Minivans Market Report Scope & Overview:

Get More Information on Minivans Market -Request Sample Report

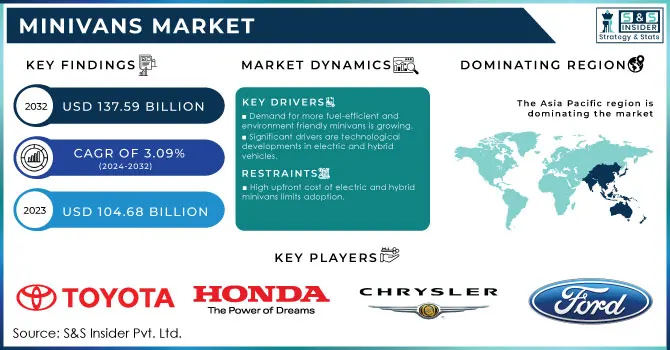

The Minivans Market Size was valued at USD 104.68 Billion in 2023 and is expected to reach USD 137.59 Billion by 2032 and grow at a CAGR of 3.09% over the forecast period 2024-2032.

The minivan market is experiencing a resurgence, driven by evolving consumer preferences and technological advancements. Families and businesses are increasingly drawn to minivans for their versatility, spaciousness, and ability to accommodate both passengers and cargo. As governments worldwide prioritize sustainable transportation, electric and hybrid minivans are gaining significant traction. These eco-friendly vehicles offer reduced emissions and lower operating costs, making them attractive choices for environmentally conscious consumers.

Moreover, technological innovations are transforming the minivan experience. Advanced safety features, cutting-edge infotainment systems, and autonomous driving technologies are enhancing comfort, convenience, and safety. Emerging markets with growing middle classes and urbanization are further fueling the demand for minivans, as they provide practical and affordable transportation solutions for growing families. As the automotive industry continues to innovate and adapt to changing consumer needs, the minivan market is poised for sustained growth and development in the years to come.

For Instance, Self-driving company May Mobility is now celebrating a new deployment of its autonomous vehicles (AVs) in Georgia. The company's Toyota Sienna Autono-MaaS minivans have rolled out at Peachtree Corners smart city development. The AVs are running in partnership with T-Mobile, providing the 5G connectivity, and the Curiosity Lab from the smart city, dedicated space for testing and assessing mobility solutions.

Minivans Market Dynamics

Key Drivers:

-

Demand for more fuel-efficient and environment friendly minivans is growing.

Environmentally savvy consumers, primarily in North America and Europe, are increasingly desirous of cleaner rather than traditional internal combustion engines. Thus, government policies supporting incentives for electric and hybrid vehicles propel the new trend.

For example, the U.S. government announced a federal tax credit of USD 7,500 for electric vehicles (EVs), in pursuit of its emission-cutting strategy. And Under its Mobility Orientation Law, France has a number of incentives. Among them is the Bonus-Malus System where electric minivans are rewarded with a bonus of up to 6,000 Euro. The Crit'Air program prohibits high emission vehicles from city centers; doing this indirectly encourages the sale of electric and hybrid minivans, even more especially in cities.

One of the main reasons for the attractiveness of fuel-efficient minivans lies in the peculiarly high price of gasoline in certain regions. Hybrid and electric minivans are gaining ground not only because of their reduced fuel consumption but also on grounds of maintenance costs, with less wear and tear likely to increase consumer preference for greener models. As the infrastructure of charging stations, etc., expands, this is likely to pick up in the near future.

-

Significant drivers are technological developments in electric and hybrid vehicles.

The modern electric minivans come with significantly improved battery life, fast charging, and far more efficient powertrains, and hence truly make minivans a better option than the conventional set of vehicles. Hybrid minivans combine electric motors with traditional internal combustion engines to maintain performance while providing much better fuel economy.

Advanced safety and entertainment technologies, including driver-assistance systems, connected-car features, and infotainment options, also are being incorporated by automakers to make minivans of interest to both family users and commercial stakeholders. These advancements ensure that electric and hybrid minivans are competitive offerings in a wider automotive market space that cannot be confined to niche status.

Restraints

-

High upfront cost of electric and hybrid minivans limits adoption.

Electric and hybrid minivans, compared to gasoline or diesel-powered counterparts, will reduce a lot of fuel consumption and maintenance costs in the long run; however, at a high cost and much higher than regular vehicles. This cost gap is mainly contributed by the expensive parts of electric and hybrid powertrains, including the lithium-ion battery.

As such, for most customers, mostly in emerging markets, the higher upfront cost offsets the long-term saving to nullify adoption. Commercial consumers who would boast large fleets may not invest in the pricey electric vehicles because they may take years without reaping the return on investment. Although government incentives and subsidies dominate many regions to counterbalance these costs, still higher prices put up a massive deterrent, primarily in price-sensitive markets.

Minivans Market Segmentation Overview

By Fuel Type

Diesel minivans are popular for more efficiency in fuel consumption and high torque, so they are great for mileage traveling or just commercial use with long-distance trucking. Diesel comprised 88% of the market share in 2023. The diesel-powered minivans are dominantly utilized in Europe and some parts of Asia, but due to the aspects of environmental concerns and ever-tightening policies to regulate emission, the demand for diesel is slowly decreasing.

