Recent innovations in implant technology have revolutionized the field, significantly improving the success rate of dental procedures. Technologies such as 3D printing and computer-aided design and manufacturing (CAD/CAM) have enhanced the precision of implants, reducing the risk of complications and improving the long-term success of the implants. For example, with 3D-printed implants, patients benefit from highly personalized solutions that perfectly match their jaw anatomy, resulting in more predictable outcomes. Similarly, robotic-assisted systems, like the Yomi Robotic System, have been shown to increase the precision of implant placement, leading to fewer complications and faster recovery times.

Another key advancement is the development of biocompatible materials, such as titanium and zirconia, which have been shown to significantly improve implant durability. Titanium, known for its strength and ability to integrate with bone, remains a preferred material, while zirconia is gaining popularity due to its aesthetic qualities, as it resembles natural tooth enamel. A study published in The Journal of Prosthetic Dentistry found that titanium implants boast a success rate of approximately 95%, underscoring their reliability as a long-term solution for tooth loss.

The growing popularity of minimally invasive implant procedures is also a key factor driving the market. These techniques, which reduce the need for extensive surgical incisions, lead to less discomfort and faster recovery for patients. According to a study in The Journal of Oral Implantology, minimally invasive implant procedures offer a 25% faster recovery time compared to traditional techniques, making them more appealing to a wider range of patients.

To address the affordability challenge, several programs and insurance initiatives have emerged to make dental implants more accessible. For example, some Medicaid programs in the U.S. now provide coverage for dental implants, and organizations like the Piton Foundation offer charitable grants to assist low-income individuals with the cost of implants. These efforts are widening access to dental implants, further propelling the market's growth.

Market Dynamics

Drivers

- Growing Demand for Aesthetic and Functional Tooth Restoration

As dental implants provide a permanent, natural-looking solution for tooth loss, their popularity has surged, particularly as patients seek both aesthetic and functional benefits. Unlike traditional dentures, which can be uncomfortable and less stable, dental implants offer a secure and long-lasting solution that mimics the look and feel of natural teeth. This growing emphasis on improving appearance, along with the increasing awareness of the negative effects of tooth loss on both oral health and overall well-being, is driving more patients to opt for dental implants. People are prioritizing high-quality, durable, and aesthetically pleasing solutions, which has led to a significant shift toward implant-based restorations, with both cosmetic and functional improvements playing a key role in the market's expansion.

- Technological Advancements in Implantology

Technological advancements have been a critical factor driving growth in the dental implants market. Innovations such as digital imaging, 3D scanning, and computer-aided design and manufacturing (CAD/CAM) have enabled precise planning and custom-fitting of implants, improving success rates and reducing treatment time. The integration of artificial intelligence (AI) and robotics is enhancing treatment accuracy, patient outcomes, and surgical precision. Robotic-assisted systems, for example, allow dental professionals to perform highly accurate procedures with minimal invasiveness, leading to faster recovery times and fewer complications. These technological improvements not only increase the appeal of dental implants but also improve the overall experience for both practitioners and patients, making implants a more attractive option in restorative dentistry.

- Improved Accessibility and Affordability

Improved accessibility and affordability are key drivers of the dental implants market. With the expansion of insurance coverage and financing options, dental implants are becoming more accessible to a broader range of patients. Programs such as Medicaid coverage in certain regions and charitable initiatives are helping lower-income individuals afford implant procedures, addressing financial barriers that may have previously deterred patients from seeking treatment. Additionally, the increasing number of dental practices offering payment plans and more affordable implant options is further contributing to the market's growth. As implants become more accessible across various demographics, including underserved populations, the demand for tooth restoration is expected to continue to rise, driving market expansion.

