Motorized Quadricycle Market Report Scope and Overview

To get more information on Motorized Quadricycle Market - Request Free Sample Report

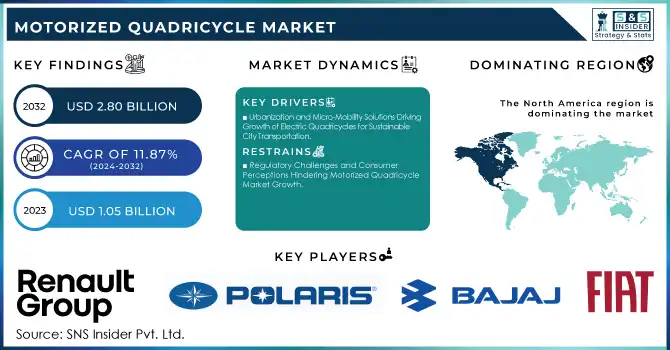

The Motorized Quadricycle Market Size was valued at USD 1.05 billion in 2023 and is expected to reach USD 2.80 billion by 2032, growing at a CAGR of 11.87% over the forecast period 2024-2032.

With a rise in preference for environment-friendly, affordable, and compact transportation alternatives, motorized quadricycle sales are gaining popularity. They play a part in urban mobility, designed for cities where standard cars could suffer from various problems related to congestion and pollution. Four-wheel electric quadricycles are particularly enticing in Europe with its strict emission standards and emphasis on low-emission vehicles. Furthermore, manufacturers of quadricycles have the opportunity to offer lower insurance costs, licensing, and maintenance fees than with conventional vehicles making the vehicles widely accessible to diverse consumer buying segments, including low-income households and businesses looking for affordable transport solutions.

The growth of the Electric quadricycle market is further bolstered by the associated advancement in technology by manufacturers who are working on producing electric and autonomous quadricycle models to attract individual and fleet users alike. Modern quadricycles are now more efficient due to advances in ultra-light materials and high-efficiency batteries and some of them are also more desirable because they come with benefits such as regenerative brakes and improved safety gear. According to the company, this trend follows the establishment of sustainable transport across the world, a segment that has received much attention in areas that are environmentally green-tech-friendly like Europe and North America where government incentives and subsidies have generated additional quadricycle sales. When it comes to 2023-2024, electric quadricycles gain a lot of public funding help. Meanwhile, Europe has seen the sales of these electric quadricycles shoot up 12. It is also indirectly supported in the U.S. by the federal tax credit of up to USD 7,500 for EV purchases.

Motorized Quadricycle Market Dynamics

KEY DRIVERS:

-

Urbanization and Micro-Mobility Solutions Driving Growth of Electric Quadricycles for Sustainable City Transportation

The urbanization trend and micro-mobility solutions are the main drivers of the motorized quadricycle market. As cities around the world go through rapid urbanization, they have been plagued with issues related to congestion, limited parking, and air quality amongst other things, particularly in high-population density regions. Because of their compact size, ease of use, and ability to operate in the narrow, crowded urban streets that are often inaccessible to traditional vehicles, motorized quadricycles provide a practical solution to these challenges. This suitability can make them perfect for private use as well as urban logistics functions (last-mile delivery services). Furthermore, the quadricycle, especially in electric form, is likely to become all the more popular as cities impose even more restrictions on conventional cars as a means of relieving congestion and cutting emissions. It goes hand in hand with the smart city goals, which promote access to low-impact transportation modes, specifically to fight pollution and reduce traffic congestion. In countries such as France, registrations of electric quadricycles increased 30-40% between 2020 and 2023.

-

Advancements in EV Infrastructure and Battery Technology Driving Growth of Electric Quadricycles

Improvements in investment in the EV framework like expanding charging stations and higher private advancement of high proficiency batteries have broad-based the intrigue and maturity of day-to-day use of electric quadricycles. A step up in battery range and a reduction in charge time is essential to bringing the consumers who once feared the range of electric models on board. In addition, battery-swapping technology and autonomous drive developments for quadricycles also expand the appeal of the vehicles into the shared and autonomous urban transport solution space. The stabilizing and plummeting costs of battery technology make the complete ownership of an electric quadricycle increasingly desirable to a wider market. This is how motorized quadricycles can help consumers respond to their needs for more reliable urban transport, convenience, and sustainability.

