Automotive Active Purge Pump Market Report Scope & Overview:

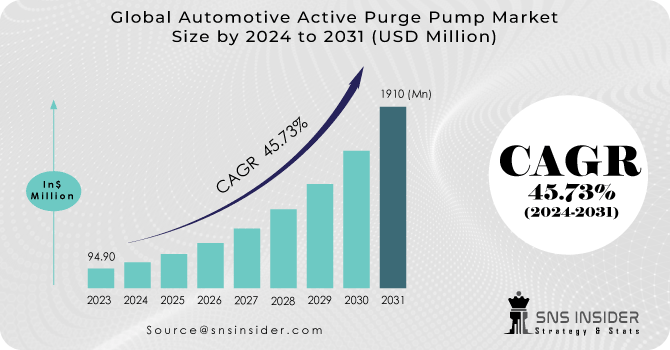

Automotive Active Purge Pump Market Size was valued at USD 94.90 million in 2023 and is expected to reach USD 1910 million by 2031 and grow at a CAGR of 45.73% over the forecast period 2024-2031.

-

What are the factors which will be contributing to the growth of market during the forecasted period?

The expanding landscape of the Automotive Active Purge Pump Market is being propelled by an array of factors poised to drive unprecedented growth. Primed by escalating environmental concerns, stringent emissions regulations, and an industry-wide pursuit of sustainability, automakers are increasingly turning towards innovative solutions like active purge pumps. These pumps, engineered to effectively manage evaporative emissions from vehicle fuel systems, not only align with regulatory mandates but also resonate with the ethos of eco-conscious consumers.

The rising penetration of electric and hybrid vehicles, coupled with the intensifying demand for lightweight and fuel-efficient automobiles, further amplifies the market's momentum. Additionally, advancements in technology, including the integration of smart sensors and adaptive control systems, are enhancing the efficiency and efficacy of active purge pumps, thereby fostering their adoption across diverse vehicle segments. As the automotive landscape continues to evolve, driven by a confluence of regulatory imperatives, consumer preferences, and technological innovations, the Automotive Active Purge Pump Market stands poised to scale new heights, heralding a paradigm shift towards cleaner and greener mobility solutions.

Market Understanding:

An active purge pump is a way to reduce evaporative hydrocarbon emissions from a car that uses electricity. The active purge pump in a car pulls hydrocarbon-filled air out of the emission canister, which is used to control evaporative hydrocarbon emissions. The reduction of hydrocarbon evaporative emissions from a vehicle can be accomplished with the use of an electromechanical device known as an active purge pump. It is responsible for controlling the purge flow as well as actuating the flow of fuel vapors from an evaporative emission canister. A motor, a vapor canister, and a valve assembly are the three components that make up an active purge pump. This type of pump supplies pressured air to the engine and removes fuel vapor from the canister. Measurement of hydrocarbon evaporative leaks, detection of air pressure, and detection of hose-off emissions are just some of the roles that an automobile active purge pump can do.

To get around severe hydrocarbon evaporation rules and legislation all around the world, In 2022, Continental AG has come out with an active purge pump as a component of the evaporative fuel processing system. This was done in order to meet the needs of their customers.

MARKET DYNAMICS:

KEY DRIVERS:

-

Increased attention in environmental and safety issues.

Concern for environmental preservation and safety has resulted in a significant increase in public awareness and engagement, promoting a collaborative commitment to protecting our world for future generations.

-

The inclination of automotive manufacturers for more effective emission control systems.

-

Stricter emission regulations would result in an increase in demand for active purge pumps.

RESTRAINTS:

-

The growing popularity of battery-powered electric vehicles;

The spike in demand for battery-powered electric vehicles indicates a changing automotive landscape, as consumers prioritize environmentally friendly transportation options. This spike in popularity is being driven by breakthroughs in battery technology, expanding charging infrastructure, and a common desire to cut carbon emissions, altering the future of mobility.

-

Market expansion may be impeded by the expensive cost of active purge pumps.

OPPORTUNITIES:

-

Fuel-efficient autos are gaining popularity.

The growing popularity of fuel-efficient vehicles reflects a growing consumer desire for vehicles that maximize energy use while minimizing environmental effect. Rising fuel costs, more environmental consciousness, and increases in engine efficiency are driving this trend, which reflects a broader shift toward sustainable transportation options.

-

Reducing hydrocarbon emissions is getting increasingly fashionable.

-

High environmental protection criteria.

