Automotive Collision Repair Market Report Scope & Overview

Get More Information on Automotive Collision Repair Market - Request Sample Report

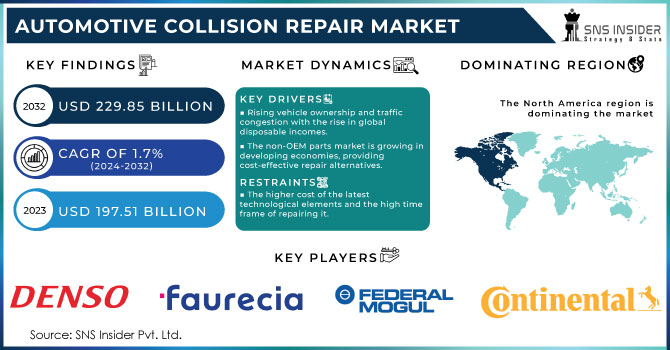

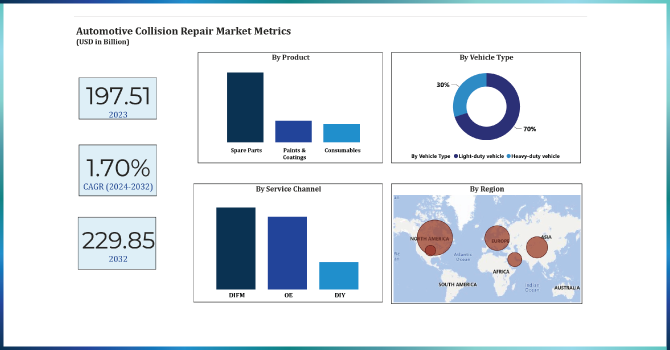

The Automotive Collision Repair Market size is expected to reach USD 229.85 Bn by 2032 and is valued at USD 197.51 Bn in 2023, the CAGR is anticipated to be over 1.7% over the forecast period of 2024-2032.

A relationship between an increase in car ownership and need for collision repairs is highly correlated and is enhancing the overall demand landscape. The number of registered vehicles in the US increased by 1.4% to more than 332 million in 2022 from 2021. This corresponds with Federal Highway Administration (FHWA) data which show US vehicle miles travelled hit a record high mark of 3.3 trillion miles in 2022, up by 3.2% YoY. More cars on the road for longer distances is estimated to create higher probability of more accidents. The National Highway Traffic Safety Administration (NHTSA) recorded over 6.7 million police-reported traffic crashes in 2022 alone, these numbers dictate how costly or economically difficult it is fixing many minor accidents that might necessitate auto body repairs. As the market price is increasing every year due to high volatility of inflationary pressures designed into them at their creation stage.

Safety, transparency and environmental implication of the automotive collision repair market are among some of the areas that governments have been aspiring to address through various activities. For instance, in the United States, body shops are required by the EPA to incorporate a rule which requires that 50% of paint overspray be captured. This greatly reduces cost of repairing (HAP). It also positively mandates that body shops should be transparent of whether they use new or recycled parts, information that would help the consumers to make informed decisions. Similarly, Europe has strict regulations for waste management within its automotive repair industry. The European Commission indicates that proper treatment of end-of-life vehicles increased up to 95% in 2021 which is evidence for the effectiveness of these laws.

Market Dynamics:

Market Dynamics:

Drivers:

-

Rising vehicle ownership and traffic congestion with the rise in global disposable incomes.

-

The automotive industry has been embracing developments in areas such as 3D printing parts and advanced tools for repair, which have potential to improve efficiency and therefore lower costs for collision repair shops.

-

The market for non-original equipment manufacturer (OEM) parts is growing particularly in developing economies that offer a cheaper alternative when it comes to repairs.

Developing economies are driving the demand for non-original equipment manufacturer (OEM) parts. These parts are considered as aftermarket parts and represent a low-cost solution in repairing collision damage. Studies show a massive change with more buyers of aftermarket parts from the automotive industry. For instance, according to India’s Society of Indian Automobile Manufacturers (SIAM) report in 2023, minor car crashes involve the use of non-OEM parts at 65%. A similar trend exists in Brazil among other developing countries where a study conducted by National Confederation of Industry (CNI) indicated that aftermarket parts controlled by automotive collision repair market targeting specific vehicle segments are valued at 70% share. In this sense, the rising popularity of non-OEM parts in emerging markets can be associated with the huge cost difference between these and the original equipment manufacturers’ (OEM) products that goes as high as 30%-50% less. Affordability remains a key determinant driving the demand for non-OEM auto parts due to budgetary constraints in some places despite issues about its quality and warranty conditions. Non-OEM penetration rates are increasing globally, but particularly in developing countries like Nigeria where spare part dealers are becoming more organized and digitalized.

Restrain:

-

Nowadays, cars have become complex, which entails repairing them at great expense due to their advanced technologies, materials and safety systems.

-

The higher cost of the latest technological elements and the high time frame of repairing it.

Considering Advanced Driver-Assistance Systems (ADAS) are an asset to automotive collision repair market since they prevent accidents. However, they complicate repair procedures through their intricate nature thereby potentially escalating expenses. Therefore, damaged radar systems cannot be easily swapped out instead, they must undergo detailed recalibration so that they function properly with other ADAS items such as cameras and LiDAR sensors. This recalibration process necessitates specialized equipment, and trained technicians, resulting in increased repair times and higher labor costs. A recent study conducted by the National Institute of Standards and Technology (NIST) states that approximately 20% of ADAS recalibration service providers lack appropriate training hence slowing down the repair process. Additionally, manufacturers have different calibration procedures, therefore repair shops are forced to purchase a wider range of automotive software and tools.