Global lithium battery demand came in at 140,000 metric tons in 2023, representing 85% of total lithium demand. Some 6,300 fast chargers were added in the U.S., raising the total to 28,000 fast chargers, with more on the way, thanks to the USD 885 million National Electric Vehicle Infrastructure program. There is also an increase in battery production capacity from 85 GWh in 2022 to 110 GWh in 2023, enough for 2.5 million electric vehicles in Europe.

RESTRAIN:

-

Regulatory Challenges and Consumer Perceptions Hindering Motorized Quadricycle Market Growth

A great number of countries have no standard policy for quadricycles most importantly, no safety standards. Certain geographic areas, such as the European Union, have developed clear definitions and requirements for light motorized vehicles, while many areas do not. Such inconsistency can restrict the growth of markets by forcing manufacturers to cater to different regulations which makes the process of developing and entering the market more complex and time-consuming. A big hurdle, too, is consumer opinion, as hearse and quadricycles are viewed as more dangerous than regular cars. This typecast occurs due to the compact nature, lightweight construction, and lower cruising/top speeds associated with quadricycles all leading to limited usage scope when compared with passenger vehicles, especially for long-distance or high-speed travel. Moreover, the awareness about the plusses of quadricycles outside the urban centers is quite nominal, further inhibiting their growth. Quadricycle, while ensuring safety and ride awareness is imperative to evolve beyond niche urban applications.

Motorized Quadricycle Market Segments Analysis

BY VEHICLE TYPE

Internal combustion (IC) engine-powered segment accounted for 61% of the share in motorized quadricycle market in 2023. This is primarily due to existing infrastructure, availability, and lower initial prices compared to electric models. When there is no charging infrastructure, the advantages of IC-powered quadricycles (which can use an existing refueling network, consumer familiarity with the technology, and generally great range and speed) can help in rural or non-urban settings (which, as we note in the electric vehicle discussion of the non-sonal needs summary post, are often quite limited in options). It's also the case that the production costs of IC engines are still lower, allowing for greater consumer penetration in markets.

The Electric Vehicle segment is expected to have the fastest compound annual growth rate between 2024 and 2032. This expected growth is based on advancing sustainability demands, available government support, and more reliable battery development, which offers longer ranges and shorter charge times. Several countries, Europe and North America in particular, have been adopting policies that promote low-emission vehicles which in turn will provide an additional impetus for the growth of the electric quadricycle market, given the stringent emission norms in urban areas. When EV technology is cheaper and more widely adopted, we can expect a large portion of the market to be either electric quadricycle.

BY APPLICATION TYPE

The commercial segment held the leading share of 47% in 2023, due to the growing requirement of efficient last-mile delivery and urban logistics, especially in densely populated areas where traditional delivery vehicles can struggle with space and emissions. Their compact dimensions and relatively low running costs make quadricycles ideally suited to congested urban environments, providing a practical alternative for companies with an eye on sustainability and economy. This demand has made them particularly suitable for food delivery, small parcel delivery, and other urban logistics tasks due to their need for maneuverability and low environmental impact.

The household segment is projected to witness the fastest growth from 2024 to 2032 owing to the rising need for sustainable and lower-priced personal transportation. With their compact size and lower emissions, quadricycles appeal to urban residents seeking easy-to-park transportation options for city travel. Moreover, governmental incentives to adopt low-emission vehicles, especially in Europe, and increasing fuel prices will incentivize consumers in the household segment to adopt them. This transition reflects the growing tendency towards employing sustainable transport options for regular purposes, which is in turn offering the household quadricycle quick growth opportunities through the timeline period.

