Automotive Bumpers Market Report Scope & Overview:

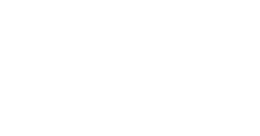

The Automotive Bumpers Market size was valued at USD 20.59 Billion in 2024, the market is expected to reach USD 28.18 Billion by 2032. And grow at a CAGR of 4% over the forecasted period of 2025-2032.

A bumper's main objective is to disperse and absorb the energy created during a collision. It crumples or deforms upon impact, which helps lessen the force applied to the car's occupants. This layout reduces the danger of injury. In the event of an accident, bumpers can also help to protect pedestrians.

The rise in the road accidents is the major driving factor of this market. For instance, the road fatalities have increase by 11.4%.

Get More Information on Automotive Bumpers Market - Request Sample Report

Pedestrian-friendly bumper designs that lessen the severity of injuries if a pedestrian is injured are mandated by regulations in several nations. In low-speed crashes and parking accidents, bumpers protect vital car parts like the headlights, grille, radiator, and engine components from harm. The aesthetics and brand identification of a car are influenced by the bumpers.

Market Size and Forecast:

-

Market Size in 2024: USD 20.59 billion

-

Market Size by 2032: USD 28.18 billion

-

CAGR (2025–2032): 4%

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Automotive Bumpers Market Key Trends:

-

Use of thermoplastics and composites is growing at around 6% CAGR in bumper production, improving fuel efficiency and reducing emissions.

-

Over 35% of new vehicles in 2024 feature bumpers with sensors, cameras, or radar systems for Advanced Driver-Assistance Systems.

-

Around 40% of consumers prefer bumpers with aesthetic and customizable designs, boosting aftermarket demand.

-

Adoption of recyclable plastics and composites is increasing at 5% annually, driven by sustainability regulations.

-

The aftermarket segment represents nearly 25% of total bumper sales, fueled by vehicle replacement and personalization trends.

-

Asia-Pacific accounts for 40% of bumper production, driven by high vehicle manufacturing in China, India, and Japan.

-

Automotive OEMs increasingly demand bumpers reducing vehicle weight by 10–15%, enhancing performance and efficiency.

Automotive Bumpers Market Key Drivers:

-

The rising concerns related to road fatalities.

The increasing focus on road safety and reduction of vehicle-related fatalities is driving the demand for advanced automotive bumpers. Governments and regulatory authorities across the globe are enforcing stricter safety standards, including crashworthiness requirements, pedestrian protection norms, and impact absorption regulations. Automotive manufacturers are responding by integrating energy-absorbing materials, smart sensors, and reinforced bumper structures to enhance occupant and pedestrian safety. Studies indicate that front-end vehicle collisions account for nearly 30–35% of road fatalities, prompting automakers to invest in bumpers that minimize damage during crashes. This trend is expected to accelerate R&D in high-performance and safety-compliant bumper solutions throughout the forecast period.

Automotive Bumpers Market Restraints:

-

The issues related to quality and availability of parts.

The automotive bumpers market faces challenges due to inconsistent quality and limited availability of parts, which can disrupt production and affect vehicle safety standards. Low-quality materials or poorly manufactured components may fail to meet impact absorption and crash-test requirements, leading to recalls and increased warranty costs. Additionally, supply chain disruptions, especially in regions dependent on imported materials or specialized plastics and composites, can delay production schedules. In 2024, industry reports indicate that nearly 15–20% of bumper-related production delays are linked to part shortages or quality issues, highlighting a significant barrier for OEMs and aftermarket suppliers

Automotive Bumpers Market Opportunities:

-

The increase in technology and demand for the safety features in vehicles.

The growing emphasis on vehicle safety and advanced technologies presents a significant opportunity for the automotive bumpers market. Modern vehicles increasingly incorporate Advanced Driver-Assistance Systems (ADAS), such as sensors, cameras, and radar, which are often integrated into bumper structures. This integration enhances collision detection, pedestrian protection, and impact absorption, driving demand for smart and reinforced bumpers. In 2024, over 35% of new vehicles globally feature ADAS-enabled bumpers, a number expected to rise steadily with stricter safety regulations and consumer awareness. Manufacturers can leverage this trend by developing high-performance, technologically advanced bumper solutions that cater to safety-conscious markets.

-

The adaptability and development of autonomous and ADAS systems.

