Audio Communication Monitoring Market Report Scope & Overview:

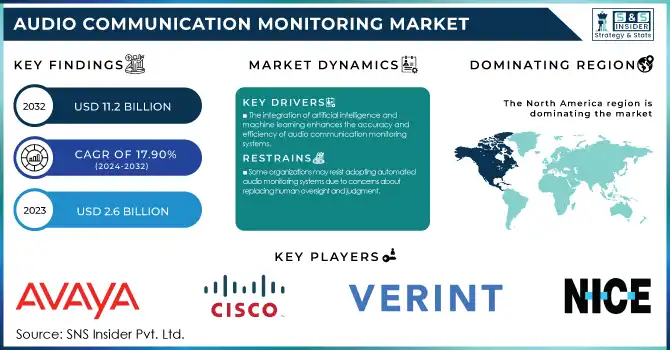

The Audio Communication Monitoring Market was valued at USD 2.6 Billion in 2023 and is expected to reach USD 11.2 Billion by 2032, growing at a CAGR of 17.90% from 2024-2032.

To get more information on Audio Communication Monitoring Market - Request Free Sample Report

The Audio Communication Monitoring market is gaining ample traction due to the growing demand for real-time monitoring and compliance with regulations in various sectors. With enhanced focus by organizations on security, fraud prevention, and customer experience, the need for sophisticated audio monitoring solutions is rising. These systems serve a wide range of applications, such as fraud detection, risk management, compliance, and customer service. However, with the combination of AI, machine learning, and cloud technology, these solutions have become smart enough for businesses to get real-time insights from audio conversations. Regulatory pressure across sectors is one of the major factors driving the growth of the Audio Communication Monitoring market. For example, in the financial sector, regulations like the Dodd-Frank Act and MiFID II require institutions to track and log communications. Likewise, HIPAA regulations require monitoring of communications to protect patient privacy, as healthcare providers must comply with these regulations. Thus, organizations are snatching up audio communication monitoring systems so that they can be compliant and not penalized. The market is also being driven by the increasing adoption of cloud-based solutions. Cloud solutions are more scalable, affordable, and easier to deploy, leading to a positive impact on the audio communication monitoring market. Cloud platforms allow businesses to track communications from a distance, obtain real-time data, and simplify operations.

Monitoring of audio communication systems has gained popularity due to the increasing focus on customer experience. These technologies are also being utilized more by businesses concerning customer interactions, identifying new areas of service issues, as well as some use in ensuring the quality of service. Audio monitoring solutions are being adopted by call centers for different purposes prominently for quality assurance, compliance, and training, among others. With customer expectations changing by the minute, the need for a secure, high-quality, and standards-compliant communication system will never cease.

Audio Communication Monitoring Market Dynamics

Drivers

-

The integration of artificial intelligence and machine learning enhances the accuracy and efficiency of audio communication monitoring systems.

The integration of artificial intelligence and machine learning has significantly enhanced the capabilities of audio communication monitoring systems, making them more accurate and efficient. AI and ML algorithms can analyze vast amounts of audio data in real time, identifying patterns, detecting anomalies, and extracting valuable insights that would be difficult or time-consuming for humans to process manually. In the context of audio communication monitoring, these technologies enable systems to automatically flag suspicious activities, detect compliance violations, and identify potential fraud or security risks, all while reducing the need for constant human oversight.

AI-powered speech recognition and natural language processing tools allow audio monitoring systems to transcribe conversations accurately, regardless of accents, dialects, or background noise. ML algorithms further enhance the system’s ability to learn from historical data, improving its detection capabilities over time. For example, in customer service, AI and ML can help identify issues such as dissatisfaction, unresolved complaints, or potential risks during interactions, enabling companies to take immediate action.

AI and ML enable proactive monitoring by providing predictive analytics, allowing businesses to anticipate potential problems before they escalate. This leads to more effective risk management, better compliance adherence, and improved customer satisfaction. As AI and ML continue to evolve, the Audio Communication Monitoring Market will benefit from even more advanced, automated, and intelligent solutions, driving further adoption across industries like finance, healthcare, and telecommunications.

-

Growing concerns over fraud and financial crimes prompt businesses to implement audio communication monitoring for early detection.

