Automotive Biometric Market Report Scope & Overview:

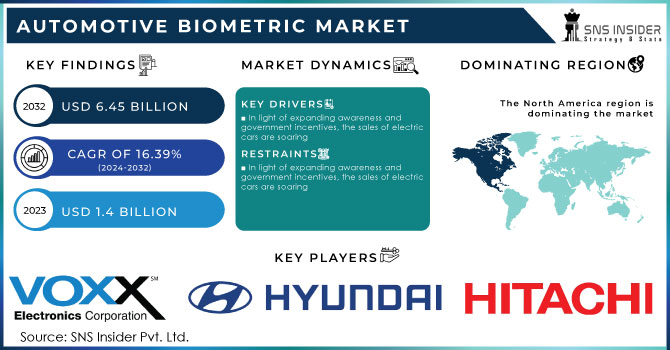

The Automotive Biometric Market Size was valued at USD 1.4 billion in 2023 and is expected to reach USD 6.45 billion by 2032 and grow at a CAGR of 16.39% over the forecast period 2024-2032.

Recently, the Automotive Biometric Market has experienced a significant change due to a combination of technological progress and changing consumer tastes. An important factor influencing this scenario is the increasing focus on customized automotive experiences. As consumers look for better integration of technology in their everyday routines, biometric solutions provide a special chance to customize the driving experience according to individual needs and preferences. Moreover, the increasing worries regarding the security and safety of vehicles have led to the implementation of biometric authentication systems, offering strong protection against theft and unauthorized entry.

Moreover, the increase in electric and autonomous vehicles has led to a need for creative biometric solutions to improve user authentication and driver monitoring to guarantee safety and efficiency in future automotive systems. With the automotive industry becoming more competitive, car manufacturers are incorporating biometric technologies to revolutionize the driving experience, leading to substantial growth and innovation in the Automotive Biometric Market.

Get PDF Sample Report on Automotive Biometric Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

In light of expanding awareness and government incentives, the sales of electric cars are soaring

-

Electric vehicles are becoming more popular because people are becoming more aware of the environmental impact

-

Government subsidies and increased vehicle range all contribute to the adoption of electric vehicles

-

Automobile biometric goods are projected to benefit from increased demand for electric automobiles

-

Concerns about safety and security are on the rise.

With safety and security concerns on the rise in the fast-paced world of today, the automotive industry is leading the way in innovation to combat these urgent challenges. Step into the Automotive Biometric Market, where state-of-the-art technology effortlessly blends with the driving experience. As vehicles become more interconnected with technology, the inclusion of biometric systems offers a new way to protect both the vehicle and its passengers. From fingerprint identification to iris scanning, the options are as varied and sophisticated, providing a customized level of security against unauthorized entry and theft.

RESTRAINTS:

-

A significant no. of components is required for the monitoring, making it expensive & difficult to operate

-

A system's operational expenses are significant because of the hefty initial investment

-

Repair and maintenance costs are associated with creating cutting-edge technology

-

Raw materials utilized in construction are becoming more expensive

OPPORTUNITIES:

-

Technological advancements in the automotive industry have increased

-

The growing popularity of fingerprint sensors in products is projected to offer considerable prospects.

With the rapid progress of technology, incorporating fingerprint sensors into automotive systems presents a wide range of possibilities. Previously limited to security applications, these sensors are now expanding into the automotive industry, providing enhanced security features as well as a customized driving experience. Imagine a future where your car easily identifies you, automatically adjusting seats, climate control, and entertainment preferences with just a simple touch.

CHALLENGES:

-

Import and export of raw materials are made more difficult because of the reliance on logistics

-

Supply networks were put under pressure due to the requirement for direct distribution & allocation across channels

Market, By Authentication Type:

The car industry is moving quickly towards a future focused on biometric verification, defined by a competitive environment divided by the specific technology used to recognize drivers. Fingerprint recognition is currently at the forefront, anticipated to hold a substantial market share of 35% by the projected year. The reason for its popularity lies in its affordability, ease of integration, and familiarity to users. However, voice recognition is emerging as a strong competitor and is expected to capture a significant market share by the designated year. Voice biometrics, which allow for a hands-free experience, are attractive to drivers concerned about safety and looking to reduce distractions. In the meantime, iris recognition, known for its strong security measures, still has a limited market presence compared to other biometric technologies because of its more expensive deployment. Nevertheless, continuous improvements in shrinking size and decreasing cost might establish iris recognition as a strong contender in the future. The global market has been categorized into segments based on authentication type including Face identification, Signature identification, Voice recognition, Fingerprint recognition, Iris recognition, Palm Recognition, Vein Recognition, and Others. Scanners and readers use fingerprints to validate and identify a user in order to allow or deny access to the vehicle's security system. The software can understand and execute tasks based on spoken instructions.

