Pediatric Interventional Cardiology Market Size Analysis

The Pediatric Interventional Cardiology Market Size was valued at USD 2.28 billion in 2023 and is projected to reach USD 5.19 billion by 2032 and grow at a CAGR of 9.58% over the forecast period 2024-2032.

To Get more information on Pediatric Interventional Cardiology Market - Request Free Sample Report

This report emphasizes the increasing prevalence and incidence of congenital heart defects (CHD) among the pediatric population in various regions, and the growing need for complex interventional cardiology treatments. The research analyzes prescription patterns for pediatric cardiology medications and the expanding use of specialized devices, tracing improvements in minimally invasive interventions. Further, it examines healthcare expenditure patterns of government funding, commercial insurance, private investments, and out-of-pocket spending that govern market forces. It also examines hospital admissions and patient populations, highlighting regional differences in accessibility to treatment, while examining research and development patterns shaping the field and enhancing clinical outcomes in pediatric interventional cardiology.

Pediatric Interventional Cardiology Market Dynamics

Drivers

-

The pediatric interventional cardiology market is driven by the rising prevalence of congenital heart defects (CHD), affecting nearly 1 in 100 newborns globally.

The shift in favor of minimally invasive interventions, including transcatheter procedures, has made patient outcomes far better and recovery shorter. Advances in interventional cardiology technology, including bioresorbable stents, 3D printing for personalized implants, and AI-driven diagnostics, are making procedures more precise and efficient. Increased government support and funding for pediatric cardiac care, as well as mounting awareness regarding screening for early CHD, have boosted cases of diagnosis and treatment. Increased accessibility of pediatric devices that are made to accommodate small anatomies has further driven market growth. Further, the development of more pediatric cardiac centers and advances in healthcare infrastructure have increased market growth. Increased adoption of telehealth and remote monitoring products has enabled long-term management of patients, with decreased hospital visits and costs. In addition, the growth in clinical trials on pediatric cardiac interventions is driving the creation of new treatment paradigms. The industry is also gaining from partnerships among medical device companies and research centers, which are streamlining product approvals and commercialization.

Restraints

-

The market faces several restraints, including the high cost of pediatric interventional cardiology procedures.

The cost of new devices like transcatheter heart valves and septal occluders is exorbitant and may limit access to low-income patients. Further, rigorous regulatory approvals are an issue since pediatric devices have to pass very strict safety standards, resulting in longer development and approval times. The scarcity of subspecialized pediatric cardiologists in most areas makes it a serious barrier to treatment, especially in rural communities. In addition, reimbursement caps on pediatric cardiac interventions in some healthcare systems impose additional costs on families. The difficulty in miniaturizing devices to accommodate pediatric patients typically leads to very high research and development expenses, which impairs the pace of innovation. Also, concerns regarding the long-term safety and longevity of pediatric devices implanted have made some healthcare professionals apprehensive about their adoption. The absence of awareness and screening programs in developing countries leads to delayed diagnosis and treatment of CHD, further limiting market growth. Supply chain disruptions and raw material shortages have also affected production and availability of key interventional devices.

Opportunities

-

The growing adoption of robotic-assisted pediatric interventions presents a major opportunity, enhancing procedural precision and reducing complications.

Increased investments in child-specific research and development have given rise to innovative technologies like bioresorbable scaffolds and tailor-made 3D-printed implants, which have brought about better treatment outcomes. Increased use of artificial intelligence (AI) in diagnostics is also facilitating earlier detection of CHD, which is resulting in earlier interventions. Increasing availability of telemedicine services for pediatric cardiology is facilitating remote consultation, and enhancing access to specialty care. Academic institution collaborations with medical device companies are driving the creation of next-generation pediatric cardiology equipment. Increased healthcare infrastructure in developing markets is offering substantial opportunities for specialized hospitals and pediatric cardiac centers. Demand is likely to grow for catheter-based valve implantation as technology continues to improve to make the procedure safer and more efficient. Applications of nanotechnology in interventional devices are creating new horizons for minimally invasive treatment options. Also, government support for access to pediatric healthcare and CHD treatment funding in developing countries will propel the market growth further. Increased development of public-private collaborations in pediatric cardiology is ensuring more access to cost-effective treatment procedures, especially in remote areas.

Challenges

-

The limited availability of pediatric-specific clinical data slows regulatory approvals and adoption of new technologies.