Automotive Bumpers Market Segment Analysis:

By Materials

The Composite Plastic segment dominates the automotive bumpers market due to its lightweight, durability, and cost-effectiveness, accounting for approximately 55% of total material usage in 2024. Metal bumpers are preferred in heavy-duty and commercial vehicles for enhanced strength and crash protection, representing around 25% of the market. Fiber-based bumpers, including carbon and glass fibers, are gaining traction in premium and sports vehicles for high strength-to-weight ratios, contributing roughly 20% of material consumption. The trend toward lightweight and fuel-efficient vehicles is expected to drive continued adoption of composite and fiber materials during 2025–2032.

By Positioning

Front-end bumpers hold a larger market share, accounting for nearly 60% of total bumper sales, as they are critical for impact absorption, pedestrian safety, and ADAS sensor integration. Rear-end bumpers represent around 40% of the market, primarily focused on collision mitigation and cosmetic design. The increasing adoption of advanced safety features, parking sensors, and cameras in front-end bumpers is driving higher demand, while rear bumpers continue to grow steadily in commercial and passenger vehicles across regions.

By End-User

The OEM (Original Equipment Manufacturer) segment dominates with a share of approximately 70%, as vehicle manufacturers prefer high-quality, regulation-compliant bumpers for new vehicles. The Aftermarket segment, representing around 30% of the market, is driven by replacement demand, vehicle customization, and repair activities. Rising consumer preference for stylized and reinforced bumpers in the aftermarket further supports growth, particularly in regions with high vehicle ownership and longer vehicle lifespans.

Automotive Bumpers Market Regional Insights:

Asia-Pacific Automotive Bumpers Market Insights

Asia-Pacific dominates the automotive bumpers market with around 40% share in 2024, driven by high vehicle production in countries like China, India, and Japan. Rising disposable incomes, growth of local automakers, and increasing demand for lightweight and safety-compliant bumpers are key drivers. Front-end bumpers account for nearly 60% of regional demand, particularly in vehicles integrated with ADAS technologies. The region’s aftermarket segment contributes approximately 25% to bumper sales due to growing consumer interest in replacement and customization. The market is projected to grow at a CAGR of 5.1% during 2025–2032.

Need any customization research on Automotive-Bumpers-Market - Enquiry Now

North America Automotive Bumpers Market Insights

North America holds about 28% of the global market in 2024, supported by established automakers and early adoption of advanced safety features. OEM demand dominates with over 70% share, driven by compliance with stringent vehicle safety regulations. Front-end bumpers are the largest segment due to ADAS integration and collision protection requirements. The aftermarket segment represents around 30% of sales, fueled by vehicle replacements and customization trends. North America is expected to expand at a CAGR of 4.5% during 2025–2032, with the U.S. being the primary contributor.

Europe Automotive Bumpers Market Insights

Europe accounts for approximately 18% of the global market in 2024. The region’s growth is fueled by premium and electric vehicle production, along with strict safety standards and consumer demand for aesthetically designed bumpers. Composite plastic bumpers dominate with around 55% share, followed by metal and fiber options. Front-end bumpers hold a 60% share of the regional market. Europe is expected to grow at a CAGR of 4.2% during the forecast period, with countries like Germany, France, and the UK leading adoption of advanced bumper technologies.

Latin America Automotive Bumpers Market Insights

Latin America contributes about 7% of the global market in 2024. Brazil and Mexico are key contributors, driven by industrialization, urbanization, and rising vehicle sales. OEMs dominate with 65% of the market, while aftermarket accounts for 35% due to replacement and repair demand. Front-end bumpers are preferred in nearly 60% of applications, primarily for safety compliance. The region is expected to grow at a CAGR of 3.8% from 2025–2032, with demand for lightweight and cost-effective bumper solutions increasing steadily.

Middle East & Africa (MEA) Automotive Bumpers Market Insights

MEA holds around 5% of the global market in 2024. Growth is driven by urbanization, infrastructure development, and rising vehicle sales in countries like UAE, Saudi Arabia, and South Africa. OEMs account for 60% of sales, while the aftermarket segment represents 40%, supported by vehicle replacement and customization needs. Front-end bumpers constitute 55–60% of the market due to safety and collision mitigation requirements. MEA is projected to grow at a CAGR of 3.5% during 2025–2032, with increasing adoption of advanced, lightweight bumper technologies.