Restraints

- High Cost and Limited Insurance Coverage

One of the key restraints in the dental implants market is the high cost of procedures, which often makes them inaccessible for many patients. Dental implant treatments typically require multiple stages, including surgical procedures and follow-up appointments, which contribute to the overall cost. In many regions, implants are not fully covered by insurance, leaving patients to pay out-of-pocket or seek alternative funding options, limiting the affordability of this treatment. While dental insurance may cover a portion of the cost, it often does not extend to the entire procedure, leading to substantial out-of-pocket expenses for patients. This financial burden can discourage individuals, particularly those in lower-income brackets, from opting for dental implants. Despite growing initiatives to make implants more affordable, including financing plans and charitable grants, the cost remains a significant challenge for widespread adoption, restricting the potential growth of the market.

Dental Implants Market Segmentation Analysis

By Material

Titanium-based dental implants maintained their dominance in 2023, holding a significant market share of 92%. This dominance can be attributed to titanium’s exceptional biocompatibility, strength, and ability to integrate with the bone (osseointegration), which has made it the most reliable material for dental implants. It is lightweight, corrosion-resistant, and durable, ensuring the long-term success of dental procedures. The high success rate and the material's track record in clinical use have contributed to its continued popularity among dental professionals and patients alike.

Zirconium is the fastest-growing material segment, driven by its aesthetic advantages and growing preference among patients who seek metal-free implant options. Zirconium implants are increasingly used due to their natural appearance, blending well with the surrounding teeth. This material is also more resistant to staining and corrosion compared to titanium, which has made it a preferred choice for patients seeking an implant that looks and feels more natural. As the demand for aesthetic and biocompatible dental solutions rises, zirconium’s market share is expected to continue to increase.

By Design

Tapered implants were the dominant design in 2023, representing around 65% of the market share. Their popularity is largely due to their superior stability, especially in cases involving less bone density. Tapered implants provide better primary stability and are suitable for various bone types, making them ideal for both routine and complex cases. This design also allows for easier placement in areas with limited bone volume, which contributes to its widespread use in modern implantology.

Parallel-walled implants are the fastest-growing design segment, gaining traction due to their simplicity and precision. These implants are often used in cases where the patient has an ideal bone structure, ensuring that the implant placement is straightforward and predictable. The design helps minimize the risk of misalignment during insertion, which enhances treatment outcomes. As a result, parallel-walled implants are becoming increasingly popular for patients with healthy jawbones, contributing to their rapid growth in the market.

Regional Analysis

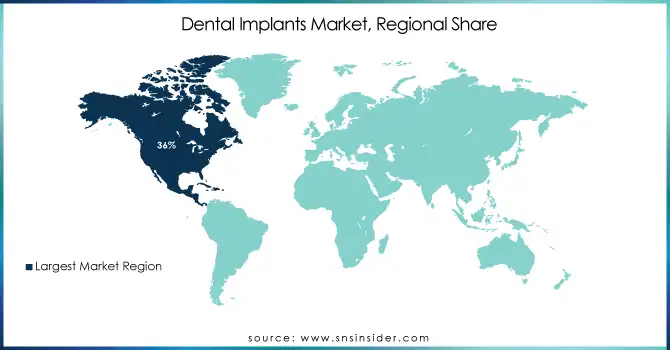

North America dominated the dental implant market share in 2023, capturing a 36% share of global revenue. This is largely due to the rapid adoption of advanced dental technologies and the presence of prominent manufacturers in the region. The growing demand for cosmetic dentistry, coupled with the high prevalence of dental issues, has accelerated market growth. Additionally, increasing disposable incomes and greater awareness of dental aesthetics are driving the rise in dental implant procedures.

Europe ranked second, with leading markets such as Germany, the UK, and France at the forefront. The region benefits from robust healthcare infrastructure, a high standard of living, and a rising elderly population seeking restorative dental solutions. Moreover, advancements in dental implant technology and the increasing popularity of minimally invasive treatments are contributing to Europe’s growth in this market.