BY TYPE

Heavy quadricycles segment accounted for a major share of 58% in 2023, mainly owing to their rugged nature, high performance, and suitability for commercial as well as private applications. These vehicles generally feature a more capable engine and are designed for heavier loads, which are more suitable for urban logistics, cargo transport, and urban commercial use. This not only enables it to carry bulkier loads but to endure lengthier journeys, making them even more practical for businesses and professionals who depend upon rugged, utility-based vehicles. Heavy quadricycles also tend to come with some additional safety features that make them popular in other applications where safety in a reliable capable vehicle is required.

The light quadricycle segment is expected to be the fastest-growing segment in terms of CAGR during the forecast period, 2024 to 2032. The growth is driven by the increased demand for personal transportation with a smaller footprint in an urban environment. Light quadricycles are generally cheaper and easier to drive than heavier ones, making them interesting for customers who value practicality, low cost, and environmental friendliness for door-to-door use (i.e. reaching short distances). Newfound governmental support for low-emission and electric vehicles especially in Europe and improvements to light electric quadricycle technology that enhance efficiency and range are also fueling the growth of these vehicles in urban settings. Increasingly strict city restrictions on emissions and traffic, meanwhile, are likely to make light quadricycles an ever-more appealing solution for green, inclusive urban mobility.

BY PRICE RANGE

The mid-price range segment dominated the motorized quadricycle segment in 2023, accounting for a 41% market share. Being in this segment is the most popular as it is one of the best combinations of affordability and quality, thus good both for personal and commercial projects. These include a good mix of key characteristics at an affordable price; targeting urban commuters, small businesses, and material delivery services, mid-range quadricycles would be a reliable option for those who seek value from their purchase. Mid-range cars offer a good balance between performance and price for consumers needing a daily-driven car without the premium price tag, resulting in larger adoption rates in the segment.

The high-price range segment is projected to be the fastest growing in terms of compound annual growth rate (CAGR) from 2024 to 2032. This projected growth is due to stronger demand for electric and higher-tech models, which typically sit in the higher-priced segment. The target consumer for high-price quadricycles on which type of cluster quadricycles will have more demand and more appeal (with good battery capacity + performance + safety) but at a high cost (not more than 40k) to purchase, so people who want to buy a sustainable and high-quality vehicle would spend some extra money on it. As more consumers are becoming aware of environmental changes, and with government support and incentives being announced to promote the use of electric vehicles

Motorized Quadricycle Market Regional Overview

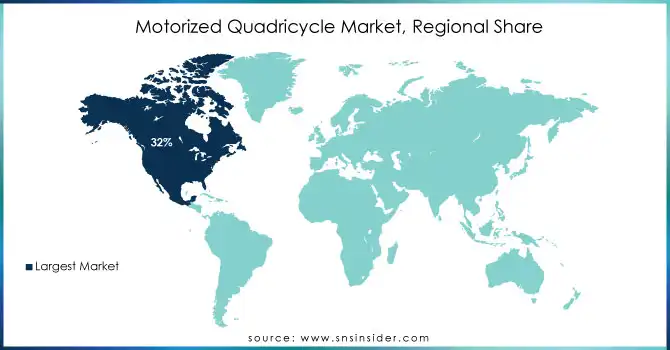

North America held a market share of more than 32% in the motorized quadricycle market in 2023. This has been fueled primarily by rising urbanization levels and the need for sustainable transportation alternatives. In congested and polluted cities such as New York, Los Angeles, and Toronto, quadricycles are a convenient and green way to travel short distances. The increasing adoption of electric vehicles (EVs) across North America has also pushed the reforms in favor of e-quadricycles that would support regional decarbonization objectives. Significantly, the U.S., as well as Canada, have since elevated a relaxing of laws beforehand imposed to solution stakeholders through tax breaks and also rebates that urge specific vehicle drivers to achieve low-emission automobiles, in turn providing the industry vestibule for electrical quadricycles.

The Asia Pacific region is anticipated to witness the fastestcompound annual growth between 2024 and 2032. Quadricycles are growing quickly regionally in nations similar to India, China, and Japan, as they provide a reasonably priced, sustainable, and obsessively deft resolution to mobility woes. The latest quadricycles are getting more common in urban spaces like Delhi, Beijing, and Tokyo, and their strong commercial applications are derived from maneuvering through congested streets and fighting off pollution.

