Automotive Electronic Control Unit Market Report Scope & Overview:

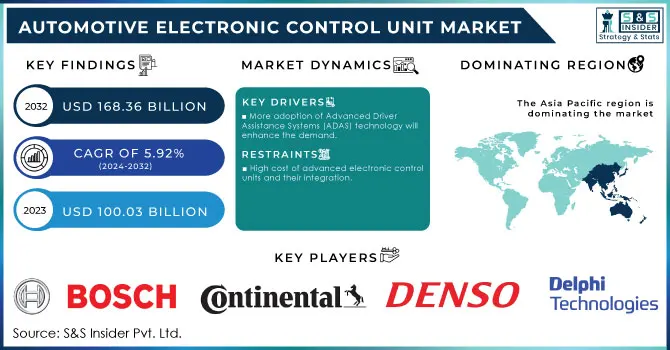

The Automotive Electronic Control Unit Market Size was valued at USD 100.03 Billion in 2023 and is expected to reach USD 168.36 Billion by 2032 and grow at a CAGR of 5.92% over the forecast period 2024-2032.

Get More Information on Automotive Electronic Control Unit Market - Request Sample Report

Constant innovations in vehicle electronics and the advent of more and more electric and autonomous vehicles drive the Automotive Electronic Control Unit (ECU) market. One of the unavoidable components in this regard is a modern vehicle's managing all of its functions, such as engine management, fuel efficiency, braking systems, and advanced driver-assistance systems. To meet these mounting consumer demands for safety, comfort, and in-car connectivity, introducing more advanced ECUs into autos is critical for manufacturers.

Recent government policies, largely in the United States and Europe, have significantly driven the ECU market. For instance, if such safety features of a new vehicle are made mandatory-ahead of time-including automatic emergency braking, and lane-keeping assistance, the demand for those sophisticated ECUs followed. Moreover, U.S. government emphasis on electric vehicles has also added to the market, which requires advanced ECUs for powertrain management and controls of such batteries to optimize energy efficiency.

OTA software updates have really changed the face of the ECU market, allowing manufacturers to remotely update the vehicle's software in place, thereby improving performance while reducing costs involved in recalls. In this regard, vehicles are well-equipped with the latest features, thus increasing ECU demand. The increasing development of autonomous vehicle technology further increases ECUs as they will be controlling systems such as sensor data processing, navigation, and real-time decision-making. Software-defined vehicles (SDVs) are a revolutionary change in the automotive world, using strong centralized electronic control units that assist with control of operations and swift implementation of new features. They are sure to be a ground-breaking innovation which promises to revolutionize mobility by offering efficiency, safety, and accessibility.

Going forward, the market will offer considerable opportunities, especially in the electric and autonomous vehicle segments. Huge investments are being made by both automobile manufacturers and tech firms in these segments, which demand more specialized ECUs. For example, PEAK-System has introduced the PCAN-MicroMod FD ECU in September 2024. It serves to integrate customer-specific add-on parts ideally in automotive engineering without a hitch. The company says that its CAN FD connection combined with a combination of analog and digital input/output options makes the new control unit very appealing. These are the 16-bit analog inputs adjustable in measurement range up to ±20 Volt as well as the high-side output switches for maximum currents up to 5 A. The main growth driver for connected cars is the dependence of these devices on ECUs for communication and data exchange.

The U.S. market will continue to grow further with more regulatory standards and the increasing demand for greener modes of transportation. The Asia-Pacific and European regions will spearhead the ECU market growth around the world. The focus by car manufacturers on fitting more ECUs in new as well as existing car models will foster market growth.

Automotive Electronic Control Unit Market Dynamics

Key Drivers:

-

More adoption of Advanced Driver Assistance Systems (ADAS) technology will enhance the demand.