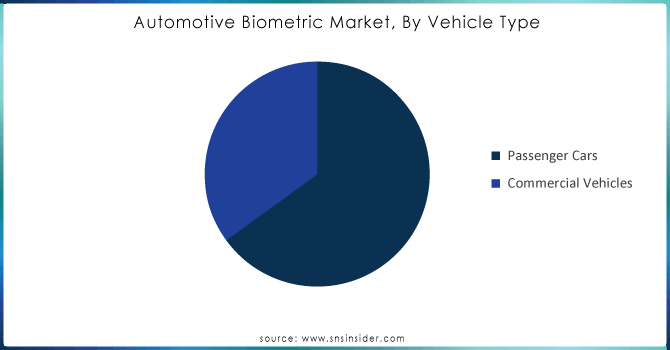

Market, By Vehicle Type:

The global market has been segmented into Passenger cars and commercial vehicles according to the vehicle type category. Passenger cars are vehicles primarily created for carrying people from one place to another. A commercial vehicle is a type of vehicle that transports goods and passengers. There is a high likelihood of an increase in the demand for automotive biometric systems in commercial vehicles due to the growing need for safety, comfort, and automation features.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Market, By Application:

Today's cars heavily depend on vehicle security systems, with the global market segmented into Vehicle Security systems, Driver Safety Systems, Advanced Steering & Infotainment, and Others based on the application segment. A vehicle security system's goal is to ensure the safety of your car. Monitoring the driver's focus is a key objective of safety systems in vehicles. Driver alertness in these systems can be evaluated and tracked through a mix of biological and performance metrics.

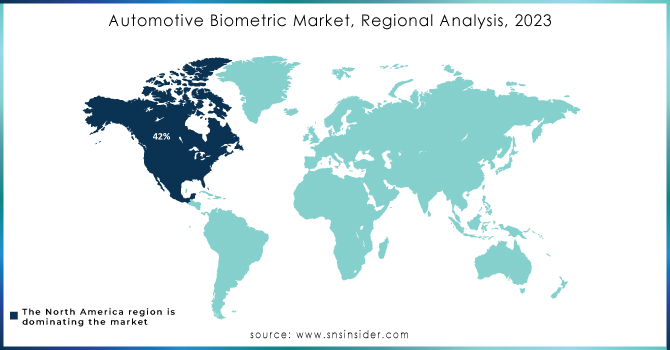

REGIONAL ANALYSIS:

North America has consistently led the way in automotive innovation, holding the biggest market share of 42% due to the strong presence of major car companies and the early adoption of advanced technologies by consumers. Yet, the area encounters obstacles like a crowded pre-owned automobile industry, leading companies to investigate fresh opportunities such as biometrics to improve worth and differentiate themselves in a fierce environment.

On the other hand, Asia Pacific stands out as a strong competitor and is expected to have the highest Compound Annual Growth Rate (CAGR) of 14.2% in the automotive industry. The increase in growth is driven by quick economic growth, a growing middle class with higher disposable incomes, and government efforts to strengthen automotive safety measures. Remarkably, China emerges as a dominant force in the area, forecasted to make a large impact on this positive trend.

In the meantime, Europe is recognized for its unique market terrain defined by its strict data privacy rules. European automotive markets place a high importance on technologies such as fingerprint recognition, maintaining a careful equilibrium between security and privacy worries, with a significant market share. Nevertheless, continuous improvements in anonymous biometric technology offer hope for increased use of different authentication techniques, which could transform the automotive industry in the area.

KEY PLAYERS:

Hitachi, Ltd., Hyundai Motors, BioEnable Technologies Pvt. Ltd, Fujitsu Limited, Voxx International Corporation, Safran S.A, Synaptics Incorporated, Nuance Communications, HID Global Corporation, Fingerprint Cards AB, and Methode Electronics, Inc. are some of the affluent competitors with significant market share in the Automotive Biometric Market.

RECENT DEVELOPMENTS:

Hitachi, Ltd.:

-

Partnerships and Collaborations: Hitachi has been actively engaging in partnerships and collaborations with various automotive companies and technology firms to integrate biometric solutions into vehicles. They might have formed new collaborations to enhance their biometric offerings or expand their presence in the automotive market.

-

Research and Development: Hitachi continuously invests in research and development to improve its biometric technology, making it more reliable, accurate, and secure for automotive applications. Recent advancements may include the development of new biometric sensors or algorithms tailored for automotive use cases.

Hyundai Motors:

-

Integration of Biometric Technology: Hyundai Motors has been exploring the integration of biometric authentication features into their vehicles to enhance security and personalization. Recent developments might include announcements regarding the implementation of fingerprint or facial recognition systems in their vehicles.

-

Focus on User Experience: Hyundai is known for its emphasis on user experience and innovation. Recent developments may involve efforts to leverage biometric technology not only for security purposes but also to create more personalized and convenient driving experiences for customers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.4 Billion |

| Market Size by 2032 | US$ 6.45 Billion |

| CAGR | CAGR of 16.39% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Authentication Type (Face identification, Signature identification, Voice recognition, Fingerprint recognition, Iris recognition, Palm Recognition, Vein Recognition, Others) • by Vehicle Type (Passenger cars, Commercial vehicles) • by Application (Vehicle Security System, Driver Safety System, Advanced Steering & Infotainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hitachi, Ltd., Hyundai Motors, BioEnable Technologies Pvt. Ltd, Fujitsu Limited, Voxx International Corporation, Safran S.A, Synaptics Incorporated, Nuance Communications, HID Global Corporation, Fingerprint Cards AB, and Methode Electronics, Inc. |

| Key Drivers | •In light of expanding awareness and government incentives, the sales of electric cars are soaring. •Electric vehicles are becoming more popular because people are becoming more aware of the environmental impact. |

| RESTRAINTS | •A significant no. of components is required for the monitoring, making it expensive & difficult to operate. •A system's operational expenses are significant because of the hefty initial investment. |