Asset Management Market Report Scope & Overview:

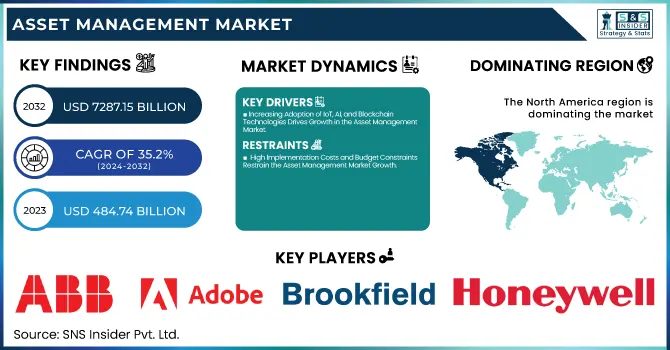

The Asset Management Market Size was valued at USD 484.74 Billion in 2023 and is expected to reach USD 7287.15 Billion by 2032 and grow at a CAGR of 35.2% over the forecast period 2024-2032. The Market penetration and technology adoption rates highlight the integration of AI, IoT, and blockchain. ROI metrics showcase cost savings and efficiency improvements, while operational efficiency statistics track downtime and maintenance cost reductions. Regulatory compliance metrics assess industry adherence to asset tracking standards. Investment trends monitor venture capital and private equity funding. End-user adoption rates reflect the shift from manual to digital solutions, while workforce impact statistics and industry benchmarks reveal productivity gains and asset utilization improvements across sectors.

To Get more information on Asset Management Market - Request Free Sample Report

Asset Management Market Dynamics

Key Drivers:

-

Increasing Adoption of IoT, AI, and Blockchain Technologies Drives Growth in the Asset Management Market

The integration of IoT, AI, and blockchain in asset management is revolutionizing the way businesses track, monitor, and optimize assets. IoT-enabled sensors provide real-time asset tracking, predictive maintenance, and enhanced visibility, reducing operational downtime and maintenance costs. AI-driven analytics improve decision-making, risk assessment, and lifecycle management, enabling businesses to maximize asset efficiency. Blockchain enhances security, transparency, and traceability, ensuring compliance with regulatory standards and minimizing fraud risks. Industries such as manufacturing, healthcare, logistics, and energy are increasingly leveraging these technologies to streamline operations and improve ROI. As digital transformation accelerates, organizations are investing heavily in smart asset management solutions, driving significant market growth. Furthermore, the rising demand for sustainable and efficient asset utilization is pushing companies to adopt these advanced technologies. With ongoing advancements and increased automation, IoT, AI, and blockchain are expected to remain key drivers shaping the future of the Asset Management Market.

Restrain:

-

High Implementation Costs and Budget Constraints Restrain the Asset Management Market Growth

The adoption of advanced asset management solutions comes with high initial implementation costs, maintenance expenses, and integration challenges, which act as major restraints in market growth. Businesses, particularly small and medium-sized enterprises (SMEs), often struggle to allocate budgets for IoT infrastructure, AI-based analytics platforms, and blockchain integration, limiting market penetration. Additionally, the cost of training employees and upgrading legacy systems to accommodate digital asset management adds to the financial burden. Companies in sectors with tight profit margins, such as retail, logistics, and healthcare, may hesitate to invest in such solutions, fearing low short-term ROI. Moreover, the complexity of integrating new technologies with existing IT ecosystems creates additional challenges. Without proper financial planning and support from regulatory incentives, businesses may delay or completely avoid investing in asset management technologies, thereby hindering market expansion despite its long-term benefits.

Opportunities:

-

Growing Demand for Cloud-Based and AI-Powered Solutions Creates New Opportunities in the Asset Management Market

The rapid shift toward cloud-based and AI-powered asset management solutions presents significant growth opportunities for market players. Cloud-based platforms offer scalability, remote accessibility, and cost-effectiveness, making them ideal for businesses looking to enhance asset visibility and control across multiple locations. AI-driven predictive analytics further improve asset utilization, maintenance scheduling, and risk mitigation, ensuring operational efficiency and cost reduction. Companies are increasingly leveraging Software-as-a-Service (SaaS) models for asset tracking and lifecycle management, eliminating the need for expensive on-premise infrastructure. Additionally, the rise of Industry 4.0, smart factories, and digital twins is accelerating cloud adoption in manufacturing and logistics sectors. With cybersecurity advancements and improved data encryption, concerns regarding cloud security are being mitigated, further driving adoption. As enterprises prioritize digital transformation, automation, and data-driven decision-making, the demand for cloud-based and AI-powered asset management solutions will continue to grow, opening new revenue streams for technology providers.

