Automotive 3D Printing Market Report Scope & Overview:

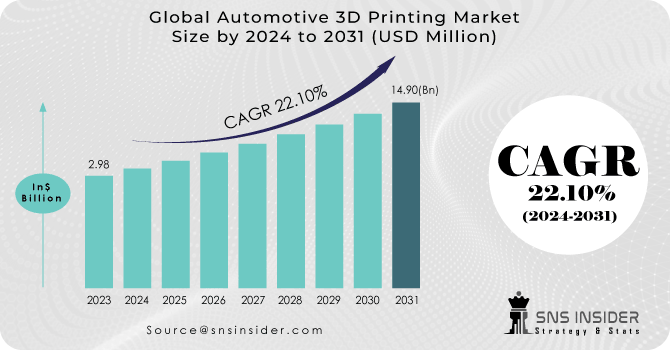

The Automotive 3D Printing Market Size was valued at USD 2.98 billion in 2023 and is expected to reach USD 14.90 billion by 2031 and grow at a CAGR of 22.10% over the forecast period 2024-2031.

The Automotive 3D Printing Market has grown significantly in recent years as a result of the confluence of the automotive and additive manufacturing industries. This breakthrough method includes layering material to create three-dimensional things, which offers considerable benefits such as personalization, rapid prototyping, and cost-effective manufacture of complicated components. The market includes a diverse range of applications, including as the production of car parts, tools, interior components, and even entirely functional automobiles. The ability of 3D printing to streamline supply chains, shorten lead times, and eliminate material waste has accelerated its adoption in the automotive industry.

To get more information on Automotive 3D Printing Market - Request Free Sample Report

Demand Overview:

The Automotive 3D Printing market is currently witnessing a surge in demand driven by a confluence of factors that underscore the industry's transition towards more efficient and customized manufacturing processes. As automakers increasingly seek to reduce time-to-market and enhance design flexibility, 3D printing technology has emerged as a transformative solution. Notable players in the market, such as Stratasys, 3D Systems, and HP, have been pivotal in advancing the adoption of 3D printing across the automotive sector. This technology facilitates the production of complex geometries, lightweight components, and prototype iterations, all of which contribute to streamlined product development cycles. Additionally, the growing emphasis on sustainability and the quest for material efficiency have further propelled the demand for 3D printing solutions within the automotive industry, as it allows for precise material usage and minimizes waste. As a result, the Automotive 3D Printing market is witnessing a notable upswing, with an increasing number of automakers recognizing its potential to revolutionize traditional manufacturing paradigms.

The continual improvements in additive manufacturing technologies are primarily responsible for the growth of the Automotive 3D Printing Market. Manufacturers are increasingly using 3D printing processes like selective laser sintering (SLS), fused deposition modeling (FDM), and stereolithography (SLA) to create lightweight yet strong components. Rapid prototyping is enabled by the use of 3D printing, allowing automobile companies to iterate designs quickly and efficiently. Furthermore, the technology makes it possible to produce complicated geometries that were previously difficult to obtain using standard manufacturing methods, resulting in increased vehicle performance and fuel efficiency.

Despite its high potential, the Automotive 3D Printing Market confronts a number of obstacles that must be addressed. One significant difficulty is the lack of high-performance materials suitable for automotive applications, which must ensure that printed parts match industry standards for durability, safety, and performance. Another challenge is scaling up production to satisfy the demands of mass manufacturing while preserving consistency. Concerns of intellectual property, particularly the protection of design files and private information, must also be addressed. Looking ahead, the market's prospects are bright, with continued research into novel materials, process improvements, and collaborations between car manufacturers and 3D printing businesses expected to drive additional industry innovation and acceptance.

MARKET DYNAMICS:

KEY DRIVERS:

-

Rapid prototyping costs and timelines accelerate market expansion.

Rapid prototyping's cost-efficiency and shortened timelines are catalysts for the accelerated expansion of the market. This approach allows automotive manufacturers to swiftly iterate designs and test concepts, reducing development cycles. As a result, the market experiences increased adoption and growth.