In India, for example, electric quadricycles such as the Bajaj Qute have gained traction as a substitute for motorcycles and cars. Likewise, Japan has championed such small EVs to complement urban transportation and lower emissions, setting the stage for quadricycles to become a major part of the region as the green transport layer.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Motorized Quadricycle Market

Some of the major players in the Motorized Quadricycle Market are:

-

Renault Group (France) - Twizy, Renault Zoe

-

Polaris Industries Inc. (U.S.) - GEM e2, GEM e4

-

Bajaj Auto Limited (India) - RE60, Qute

-

Aixam-Mega (France) - Aixam e-city, Mega e-City

-

Yamaha Motor Co., Ltd. (Japan) - Yamaha ATV, Yamaha Raptor

-

Mahindra Electric Mobility Limited (India) - e2o Plus, eVerito

-

SWINCAR (U.K.) - SWINCAR e-Spider, SWINCAR e-Cross

-

GEM Electric Vehicles (Waev Inc.) (U.S.) - GEM e6, GEM e4

-

Ligier Group (France) - Ligier JS50, Ligier X-Pro

-

Microlino (Switzerland) - Microlino 2.0, Microlino Urban

-

Arcimoto (U.S.) - Arcimoto FUV, Arcimoto Deliverator

-

Fiat (Italy) - Fiat Panda 4x4, Fiat 500L

-

PMV Electric (India) - EaS-E, EaS-E Pro

-

Citroen (France) - Citroen Ami, Citroen Mehari

-

Club Car, LLC (U.S.) - Club Car Tempo, Club Car Onward

-

Chatenet (France) - Chatenet CH40, Chatenet CH46

-

Textron (U.S.) - Cushman Hauler, E-Z-GO RXV

-

Italcar Industrial S.r.l. (Italy) - Italcar ATV, Italcar Microcar

-

Alke (Padua, Italy) - Alke ATX 100E, Alke ATX 160E

-

Goupil (France) - Goupil G4, Goupil G5

Some of the Raw Material Suppliers for Motorized Quadricycle Companies:

-

BASF SE

-

Dow Inc.

-

ArcelorMittal

-

Covestro AG

-

LG Chem Ltd.

-

Samsung SDI Co., Ltd.

-

3M Company

-

SGL Carbon SE

-

Nexans S.A.

-

Umicore

RECENT TRENDS

-

In October 2024, Renault's Mobilize brand launched two new electric quadricycles, the Duo and Bento, designed for urban mobility and commercial use, starting at €7,600.

-

In October 2024, Citroën unveiled the updated Ami electric quadricycle at the 2024 Paris Motor Show, featuring a new design and the beach-inspired Ami Buggy Vision concept. The Ami will launch in 2025, offering a compact, eco-friendly solution for urban mobility.

-

In October 2024, Ligier debuted new quadricycle models, including the Ligier JS50, at the Paris Motor Show 2024. The JS50 targets urban drivers with its compact design and eco-friendly features, bolstering Ligier's presence in the European small electric vehicle market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.05 Billion |

| Market Size by 2032 | USD 2.80 Billion |

| CAGR | CAGR of 11.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (IC Powered Vehicle, Electric Vehicle) • By Application Type (Household, Commercial, Others) • By Type (Light Quadricycle, Heavy Quadricycle) • By Price Range (Low, Mid, High) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Renault Group, Polaris Industries Inc., Bajaj Auto Limited, Aixam-Mega, Yamaha Motor Co., Ltd., Mahindra Electric Mobility Limited, SWINCAR, GEM Electric Vehicles (Waev Inc.), Ligier Group, Microlino, Arcimoto, Fiat, PMV Electric, Citroen, Club Car, LLC, Chatenet, Textron, Italcar Industrial S.r.l., Alke, Goupil. |

| Key Drivers | • Urbanization and Micro-Mobility Solutions Driving Growth of Electric Quadricycles for Sustainable City Transportation • Advancements in EV Infrastructure and Battery Technology Driving Growth of Electric Quadricycles |

| RESTRAINTS | • Regulatory Challenges and Consumer Perceptions Hindering Motorized Quadricycle Market Growth |