Another crucial motive for the ECU market is the mass application of ADAS technologies, not to mention that governments of any country now make use of this requirement as a great leaver in increasing vehicle safety. All these ADAS systems, such as adaptive cruise control, lane departure warning, and automatic emergency braking, require very sophisticated ECU processing from cameras and sensors data in real-time driving adjustments.

Now, as a result of the increasingly evolving need of consumers for these types of vehicles, the manufacturers are equipping more and more models with such equipment in the standard list, which further adds to the demand chain of ECUs. Moreover, government mandates like those in Europe and the U.S. which mandate the manufacturers to deploy ADAS features in every new vehicle have further escalated the requirement. An increase in fitted ADAS brings about increased complexity and the number of ECUs in a vehicle. This is part of the moving factor behind this growing market.

-

Growing market demand for electric vehicles and hybrid vehicle technologies.

The ECU market is considerably being boosted by another aspect- the growing demand for hybrid vehicles and electric vehicles. Electric vehicles rely much on ECUs to manage battery performance, power distribution, and the regenerative braking systems. ECUs are also important for the maximization of electric motor efficiency so that maximum efficiency in energy use can be achieved.

Due to the encouragement by several governments to sell EVs and gradually phase out internal combustion engine vehicle markets, the ECU market for electric vehicles is expected to grow. In countries such as the U.S., where the EV market is penetrating at a rapid pace, long-term opportunities for ECU manufacturers are expected due to the growing penetration of electric and hybrid vehicles.

Restraint

-

High cost of advanced electronic control units and their integration.

The cost of the advanced ECUs is the most significant restraint on the growth of the market for autonomous and semi-autonomous vehicles. ECUs of such a type made for ADAS, electric vehicles, or completely autonomous systems are much more complex as compared to one made for traditional systems. Often, for analyzing and making decisions in real-time, more advanced hardware, high-end sensors, and sophisticated algorithms-based software are required. Such a mechanism makes the vehicle costlier, which makes it inaccessible to the masses.

This price sensitivity is highly visible in developing markets, which consumers there would mostly prefer affordability over luxurious options. Further, a car with many ECUs is expensive as the integration requires high-end engineering and costly testing. Also, adding high-technology ECUs will be a problem without raising the price of the vehicle to an unattainable level. This will be a barrier cost to penetration into lower end vehicles and newly developing markets, thus limiting overall market growth.

Automotive Electronic Control Unit Market Segmentation Overview

By Autonomy

In 2023, Conventional Vehicles still have a majority market share of 69%. Of course, most of them are of the human-driven variety, but they do have quite a few ECUs in control of the engine, the braking systems, and infotainment. Conventional vehicles continue to dominate global sales in most regions, especially in emerging markets where the shift to autonomous driving is slower.

Autonomous Vehicles will be the fastest-growing segment, with an 8.24% CAGR during the forecast period through 2024 and 2032. With increased technology for self-driving cars, the number and complexity of ECUs will surge prominently in these vehicles. ECU is also widely used in Autonomous vehicles, where it controls everything, including navigation and sensor data processing to different decision-making systems. As companies like Tesla, Waymo, and many others accelerate their investment into the autonomous driving technology, this market would have immense growth scope in the coming years.

By End Use

Passenger Cars held 62% market share in 2023. Adoption of ECUs in cars for both safety/infotainment and improved engine management would have ensured passenger cars dominated the market share. Besides, increasing demand for higher advanced features such as ADAS, connectivity, and comfort from consumers would make manufacturers increase ECU integration into passenger cars.

LCV market segment is expected to grow at a fastest rate, with an estimated CAGR of 7.44% from 2024 to 2032. Increasing demand for e-commerce and last-mile delivery services has driven the LCV production, wherein many are now fitted with advanced ECUs managing the engine, control navigation, and telematics system. With increased demand for commercial vehicles, which are efficient and reliable, especially those that will be used in urban deliveries, the Automotive ECU market for this segment would boom highly.