-

An increase in R&D efforts worldwide is one factor driving the automotive 3D printing market.

-

Automobile manufacturers are investing in automotive technology to build fuel-efficient vehicles with low emissions.

-

Market expansion is helped by fast prototyping's lower costs and shorter lead time.

-

Increased government support for 3D printing-related research and development.

RESTRAINTS:

-

The expected growth of the market would be impeded by the product's high beginning cost.

The hefty initial expenditures associated with the device may stymie planned market expansion. Despite the potential benefits, the financial barrier may prevent widespread adoption, especially among smaller automotive players. Overcoming this obstacle will be critical to realizing the technology's full market potential.

-

The market's expansion would be hampered by a scarcity of competent personnel and knowledge.

OPPORTUNITIES:

-

Rapid urbanization benefits the 3D printing industry for autos.

Rapid urbanization is a key driver of the automobile 3D printing sector. As cities grow in size, there is a greater demand for efficient transportation solutions, which encourages the adoption of novel manufacturing processes such as 3D printing to make customized, sustainable, and localized automotive components that meet the needs of urban mobility. This tendency is propelling the expansion of the automotive 3D printing market.

-

The market will profit from technology advancements in the next years.

-

Using 3D printing technology, designers can discover defects or difficulties in prototype creation.

-

Emissions must be reduced as the heavy engineering sector expands.

CHALLENGES:

-

The future of 3D printing poses a difficulty for intellectual property and copyright legislation.

The expanding world of 3D printing provides intellectual property and copyright regulations with new issues. With the ease with which items can be reproduced, enforcing and maintaining design rights becomes complicated, needing a delicate balance between fostering innovation and protecting creators' rights. Adapting legal frameworks to this changing environment is critical for dealing with these challenges.

-

free component designs and blueprints available on the internet pose a danger to patent holders.

IMPACT OF ECONOMIC SLOWDOWN:

As automotive manufacturers navigate through economic uncertainties, there has been a noticeable adjustment of priorities and investments in 3D printing technologies. The slowdown has prompted industry players to scrutinize cost structures, emphasizing the need for efficient and cost-effective manufacturing processes. Despite the challenges, the Automotive 3D Printing Market has exhibited resilience, with a growing emphasis on leveraging additive manufacturing for prototyping, customization, and small-scale production. The economic downturn has accelerated the shift towards agile and flexible manufacturing practices, where 3D printing plays a pivotal role in facilitating rapid design iterations and reducing time-to-market. Additionally, the demand for sustainable practices has gained prominence, with 3D printing enabling the production of lighter and more fuel-efficient automotive components, aligning with broader industry trends towards eco-friendly solutions. As the automotive sector continues to navigate the economic headwinds, the Automotive 3D Printing Market stands poised to evolve, adapting to new paradigms that prioritize efficiency, flexibility, and sustainability.

IMPACT OF RUSSIA –UKRAIN WAR:

The geopolitical tension has disrupted the supply chain of critical raw materials, such as metals and polymers, essential for 3D printing processes within the automotive sector. The uncertainty surrounding resource availability and price fluctuations by approx.10-12% which has has compelled key players in the automotive 3D printing market, including Stratasys, 3D Systems, and HP Inc., to reassess their sourcing strategies and production timelines. Moreover, the geopolitical instability has led to increased concerns about transportation and logistics, affecting the timely delivery of 3D-printed components to automotive manufacturers worldwide. As the industry navigates through these challenges, there is a heightened focus on diversifying supply chains and exploring alternative sourcing options to mitigate the impact of the Russia-Ukraine conflict on the Automotive 3D Printing Market.

