Electronic Skin Market Size & Overview:

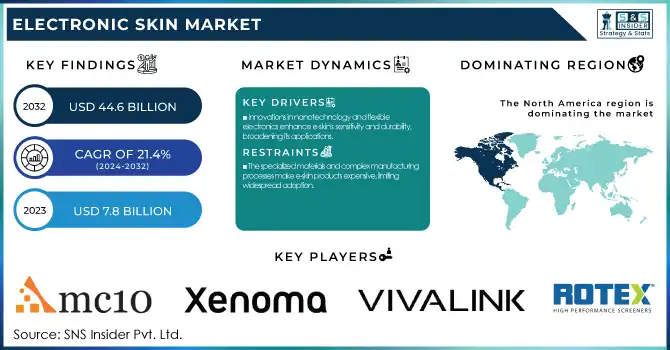

The Electronic Skin Market Size is projected to grow from USD 7.8 billion in 2023 to USD 44.6 billion 2032, at a CAGR of 21.4% during the forecast period 2024-2032.

To Get more information on Electronic Skin Market - Request Free Sample Report

The global electronic skin market report offers insights into key trends related to the adoption and growth in Healthcare, Robotics, and Wearables. It also investigates medical uses, including prosthetics, wound monitoring, and chronic disease management. The report also analyzes production and shipment volumes and healthcare expenditures from hospitals, research institutions, and commercial sectors. Additionally, it explores AI and IoT integration, enhancing smart sensor functionality. It offers a regional regulatory and compliance landscape, which provides an overview of approvals and standards that are helping towards market growth. This report provides valuable insights to the stakeholders in the electronic skin industry. Owing to the growing demand for advanced healthcare monitoring solutions and wearable technology, the electronic skin market is witnessing substantial growth. The U.S. Department of Health and Human Services reported a 15% rise in chronic disease prevalence among adults from 2020 to 2024, highlighting the need for continuous health monitoring devices.

Electronic Skin Market Dynamics

Drivers

-

Innovations in nanotechnology and flexible electronics enhance e-skin's sensitivity and durability, broadening its applications.

The e-skin market is seeing an increase in functionalities and applications mainly due to technological advancement. Recent developments have led to the creation of ultra-thin nanomesh organic field-effect transistors (OFETs) that are breathable and enable long-lasting connections without any discomfort caused by the previous versions of OFETs. For example, in September 2022, DGIST developed electronic skin also known as a mesh structure which is a unique feature this structure provides prolonged uses without any pain. Another significant advancement includes the device of e-skin integrating with electroactive polymers (EAPs). EAPs can change shape or size when an electrical voltage is applied, making them ideal for creating flexible, responsive electronic skin. Such materials find use in a wide range of applications, including healthcare monitoring, robotics, prosthetics, etc., improving functions and user experience. Incorporating this aspect in single or multiphoton excitation, these lightweight, flexible sensors have the potential for functionality in large areas and in conjunction with flexible electronics that complement the expanding electronic skin industry. Furthermore, the application of e-skin in cosmetic products, such as microcurrent face masks, is gaining traction. These advanced masks deliver essential skincare nutrients to deeper skin layers, enhancing efficacy.

Restraints:

-

The specialized materials and complex manufacturing processes make e-skin products expensive, limiting widespread adoption.

High material and fabrication costs are barring the widespread adoption of electronic skin (e-skin) devices. A primary contributor is the expense of essential raw materials; for instance, graphene, integral to e-skin development, is priced between USD 60,000 and USD 200,000 per ton. This significant cost directly increases the manufacturing costs of e-skin products, making them more expensive to producers as well as consumers. Furthermore, the costs significantly inflate due to the complex design and fabrication processes needed to replicate the sophisticated functions of human skin. Absorbing these sensory capabilities by using biomimetic materials requires further material studies and complex manufacturing techniques which increases the overall production cost.

E-skin technologies also have low market penetration, which compounds these financial challenges. The cost associated with the aforementioned has made them less accessible to the masses and is, therefore, used only in niche applications across industries and households. Consequently, the anticipated benefits of e-skin technologies are often overshadowed by their prohibitive costs, limiting their practical use and market growth.

Opportunities:

-

E-skin's capability for continuous health monitoring presents significant potential in telemedicine and chronic disease management.