Challenges:

-

Data Security and Cyber Threats Pose Major Challenges to the Asset Management Market Growth

As businesses increasingly rely on IoT, AI, and cloud-based asset management solutions, concerns over data security, cyber threats, and system vulnerabilities are rising. Asset management platforms store and process sensitive enterprise data, including financial records, equipment details, and operational insights, making them prime targets for cyberattacks. Ransomware, data breaches, and hacking incidents pose risks to asset integrity and business continuity. Additionally, the growing integration of IoT devices increases potential attack vectors, as unsecured endpoints can be exploited to access critical systems. Organizations must invest in advanced cybersecurity solutions, encryption technologies, and multi-factor authentication to safeguard their asset management networks. However, small and mid-sized businesses (SMBs) often lack the resources and expertise to implement strong cybersecurity frameworks, making them vulnerable to attacks. Regulatory bodies are enforcing strict compliance measures, requiring businesses to adopt robust data protection strategies. Addressing cybersecurity risks remains a key challenge for ensuring long-term market growth.

Asset Management Market Segments Analysis

By Asset Type

The Digital Assets segment accounted for the largest revenue share of 25% in 2023, driven by the increasing demand for secure, scalable, and AI-powered asset management solutions. Businesses across industries are investing in blockchain, cloud-based storage, and AI-driven analytics to efficiently manage their growing digital asset portfolios. The adoption of blockchain for asset tokenization and secure data management is gaining momentum, ensuring transparency and reducing fraud risks. Organizations in sectors such as finance, media, and healthcare are leveraging advanced asset management platforms to streamline operations, reduce costs, and optimize asset utilization.

The In-Transit Assets segment is experiencing the highest CAGR of 37.62%, fueled by the increasing demand for real-time tracking, predictive analytics, and IoT-enabled logistics solutions. Companies are investing in RFID, GPS, and AI-powered analytics to improve supply chain visibility and asset security. The rise of e-commerce, global trade expansion, and just-in-time delivery models is further driving demand for advanced asset-tracking solutions. Logistics and transportation companies are increasingly leveraging cloud-based asset management platforms to reduce transit delays, optimize fleet performance, and mitigate risks.

By Function

The Location & Movement Tracking segment dominated the Asset Management Market with a 37% revenue share in 2023, driven by the increasing need for real-time visibility, operational efficiency, and security across industries. Businesses are integrating IoT, RFID, GPS, and AI-driven tracking solutions to enhance asset utilization, prevent losses, and improve productivity.

Industries such as logistics, manufacturing, healthcare, and aviation are increasingly adopting location and movement tracking solutions to optimize supply chains, workforce efficiency, and equipment management. With growing regulatory requirements for asset traceability and compliance, companies are investing in cloud-based asset-tracking platforms to ensure seamless integration and security.

The Repair and Maintenance segment is projected to grow at the highest CAGR of 37.73%, driven by the rising adoption of predictive maintenance, AI-powered diagnostics, and digital twin technology in asset management. Businesses are shifting from reactive to predictive maintenance models, reducing downtime, operational costs, and equipment failures.

In June 2024, IBM expanded its Maximo Application Suite, integrating AI-based predictive maintenance tools for industrial asset management. Similarly, Rockwell Automation introduced LifecycleIQ Services, providing proactive maintenance solutions to optimize asset performance and longevity.

By Application

The Aviation Asset Management segment dominated the Asset Management Market with a 63% revenue share in 2023, driven by the rising demand for fleet optimization, predictive maintenance, and digital tracking solutions. Airlines and airport authorities are increasingly adopting AI, IoT, blockchain, and cloud-based platforms to streamline asset lifecycle management, reduce operational costs, and enhance safety compliance.

In March 2024, SAP SE launched SAP Intelligent Asset Management, integrating AI-powered predictive analytics for aircraft maintenance and component tracking. Similarly, GE Aerospace introduced a digital twin-based asset management solution, allowing airlines to monitor engine performance and prevent failures in real time.

The aviation industry is under stringent regulatory pressure to ensure optimal asset utilization, risk mitigation, and compliance with safety standards. With the increasing adoption of smart asset tracking, blockchain-based leasing solutions, and automated maintenance scheduling, aviation companies are improving fleet longevity, reducing downtime, and optimizing fuel efficiency.

The Infrastructure Asset Management segment is experiencing the highest CAGR of 38.8%, driven by the increasing focus on smart infrastructure, digital transformation, and sustainability initiatives. Governments and enterprises are investing in IoT-enabled sensors, AI-driven predictive analytics, and cloud-based asset management platforms to enhance the efficiency and longevity of infrastructure assets such as transportation networks, energy grids, water systems, and public utilities.

In November 2024, Bentley Systems launched OpenCities Planner, a digital twin-based infrastructure asset management solution designed to improve urban planning and maintenance efficiency. Similarly, Hexagon AB introduced HxGN EAM, an AI-powered asset management platform tailored for critical infrastructure monitoring and lifecycle optimization.