Market, By Application:

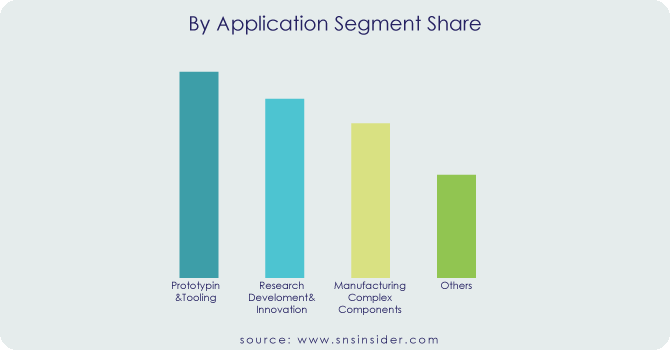

The global market has been divided into Prototyping & Tooling, Research, Development & Innovation, Manufacturing Complex Components, and Others Based on the application segment. The largest share of the market will come from the prototyping and tooling segment. The segment has grown steadily over time and will continue to do so in the future. The main reasons for this are how quickly the prototype can be made, how simple the process is, how much it costs, how many different filaments can be used, how easily the design can be changed, and how little waste there is.

Market, By Technology:

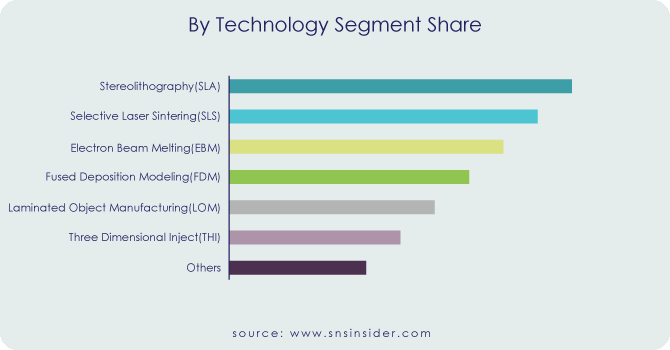

The global market has been divided into Stereolithography (SLA), Selective Laser Sintering (SLS), Electron Beam Melting (EBM), Fused Deposition Modeling (FDM), and Laminated Object Manufacturing (LOM), Three-Dimensional Inject Printing, Others Based on the technology segment. In the automotive business, the FDM is one of the most often utilized methods of 3D printing. In the automobile 3D printing sector, the method's adaptability in producing prototypes, concept model parts, and finished items keeps it strong.

Market, By Material:

Need any customization research on Automotive 3D Printing Market - Enquiry Now

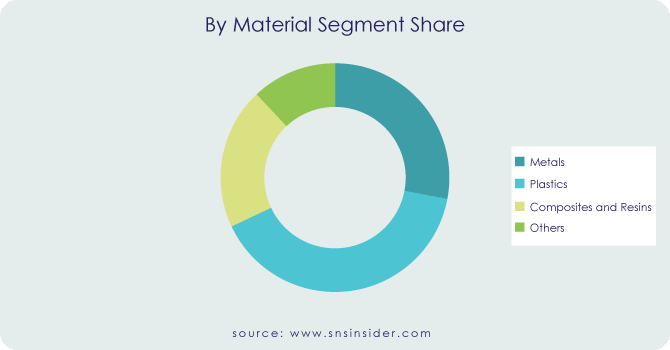

The global market has been divided into Metals, Plastics, Composites and Resins, and Others based on the material segment. Polymer is the most commonly used material due to its strength and flexibility. There will be an increase in the usage of metals in automobile 3D printing, however, as parts that must endure high pressure and temperature can be printed using metal 3D printers.

MARKET SEGMENTATION:

By Application:

-

Prototyping & Tooling

-

Research, Development & Innovation

-

Manufacturing Complex Components

-

Others

By Technology:

-

Stereolithography (SLA)

-

Selective Laser Sintering (SLS)

-

Electron Beam Melting (EBM)

-

Fused Deposition Modeling (FDM)

-

Laminated Object Manufacturing (LOM)

-

Three-Dimensional Inject Printing

-

Others

By Material:

-

Metals

-

Plastics

-

Composites and Resins

-

Others

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSIS:

