Railway Telematics Market Report Scope & Overview:

Get More Information on Railway Telematics Market - Request Sample Report

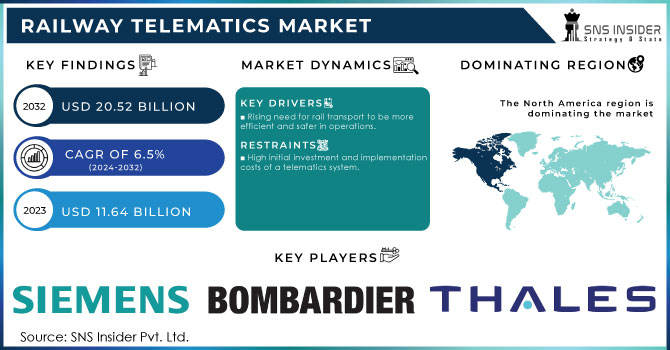

The Railway Telematics Market Size is projected to reach USD 20.52 billion by 2032 and will be growing at a CAGR of 6.5% over 2024-2032. The market was valued at USD 11.64 billion in 2023.

Improvements in efficiency and safety are supposed to be the key drivers for the demand in the Railway Telematics Market. As the need to track train operations in real time is increasing, the real-time tracking of data has become very crucial as nearly 70% of railway operators are reportedly improving their operational performance with increased visibility. There has been a sharp increase in the adoption of IoT in the railway sector; 45% of the companies are utilizing IoT-enabled solutions to optimize maintenance and reduce downtimes. This integration is critical for predictive maintenance, avoiding delays brought about by equipment failures. Other drivers will include rigid regulatory compliance in safety and efficiency standards, forcing rail operators to invest in sophisticated telematics systems. An above 60 % of rail operators attribute regulatory compliance as a major drive for adopting new technologies.

That is why this demand is further encouraged by the growing importance of sustainability and the aim to decrease carbon emissions; after all, data shows telematics systems on rails can decrease fuel consumption up to 15%. Lastly, freight and passenger traffic continue to increase and this will be about 25% within the next ten years, so it requires more efficient management systems. Such factors are driving the railway telematics market as stakeholders have become aware of the fact that application of more advanced technologies is necessary to enhance efficiency, safety, and sustainability in their operations. Some of the significant trends include increased demand for real-time monitoring and data analytics that enable rail operators to optimize performance and reduce downtime.

Railway companies are investing in advanced telematics solutions to help improve predictive maintenance by reducing unexpected failures by as much as 40%. Another added motivation for telematics systems is the increasing concern over safety regulations and compliance; about 60% of rail operators point to better safety management as their reason for investing in telematics. Another crucial trend is the integration of IoT technology and is anticipated to reach 35 % of the telematics systems concerning more connectivity and better data exchange between the vehicles and the central systems. Also, sustainability in the Public Transportation sector is now becoming a very crucial factor by forcing railway operators for telematics concerning fuel efficiency and emission monitoring, as around 50 % are giving much importance to these factors within the telematics strategies.

Railway Telematics Market Dynamics:

Drivers:

-

Rising need for rail transport to be more efficient and safer in operations.

With an expanding rail system around the globe, companies operating trains are under pressure to streamline services, ensure minimal delays, and at the same time, make improvements to safety measures. Telematics can, therefore, be applied in the management of a train to track performance in real-time. Applications may range from speed and location tracking to checking on performance indicators. Industry statistics have it that with the use of telematics, operational efficiency could be boosted by as much as 20% following its deployment, much maintenance cost and downtime reduced or completely eliminated. This also impacts positively upon decision-making processes since data analytics lets one realize problem events beforehand or at the onset, hence enabling proactive maintenance and response to potential issues in good time. Increasing freight transport in North America and Europe only calls for more reliable and efficient rail systems. Freight transport by rail has grown by about 10% in the last five years alone, and increased volumes require more advanced technology to control them. However, growing concerns towards sustainability have, on the other hand, brought focus and demand for using rail transport reasons that relate to being energy-friendly, thus investment in telematics solutions supporting energy efficiency in operations. Hence, the significance of telematics systems adoption was especially felt by the rail operators when they had to align the structure with regulatory standards and customer expectations in regard to reliability and sustainability in the services.