CHALLENGES:

-

In megacities, exhaust gases and sunlight cause photochemical haze.

The combination of exhaust emissions and sunshine causes photochemical haze, a complex mix of toxins and particles, to accumulate within megacities. This haze lowers air quality, affecting both human health and the environment, emphasizing the critical need for effective air quality control techniques in densely populated urban areas.

-

Manufacturers confront a huge challenge in terms of hydrocarbon emission product innovation and development.

IMPACT OF ECONOMIC SLOWDOWN:

As a consequence of the prolonged recession, consumer spending has dwindled, leading to a decline in demand for automotive active purge systems. Manufacturers are consequently scaling back production and sales, significantly impacting the market's growth trajectory. In February 2023, the average import price of DC motors stood at $2.7 per unit, marking a 6% increase from the preceding month of January. Furthermore, the average selling price of all sensors is projected to be 11% higher in 2022 compared to 2021.

Amidst the recession-induced challenges, the prices of commodities have surged, hindering people's ability to procure manufacturing raw materials. Aalberts integrated piping systems, renowned for its "Apollo" Valves, responded to ongoing escalations in shipping, labor, and material costs by instituting a 4% price hike on bronze and brass ball valves. Additionally, they implemented a 4% increase in prices for gate, globe, and check valves.

IMPACT OF RUSSIA UKRAINE WAR:

The escalation of the conflict between Russia and Ukraine has sparked heightened global tensions and raised concerns about regional security. This deterioration in diplomatic relations has had ripple effects, impacting global energy markets due to disrupted supply channels and contributing to broader shifts in international security dynamics. Diplomatic efforts and peace resolutions are now imperative to address these challenges.

In the realm of motor technology, BLDC (Brushless DC) motors have emerged as highly reliable and efficient alternatives to brushed motors. With fewer moving parts, BLDC motors can operate for up to 20,000 hours, significantly surpassing the service life of brushed motors, which typically range from 3,000 to 5,000 hours. Additionally, BLDC motors generate less noise and experience reduced electromagnetic interference, making them increasingly favored in various applications.

The plastics industry faced a severe setback in February 2021 when a winter storm devastated Texas, damaging electrical infrastructure and causing an 80% reduction in US resin output. This natural disaster, coupled with subsequent challenges such as significant price hikes in polypropylene (PP) and polyethylene (PE), as well as a 30% decrease in production capacity, compounded the industry's woes.

Market, By Material Type:

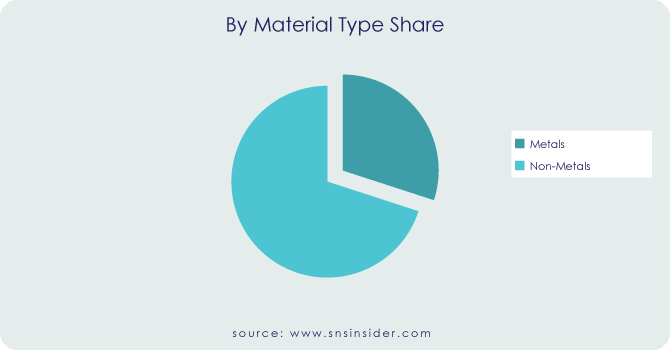

The material segment, encompassing both metals and non-metals, within the Automotive Active Purge Pump Market plays a pivotal role in understanding the dynamics driving this industry. Metals, such as aluminum, stainless steel, and various alloys, are often utilized in the manufacturing of automotive components due to their robustness, heat resistance, and lightweight properties, thus contributing to the efficiency and durability of active purge pump systems. Non-metal materials, including plastics, rubbers, and composites, are equally crucial, providing flexibility, insulation, and corrosion resistance in various pump components, ensuring optimal performance under diverse environmental conditions. Non-metals likely hold a higher share due to their wider range of applications within the pump and focus on weight reduction in vehicles. The non metals subsegment holds the share of approximately 70%.