Electric minivans is expected with fastest CAGR of 12.32% during 2024 through 2032. Drivers impacting this business segment would be the need for government incentives and increasing awareness among consumers of the growing need for environmental sustainability, increasing demand for electric vehicles. To meet this increasing demand, the automotive industry is launching more electric models. This will further accelerate the electric minivan market. Despite this, the petrol minivans will continue to hold considerable market shares as consumers gradually shift towards these greener alternatives.

By Application

The Passenger Vehicle segment accounted for the highest market share of 74% in the global market in 2023. This is essentially because minivans are widely used by families due to ample space inside, comfort, and safety features. Minivans are the first choice for large families, recreational travelers, and cargo space demanders, thus enhancing their market share significantly.

The rate would be in the Commercial Vehicle segment will experience fastest growth over the forecast period, driven mainly by increasing demand for minivans for shuttle services, rental fleets, and corporate transport as the minivan offers versatility ideal for commercial application which would be critical in urban areas where maneuverability and fuel efficiency are pivotal. The commercial fleet of electric and hybrid minivans is expected to further fuel the growth in this segment due to increased acceptance and popularity of electric and hybrid vehicles by most of the fleet owners.

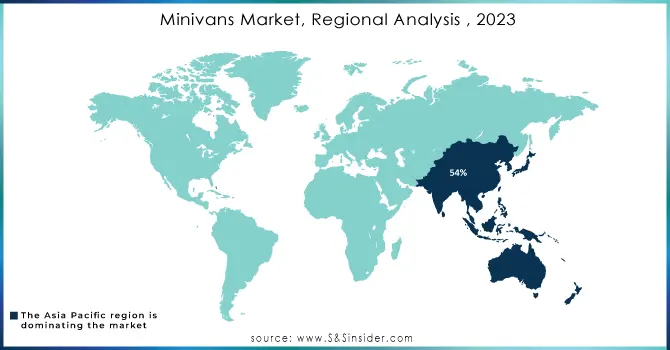

Minivans Market Regional Analysis

Asia Pacific gained the majority market share of 54% in the global market for minivans in 2023. This is because of huge demand areas in countries such as China and Japan, where minivans are highly in demand for both personal and business purposes. China has continuously seen more frequent usage of minivans for family purposes because of its ever-advancing middle-class and increased levels of urbanization. The same has been observed for Japan as well.

The region that is anticipated to show the highest growth in the forecast period is North America, with a CAGR of 5.27% from 2024 to 2032. A major reason for the growth is the rising interest in electric and hybrid minivans in the USA. There have been many incentives offered for EV purchases, and these have aroused the interest of buyers specifically targeting an eco-friendly mode of transport. Strong charging infrastructure and the desire for roomy, comfortable vehicles make North America a lucrative market for minivans.

Need Any Customization Research On Minivans Market - Inquiry Now

Key Players in Minivans Market

Some of the major players in the Minivans Market are

-

Toyota (Sienna, Proace)

-

Honda (Odyssey, Stepwgn)

-

Chrysler (Pacifica, Voyager)

-

Kia (Carnival, Sedona)

-

Ford (Transit Connect, Galaxy)

-

Mercedes-Benz (V-Class, EQV)

-

Volkswagen (Caddy, Multivan)

-

Renault (Espace, Kangoo)

-

Nissan (Serena, NV350)

-

Peugeot (Traveller, Expert)

-

Hyundai (Staria, H-1)

-

Citroen (Spacetourer, Berlingo)

-

Opel (Zafira Life, Vivaro)

-

Fiat (Ducato, Scudo)

-

Suzuki (Every, Solio)

-

Mazda (Biante, Premacy)

-

Mitsubishi (Delica, RVR)

-

Subaru (Exiga, Levorg)

-

GMC (Savana, Safari)

-

Chevrolet (Express, Uplander)

Recent Trends

-

September 2024: Kia's do-it-all Carnival MPV, arriving this month with the usual range of cosmetic and technology enhancements, also debuts a new turbo hybrid motor. Hybrid version, the added Carnival Hybrid has a 1.6-litre turbo-hybrid engine and a 54 kW motor and a six-speed automatic transmission the only tranny offered for front-wheel drive. The combined output runs at 242 horsepower, 271 lb.-ft. of torque.

-

October 2024: Honda Motor Co., Ltd. announced that it will begin sales of a new commercial-use mini-EV, the N-VAN e in Japan. The new model will be developed by adding features unique to EVs, such as user-friendliness, to the popular gasoline-powered N-VAN model, which has received great attention as a car accommodating diversified needs for both commercial and recreational use.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 104.68 Billion |

| Market Size by 2032 | US$ 137.59 Billion |

| CAGR | CAGR of 3.09 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type(Plug-In Minivan, Hybrid Minivan, Mini MPV, Compact MPV, Large MPV) • By Fuel Type (Diesel, Petrol, Electric, Other) • By Application (Commercial Vehicle, Passenger Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Toyota, Honda, Chrysler, Kia, Ford, Mercedes-Benz, Volkswagen, Renault, Nissan, Peugeot, Hyundai, Citroen, Opel, Fiat, Suzuki, Mazda, Mitsubishi, Subaru, GMC, Chevrolet. |

| Key Drivers | • Demand for more fuel-efficient and environment friendly minivans is growing. • Significant drivers are technological developments in electric and hybrid vehicles. |

| Restraints | • High upfront cost of electric and hybrid minivans limits adoption. |