Restrains:

-

High initial investment and implementation costs of a telematics system.

The advantages include higher operational efficiency and safety, but these up-front installation and maintenance costs can be prohibitive for many small rail operators. According to SNS Insider study, the development of high-end telematics systems would require an investment from 5% to 10% of annual budgets for railway operators, which might be a very high investment for organizations that have already been facing tight financial constraints. Introducing the telematics solution into the existing legacy system at the railway operator would also not be easy and timely and would require considerable investment in infrastructure and training. This is complicated by inconsistencies in standards and interoperability among various rail networks, which could prevent the use of new solutions or raise the risk factors associated with operations.

Recent studies indicate that some 30% of rail operators still fear that new telematics solutions developed might not be compatible with their current systems, making them hesitant towards the adoption of such technologies. The actual financial burden in relation to the expected benefits is what can make the process of innovation and transformation in the railway industry take a noticeably long time, resulting in restrained growth within the market in deciding whether the costs outweigh the benefits.

Railway Telematics Market Segmentation Overview:

By Solution:

Revenue share by the largest group is fleet management which held 35% market share in 2023 in which companies look at optimal scheduling and resource allocation with enhanced operational efficiencies through real-time data and analytics. Automatic Stock Control, which has a 25% market share, also makes its way up as it significantly reduces the stock discrepancy and has improved inventory management, growing at 20% per annum. About 15% is covered by Remote Data Access, which is derived from the need for real-time visibility and operation flexibility, with a projected CAGR of 18%. Railcar Tracking and Tracing accounts for around 20% and is considered to be a critical feature for enhancing asset visibility. The increasing GPS and IoT technologies propel these capabilities. "Others" is the smallest category at 5%, yet it is comprised of niche solutions designed to meet special operational requirements.

Railcar Type

Hoppers held the largest share of revenue in the total railcar market, with around 30%. Hoppers are being feted because their rising demand is linked to the transport of bulk commodities like grains, coal, and minerals, which come first in optimizing logistics. Tank Cars accounted for about 25% of revenue and form the basic framework used for liquids or gaseous products, which may be hazardous. Growing governmental regulation on safety and surveillance is driving this segment into embracing telematics in order to ensure compliance and enhance operational safety. Well Cars, used basically to shift intermodal containers, account for around 15% market share and represent growing international trade and e-commerce volumes. Boxcars continue to remain the best in the rail freight business, carrying all commodities with a 20% market share. Refrigerated Boxcars continue to stand at 5% and are essentially used for perishable products only.

Component Type

Major contributions in the segment involve Telematics Control Units, which account for about 60% of the total revenues. These units form the backbone of the telematics systems because they collect and transmit data captured by sensors and onboard systems to implement real-time monitoring and analysis. Major factor driving TCUs are the increasing complexity in rail operations and the demand for integrated data solutions. Sensors, at about 40% in terms of component type revenue, are equally critical as they capture key operational data, such as temperature, speed, and location. The ability of advanced sensor integration, including those with installed IoT devices, to be placed and positioned results in more accurate and reliable data collection, thus supporting more informed decisions about maintenance and operational efficiency.

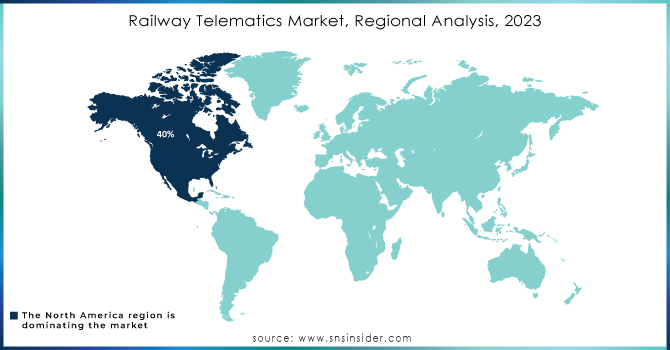

Railway Telematics Market Regional Analysis:

North America accounted for the largest market share, amounting to about 40% of overall revenue, primarily due to the sheer size of the U.S. rail network and substantial investments in smart technologies that continue to be made there. The emphasis on safety and corresponding regulatory requirements supports advanced telematics solutions in this region, enhancing operational efficiency as well as asset tracking capabilities. Europe is another region and lags close to that figure with a share of about 30%, where the high quest for smart transportation solutions and increasing volumes of rail freight are pushing up demand for telematics. The European Union's tough policies on emissions and safety stimulate further adoption of innovative solutions for rail operators in the region.

