Automotive Tire Inflator Market Report Scope & Overview:

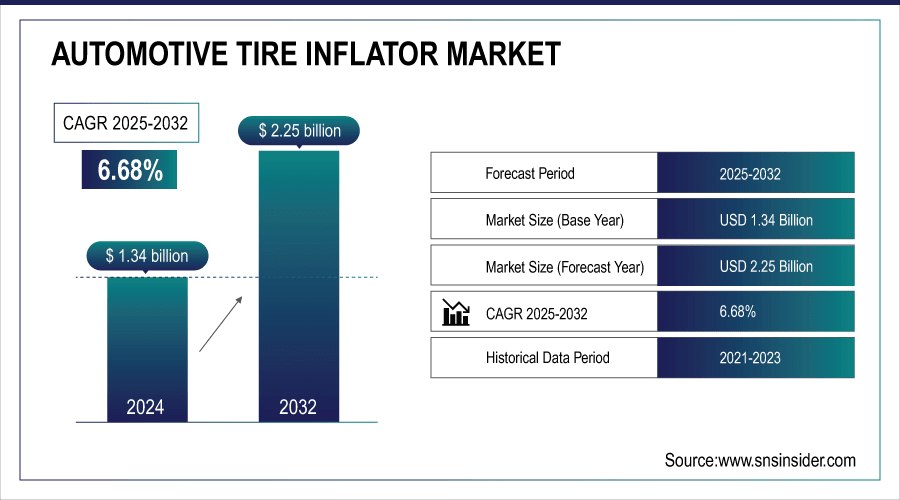

The Automotive Tire Inflator Market size was valued at USD 1.34 Billion in 2024 and is projected to reach USD 2.25 Billion by 2032, growing at a CAGR of 6.68% during 2025–2032.

The automotive tire inflator market is experiencing significant growth, driven by increasing vehicle ownership, rising awareness of tire maintenance, and the demand for portable, multi-functional solutions. Products now combine convenience, speed, and safety features, including high-pressure inflation capabilities, digital interfaces, rechargeable batteries, and integrated power banks. The market caters to passenger vehicles, two-wheelers, off-road vehicles, and recreational vehicles, with applications spanning commercial transportation, military, agriculture, and logistics. Technological advancements, such as lithium-powered compact designs and smart auto-shutoff functions, are enhancing usability and reliability. Rising consumer preference for emergency preparedness and roadside assistance tools further fuels market adoption worldwide.

July 17, 2025 – The NOCO Boost Air AX65 combines a 2000A jump starter, 100 PSI tire inflator, 60W USB-C power bank, and LED flashlight in one rugged unit, providing a complete roadside emergency solution. It quickly inflates tires, jump-starts vehicles, and charges devices, making it a versatile all-in-one automotive tool.

To Get More Information On Automotive Tire Inflator Market - Request Free Sample Report

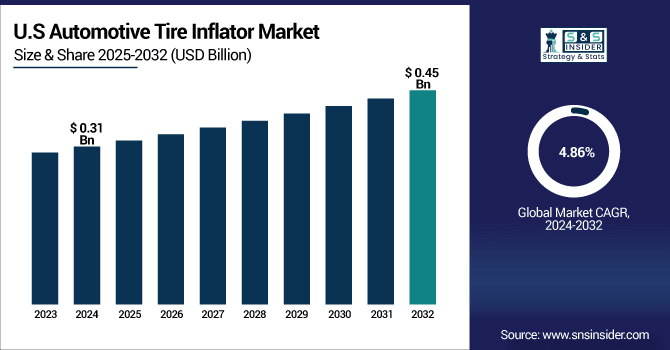

The U.S Automotive Tire Inflator Market size was valued at USD 0.31 Billion in 2024 and is projected to reach USD 0.45 Billion by 2032, growing at a CAGR of 4.86% during 2025–2032, driven by increasing vehicle ownership, growing demand for portable and multi-functional tire maintenance tools, and rising consumer awareness of road safety. Technological advancements, such as lithium-powered inflators, digital pressure monitoring, and rechargeable designs, are enhancing convenience and reliability. Additionally, the expansion of commercial, off-road, and recreational vehicle segments is fueling market adoption globally.

Automotive Tire Inflator Market Highlights:

-

Growing adoption of connected and intelligent tire monitoring systems is driving automotive tire inflator market growth.

-

High costs and technological complexity of advanced automotive systems limit market expansion.

-

Rising demand for smart and connected vehicle systems presents significant opportunities for next-generation tire and braking solutions.

-

Advanced sensors, low-power electronics, and predictive algorithms enhance safety, efficiency, and real-time vehicle monitoring.

