AUTOMOTIVE TRANSMISSION MARKET KEY INSIGHTS:

To Get More Information on Automotive Transmission Market - Request Sample Report

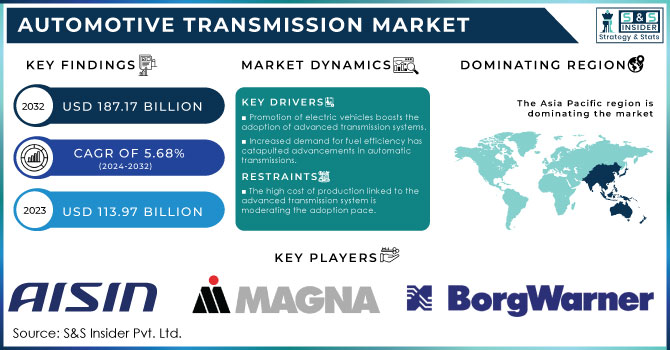

The Automotive Transmission Market Size was valued at USD 113.97 Billion in 2023 and is expected to reach USD 187.17 Billion by 2032 and grow at a CAGR of 5.68% over the forecast period 2024-2032.

The Automotive Transmission Market is growing at a strenuous pace backed by the integration of technology, government policies, and shifts in consumer demand towards fuel-efficient and electric vehicles. Stringent fuel efficiency and emission standards are being enforced by various governments that is forcing auto manufacturers to introduce advanced systems of transmission. In the United States government policies play an important role in making the corporate average fuel economy standards for companies. The Corporate Average Fuel Economy standards and Zero Emission Vehicle mandate is the most critical policy forcing high usage of efficient transmission systems, thereby making car manufacturers invest greatly in fuel efficiency and low-emission technologies. Similarly, Euro 7 Regulations of Europe target the need to limit CO2 emissions by forcing the development of a more efficient transmission system which would result in maximum engine performance.

The technology is also helping market enlargement through variants of dual-clutch transmission (DCT) and continuously variable transmission (CVT) in order to have gear shifts as smooth as possible to ensure less fuel consumption and better vehicle performance. With the growing needs for EVs, car manufacturers are focusing more on the production of multi-speed transmissions designed exclusively for EVs to make them efficient and increase their range. The U.S. government's move toward electric mobility may include tax credits and grants provided for the production of electric vehicles, which can spur growth in the transmission market. The Japan government focuses on fuel efficiency and technological advancements in vehicles, driven by the Automobile Fuel Efficiency Improvement Act, urging the adoption of cutting-edge transmission systems.

The future prospects of this market would largely emanate from the widespread implementation of electric and hybrid vehicles into the global automotive industry. Advanced transmission systems are likely to be used in such vehicles for optimization of their performance and energy consumption. Positive government policies toward electric vehicle adoption and efforts towards encouraging the use of low-emission vehicles in the U.S. would boost the growth of this market in the next decade.

MARKET DYNAMICS

KEY DRIVERS:

-

Promotion of electric vehicles boosts the adoption of advanced transmission systems.

The global push towards electric vehicles (EVs) is one significant driving force in the adoption of advanced transmission systems. Although there are fewer mechanical components in an electric vehicle compared to that of a traditional vehicle, multi-speed transmission can potentially make a big difference in the efficiency and range of a vehicle. The leading producers of popular vehicles are developing electric powertrain systems that integrate advanced transmission technologies that maximize performance.

Almost 14 million new electric cars were registered worldwide in 2023, taking their total to 40 million on the roads-by comparison to the sales forecast in the 2023 edition of the Global EV Outlook (GEVO-2023). In 2023, electric car sales were 3.5 million greater than in 2022, or 35% more than a year earlier.

Hybrid electric vehicles are also quickly gaining popularity, with what is needed now for such vehicles the sophisticated transmission technologies that will smoothly switch between electric and internal combustion power. In U.S.-like markets, for example, the government policies that encourage zero-emission vehicles push the automobile industries to invest in next-generation transmission technologies to stay ahead.

-

Increased demand for fuel efficiency has catapulted advancements in automatic transmissions.

