Automatic Labelling Machine Market Report Scope & Overview:

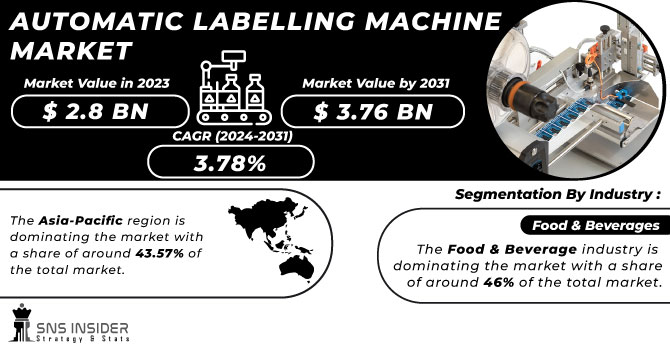

The Automatic Labelling Machine Market size was valued at USD 2.8 Billion in 2023 and is now anticipated to grow to USD 3.76 Billion by 2031, displaying a compound annual growth rate (CAGR) of 3.78% during the forecast Period 2024 - 2031. The automatic labeling machine market is growing at a significant rate with a variety of factors into play. The key driver for the growth is the rising demand towards automation & efficiency as manufacturers are increasing production speeds. Automatic labelling is becoming preference compared to manual processes as it ensures consistent and accurate placement of label, minimizing errors and also reduces the labor costs by eliminating manual labeling tasks. Also, the rising focus towards branding & product differentiation is enhancing the appeal of product & increasing the brand recognition.

Get More Information on Automatic Labelling Machine Market - Request Sample Report

The advancements in labelling technology are helping in smart labeling that allows real-time code verification and track-and-trace functionality like object recognition & defect recognition. Also, the increasing importance of sustainability practices is helping in innovating biodegradable labelling materials & green packaging. Further, the growing consumer preference towards transparency of product information like ingredients, origin, etc. is facilitating for automatic labelling. And the increasing demand for single serving products is creating demand for automatic labelers. All these factors are driving the automatic labelling machine market.

Market Dynamics

Drivers

-

High Efficiency requirements with rising production speed is driving the market towards its growth.

-

Rising emphasis towards product appeal & differentiation with high-quality labels is driving the market.

Restraints

-

High maintenance cost is creating a restraint in the market growth.

-

Complexity in integrating with existing product lines is creating a restraint in the market growth.

Opportunities

-

Expansion in new applications like product marking, coding, and serialization can create growth opportunities.

-

Implementation of RFID in product labelling is creating growth opportunities for the market.

Rising demand towards high-speed labeling and automation is driving the growth in labeling equipment market. The demand for RFID has features like tracking and anti-counterfeiting that is of great help for manufacturers to track their shipments easily. The labels help in ensuring that products not tampered and are delivered safely. The adoption rate of RFID’s in America is 93% in 2022.

Challenges

-

Highly unreliable after sales support is creating a challenge in the market growth as companies might become hesitant for the adoption of such technology.

-

Limited flexibility for short production can create challenges in market growth.

Automatic labeling machines provides high efficiency for large productions but at the same time they may not be cost-efficient for short production quantities. Thus, limiting their preference for diversified product lines or those with seasonal fluctuations in demand is creating challenges for the market growth.

Impact of Russia-Ukraine War

The Russia-Ukraine war has a huge impact on the automatic labeling machine market. The global supply chain disruptions have created problems as Russia being a key supplier for raw materials required for manufacturing of label machines. The war has created shortages of parts which directly raised the prices of components. Also, the energy price hike is complicating things even further as there is 70.72% increase in crude oil prices & coal price increases to 96% in 6 months. Moreover, the war created economic uncertainties with financial burdens making them unable to invest on new equipment’s like labelling machine causing a dip in the market growth. But on the other side, the war has shifted the focus towards domestic production further reducing reliance over global market. The war is pushing into supply chain flexibility which may consecutively increase the adoption of labelling machine. Also, the automatic labelling machine is offering a less labor-intensive solution which might favor in compensation over labor shortages.

Impact of Economic Slowdown

Economic slowdown has a huge impact on the automatic labeling machine market. The demand for the machine will take a dip as businesses may face financial burdens and procurement for new machine will be at halt. The slowdown will lower the production levels across manufacturing sector which will further reduce the need for labelling machines because of less requirement of label in products. The reduced production levels have caused shortages of supply of products leading to long lead time affecting availability & pricing of products. But on the other side, the focus towards cost effectiveness & reduced labor cost in long run can drive the market even in this slowdown. Also, the slowdown can raise the demand for refurbished labelling machine creating opportunities for companies that look for affordable options.