-

Robert Bosch won the Best of Sensors 2025 award for its SMP290 tire-pressure sensor with Bluetooth 5.3 and multi-sensing capabilities.

-

Brembo and Michelin partnered to develop the Sensify smart brake system with predictive digital models and wheel-specific control.

Automotive Tire Inflator Market Drivers:

-

Growing Demand for Connected and Intelligent Tire Monitoring Systems

The increasing adoption of connected and intelligent tire monitoring systems is driving growth in the automotive tire sensor market. As vehicles become more technologically advanced, the need for compact, energy-efficient sensors with real-time data transmission has risen, enabling predictive maintenance and enhanced vehicle safety. This demand encourages manufacturers to develop multi-functional, wireless tire sensors, which reduce system complexity and improve operational efficiency. As a result, automakers are integrating advanced tire pressure monitoring solutions, boosting innovation in MEMS technology, low-power electronics, and intelligent vehicle diagnostics, thereby accelerating market expansion globally.

Jul 22, 2025 – Robert Bosch GmbH won the Best of Sensors 2025 award for its SMP290 tire-pressure sensor module, featuring Bluetooth 5.3 connectivity, ultra-low power consumption, and integrated multi-sensing capabilities for passenger and commercial vehicles. The sensor enables real-time data transmission, over-the-air updates, and advanced vehicle dynamics monitoring, setting a new standard in tire pressure monitoring systems.

Automotive Tire Inflator Market Restraints:

-

High Costs and Technological Complexity of Advanced Automotive Systems

The growing complexity and high costs associated with advanced automotive systems, including smart brakes, connected tire sensors, and multi-functional inflators, are restraining market growth. As vehicles integrate more electronics, MEMS sensors, and wireless communication modules, manufacturers face higher production expenses and extended development cycles. This limits adoption, particularly in price-sensitive segments like two-wheelers and economy passenger cars. Additionally, integrating these technologies requires specialized expertise and infrastructure, creating barriers for smaller suppliers. Consequently, the market expansion is tempered by cost pressures and implementation challenges, slowing widespread deployment of next-generation automotive safety and monitoring solutions.

Automotive Tire Inflator Market Opportunities:

-

Rising Adoption of Smart and Connected Vehicle Systems

The increasing shift toward smart and connected vehicles is creating significant opportunities in the automotive braking and tire systems market. As vehicles integrate advanced electronics and predictive control technologies, there is growing demand for intelligent solutions that optimize safety, performance, and vehicle dynamics. This drives manufacturers to develop digitally controlled brakes and connected tire systems, which enhance real-time responsiveness and reduce accident risks. Consequently, automakers are investing in partnerships and R&D to incorporate such systems, fostering innovation in sensors, predictive algorithms, and integrated vehicle architectures, ultimately expanding the market for next-generation automotive components globally.

Apr 13, 2025 – Brembo and Michelin have partnered to develop the Sensify smart brake system, featuring real-time predictive digital models and wheel-specific control for enhanced safety and vehicle dynamics. The technology aims to integrate seamlessly with next-generation connected cars, offering intelligent, data-driven braking for future-ready vehicles.

Automotive Tire Inflator Market Segment Highlights:

-

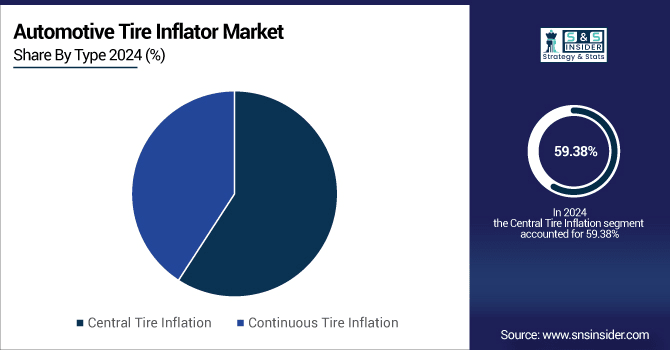

By Type: Dominant: Central Tire Inflation – 59.38%, Fastest-growing: Continuous Tire Inflation – 7.86% CAGR

-

By Component: Dominant: ECU – 34.38%, Fastest-growing: Pressure Sensor – 8.08% CAGR

-

By Application: Dominant: Commercial Transportation – 39.13%, Fastest-growing: Agriculture & Construction – 8.91% CAGR

-

By End User: Dominant: Passenger Vehicles – 49.25%, Fastest-growing: Off Road – 9.04% CAGR

Automotive Tire Inflator Market Segment Analysis:

By Type, Central Systems Dominate as Continuous Inflation Gains Momentum

Central tire inflation systems continue to lead due to their widespread adoption and reliable performance across various vehicles. At the same time, continuous tire inflation solutions are showing the fastest growth, driven by rising demand for more versatile and convenient tire maintenance technologies. This trend reflects a shift toward solutions that enhance real-time pressure management, efficiency, and overall vehicle performance across passenger, commercial, and off-road applications.