The ethical issues involved in testing pediatric interventional cardiology devices pose obstacles to the execution of large-scale clinical trials. The pediatric cardiovascular anatomy is complicated, making device development with adjustable patient sizes very difficult. Long-term durability issues for implanted pediatric devices are a serious concern, as children grow out of the implanted devices, which require multiple procedures. Training gaps and expertise deficiencies among general cardiologists are the key constraints to adopting sophisticated pediatric interventions, particularly in smaller health centers. Resistance towards embracing newer technologies based on cost considerations and lack of familiarity also arrests market penetration. Logistical issues regarding supply chain management, such as raw material procurement delays and manufacturing, also affect the timely delivery of key pediatric cardiology devices. Follow-up and compliance in pediatric patients continue to be an issue, with long-term monitoring being necessary for successful treatment. The risk posed by radiation from imaging methods involved in interventional cardiology procedures is a cause for safety concern, especially in pediatric patients. Lastly, market consolidation of the major players is creating an entry barrier for smaller players, reducing competition and innovation.

Pediatric Interventional Cardiology Market Segmentation Analysis

By Device Type

Transcatheter heart valves dominated the market in 2023 with a share of 35.2% of the pediatric interventional cardiology market. This was fueled by the rising incidence of congenital heart defects, increasing demand for minimally invasive valve replacement surgeries, and improvements in valve design. The increasing use of transcatheter pulmonary valve implantation and transcatheter aortic valve replacement among pediatric patients contributed greatly to this segment's dominance.

Closure devices are the most rapidly growing segment, with swift uptake owing to their efficacy in treating atrial septal defects, ventricular septal defects, and patent ductus arteriosus. The growing availability of sophisticated, bioresorbable, and self-expanding closure devices is driving market growth. Moreover, enhanced catheter-based closure procedures with lower procedural risks are driving growth.

By Procedure

Congenital heart defect correction procedures led the market, accounting for 41.7% of the overall revenue in 2023. The prevalence of congenital heart defects and the growing number of early interventions among newborns and children played a major role in driving this segment's dominance. The growing use of minimally invasive procedures and enhanced diagnostic capabilities have also fueled growth in this segment.

Catheter-based valve implantation is seeing the most rapid growth with expanding approvals for pediatric-specific valve devices and the transition towards non-surgical treatments. Reduced hospitalization time, lower complication risks, and increasing acceptability of percutaneous valve procedures among children with CHD have fuelled rapid uptake.

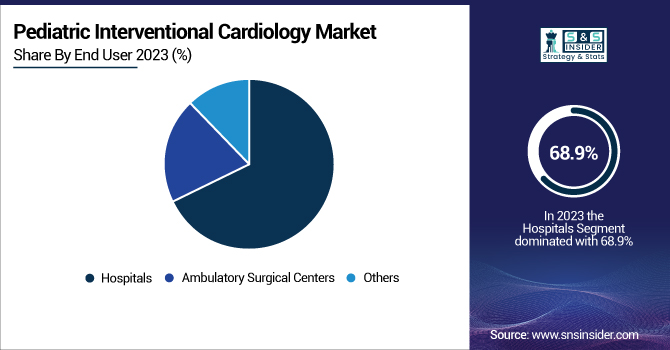

By End User

Hospitals contributed the highest share of 68.9% to pediatric interventional cardiology in 2023. The reason behind this segment's dominance lies in the presence of trained pediatric cardiologists, well-equipped catheterization labs, and post-procedure care facilities. The reluctance to use non-hospital-based interventional procedures in children because of the nature of pediatric heart diseases has cemented this segment's position.

Ambulatory Surgical Centers represent the most rapidly growing segment owing to their economic efficiency, reduced hospital stays, and growing usage of minimally invasive procedures. Growth in this sector has been driven by the expansion of ASCs with pediatric cardiology facilities and innovation in outpatient cardiac interventions.

