4D Printing in Healthcare Market Size & Growth Overview:

Get more information on 4D Printing in Healthcare Market - Request Sample Report

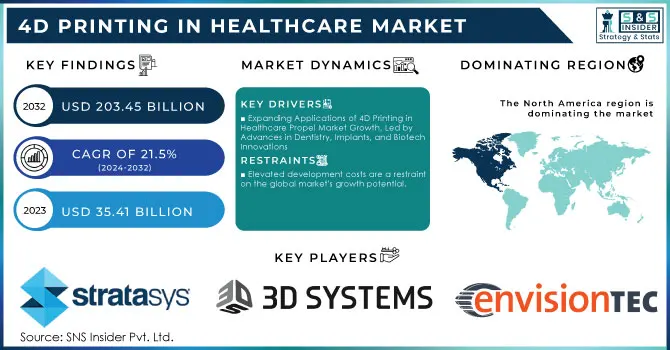

The 4D Printing in Healthcare Market Size was valued at USD 35.41 billion in 2023 and is expected to reach USD 203.45 billion by 2032 and grow at a CAGR of 21.5% over the forecast period 2024-2032.

Primary factors for exponential growth in the global market for 4D printing in healthcare are its innovative applications and rapid technological advancement. As an evolution of 3D printing technology, 4D printing adds a new concept called time as the fourth dimension in which the printed models' physical form or shape changes under the influence of temperature, light, heat, and other stimuli. It is in these regions that this 4D printing technology is revolutionizing the medical world. This technology holds significant promise for artificial organs, prosthetics, and tissue engineering. One of the primary advantages of 4D printing is its ability to create dynamic, shape-shifting clinical models, which of course significantly minimizes resource use as well as energy wastage.

4D printing is increasingly being used in chemotherapy and has a lot of scope in devising smart models for therapy. The rising innovation in 3D printing and healthcare research is also enhancing the acceptance of 4D printing technology. Rising consumer transition from 3D-printed medical devices to 4D-printed applications, such as bioprinting, orthodontic devices, stents, and biomedical splints, also propel the market. Growth in the number of tissue engineering procedures along with rising disposable incomes is also fueling the growth of the market.

Market players are focusing on producing applications for targeted drug delivery with the assistance of 4D printing and is expected to speed up growth in the coming years. For example, in May 2019, 3D Systems launched Simbionix ANGIO Tab Pro, an endovascular simulator, which underlines the growing role of 4D printing in healthcare innovation. High development costs, stringent government regulations, and low awareness, mainly in developing and poor countries, will likely drag the market growth.

Despite the challenges, future demand for new drugs to cure diseases including cancer and cardiovascular conditions will keep pushing the market forward. Cancer-battling nanorobots and similar novel solutions developed are examples of what 4D printing can bring in terms of transforming treatment options in healthcare. However, the market's growth is hampered by a lack of expertise and a slow adoption rate in a few areas as the tech is still underutilized in such regions.

| Application | Description | Regulatory Approval |

|---|---|---|

| Bio-printed Tissues | Creation of functional tissues for implantation, facilitating organ replacement and repair. | FDA IND (Investigational New Drug) |

| Organ Models | Development of anatomical models for drug testing and disease research, enhancing preclinical studies. | Not applicable; for research use only |

| Vascular Grafts | Biodegradable grafts are designed to repair or replace damaged blood vessels, improving vascular health. | FDA 510(k) (Class II) |

| Skin Replacement | Engineered skin products for burn treatment and chronic wound healing. | FDA PMA (Premarket Approval) |

| Bone Regeneration | Scaffold structures are created to support and enhance bone growth, especially in complex fractures. | FDA 510(k) (Class II) |

| Responsive Drug Delivery Systems | Systems designed to release drugs in response to physiological triggers, improving treatment efficacy. | FDA IND (Investigational New Drug) |

| Personalized Dosage Forms | Customizable medications tailored to individual patient needs, enhance adherence and effectiveness. | FDA 510(k) (Class II) |

| Implantable Drug Delivery Devices | Devices that gradually release medication over a specified period, ensure consistent therapeutic levels. | FDA PMA (Premarket Approval) |

| Anatomical Models | 3D-printed models of patient-specific anatomy for surgical planning, allowing for better preoperative strategies. | Not applicable; for research use only |