Regional Analysis

North America led the Asset Management Market in 2023, holding an estimated 38% market share, driven by high technology adoption, strong regulatory frameworks, and substantial investments in digital asset management solutions. The region’s dominance is fueled by the presence of key market players such as IBM, Oracle, Rockwell Automation, and Honeywell, which are continuously innovating in AI, IoT, and cloud-based asset management.

Additionally, Zebra Technologies launched an upgraded MotionWorks Asset Tracking solution, enhancing real-time asset visibility for logistics and healthcare industries. The stringent regulatory requirements in sectors like healthcare, aviation, and infrastructure have also pushed organizations to adopt smart asset management solutions.

The Asia Pacific region is experiencing the highest growth in the Asset Management Market, with an estimated CAGR of 39.4%, driven by rapid industrialization, digital transformation, and increased investments in infrastructure and smart asset management solutions.

Similarly, Siemens expanded its MindSphere IoT suite, enabling real-time tracking and predictive analytics for industrial assets. The rising adoption of cloud-based asset management platforms in sectors such as manufacturing, energy, and transportation is accelerating growth in the region. With government initiatives promoting smart infrastructure and digital transformation, Asia Pacific is expected to witness exponential growth, making it the most promising region in the global Asset Management Market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Asset Management Market are:

-

ABB Inc. (ABB Ability™ Asset Suite, ABB Ability™ Smart Sensor)

-

Adobe Systems Inc. (Adobe Experience Manager Assets, Adobe Workfront)

-

Brookfield Asset Management Inc. (Brookfield Infrastructure Asset Solutions, Brookfield Asset Lifecycle Management)

-

Honeywell International Inc. (Honeywell Forge Asset Performance Management, Honeywell RTLS for Asset Tracking)

-

IBM Corp. (IBM Maximo Application Suite, IBM TRIRIGA)

-

Oracle Corp. (Oracle Enterprise Asset Management (EAM), Oracle Primavera Unifier)

-

Rockwell Automation, Inc. (FactoryTalk AssetCentre, Rockwell Automation LifecycleIQ Services)

-

Siemens AG (Siemens Teamcenter Asset Management, Siemens MindSphere)

-

WSP Global Inc. (WSP Asset Management Advisory, WSP Infrastructure Asset Solutions)

-

Zebra Technologies Corp. (Zebra MotionWorks Asset Tracking, Zebra RFID Asset Management)

-

Hitachi, Ltd. (Hitachi Lumada Asset Performance Management, Hitachi Asset Lifecycle Management)

-

General Electric Company (GE Digital APM (Asset Performance Management), GE Predix Asset Performance Management)

-

Bentley Systems, Incorporated (Bentley AssetWise, Bentley OpenUtilities)

-

Hexagon AB (Hexagon HxGN EAM (Enterprise Asset Management), Hexagon Asset Lifecycle Intelligence)

-

AssetWorks, Inc. (AssetWorks EAM, AssetWorks FleetFocus)

-

SAP SE (SAP Intelligent Asset Management, SAP Enterprise Asset Management)

Recent Trends

-

November 2024: ABB completed its second investment in Pratexo, an edge-to-cloud solution provider, strengthening its capabilities in industrial asset management. This investment aimed to enhance real-time data processing and decision-making for asset-intensive industries.

-

June 2024: Adobe introduced a generative AI-powered Content Hub to transform digital asset management. The platform enabled brands to manage and optimize millions of creative assets efficiently, improving workflow automation and asset utilization.

| Report Attributes | Details |

| Market Size in 2023 | US$ 484.74 Billion |

| Market Size by 2032 | US$ 7287.15 Billion |

| CAGR | CAGR of 35.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution [Real-Time Location System (RTLS), Barcode, Mobile Computer, Labels, Global Positioning System (GPS), Others], Service [Strategic Asset Management, Operational Asset Management, Tactical Asset Management]) • By Asset Type (Digital Assets, Returnable Transport Assets, In-transit Assets, Manufacturing Assets, Personnel/Staff) • By Function (Location & Movement Tracking, Check-In/Check-Out, Repair and Maintenance, Others) • By Application (Infrastructure Asset Management [Transportation, Energy Infrastructure, Water & Waste Infrastructure, Critical Infrastructure, Others], Enterprise Asset Management, Healthcare Asset Management, Aviation Asset Management, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Inc., Adobe Systems Inc., Brookfield Asset Management Inc., Honeywell International Inc., IBM Corp., Oracle Corp., Rockwell Automation, Inc., Siemens AG, WSP Global Inc., Zebra Technologies Corp., Hitachi, Ltd., General Electric Company, Bentley Systems, Incorporated, Hexagon AB, AssetWorks, Inc., SAP SE. |