Pediatric Interventional Cardiology Market Regional Insights

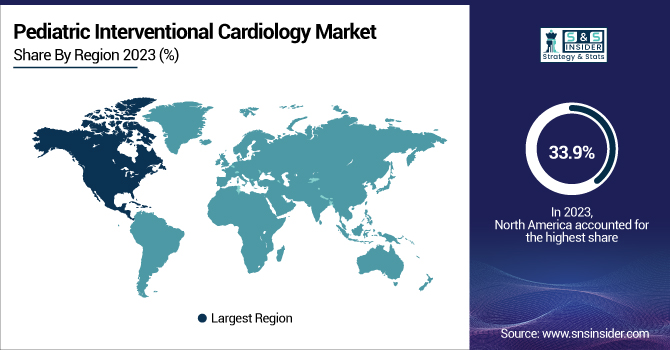

North America led the pediatric interventional cardiology market in 2023, with a share of 38.5% of the overall market. The dominance of the region was fueled by a high incidence of congenital heart defects, superior healthcare infrastructure, and robust reimbursement policies. The United States dominated the market because of its extensive use of minimally invasive pediatric cardiac interventions, the presence of major market players, and higher funding for pediatric cardiology research. In addition, government programs like early screening policies and newborn detection of CHD have played an important role in a large number of procedures within the region.

Asia-Pacific was the most rapidly growing region, with the highest growth rate compared to all other regions. The fast growth is driven by a rising birth rate with rising incidence of CHD, rising healthcare expenditure, and enhanced access to advanced pediatric cardiac interventions. These countries include China, India, and Japan, which are spearheading this growth because of improving medical infrastructure, rising awareness, and an improving number of pediatric cardiology experts. Favorable regulatory clearances and growing medical tourism in the Asia-Pacific region have also promoted the use of interventional procedures, and thus it is the most promising area for future market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Pediatric Interventional Cardiology Market

-

NuMed Inc.: Z-6 Balloon Catheter, Tyshak II Balloon Catheter

-

Medtronic: Harmony Transcatheter Pulmonary Valve System, Melody Transcatheter Pulmonary Valve

-

GE Healthcare: Vivid Cardiovascular Ultrasound Systems, LOGIQ E10 Ultrasound

-

Gore Medical: CARDIOFORM Septal Occluder, HELEX Septal Occluder

-

Abbott: Amplatzer Septal Occluder, Amplatzer Piccolo Occluder

-

Cordis: PALMAZ Blue Balloon-Expandable Stent, Sleek OTW Catheter

-

Edwards Lifesciences: SAPIEN XT Transcatheter Heart Valve, SAPIEN 3 Ultra System

-

Siemens Healthineers: ACUSON SC2000 Ultrasound System, ARTIS icono angiography systems

-

Toshiba Medical Systems (Canon Medical Systems): Aplio i-series Ultrasound, Alphenix Interventional Systems

-

Biotronik: Orsiro Mission Drug-Eluting Stent, Passeo-18 Lux Drug-Coated Balloon

-

Terumo Corporation: Misago Peripheral Self-Expanding Stent, Glidewire GT Guidewire

-

Boston Scientific Corporation: ACURATE neo Aortic Valve System, Ranger Drug-Coated Balloon

-

Cardinal Health: Cordis ADROIT Guiding Catheter, Cordis EMPIRA Pre-dilatation Balloon

-

B. Braun SE: SeQuent Please NEO Drug-Eluting Balloon, Coroflex ISAR NEO Stent

-

MicroPort Scientific Corporation: Firehawk Rapamycin Target Eluting Stent, VitaFlow Transcatheter Aortic Valve

Recent Developments in the Pediatric Interventional Cardiology Market

In Jan 2025, Rainbow Children’s Heart Institute achieved a global milestone by performing the world’s first fetal balloon aortic valvuloplasty with device closure on a 27-week-old fetus diagnosed with critical aortic stenosis. Led by Dr. Koneti Nageswara Rao and a multidisciplinary team, this pioneering procedure marks a breakthrough in fetal cardiac interventions, setting a new benchmark in pediatric interventional cardiology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.28 billion |

| Market Size by 2032 | USD 5.19 billion |

| CAGR | CAGR of 9.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type [Transcatheter Heart Valves, Closure Devices, Catheters, Guidewires, Balloons, Stents, Others] • By Procedure [Angioplasty, Coronary Thrombectomy, Congenital Heart Defect Correction, Catheter-based Valve Implantation, Others] • By End User [Hospitals, Ambulatory Surgical Centers, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NuMed Inc., Medtronic, GE Healthcare, Gore Medical, Abbott, Cordis, Edwards Lifesciences, Siemens Healthineers, Toshiba Medical Systems (Canon Medical Systems), Biotronik, Terumo Corporation, Boston Scientific Corporation, Cardinal Health, B. Braun SE, MicroPort Scientific Corporation. |