Key Market Segmentation

By Type

-

Self-Adhesive/Pressure-Sensitive Labelers

-

Shrink-Sleeve Labelers

-

Glue-based Labelers

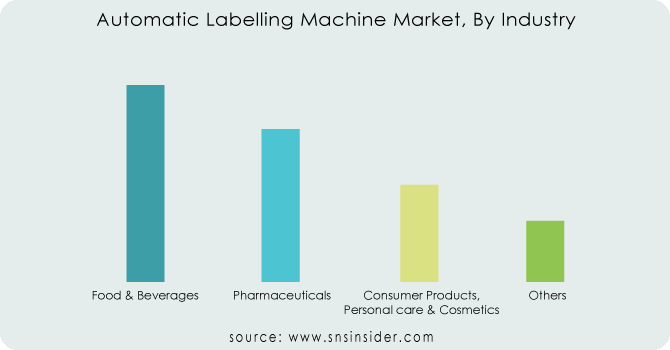

By Industry

-

Food & Beverages

-

Pharmaceuticals

-

Consumer Products, Personal care & Cosmetics

-

Others

The Food & Beverage industry is dominating the market with a share of around 46% of the total market. The reason for dominance is because food labeling is an important feature in food and beverage packaging. The label covers the details about the product as well as the producer. Also, label acts as a way it is a way by which the consumers heath is protected in terms of nutrition and food safety.

Need Customized Research on Automatic Labelling Machine Market - Enquiry Now

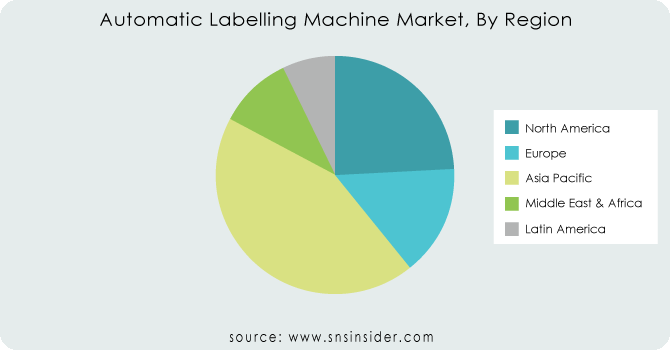

Regional Analysis

The Asia-Pacific region is dominating the market with a share of around 43.57% of the total market. The dominance is because of increasing demand over labelling solution among manufacturers. The rising need for packaged food & beverages is driving the growth of the market. The rising standard of living & consumer spending is creating demand for packaged products. Also, high concentration of population is driving the dominance in the region.

North America is the fastest growing region next to Asia-Pacific because of rising demand over packaged foods & Pharmaceuticals.

Regional Outlook

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players are The Krones Group, MPI Label Systems, Inc., Salzgitter AG, Fuji Seal International, Inc., ProMach inc., Marchesini Group s.p.a., IMA Group, Accutek Packaging Equipment Companies, Inc., Barry-Wehmiller Group, Inc., Newman Labelling Systems Ltd. and others.

MPI Label Systems, Inc-Company Financial Analysis

Recent Developments

- In September 2023, Markem-Imaje introduced the SmartJet Pro Series, a high-speed pressure-sensitive labeling system featuring a tamp-tamp applicator for precise label placement at production line speeds exceeding 600 meters per minute.

- In January 2024, Weber Packaging Solutions launched the TQS-I integrated print & apply system. This system combines a high-resolution inkjet printer with a labeling head, allowing for on-demand variable data printing and label application in a single step.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.8 Billion |

| Market Size by 2031 | US$ 3.76 Billion |

| CAGR | CAGR of 3.78% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Self-Adhesive/Pressure-Sensitive Labelers, Shrink-Sleeve Labelers, Glue-Based Labelers) • By Industry (Food & Beverages, Pharmaceuticals, Consumer Products, Personal care & Cosmetics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | The Krones Group, MPI Label Systems, Inc., Salzgitter AG, Fuji Seal International, Inc., ProMach inc., Marchesini Group s.p.a., IMA Group, Accutek Packaging Equipment Companies, Inc., Barry-Wehmiller Group, Inc., Newman Labelling Systems Ltd. |

| Key Drivers | • High Efficiency requirements with rising production speed is driving the market towards its growth. • Rising emphasis towards product appeal & differentiation with high-quality labels is driving the market. |

| Restraints | • High maintenance cost is creating a restraint in the market growth. • Complexity in integrating with existing product lines is creating a restraint in the market growth. |