| Surgical Guides | Customized guides that assist surgeons in performing precise and accurate surgical procedures. | FDA 510(k) (Class II) |

| Training Simulators | Realistic simulators are used for training medical professionals and enhancing surgical and procedural skills. | Not applicable; for training purposes only |

| Custom Prosthetic Devices | Tailored prosthetics that fit the individual patient's anatomy, improving comfort and functionality. | FDA 510(k) (Class II) |

| Adaptive Orthotic Devices | Orthotics that dynamically adjust to changes in the patient's anatomy, providing better support. | FDA 510(k) (Class II) |

| Dynamic Footwear | Shoes engineered to alter structure for optimal comfort and support based on user activity. | FDA 510(k) (Class II) |

| Biodegradable Supports | Temporary supports that dissolve naturally after a specific healing period, minimizing the need for additional surgeries. | FDA 510(k) (Class II) |

| Enhanced Imaging Devices | Imaging tools that adapt based on the patient’s needs, improving diagnostic accuracy. | FDA 510(k) (Class II) |

| Diagnostic Scanners | Scanners capable of changing configurations to meet various diagnostic requirements. | FDA PMA (Premarket Approval) |

| Customizable Imaging Platforms | Platforms specifically designed to cater to individual imaging needs, enhancing patient-specific diagnostics. | Not applicable; for research use only |

| Adaptive Contrast Agents | Agents that modify their properties in response to physiological changes, provide better imaging results. | Not applicable; for research use only |

Market Dynamics

Drivers

-

Expanding Applications of 4D Printing in Healthcare Propel Market Growth, Led by Advances in Dentistry, Implants, and Biotech Innovations

4D printing is increasingly being applied in health care and healthcare applications, including the dental market, implants, and prosthetics, resulting in massive market growth. The major market is dentistry and the 4D printing further advanced the production of clear aligners and other restorative devices. Align Technology has set itself high as a leader in clear aligners, capturing almost 80% of the 4D printing healthcare market, and producing over 2 million custom aligners per week since 2023. This kind of technology would aid in improving adaptability for dental devices, with the possibility of having weekly adjustments for aligners to properly fit aligners as the conformation of the teeth keeps changing. Further added R&D efforts are fueling momentum in the market. For example, an advanced bio-ink was developed by a study from the United States, which enables the printing of catalytically active live cells into adaptable 3D geometries applicable in complex healthcare applications. Major investments in 3D and 4D printing startups, especially in Asia-Pacific, by chemical majors such as BASF and Evonik have aided these developments and expanded the geographic reach of the market.

The demand for resource management innovations is rising, and an increased prevalence of chronic diseases further adds momentum to the market. From early 2023, the pharmaceutical and biotech industry recorded enhanced adoption of 4D printing for applications in drug delivery systems and tissue engineering. Most recently, innovation in 4D printing has led to the development of record miniaturization of new vascular stents meeting the demand for minimally invasive medical devices. By 2023, these innovations will greatly provide a boost to market growth, and this sector is still expected to expand rapidly with newly unveiled product capabilities.

Restraints

-

Elevated development costs are a restraint on the global market's growth potential.

4D Printing in Healthcare Market Segmentation

By Component

The 3D Printers segment dominated the 4D printing in healthcare market worldwide in 2023 with more than 30.0% in terms of market share. It owes such dominance to the wide adoption of advanced 3D printers, foundational to the 4D printing application in personalized patient care and prosthetics. As healthcare providers increasingly adopt 3D printers to develop intricate models and patient-specific implants, this segment continues to dominate.

The Living Cells segment is the fastest growing over the forecast period. Advances in bioprinting that exploit living cells, and applications in tissue engineering and regenerative medicine are likely to drive growth in this segment. Dynamic healthcare solutions through the use of living cells make this area rather promising. The estimation of a compound annual growth rate of 19% within the next couple of years is fair.

By Technology

PolyJet was the biggest portion in 2023, which makes up around 35.0% of the technology market share. Most prefer it because it can build complex, multi-material accuracy healthcare devices such as prosthetics and surgical guides with such high resolution and precision. However, the SLA segment will grow the fastest at an estimated 17% CAGR. SLA technology is quite precise, hence more applications are available in delicate structures such as dental and orthopedic devices. This is one of the primary reasons for the increasing demand for customized medical models and implants.