The Asia-Pacific region, holding some 20%, shows rapid growth based on urbanization, increased expansion of rail infrastructure, and the growing need to realize efficient solutions in logistics. High investment into rail modernization in emerging economies, such as India and China, is substantially driving market prospects. Middle East and Africa, with an estimated 10%, are only beginning to adapt to telematics due to regional governments emphasizing improving their rail infrastructure and efficiency of operations. This regional heterogeneity brings varied opportunities for growth and innovation in the landscape of railway telematics.

Need Any Customization Research On Railway Telematics Market - Inquiry Now

Key Players in Railway Telematics Market

The major railway telematics market key players are:

-

Siemens AG: (Siemens Mobility Telematics Solutions, Railway Control Systems)

-

Bombardier Inc.: (Advanced Train Control Systems (ATCS), Train Communication Network (TCN))

-

Thales Group: (On-board Telematics Systems, Railway Signaling Solutions)

-

Alstom SA: (Smart Mobility Solutions, Train Control & Monitoring Systems)

-

General Electric (GE): (GE Transportation’s RailConnect 360, Predix Platform for Rail Analytics)

-

IBM Corporation: (IBM Watson IoT for Rail, Rail Operations Management Solutions)

-

Trimble Inc.: (Rail Asset Management Solutions, Telematics for Fleet Management)

-

Mitsubishi Electric Corporation: (Train Control Systems, Railway Telematics Solutions)

-

Nokia Corporation: (Railway Communication Solutions, IoT Connectivity for Rail Operations)

-

Hitachi Rail: (Smart Railway Systems, Traffic Management Solutions)

-

SAP SE: (SAP Transportation Management, SAP Asset Intelligence Network)

-

Toshiba Corporation: (Railway Automation Systems, Telematics and Monitoring Solutions)

-

Kapsch TrafficCom AG: (Vehicle and Fleet Management Systems, Telematics for Freight and Logistics)

-

Cleveland Track Material: (Track Monitoring Solutions, Railway Infrastructure Management Tools)

-

Cisco Systems, Inc.: (Railway Network Infrastructure Solutions, IoT Solutions for Rail Operations)

-

Bae Systems: (Cybersecurity for Railway Operations, Railway Command and Control Systems)

-

Oracle Corporation: (Oracle Transportation Management Cloud, Data Analytics for Rail Performance)

-

Zebra Technologies Corporation: (Asset Tracking and Management Solutions, RFID Solutions for Rail Logistics)

-

Railinc Corporation: (Interline Settlement Services, Railcar Tracking and Monitoring Services)

-

Wabtec Corporation: (Positive Train Control Systems, Railway Condition Monitoring Systems)

Recent developments:

• Siemens AG - March 2024 They introduced analytics using AI into its railway business for predictive maintenance.

• Alstom SA - January 2024 Launched smart mobility platform that promises to improve sharing of real-time data and operational efficiency.

• Bombardier Inc. - February 2024: Introduced high-tech digital signalling systems to improve the safety and the performance of the trains.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.64 Billion |

| Market Size by 2032 | USD 20.52 Billion |

| CAGR | CAGR of 6.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component Type: (Telematics Control Unit, Sensors) • By Solution Type: (Fleet Management, Automatic Stock Control, Remote Data Access, Railcar Tracking And Tracing, Others) • By Railcar Type: (Hoppers, Tank Cars, Well Cars, Boxcars, Refrigerated Boxcars, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alstom SA, General Electric, IBM Corporation, Trimble Inc, Mitsubishi Electric Corporation, SAP SE, Nokia Corp, Hitachi Rail, Bae Systems, Zebra Tech |

| Key Drivers | Rising need for rail transport to be more efficient and safer in operations. |

| Restraints | High initial investment and implementation costs of a telematics system. |