Electric Motorcycles Market Report Scope & Overview

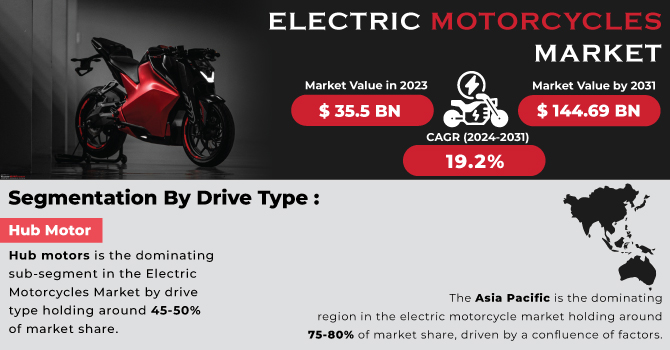

The Electric Motorcycles Market Size was valued at USD 35.5 billion in 2023 and is expected to reach USD 144.69 billion by 2031 and grow at a CAGR of 19.2% over the forecast period 2024-2031.

Environmental concerns are driving the electric motorcycle growth. The consumers are increasingly seeking energy-efficient ways to commute, and they're concerned about the environmental impact of traditional gasoline-powered motorcycles. Rising fuel prices and concerns over fossil fuel reserves further push the market towards electric options. The established motorcycle manufacturers are entering the electric space, while new startups are offering technologically advanced electric motorcycles.

Get More Information on Electric Motorcycles Market - Request Sample Report

The development of charging infrastructure is crucial for electric motorcycle adoption. Fortunately, companies are investing in creating networks of charging stations. Additionally, battery costs are decreasing, and battery management technology is improving, making electric motorcycles more affordable and practical. Manufacturers are incorporating telematics, cellular connectivity, and improved aerodynamics into their designs, creating exciting new possibilities. This shift towards electric vehicles not only reduces reliance on fossil fuels but also helps for developing production facilities that utilize abundant nickel resources for battery production.

MARKET DYNAMICS:

KEY DRIVERS:

- Rising fuel costs, supply uncertainty, and environmental concerns drive electric motorcycle market growth.

Rising fuel costs and supply concerns are driving the electric motorcycle market. With traditional fuel prices fluctuating and inflation on the rise, consumers are seeking cost-effective and efficient transportation options. Electric motorcycles offer a solution, eliminating fuel dependency and providing comparable performance with the benefit of charging at home or on the go. As environmental awareness grows, the demand for electric alternatives to gasoline-powered vehicles, including motorcycles, is increasing.

- Advancements in battery technology are increasing the range and performance of electric motorcycles.

RESTRAINTS:

- High Costs and Limited Repair Options Hinder Electric Motorcycle Growth

The high cost of electric motorcycles is a major problem for the industry's growth. Compared to their fuel-powered counterparts, electric motorcycles remain a less affordable option. Additionally, a lack of skilled technicians poses a technical challenge. Traditional motorcycles have a vast network of mechanics, but the repair infrastructure for electric motorcycles is limited. This scarcity of qualified repair personnel discourages potential buyers, hindering wider adoption.

- Limited charging infrastructure hindering convenient and widespread use.

OPPORTUNITIES:

- Advancements in battery technology can conquer range anxiety, a major barrier for electric motorcycle adoption.

- Partnerships between established motorcycle manufacturers and electric vehicle startups can accelerate innovation and market penetration.

CHALLENGES:

- Electric motorcycles' high upfront cost deters budget-conscious consumers.

- Compared to traditional motorcycles, finding qualified technicians to service electric motorcycles can be difficult.

IMPACT OF RUSSIA-UKRAINE WAR

The ongoing conflict between Russia and Ukraine has disrupted the electric motorcycle market in several ways. The sanctions imposed on Russia have restricted trade, impacting access to crucial raw materials like lithium and nickel, essential for battery production. This shortage could lead to price hikes of around 10-15% for electric motorcycle batteries, a key component affecting overall vehicle cost. The war has diverted resources away from research and development in the electric vehicle sector. This slowdown could hinder advancements in battery technology, a crucial factor for addressing range anxiety among potential customers. The war has disrupted global supply chains, causing delays in the shipment of components and finished electric motorcycles. This could lead to production slowdowns and potential stock shortages in certain regions, impacting overall sales figures. These disruptions come at a time when the electric motorcycle market was experiencing significant growth. Thus, the war in Russia-Ukraine has undoubtedly caused the uncertainty, potentially causing a temporary setback in the industry's momentum.