Automotive Bumpers Market Key Players:

-

Toyota Boshoku Corporation

-

Plastic Omnium

-

Magna International, Inc.

-

Toyoda Gosei Co., Ltd.

-

SMP Deutschland GmbH

-

Yanfeng Plastic Omnium Automotive Exterior Systems Co., Ltd.

-

JiangNan Mould & Plastic Technology Co., Ltd.

-

Venture Otto SA (Pty) Ltd.

-

NTF Private Ltd.

-

Fab Fours, Inc.

-

Hyundai Mobis Co., Ltd.

-

Benteler Automotive

-

Samvardhana Motherson Group (SMG)

-

Faurecia SA

-

Tong Yang Group

-

KIRCHHOFF Automotive

-

Yanfeng Automotive Interiors

-

Futaba Industrial Co., Ltd.

-

Flex-N-Gate Corporation

-

Montaplast GmbH

Automotive Bumpers Market Competitive Landscape:

Honda Motor Co., Ltd. is a Japan-based multinational automaker and motorcycle manufacturer, headquartered in Tokyo. Established in 1948, Honda is recognized globally for its innovation, engineering excellence, and fuel-efficient vehicles. The company produces a wide range of products including cars, motorcycles, scooters, engines, and power equipment. Honda is also actively investing in electric vehicles (EVs), hybrid technologies, and autonomous driving solutions to meet evolving mobility demands. Operating in over 150 countries, the company employs more than 220,000 people worldwide. Honda is listed on the Tokyo Stock Exchange under the ticker 7267.T, maintaining a strong reputation for quality, safety, and reliability.

-

In December 2024, Japan-based automakers Honda and Nissan signed a memorandum of understanding to initiate discussions for what could become the largest domestic merger in Japanese automotive history, potentially forming the world’s third-largest carmaker by sales. The companies aim to finalize the merger agreement and complete the process by 2026.

Toyoda Gosei Co., Ltd. is a Japanese multinational company headquartered in Kariya, Aichi Prefecture, specializing in the design and manufacture of automotive components. Established in 1949 as part of the Toyota Group, the company produces rubber, plastic, and safety systems, including bumpers, weatherstrips, interior components, and airbag systems. Toyoda Gosei emphasizes innovation, safety, and environmental sustainability, catering to both domestic and international automotive markets. Operating in multiple countries with numerous production facilities, the company serves major automakers worldwide. It is committed to expanding global manufacturing capabilities to meet rising demand for advanced and high-quality automotive safety components.

-

In September 2024, Toyoda Gosei Co., Ltd. announced plans to set up a new manufacturing facility in Harohalli, Karnataka, India, scheduled to begin operations in January 2026. The plant will focus on producing automotive safety components, including bumpers, highlighting the company’s strategy to expand global production and meet rising demand in the Indian automotive market.

| Report Attributes | Details |

| Market Size in 2024 | USD 20.59 Billion |

| Market Size by 2032 | USD 28.18 Billion |

| CAGR | CAGR of 4% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Materials (Composite Plastic, Metal, Fiber) • By Positioning (Front Ends, Rear Ends) • By End User (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Toyota Boshoku Corporation, Plastic Omnium, Magna International, Inc., Toyoda Gosei Co., Ltd., SMP Deutschland GmbH, Yanfeng Plastic Omnium Automotive Exterior Systems Co., Ltd., JiangNan Mould & Plastic Technology Co., Ltd., Venture Otto SA (Pty) Ltd., NTF Private Ltd., Fab Fours, Inc., Hyundai Mobis Co., Ltd., Benteler Automotive, Samvardhana Motherson Group (SMG), Faurecia SA, Tong Yang Group, KIRCHHOFF Automotive, Yanfeng Automotive Interiors, Futaba Industrial Co., Ltd., Flex-N-Gate Corporation, Montaplast GmbH |

Frequently Asked Questions

Ans: China will have the highest share and APAC will be the fastest growing region.

Ans: The increase in technology and demand for the safety features in vehicles and the adaptability and development of autonomous and ADAS systems.

Ans: The volatility in prices related to raw materials and other major components.

Ans: The CAGR growth rate recorded was 4%

Ans: The Automotive Bumpers Market size was valued at USD 20.59 Billion in 2024, the market is expected to reach USD 28.18 Billion by 2032. And grow at a CAGR of 4% over the forecasted period of 2025-2032.