By Component, ECU Leads While Pressure Sensors Drive Fastest Growth

In the component segment, ECUs continue to dominate due to their critical role in controlling tire inflator systems and ensuring reliable performance. Meanwhile, pressure sensors are experiencing the fastest growth, driven by the increasing demand for accurate, real-time tire monitoring. This trend highlights the shift toward advanced sensing technologies that enhance safety, efficiency, and overall vehicle performance across passenger, commercial, and off-road vehicles

By Application, Commercial Transportation Leads While Agriculture & Construction Shows Fastest Growth

Commercial transportation continues to dominate due to its extensive use of tire inflator systems across fleet operations. At the same time, agriculture and construction applications are showing the fastest growth, driven by rising demand for durable and efficient tire maintenance solutions in challenging environments. This trend reflects the shift toward specialized applications that enhance operational efficiency, vehicle performance, and safety across diverse industrial and commercial sectors.

By End User Passenger Vehicles Lead While Off-Road Segment Shows Fastest Growth

Passenger vehicles continue to dominate due to their large market base and widespread adoption of tire inflator systems. Meanwhile, off-road vehicles are experiencing the fastest growth, driven by increasing demand for robust and reliable tire maintenance solutions in rugged terrains. This trend highlights the rising focus on specialized applications that enhance safety, performance, and convenience for diverse vehicle types across both everyday and recreational use.

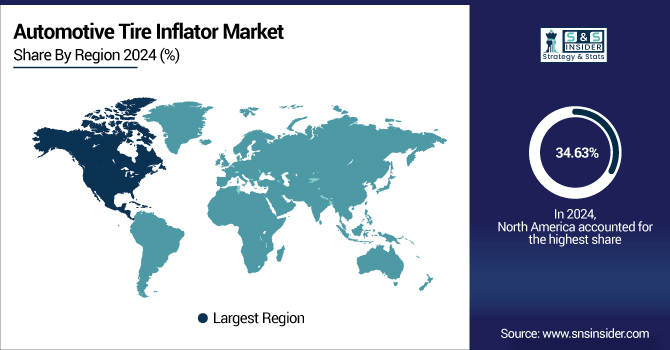

Automotive Tire Inflator Market Regional Highlights:

-

By Region – Dominating: North America (34.63% in 2024 → 32.38% in 2032, CAGR 3.38%)

-

Fastest-Growing Region: Asia-Pacific (20.88% in 2024 → 26.13% in 2032, CAGR 7.17%)

-

Europe: 24.88% → 24.13% (CAGR 3.85%)

-

South America: 9.88% → 9.13% (CAGR 3.22%, declining)

-

Middle East & Africa: 9.75% → 8.25% (CAGR 2.08%, declining)

Automotive Tire Inflator Market Regional Analysis:

North America Automotive Tire Inflator Market Insights:

North America leads the Automotive Tire Inflator Market, holding a strong share driven by advanced automotive infrastructure, rising adoption of connected tire inflation systems, and increasing demand for safety and convenience features. Continuous innovation, expanding electric vehicle fleet, and growing emphasis on smart maintenance solutions further strengthen its regional dominance.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

U.S. Automotive Tire Inflator Market Insights:

The U.S. leads North America’s Automotive Tire Inflator Market, driven by high vehicle ownership, advanced automotive infrastructure, growing demand for connected tire solutions, and increasing adoption of portable, efficient, and smart inflation technologies across various vehicle segments.

Asia-Pacific Automotive Tire Inflator Market Insights:

Asia-Pacific is the fastest-growing region in the Automotive Tire Inflator Market, driven by rapid urbanization, expanding automotive production, and increasing adoption of electric and connected vehicles. Rising consumer demand for convenient tire maintenance solutions, government initiatives promoting vehicle safety, and strong investments in infrastructure further accelerate the region's market growth.

-

China Automotive Tire Inflator Market Insights:

China leads Asia-Pacific in electric outboard adoption, driven by strong government support, rapid electrification of marine transport, expanding recreational boating activities, and growing demand for sustainable, efficient, and low-emission propulsion solutions across diverse watercraft segments.