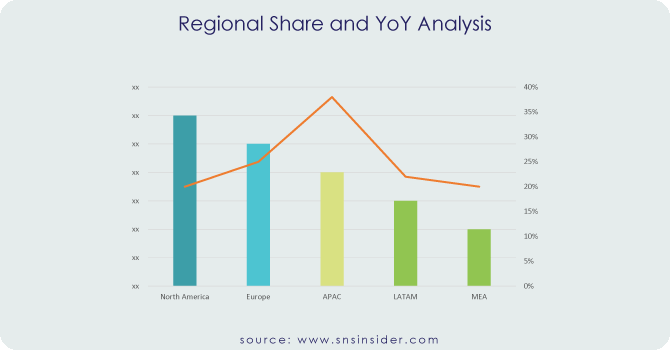

The Automatic High Beam Control (AHBC) market displays a fluid regional landscape, with North America's developed economies taking the lead in 2022, commanding a substantial market share of $4.2 billion, as reported in the latest market research. Fueled by stringent safety regulations and the prominent presence of leading car manufacturers, this region asserted its dominance. Nevertheless, the Asia-Pacific region is poised for rapid expansion, anticipating a remarkable CAGR exceeding 23.20% during the forecast period (2024-2031). This surge is attributed to the expanding middle class, a spike in vehicle production, and heightened governmental emphasis on enhancing road safety infrastructure. Consequently, the growth trajectory in Asia-Pacific is expected to narrow the market share gap between regions in the ensuing years.

KEY PLAYERS:

Stratasys (Israel), 3D Systems (US), Desktop Metal (US), EOS (Germany), Arcam AB (Sweden), Renishaw plc. (UK), HP (US), Buggati, EPlus3D (China), Materialise (Belgium), Carbon (US), SLM Solutions Group AG (Germany), Voxeljet (Germany), Farsoon Technologies (China) and Sinterit (Poland), Protolabs (US), Nexa3D (US), and Ultimaker (Netherlands) are some of the affluent competitors with significant market share in the Automotive 3D Printing Market.

3D Systems (US)-Company Financial Analysis

Recent Development:

-

Renishaw will release a new line of RenAM 500 3D printing machines in May 2022. RenAM 500S Flex, a single laser 3D printing machine, and RenAM 500Q Flex, a four-laser 3D printing machine. Both systems had a streamlined powder handling system that is suitable for R&D, pre-production, or bureau environments.

-

3D Systems added extrusion technology to its solution offering in February 2022 with the acquisition of Titan Additive LLC, a global leader in polymer extrusion technology. This will broaden the options available to its clients

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.98 Billion |

| Market Size by 2031 | US$ 14.90 Billion |

| CAGR | CAGR of 22% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Application (Prototyping & Tooling, Research, Development & Innovation, Manufacturing Complex Components, Others) • by Technology (Stereolithography (SLA), Selective Laser Sintering (SLS), Electron Beam Melting (EBM), Fused Deposition Modeling (FDM), Laminated Object Manufacturing (LOM), Three-Dimensional Inject Printing, Others) • by Material (Metals, Plastics, Composites and Resins, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stratasys (Israel), 3D Systems (US), Desktop Metal (US), EOS (Germany), Arcam AB (Sweden), Renishaw plc. (UK), HP (US), Buggati, EPlus3D (China), Materialise (Belgium), Carbon (US), SLM Solutions Group AG (Germany), Voxeljet (Germany), Farsoon Technologies (China) and Sinterit (Poland), Protolabs (US), Nexa3D (US), and Ultimaker (Netherlands) |

| Key Drivers | • Rapid prototyping costs and timelines accelerate market expansion. • An increase in R&D efforts worldwide is one factor driving the automotive 3D printing market. • Automobile manufacturers are investing in automotive technology to build fuel-efficient vehicles with low emissions. • Market expansion is helped by fast prototyping's lower costs and shorter lead time. • Increased government support for 3D printing-related research and development. |

| RESTRAINTS | • The expected growth of the market would be impeded by the product's high beginning cost. • The market's expansion would be hampered by a scarcity of competent personnel and knowledge. |