E-skin technology is transforming healthcare tracking as it allows for continuous and non-invasive monitoring of critical health parameters. One significant step is the creation of an electronic finger wrap by engineers at the University of California San Diego. Powered only by human sweat this advanced device independently monitors important biomarkers without the need for external power sources, including glucose, vitamins, and drugs. Its ease of use is comparable to wearing an adhesive bandage, making it a practical tool for real-time health tracking. In the commercial space, vendors such as Empatica have released medical-grade wearables that monitor physiological signals in real-time. Empatica’s devices, including the Embrace2, measure heart rate variability, electrodermal activity, and skin temperature, among other metrics. This demonstrates that Embrace2 is a reliable and effective health monitor, which played a role in its recent FDA clearance as a seizure-alerting solution for epilepsy patients.

These developments highlight the significant potential of e-skin technology in personalized healthcare. E-skin devices could enable continuous and real-time monitoring and empower early diagnosis of health concerns, improving disease management and overall patient outcomes. As research progresses and more devices receive regulatory approval, the integration of e-skin technology into routine healthcare practices is poised to become increasingly prevalent.

Challenges:

-

Integrating advanced materials and electronics in e-skin systems poses challenges in ensuring product reliability and performance.

Advanced materials and electronics will have to be integrated into e-skin (electronic skin) systems to overcome the massive technological challenges associated with this technology. Achieving the necessary flexibility, stretchability, and biocompatibility requires complex fabrication processes. An example of this would be designing an e-skin that needs to accommodate three-dimensional surfaces while still retaining sensory accuracy, which requires a complex design process that is also compounded by material selection. Recent developments have enabled the use of artificial intelligence (AI) to revise material discovery and sensor design, striving for improved e-skin performance. However, ensuring reliable data collection and transmission in varying environmental conditions remains a hurdle.

Electronic Skin Market Segmentation Insights

By Product Type

In 2023, the electronic patches segment dominated the revenue share in the global market, contributing nearly 87% of the revenue. Hence, the leading position of electronics patches is ascribed to their versatility and non-invasive characteristics across end-user applications. Between 2021 and 2024 alone, the number of wearable medical devices utilizing electronic patches that received approval from the U.S. Food and Drug Administration (FDA) increased by 30% highlighting the growing acceptance of this tool in the healthcare landscape. Furthermore, the U.S. Department of Defense increased its funding for electronic patch research by 40% in 2024, focusing on applications in soldier health monitoring and performance enhancement. This investment has fast-tracked the development of more advanced and dependable electronic patch technologies. Meanwhile, the U.S. Department of Defense accelerated the annual budget for electronic patch research applications to soldier's health monitoring and performance upgrade for 2024 with a 40% increase. Electronic patches have gained in prominence due to their relative convenience and ease of use. According to a November 2024 survey by the American Medical Association, 75% of physicians reported better patient compliance rates using electronic patch-based monitoring systems as opposed to traditional devices. This widespread acceptance among healthcare professionals has significantly strengthened the market position of the segment.

By Component

Electroactive polymers are one of the significant segments that held approximately 30.0% of the revenue share in 2023. The unique properties of electroactive polymers enable their use for electronic skin, resulting in this huge share in the market. The U.S. Department of Energy reported a 35% increase in research funding for advanced polymer materials in 2024, with a substantial portion dedicated to electroactive polymers for flexible electronics. A study by the National Institute of Standards and Technology (NIST) released in 2024 revealed that the sensitivity and responsiveness of electroactive polymer-based sensors have improved by 25 % over older generations. As a result, electronic skin devices have become more accurate and reliable, which has facilitated their use in multiple domains. The U.S. Environmental Protection Agency (EPA) tracked a decrease of over 20% in e-waste generated from wearable devices incorporating electroactive polymers in 2024, due to their extended product lifetime and inherent recyclability. This environmental benefit has increased the appeal of electroactive polymer-based electronic skin products among environmentally conscious consumers and manufacturers.

By Sensors

Electrophysiological sensors segment accounted for the largest revenue share of 39% in 2023. This dominance is primarily due to the critical role these sensors play in monitoring vital signs and neurological activity. According to the National Institutes of Health (NIH), funding for electrophysiological research projects across its various institutes in 2024 rose by more than 40%, highlighting the increasing relevance of various sensors for health applications. According to the U.S. Centers for Disease Control and Prevention (CDC), the early detection rates of cardiovascular disorders have improved by 25% with the introduction of wearable electrophysiological sensors from 2022 to 2024. This remarkable influence has resulted in the adoption of electronic skin devices utilizing these sensors in preventive health care.