-

The shift to cloud-based solutions offers scalability, cost-effectiveness, and remote monitoring capabilities, boosting market growth.

Restraints

-

Some organizations may resist adopting automated audio monitoring systems due to concerns about replacing human oversight and judgment.

Some organizations may hesitate to adopt automated audio communication monitoring systems due to concerns about replacing human oversight and judgment. Although automation offers significant benefits such as increased efficiency, real-time monitoring, and scalability, it raises concerns about losing the personal touch and critical decision-making that human operators provide. In sectors like customer service, where interaction quality is crucial, businesses may worry that automated systems could miss subtle nuances in tone, sentiment, or context that a human would catch. Additionally, there is a belief that automated systems might struggle to interpret complex conversations, particularly in high-stakes situations like fraud detection or compliance monitoring, where human intuition is essential. Furthermore, organizations may be concerned that relying solely on automation could lead to errors or misinterpretations, especially when dealing with sensitive data or regulatory compliance. This could expose them to legal or reputational risks. Consequently, many businesses prefer to combine human oversight with automation, using automated systems as a supplement to, rather than a replacement for, human judgment. Addressing these concerns requires building trust in the technology, proving its accuracy, and ensuring that it works alongside human decision-making rather than replacing it completely.

-

Stringent data privacy regulations, such as GDPR, may hinder the collection and analysis of audio data, especially in regions with strict privacy laws.

-

Integrating audio monitoring systems with existing IT infrastructures and communication platforms can be complex and time-consuming.

Audio Communication Monitoring Market Segment Analysis

By Component

The solution segment dominated the Audio Communication Monitoring market and represented a revenue share of more than 69% in 2023, driven by the growing demand for integrated systems that offer real-time analysis and compliance capabilities. Solutions like AI-driven monitoring tools, speech recognition software, and analytics platforms are increasingly being adopted across industries such as finance, healthcare, and customer service to ensure regulatory adherence and improve customer experience. The rise of cloud-based solutions has further bolstered this segment, providing businesses with the flexibility to access monitoring systems remotely and scale operations effectively. Looking ahead, the solution segment is expected to maintain its dominance, fueled by advancements in AI, machine learning, and natural language processing, which will enhance the precision and functionality of audio monitoring systems.

The services segment is projected to experience the fastest growth, driven by the increasing demand for customization, integration, and support services for audio communication monitoring systems. As more businesses implement these systems, they require professional services such as installation, system integration, training, and ongoing maintenance to ensure peak performance. Managed services, particularly for outsourcing monitoring and compliance functions, are gaining traction. The need for specialized services will continue to rise as organizations seek to tailor their monitoring systems to meet specific needs and regulatory demands. The future of the services segment will be shaped by the expansion of service offerings, especially in cloud-based monitoring and analytics.

By Deployment

The cloud segment dominated the Audio Communication Monitoring market and accounted for a revenue share of more than 73% in 2023 , driven by the growing demand for scalable, flexible, and cost-efficient solutions. Cloud-based systems enable businesses to monitor audio communications remotely, offering real-time access to data and boosting operational efficiency. The surge in remote work adoption and the advantages of reduced infrastructure costs and easy scalability further accelerate the shift toward cloud solutions. As cloud technology advances, the integration of AI and machine learning will enhance the functionality of cloud-based monitoring systems, improving their real-time analysis and compliance capabilities. This segment is poised for continued growth, fueled by the increasing reliance on cloud services and the ongoing digital transformation across industries.

The on-premises deployment segment is expected to experience the fastest growth due to the increasing demand for higher security, data privacy, and more control over monitoring systems. Highly regulated sectors like finance and healthcare prefer on-premises solutions to ensure sensitive data remains within their infrastructure, avoiding potential security risks associated with cloud storage. On-premises systems also provide organizations with greater control over monitoring processes and customization. As regulatory requirements tighten and data privacy concerns grow, the demand for on-premises solutions is set to rise, making it the fastest-growing segment in the Audio Communication Monitoring market.