By Application

In 2023, Patient-Specific Implants held the largest share in the application segment, with a market share of more than 40.0%. This is because 4D printing provides a unique capacity to customize healthcare solutions that meet the particular anatomy of an individual patient. In orthopedic and dental fields, patient-specific implants have become indispensable for improving surgical outcomes and patient comfort that is due to their increasing adoption.

With an enormous CAGR of 18.0%, medical models are expected to experience the highest growth rate. These medical models created with 4D printing technology provide a higher level of accuracy in surgical planning. Hence, these are essential tools during training and procedural simulation.

4D Printing in Healthcare Market Regional Analysis

The Americas remained dominant through 2023 due to its prominent medical device companies, increased research and development into healthcare technology, and significant investment in healthcare technology. Major contributors to this are the U.S. and Canada, with the U.S. leading a little over 40% of patents introduced in 2023 related to healthcare technology, most of which concern leading-edge 4D printing technologies. The rising adoption of this technology in customized medical applications like orthopedic implants and patient-specific devices will further drive the market forward.

Europe was the second largest globally with strong adoption across various healthcare sectors. Recent assessments indicate that over 70% of healthcare service providers in Europe have begun using 4D printing technology, especially in customizing surgical models and dental applications, by 2023. This is spurred forward due to positive regulatory policies and high demand for customized healthcare equipment, particularly across Western Europe. Industry leaders in this region are also investing further in research and development about 4D bioprinting, hoping that this trend will increase the success rate of patient recovery and decrease the complexities of processes.

In Asia-Pacific, it was the highest growth rate witnessed in 2023 on account of the large investments made by government bodies as well as private players in 4D printing innovation. China, India, and Japan have adopted 4D printing technology quickly, especially under the encouragement of government policies along with increased healthcare spending. Recent joint ventures such as BASF's connectivity with local firms also played a part in this high growth rate. The growth of the biotechnology industry, along with Asia-Pacific's focus on resource-efficient advanced healthcare technology, places this region at the forefront of what is likely to spur the development of the global 4D printing healthcare market over the next few years.

Need any customization research on 4D Printing in Healthcare Market - Enquiry Now

4D Printing in Healthcare Market Key Players

3D/4D Printing Technologies

-

EnvisionTEC

-

Poietis

-

Organovo Holdings Inc.

-

Materialise NV

-

Dassault Systèmes

Healthcare Management Solutions

-

Accenture plc

-

Allscripts Healthcare Solutions Inc.

-

Athenahealth Inc.

-

CareCloud Corporation

-

Cerner Corporation

-

Cognizant Technology Solutions Corporation

-

eClinicalWorks LLC

-

GE Healthcare

-

Genpact Limited

-

IBM Corporation

-

Infor Inc.

-

McKesson Corporation

-

Oracle Corporation

-

Quest Diagnostics

-

Siemens Healthcare

-

The SSI Group Inc.

Recent Developments

In Sept 2024, A medtech start-up is revolutionizing orthopedic care by leveraging 4D printing to create adaptive, self-adjusting implants and braces. This innovation enhances patient outcomes and highlights the growing impact of 4D printing in personalized healthcare solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 35.41 billion |

| Market Size by 2032 | US$ 203.45 billion |

| CAGR | CAGR of 21.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Equipment, 3D Printers, 3D Bioprinters, Programmable Materials, Shape-memory Materials, Hydrogels, Living cells, Software & Services) • By Technology (FDM, PolyJet, Stereolithography, SLS) • By Application (Medical Models, Surgical Guides, Patient-specific Implants) • By End-User (Hospitals & Clinics, Dental Laboratories, Other End-Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stratasys Ltd, 3D Systems, Inc, EnvisionTEC, Poietis, Organovo Holdings Inc., Materialise NV, Dassault Systèmes, Accenture plc, Allscripts Healthcare Solutions Inc., Athenahealth Inc., CareCloud Corporation, Cerner Corporation, Cognizant Technology Solutions Corporation, eClinicalWorks LLC, GE Healthcare, Genpact Limited, IBM Corporation, Infor Inc., McKesson Corporation, Oracle Corporation, Quest Diagnostics, Siemens Healthcare, The SSI Group Inc. |

| Key Drivers | • Expanding Applications of 4D Printing in Healthcare Propel Market Growth, Led by Advances in Dentistry, Implants, and Biotech Innovations |

| Restraints | • Elevated development costs are a restraint on the global market's growth potential. |