Need any customization research on Automotive Collision Repair Market - Enquiry Now

Market Segmentation

By Product

-

Paints & Coatings

-

Consumables

-

Spare Parts

Spare parts including bumpers, fenders, hoods and other structural components dominated with a share of above 63% in 2023. This supremacy is directly related to high number of road accidents whereby these parts bear most impacts. Paints and coatings follow at around 20%, showing how aesthetic appeal helps in achieving a perfect repair job. Consumables such as sandpaper, masking tape or solvents held around 17% share. Although each may seem small in its own right consumables play an important role as they provide invisible support to any repairs ensuring smooth operations while ensuring smooth operations and high-quality results.

By Vehicle Type

-

Light-duty vehicle

-

Heavy-duty vehicle

In 2023 light-duty vehicles held around 70% share and dominated the vehicle type segment, this segment includes passenger cars, SUVs and crossovers. The advantage of the economy of scale in this segment is that they can be easily replaced and maintained by a large work force with enough experience in handling standard vehicles. The heavy-duty vehicles that include pickup trucks and buses constitute the remaining smaller portion about 30% but still have relatively high average repair cost.

For these, however, their intricate structures as well as tailor-made parts mostly necessitate involvement of authorized dealerships or certified repair shops. It is worth mentioning here that both segments are currently witnessing increased demand for electric and hybrid vehicles thus, posing its own unique challenges. There is need for specialized training for technicians who undertake repairs on vehicles with high-voltage systems to ensure compliance with safety norms. This is an emerging trend anticipated to provide the automotive collision repair market further during the expected rapid uptake of electric vehicles.

By Service Channel

-

DIY

-

DIFM

-

OE

The automotive collision repair market has different offerings through various channels to meet individual customer preferences. Do-It-Yourself (DIY) solutions accounted for 15% share attracting people who prefer low budgets for instance dents and scratches repairs. Online tutorials, available spare parts, and cheap tools allow DIY experts to do almost anything about their cars. Nevertheless, many customers prefer professional repairs due to their complexities or security concerns which may prohibit them from doing such jobs themselves as it could be dangerous. Online tutorials, readily available parts, and affordable tools empower DIY enthusiasts.

However, complex repairs or safety concerns often push customers towards professional channels. As OE service outlets and dealerships, they accounted about 40% of the market share in 2023. They offer assurance by way of certified technicians, parts that won’t void a warranty, and maintenance of manufacturer repair guideline. Although they are usually more expensive compared to other options, these channels guarantee quality repairs and may help retain the value of a car when it is time to sell. The rest 45% share is accounted by Do-It-For-Me (DIFM) segment which is growing rapidly.

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Regional Analysis:

North American Automotive Collision Repair Market accounted for over 42.6% of global market share in 2023 dominating the market. High density of vehicles increases the need for repairs in North America because households own up to above 80% with most being used cars thus needing more repairs on average per unit than new ones do. Secondly, high accident rates sustain demand for repair facilities in an area. In the U.S., alone there are approximately 6 million motor vehicle accidents each year involving damage done to automobiles including about one quarter that result in property damage only. Insurance penetration is the third factor. The presence of more than 85% insurance coverage on North America’s automobiles creates reasons for these consumers to look for professional collision repair services. Lastly, NA marketplace has a well-developed fixing network exists. This kind of mix in North America comprises about 20% chain and 80% independent shops, thereby increasing availability of services in different locations. This variation makes the North American Automotive Collision Repair Market strong and dynamic.

APAC region experienced the highest CAGR in 2023 and is expected to be around 2.9% over the forecast period of 2024-2032. The key factor here is rising demand for vehicles which is projected to be about 60% of total car sales by 2030 globally, while on the other it struggles with factors that increase repairs needs. Above 70% of APAC roads do not have proper safety features hence higher accident rates compared to other parts globally. In addition to this, uninterested enforcement of traffic rules largely contributes to this market among others factors as discussed above.

Key Players

The major key players are 3M, Automotive Technology products, Continental AG, Denso Corporation, Faurecia, Federal-Mogul LLC, Honeywell International, Johnson Controls, Mitsuba Corp, Robert Bosch and others.

Recent developments

Continental AG – The company has started the production of its most sustainable tires @Ultra Contact NXT in volume.

Faurecia- The company have announced a strategic partnership with Renault group in order to increase the aftersales services in automotive industry.

| Report Attributes | Details |

| Market Size in 2023 | US$ 197.51 Bn |

| Market Size by 2032 | US$ 229.85 Bn |

| CAGR | CAGR of 1.7 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product (Paints & Coatings, Consumables, Spare Parts), • by Vehicle Type (Light-duty vehicle, Heavy-duty vehicle), • by Service Channel (DIY, DIFM, OEM), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, Automotive Technology products, Continental AG, Denso Corporation, Faurecia, Federal-Mogul LLC, Honeywell International, Johnson Controls, Mitsuba Corp, Robert Bosch |

| Key Drivers |

|

| Market Restraints |

|