According to the U.S. Bureau of Labor Statistics, demand for healthcare professionals specializing in electrophysiology is projected to grow by as much as 30% through 2030, demonstrating continued growth for this new class of sensors and their role as part of the future of medical diagnostics and treatment. This growing expertise in the field has contributed to the development of more advanced and accurate electrophysiological sensors for electronic skin applications.

By Application

The health monitoring systems segment accounted for the largest revenue share of 39% in 2023. This sizable share of the market is motivated by the rising emphasis on preventative healthcare in addition to remote patient management. The U.S. Centers for Medicare & Medicaid Services reported a 45% increase in reimbursements for remote patient monitoring services using wearable devices between 2022 and 2024, incentivizing the adoption of electronic skin-based health monitoring systems. In 2024, the National Health Interview Survey by the CDC found that 65% of adults with chronic conditions used wearable health-monitoring devices, up from 40% in 2022. The significant rise in usage of the user adoption of telehealth systems has driven the growth of the health monitoring systems segment.

In 2024, the U.S. Department of Veterans Affairs rolled out a nationwide program to equip veterans with chronic conditions with electronic skin-based health monitoring systems, to veterans with chronic conditions, resulting in a 30% reduction in hospital readmissions within the first year of implementation. The tremendous success of this large-scale deployment is a testament to the efficacy of these systems as a means of improving patient outcomes and lowering healthcare costs.

Electronic Skin Market Regional Analysis

North America dominated the electronic skin market in 2023, which accounted for a market share of 38%. The region has a strong culture of advanced healthcare infrastructure, rapid adoption of new technologies, and strong research and development expenditures contributing to this leading position. The U.S. National Science Foundation recently announced a 35% increase in flexible electronics research funding for 2024, of which a sizable portion will go toward electronic skin technologies.

Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This tremendous growth is attributed to factors such as increasing healthcare expenditure, growing acceptance of wearable health monitoring devices, and favourable government initiatives to encourage digital health solutions. In 2024, the Chinese Ministry of Science and Technology announced a USD 2 billion investment in flexible electronics research and development (R&D), targeting consumer electronics and electronic skin applications for healthcare and robotics.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Key Service Providers/Manufacturers

-

MC10, Inc. (BioStampRC®, Wearable Hydration Monitor)

-

Xenoma Inc. (e-skin Sleep & Lounge, e-skin EMStyle)

-

VivaLNK, Inc. (Vital Scout, Fever Scout)

-

Gentag, Inc. (NFC Skin Patches, Wireless Skin Sensors)

-

Bloomlife (Smart Pregnancy Tracker, Contraction Monitor)

-

Dialog Semiconductor (SmartBond™ Bluetooth Low Energy SoCs, Wireless Charging ICs)

-

Rotex Inc. (Rotex Skin, Rotex Patch)

-

Intelesens Ltd. (Aingeal, zensor™)

-

Immageryworks Pty Ltd (iSkin, iSense)

-

Plastic Electronic GmbH (FlexSense, FlexLight)

Key Users:

-

Healthcare Providers

-

Sports and Fitness Companies

-

Robotics Manufacturers

-

Prosthetics Developers

-

Wearable Technology Companies

-

Cosmetic Industry

-

Automotive Industry

-

Virtual Reality (VR) Developers

-

Military and Defense Organizations

-

Elderly Care Facilities

Recent Developments

-

In May 2024, L'Oréal unveiled a bio-printed electronic skin that replicates human skin properties like acne, tanning, and wound healing, advancing cruelty-free beauty testing.

-

In July 2024, Zhenan Bao highlighted her work on flexible, skin-resembling wearable electronics intended to promote healing, reduce anxiety, and heighten sensory perception, with potential medical and neuroscience applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.8 Billion |

| Market Size by 2032 | USD 44.6 Billion |

| CAGR | CAGR of 21.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Electronic Patches, Electronic Skin Suits) • By Sensors (Tactile Sensors, Electrophysiological Sensors, Chemical Sensors, Others) • By Component (Stretchable Circuits, Stretchable Conductors, Photovoltaics Systems, Electroactive Polymers) • By Application (Drug Delivery Systems, Health Monitoring Systems, Cosmetics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | MC10 Inc., Xenoma Inc., VivaLNK Inc., Gentag Inc., Bloomlife, Dialog Semiconductor, Rotex Inc., Intelesens Ltd., Immageryworks Pty Ltd, Plastic Electronic GmbH |