Europe Automotive Tire Inflator Market Insights:

The European Automotive Tire Inflator Market is expanding steadily, supported by strict vehicle safety regulations, growing adoption of advanced tire monitoring systems, and increasing focus on fuel efficiency. Rising demand for electric and hybrid vehicles, along with continuous innovation in automotive technologies, further contributes to the region’s consistent market growth.

-

Germany Automotive Tire Inflator Market Insights:

Germany dominates the European Automotive Tire Inflator market, driven by its robust automotive manufacturing industry, advanced technological innovations, and strict vehicle safety regulations, fostering strong demand for smart and efficient tire inflation solutions.

Latin America Automotive Tire Inflator Market Insights:

The Latin American Automotive Tire Inflator Market is emerging, driven by growing automotive production, increasing demand for affordable maintenance solutions, and rising adoption of passenger and commercial vehicles. Expanding infrastructure projects, improving road safety standards, and the gradual shift toward electric and connected vehicles further contribute to the region’s promising market growth.

Brazil Automotive Tire Inflator Market Insights:

Brazil leads the Latin America Automotive Tire Inflator market, fueled by its expanding automotive industry, growing vehicle ownership, and increasing demand for affordable, efficient, and portable tire inflation solutions across passenger and commercial vehicle segments.

Middle East & Africa Automotive Tire Inflator Market Insights:

The Middle East & Africa Automotive Tire Inflator market is growing steadily, supported by expanding automotive sales, increasing investments in transportation infrastructure, and rising adoption of advanced vehicle maintenance solutions. Government initiatives to enhance road safety and the gradual shift toward electric and connected vehicles further drive the region’s market expansion.

-

Saudi Arabia Automotive Tire Inflator Market Insights:

Saudi Arabia dominates the Middle East & Africa Automotive Tire Inflator market, driven by a robust automotive aftermarket, increasing vehicle ownership, and rising demand for advanced, efficient, and connected tire maintenance solutions across the country.

Automotive Tire Inflator Market Competitive Landscape:

BLACK+DECKER, established in 1910, is an American brand renowned for its power tools, home improvement products, and appliances. Founded in Baltimore, Maryland, by S. Duncan Black and Alonzo G. Decker, the company revolutionized the industry with innovations like the pistol-grip electric drill in 1916. In 2010, BLACK+DECKER merged with Stanley Works to form Stanley Black & Decker, a global leader in tools and security solutions. Headquartered in Towson, Maryland, the brand continues to serve DIY enthusiasts and professionals worldwide.

-

In Sept 2025, BLACK+DECKER offers its bestselling Portable Air Conditioner at a record low price, providing efficient cooling for rooms up to 400 sq. ft. The unit combines cooling, dehumidification, and fan functions in a portable design with caster wheels, ideal for bedrooms, offices, and apartments.

Automotive Tire Inflator Market Key Players:

-

FTL (IDEX Corporation)

-

Dana Incorporated

-

Stanley Black & Decker, Inc.

-

Michelin

-

Kensun, Inc.

-

Hendrickson

-

Slime (ITW Global Tire Repair Inc.)

-

Bon-Aire Industries, Inc.

-

Campbell Hausfeld (Marmon / Berkshire Hathaway Company)

-

Coido

-

Guangzhou Meitun Electronic Commerce Co. Ltd. (Tirewell)

-

BLACK+DECKER Inc.

-

Nexpow

-

Torqeedo GmbH

-

Mercury Marine

-

Yamaha Motor Co., Ltd.

-

Minn Kota (Johnson Outdoors)

-

Pure Watercraft

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.34 Billion |

| Market Size by 2032 | USD 2.25 Billion |

| CAGR | CAGR of 6.68% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Central Tire Inflation (CTI), Continuous Tire Inflation (CTI)) • By Component(ECU (Electronic Control Unit), Compressor, Pressure Sensor, Others) • By Application(Commercial Transportation, Military & Defense, Agriculture & Construction, Logistics & Fleet Management) • By End User (Passenger Vehicles, Two Wheelers, Off-Road and Recreational Vehicles (RV)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Robert Bosch GmbH, FTL (IDEX Corporation), Dana Incorporated, Stanley Black & Decker, Inc., Michelin, VIAIR Corporation, Kensun, Inc., Hendrickson, Slime (ITW Global Tire Repair Inc.), Bon-Aire Industries, Inc., Campbell Hausfeld (Marmon / Berkshire Hathaway Company), Coido, Guangzhou Meitun Electronic Commerce Co. Ltd. (Tirewell), BLACK+DECKER Inc., Nexpow, Torqeedo GmbH, Mercury Marine, Yamaha Motor Co., Ltd., Minn Kota (Johnson Outdoors), Pure Watercraft. |