IMPACT OF ECONOMIC SLOWDOWN

The economic downturns disrupts the electric motorcycle market. During a slowdown, consumer spending weakens, potentially leading to a 15-20% decline in sales. This can be attributed to several factors. The electric motorcycles currently carry a higher price tag compared to traditional gasoline models. In times of economic hardship, budget-conscious consumers might prioritize affordability over environmental benefits. The economic slowdowns can lead to job losses and reduced disposable income, further limiting discretionary spending on non-essential purchases like electric motorcycles. The businesses, a significant segment of the electric motorcycle market for delivery fleets, might delay fleet upgrades due to tighter budgets. Thus, as fuel prices typically rise during economic recoveries, consumers might revisit electric motorcycles as a cost-effective alternative in the long run, leading to a potential market rebound after the slowdown.

KEY MARKET SEGMENTS:

By Drive Type

- Belt Drive

- Chain Drive

- Hub Motor

Hub motors is the dominating sub-segment in the Electric Motorcycles Market by drive type holding around 45-50% of market share. Their ease of installation, strong performance, and affordability make them a favourite for manufacturers. Advantages like high torque, improved handling, and extended range further fuel segment growth. Hub motors' efficiency, compact size, and reduced maintenance needs are making them increasingly popular, leading to a quieter and more enjoyable riding experience.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Battery Type

- Lithium-ion

- Lead Acid

- Others

Lithium-ion (Li-ion) Batteries is the dominating sub-segment in the Electric Motorcycles Market by battery type holding around 80-90% of market share. Li-ion batteries offer superior performance compared to other options. They have a higher energy density, longer lifespan, and faster charging times. While initially more expensive, their advantages outweigh the cost for most manufacturers and consumers.

By End-Use

- Personal

- Commercial

Personal Use is the dominating sub-segment in the Electric Motorcycles Market by end-use holding around 65-70% of market share. This is driven by factors like increasing environmental consciousness, lower running costs compared to gasoline motorcycles, and government incentives for electric vehicles. However, the commercial segment is expected to grow significantly in the coming years due to the economic benefits electric motorcycles offer for delivery fleets and other commercial applications.

REGIONAL ANALYSES

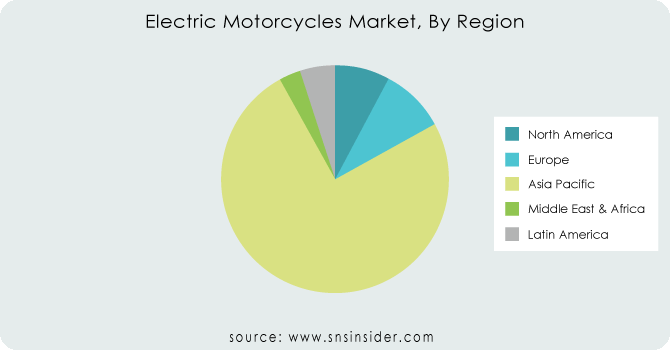

The Asia Pacific is the dominating region in the electric motorcycle market holding around 75-80% of market share, driven by a confluence of factors. Government incentives and a robust manufacturing base make electric motorcycles more accessible. Additionally, high fuel costs and the dominance of scooters, ideal for electric technology, fuel growth.

Europe is the second highest region in this market, backed by existing electric vehicle infrastructure and stricter emission regulations. However, higher upfront costs and a strong gasoline motorcycle market hinder faster growth.

North America is the fastest growing region in this market. Major investments by manufacturers, rising consumer interest in eco-friendly options, and a focus on high-performance electric motorcycles are propelling this rapid growth.

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Harley Davidson, Lito Motorcycles, Essence Motorcycles, Tacita, Alta Motors, Yadea, Lima, Tailg, Wuyang Honda, Supaq and other key players.

Harley Davidson-Company Financial Analysis

RECENT DEVELOPMENT

-

In Jan. 2024: Cleveland's electric motorcycle startup, Land Moto, seeks to elevate its battery tech with a fresh $3 million funding boost, adding to their previous $7 million. Their focus: the head-turning District e-moto, blurring the lines between e-bikes and motorcycles.

-

In Feb. 2024: Hero MotoCorp and Zero Motorcycles are teaming up to create a new electric motorcycle platform with four models planned. Zero, known for lightweight electric bikes, will bring its expertise to the collaboration. The first motorcycles are expected in 2025.

| Report Attributes | Details |

| Market Size in 2023 | US$ 35.5 Billion |

| Market Size by 2031 | US$ 144.69 Billion |

| CAGR | CAGR of 19.2 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Range (75 Miles, 75-100 Miles, More Than 100 Miles) • By Battery Type (Lead Acid, Lithium-Ion Acid, Nickel metal hydride) • By Voltage Type (Below 24, 24-48, 48-60, Above 60 |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Harley Davidson, Lito Motorcycles, Essence Motorcycles, Tacita, Alta Motors, Yadea, Lima, Tailg, Wuyang Honda, Supaq |

| Key Drivers | • The rise in adoption and the rising sales of electric motorcycles. |

| Market Opportunity | • The government initiatives for climate control. |