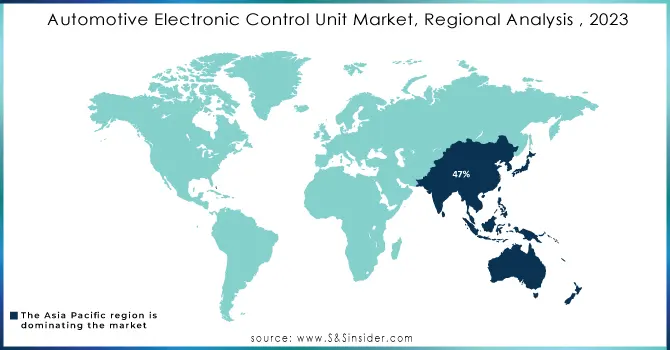

Regional Analysis

Asia Pacific region accounted for Automotive ECU's worldwide major share amounting to 47% in the year 2023. Presence of mass automobile manufacturers in China, Japan, and South Korea is the main reason for regional domination; consumers continue to demand high end automotive technologies, and a huge rise in popularity of electric vehicles and ADAS integrations in premium as well as mass-market models in China has propelled the ECU market.

North America is expected to be the fastest-growing region, with a CAGR for the period from 2024-2032; 6.97% is attributed to high presence of EV manufacturers, advancements in autonomous driving technologies, and stringent government regulations intended to improve vehicle safety and reduce emissions. Tesla, a front runner in electric and autonomous vehicle in North America, is expected to enjoy high growth rates in the demand for advanced ECUs.

Need Any Customization Research On Automotive Electronic Control Unit Market - Inquiry Now

Key Players in Automotive Electronic Control Unit Market

-

Robert Bosch GmbH (Engine Control Units, ADAS ECUs)

-

Continental AG (Body ECUs, Chassis & Safety ECUs)

-

Denso Corporation (Powertrain ECUs, Safety ECUs)

-

Delphi Technologies (Vehicle Control Units, Powertrain ECUs)

-

Magneti Marelli (Engine Control Units, Telematics ECUs)

-

ZF Friedrichshafen AG (ADAS ECUs, Powertrain Control ECUs)

-

Mitsubishi Electric Corporation (Body Control Modules, Infotainment ECUs)

-

Hitachi Automotive Systems (Engine ECUs, Hybrid ECUs)

-

Autoliv Inc. (Airbag Control Units, Safety ECUs)

-

Hyundai Mobis (Chassis Control Units, Safety Control Modules)

-

Valeo SA (Powertrain Control ECUs, ADAS ECUs)

-

Aptiv PLC (Autonomous Driving ECUs, Body Control Modules)

-

Lear Corporation (Body Control Units, Seating ECUs)

-

Hella KGaA Hueck & Co. (Lighting Control ECUs, ADAS ECUs)

-

NXP Semiconductors (ADAS ECUs, Connectivity ECUs)

-

Texas Instruments (Infotainment ECUs, Power Management ECUs)

-

Panasonic Corporation (Battery Management ECUs, Infotainment ECUs)

-

Siemens AG (Powertrain ECUs, Telematics Control ECUs)

-

Infineon Technologies AG (ADAS ECUs, Power Management ECUs)

-

Renesas Electronics Corporation (ADAS ECUs, Powertrain Control Units)

Recent Developments

-

September 2024: With combined strengths, NXP Semiconductors and TTTech Auto agreed on a strategic partnership towards enhanced in-vehicle networking and unleashing the potential of automotive connectivity. Their customers had requested series-ready electronic control units (ECUs) based on the chipset technologies of the latest generation.

-

December 2024: Continental and Synopsys announced a strategic collaboration to accelerate the development and validation of software features and applications of the Software-Defined Vehicle (SDV). The new collaboration combines Synopsys' world-class virtual prototyping solutions for virtual Electronic Control Units (vECU) within Continental's Automotive Edge (CAEdge) cloud-based development framework.