Market, By Components:

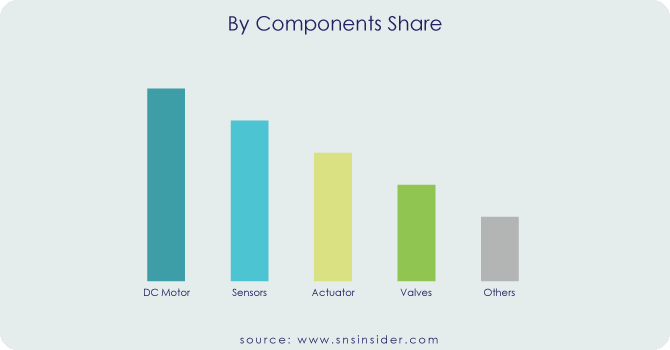

Segment analysis of components in the Automotive Active Purge Pump Market reveals distinct trends. Sensor segments exhibit growth owing to increasing demand for advanced emission control systems, necessitating precise monitoring. Valves segment displays steady growth, driven by continuous innovation in valve technologies for efficient purge pump operations. DC motors segment experiences robust expansion due to their crucial role in pump functioning, especially in electrified vehicle applications. These segments collectively shape the market landscape, reflecting the industry's focus on enhancing performance, efficiency, and environmental compliance in automotive emissions control systems.

Market, By Manufacturing Process:

The global market has been divided into Cutting, Vacuum Forming, Injection Molding, and Others based on the manufacturing process segment. Vacuum forming is expected to increase faster than other manufacturing processes over the forecast period. It reduces production costs and time. Vacuum forming will be in high demand for mass production in the automobile industry in the next years.

KEY MARKET SEGMENTATION:

By Material Type

-

Metal

-

Non-Metal

By Components

-

DC Motor

-

Sensors

-

Actuator

-

Valves

-

Others

By Manufacturing Process

-

Cutting

-

Vacuum Forming

-

Injection Molding

-

Others

REGIONAL ANALYSIS:

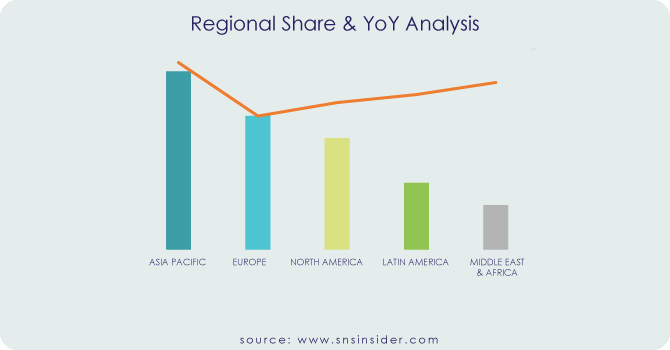

The Asia Pacific region has the greatest market share, as demand for automobiles has increased rapidly in recent years in the region, particularly in China and India. Rising disposable incomes, urbanization, and changing lifestyles have all contributed to an increased need for mobility. This industry, which is critical for adhering to emissions regulations and improving air quality, is expanding as a result of growing automotive demand. Furthermore, there is a growing emphasis on environmental sustainability, with governments, consumers, and businesses all recognizing the importance of reducing emissions and protecting the environment.

As a result, there is a growing need for cleaner, more efficient vehicles, particularly those equipped with advanced emissions control systems such as Automotive Active Purge Pumps, which help to reduce hazardous emissions and improve air quality. With main automobile manufacturing powerhouses such as China, Japan, and South Korea, the Asia Pacific area is a vital center for the industry. Automotive Active Purge Pumps, being a key component of automobile emissions control systems, have a substantial market in the region's increasing automotive production sector.

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Robert Bosch GmbH (Germany), Daimler AG, Continental AG (Germany), Agilent Technologies (U.S.), and Denso Corporation (Japan) are some of the affluent competitors with significant market share in the Automotive Active Purge Pump Market.

Daimler AG-Company Financial Analysis

RECENT DEVELOPMENT:

-

Bosch Automotive Service Solutions Inc. recently significantly reduced emissions by providing unconventional purge pump technology for petrol vehicles

-

Recent considerable improvements in the elimination of pollutants were accomplished by Continental AG through the development of an advanced active purge pump system for petrol engines.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 94.90 Million |

| Market Size by 2031 | US$ 1910 Million |

| CAGR | CAGR of 45.73% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material Type (Metal, Non-Metal) • by Components (DC Motor, Sensors, Actuator, Valves, Others) • by Manufacturing Process (Cutting, Vacuum Forming, Injection Molding, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH (Germany), Daimler AG, Continental AG (Germany), Agilent Technologies (U.S.), and Denso Corporation (Japan) |

| Key Drivers | • Increased attention in environmental and safety issues. • The inclination of automotive manufacturers for more effective emission control systems. • Stricter emission regulations would result in an increase in demand for active purge pumps. |

| RESTRAINTS | • The growing popularity of battery-powered electric vehicles; • Market expansion may be impeded by the expensive cost of active purge pumps. |