With increased consumer demand for fuel-efficient cars in North America and Europe, innovations in automatic transmission systems are attributed to such growing demand. Consumers require more fluid, responsive drives. Needless to say, car manufacturers had to create high sophistication transmission systems if this kind of smooth performance was to be achieved with DCT and CVT, with the added advantage of achieving better fuel economy than a traditional manual gear box.

In the US where the Corporate Average Fuel Economy standards require stringent enforcement and high fuel efficiency, it has made highly efficient automatic transmission focus for automobile manufacturers. These sophisticated transmission systems are gaining widely across both passenger vehicles and LCVs, which is helping in propelling market growth across all vehicle classes.

RESTRAINTS

-

The high cost of production linked to the advanced transmission system is moderating the adoption pace.

Probably the biggest challenge that has confronted the automotive transmission market is the prohibition expense associated with the developing and manufacturing the advanced transmission systems for electric and hybrids. For example, the DCT and the CVT are relatively complex to design and made of materials that increase the cost of manufacturing. This usually gets passed on to consumers who therefore end up paying more for vehicles equipped with such systems, thus limiting their use in sensitive markets, mainly in developing nations, who are sensitive to cost.

For instance, while the regulatory environment of the U.S. and Europe is favorable for promoting fuel-efficient and low-emission vehicles, bringing in the technologies is proving to be a challenge for manufacturers to be affordable for all consumption segments. This is a major barrier to adoption because consumers within certain regions may opt for cheaper alternatives, which may assume the lower levels of fuel efficiency or even performance.

KEY SEGMENTATION ANALYSIS

BY VEHICLE TYPE

Based on the previous data, in the year 2023, the automobile transmission market is still the most dominated by passenger cars with share of 64%, primarily supported by consumer demand and improvements in automatic and hybrid transmission technologies. Due to comfort in driving and better fuel efficiency, automatic transmissions are gaining preference in passenger cars. This factor, with increasing demand from the hybrid and electric passenger car market-especially in regions like North America and Europe-has also led to the increased need for advanced transmission systems.

The LCV segment is anticipated to be the one that growth will be highest in, during the forecast period, registering a CAGR of 7.12% from 2024 to 2032. The increasing uses of LCV in e-commerce and logistics, especially in urban areas, have further built-up demand for more efficient transmission systems. An LCV with an automatic transmission enjoys better fuel economy and lesser emissions, which are highly related to meeting stringent government regulations, especially in the U.S. and Europe.

BY FUEL TYPE

Gasoline vehicles led the market for the year 2023, making up 53% of market share. The mass application in the passenger car makes gasoline vehicles staying on top, as they are relatively more affordable compared to diesel or electric vehicles. Upgrades in automatic transmissions, including dual-clutch and continuously variable ones, have improved fuel economies of gasoline vehicles, making them more attractive to customers.

However, the diesel segment is expected to grow at a modest pace with a CAGR of 6.30% during the forecast period of 2024-2032. Diesel engines mainly are used in heavy-duty transports like HCVs based on the durability and fuel efficiency of vehicles. Thus, despite emission-related issues, which further declined the market for diesel passenger cars, the diesel segment will continue to be an important portion for HCVs and a few LCVs.

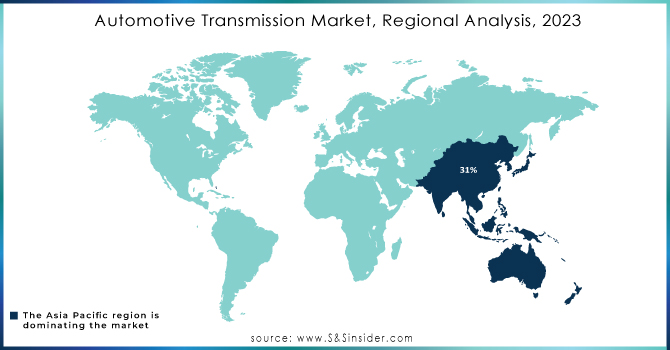

REGIONAL ANALYSIS

Asia Pacific is the largest contributor to the automotive transmission market. In 2023, Asia Pacific captured 31% of global market share. Except for the rapidly developing automotive industry, China and India are major contributors for the high demand of passenger automobiles. Effort from the government, especially in electric vehicle adoption in China, has helped to accelerate the development of advanced transmissions. New Energy Vehicle (NEV) policy and extremely strict fuel efficiency regulations have lifted the rise in the growth of automatic and electric vehicle transmission systems in China. Additionally, incentives towards EV purchases provided by the government also boost the trend.