The Asia-Pacific region is experiencing the fastest growth in dental implants. Countries like China, India, and Japan are seeing a rise in dental implant procedures due to improvements in healthcare infrastructure, growing disposable incomes, and a heightened focus on dental aesthetics. The expanding middle class and increasing awareness of oral health are key drivers, along with the cost-effectiveness of dental treatments in certain countries, which is attracting medical tourists for dental care.

Get Customized Report as per Your Business Requirement - Enquiry Now

Dental Implants Key Companies

-

Straumann Dental Implants (Roxolid, Bone Level Implants, Tissue Level Implants)

-

Straumann Pro Arch

-

Astra Tech Implant System

-

Xive Implant System

-

Ankylos Implant System

-

Neodent Implants

-

AlphaBio Neo Implants

-

ZimVie Inc. (Zimmer Biomet)

-

Tapered Screw-Vent Implants

-

Branemark System Implants

-

Osstem Implant

-

TS III Implants

-

TS IV Implants

-

SuperLine Implants

-

BioHorizons

-

BioHorizons Implant System

-

Laser-Lok Technology Implants

-

CeraRoot SL

-

CeraRoot Ceramic Implants

-

-

Envista Holdings Corporation (Danaher)

-

NobelActive Implants

-

NobelParallel Implants

-

Cortex

-

Cortex Implants (Tapered and Conical)

-

Anyridge Implants

-

Dentium

-

SuperLine Implants

-

Ossimplant Implants

-

Zest Dental Solutions

-

Zest Locators (abutments and attachment systems for overdentures)

-

-

Bicon, LLC

-

Bicon Dental Implants

-

-

Leader

-

Leader Implants (LID and ILE systems)

-

-

Anthogyr SAS

-

Axiom Implants

-

Tapered Implants

-

DENTIS

-

DENTIS Implants (Smart and DS systems)

-

-

T-Plus Implant Tech. Co.

-

T-Plus Implants

-

-

KYOCERA Medical Corp.

-

Kyocera Ceramic Implants

-

-

Lifecore Dental Implants

-

Lifecore Dental Implants

-

-

Neobiotech USA Inc.

-

Neosse Implants

-

K3 Pro Implants

-

Sweden & Martina

-

SM and Prime Implants

-

-

TBR Implants Group

-

TBR Implants

-

-

Global D

-

Global D Implants

-

-

MOZO-GRAU S.A.

-

Mozo-Grau Implants

-

Recent Developments in the Dental Implants Market

In Nov 2024, Plasmapp introduced ACTILINK, a cutting-edge device now available in Singapore, designed to boost dental implant success rates and accelerate healing by activating implant surfaces just before placement, reducing treatment timelines from months to weeks.

In Sept 2024, Yndetech srl, a leading provider of digital dental systems and implants in Italy, integrated the Russell AMPro Lab Sieve Station at its Lecce facility. This advanced system will optimize the processing of cobalt-chromium and titanium powders for Additive Manufacturing, enhancing the production of dental implants.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.71 Billion |

| Market Size by 2032 | USD 9.71 Billion |

| CAGR | CAGR of 8.38% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Titanium, Zirconium, Others) • By Design (Tapered Implants, Parallel Walled Implants) • By Type (Endosteal Implants, Subperiosteal Implants, Transosteal Implants) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Institut Straumann AG, Dentsply Sirona, Henry Schein, Inc., ZimVie Inc. (Zimmer Biomet), Osstem Implant, BioHorizons, CeraRoot SL, Envista Holdings Corporation (Danaher), Cortex, Dentium, Zest Dental Solutions, Bicon, LLC, Leader, Anthogyr SAS, DENTIS, T-Plus Implant Tech. Co., KYOCERA Medical Corp., Lifecore Dental Implants, Neobiotech USA Inc., Sweden & Martina, TBR Implants Group, Global D, MOZO-GRAU S.A. |

| Key Drivers | • Growing Demand for Aesthetic and Functional Tooth Restoration • Technological Advancements in Implantology • Improved Accessibility and Affordability |

| Restraints | • High Cost and Limited Insurance Coverage |