Regional Analysis

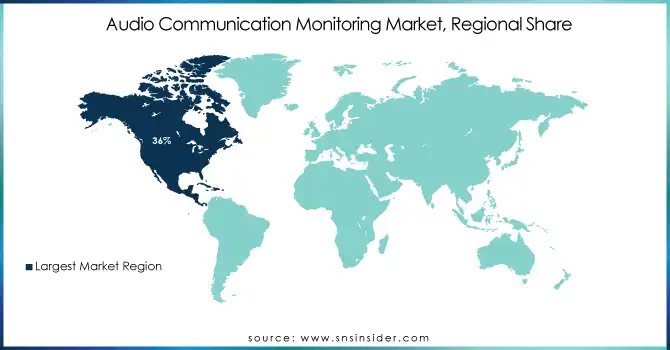

North America dominated the Audio Communication Monitoring market and accounted for a revenue share of more than 36% In 2023, driven by the presence of key technology companies, strong regulatory frameworks, and the high adoption of advanced monitoring solutions across industries like finance, healthcare, and customer service. The region's focus on compliance with strict regulations such as Dodd-Frank and HIPAA further fuels the demand for audio communication monitoring systems. Additionally, the growing emphasis on customer experience and operational efficiency is accelerating the adoption of these solutions. Future growth in North America will be driven by advancements in AI and machine learning, enabling more accurate and real-time monitoring, as well as the increasing shift toward cloud-based solutions. North America is expected to maintain its dominance as the market continues to evolve.

The Asia-Pacific region is expected to register the fastest CAGR in the Audio Communication Monitoring market, driven by rapid technological advancements, increasing regulatory compliance requirements, and the rise of digital transformation across industries. Countries like China, India, and Japan are witnessing significant growth in sectors such as finance, telecommunications, and healthcare, all of which require robust communication monitoring solutions. The rise of cloud adoption, AI integration, and the growing need for customer service optimization are key factors driving the demand for audio communication monitoring systems in the region. As APAC continues to experience rapid economic growth and increased investments in technology, the region is poised for substantial expansion in the coming years, making it the fastest-growing market globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

The major key players along with their headquarters

-

NICE Ltd. (Ra'anana, Israel)

-

Verint Systems Inc. (Melville, New York, USA)

-

Cisco Systems, Inc. (San Jose, California, USA)

-

Avaya Inc. (Santa Clara, California, USA)

-

Red Box Recorders (London, United Kingdom)

-

Genesys (Dublin, California, USA)

-

Calabrio, Inc. (Minneapolis, Minnesota, USA)

-

AudioCodes Ltd. (Lod, Israel)

-

Aspect Software (Chelmsford, Massachusetts, USA)

-

3CLogic (Rockville, Maryland, USA)

-

Verba Technologies (Prague, Czech Republic)

-

VoiceBase (San Francisco, California, USA)

-

CallMiner (Waltham, Massachusetts, USA)

-

Sangoma Technologies Corporation (Markham, Ontario, Canada)

-

Zycoo (Shenzhen, China)

Recent Developments

-

In November 2024Bose acquired high-end audio brand McIntosh, including its subsidiary Sonus faber. This strategic move aims to enhance Bose's product lineup and explore new opportunities in the automotive audio sector. Both companies plan to leverage their expertise to develop advanced in-car audio systems.

-

In October 2024: Audiovisual specialist Audinate adjusted its revenue targets for the 2025 fiscal year due to weaker-than-expected customer demand. The company cited factors such as shorter order lead times, increased industry inventory, and soft end-user demand as reasons for this adjustment.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 2.6 Billion |

|

Market Size by 2032 |

USD 11.2 Billion |

|

CAGR |

CAGR of 17.90% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Solution, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

NICE Ltd., Verint Systems Inc., Cisco Systems, Inc., Avaya Inc., Red Box Recorders, Genesys, Calabrio, Inc., AudioCodes Ltd., Aspect Software, 3CLogic, Verba Technologies, VoiceBase, CallMiner, Sangoma Technologies Corporation, Zycoo |

|

Key Drivers |

• Growing concerns over fraud and financial crimes prompt businesses to implement audio communication monitoring for early detection. |

|

RESTRAINTS |

• Stringent data privacy regulations, such as GDPR, may hinder the collection and analysis of audio data, especially in regions with strict privacy laws. |