Asia Pacific is also expected to lead in terms of growth rate, with a CAGR of 6.3% during the forecast period of 2024 to 2032. Increased urbanization coupled with rising disposable income boosts the growth rate in this market regarding automatic and hybrid transmissions in emerging economies.

Do You Need any Customization Research on Automotive Transmission Market - Inquire Now

KEY PLAYERS

Some of the major players in the Automotive Transmission Market are

-

AISIN Corp. (Automatic Transmissions, Hybrid Systems)

-

Magna International (Dual-Clutch Transmissions, Hybrid Powertrains)

-

ZF Friedrichshafen AG (Automatic Transmissions, Electric Powertrains)

-

BorgWarner Inc. (Dual-Clutch Transmissions, Electric Drive Modules)

-

JATCO Ltd. (CVTs, Automatic Transmissions)

-

Continental AG (Transmission Control Units, Hybrid Systems)

-

Eaton Corp. (Heavy-Duty Transmissions, Electric Vehicle Transmissions)

-

Schaeffler AG (Hybrid Modules, Electric Axles)

-

Punch Powertrain (Hybrid Transmissions, CVTs)

-

Hyundai Transys (Automatic Transmissions, Hybrid Systems)

-

Allison Transmission (Automatic Transmissions, Hybrid Powertrains)

-

Voith GmbH (Automatic Transmissions, Heavy-Duty Systems)

-

EXEDY Corporation (Manual Transmissions, CVTs)

-

Dana Inc. (Electric Vehicle Transmissions, Axle Systems)

-

NSK Ltd. (Transmission Bearings, Electric Drive Systems)

-

AVL Group (Electric Drive Systems, Transmission Test Systems)

-

Ricardo plc (Transmission Systems, Hybrid Powertrains)

-

TREMEC Corp. (Dual-Clutch Transmissions, Heavy-Duty Transmissions)

-

GKN Automotive Ltd. (Electric Drive Systems, All-Wheel Drive Transmissions)

-

JTEKT Corp. (Manual Transmissions, Electric Powertrains)

-

Uno Minda Limited

RECENT TRENDS

-

August 2024: Uno Minda Limited is a result of the erstwhile Minda Industries Limited, which has emerged as a tier-one global supplier in innovative systems and solutions for cars. This company recently announced a strategic partnership with Aisin Corporation, Japan. The partnership has been formalized under a TLA or a three-party agreement, pursuant to which the two companies have agreed to design and sell sunroofs in the Indian market.

-

October 2024: Allison Transmission is celebrating a relationship that has truly withstood the test of time: one with the Port Authority of Thailand (PAT). PAT operates a fleet of 150 industry-leading Terberg and Kalma Ottawa terminal tractors at both of its key ports, each powered by robust Cummins EURO 5 diesel engines and Allison 3000 Series fully automatic transmissions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 113.97 Billion |

| Market Size by 2032 | US$ 187.17 Billion |

| CAGR | CAGR of 5.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Transmission Type (Automatic Transmission, Manual Transmission, Automatic Manual Transmission, Continuous Variable Transmission, Dual Clutch Transmission) • By Vehicle Type (Passenger Car, LCV, HCV) •By Engine (IC Engine and Electric) • By Fuel Type (Gasoline, Diesel, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AISIN Corp., Magna International, ZF Friedrichshafen AG, BorgWarner Inc., JATCO Ltd., Continental AG, Eaton Corp., Schaeffler AG, Punch Powertrain, Hyundai Transys, Allison Transmission, Voith GmbH, EXEDY Corporation, Dana Inc., NSK Ltd., AVL Group, Ricardo plc, TREMEC Corp., GKN Automotive Ltd., JTEKT Corp. |

| Key Drivers | • Promotion of electric vehicles boosts the adoption of advanced transmission systems. • Increased demand for fuel efficiency has catapulted advancements in automatic transmissions. |

| Restraints | • The high cost of production linked to the advanced transmission system is moderating the adoption pace. |