Automotive Engine Oil Market Size & Overview:

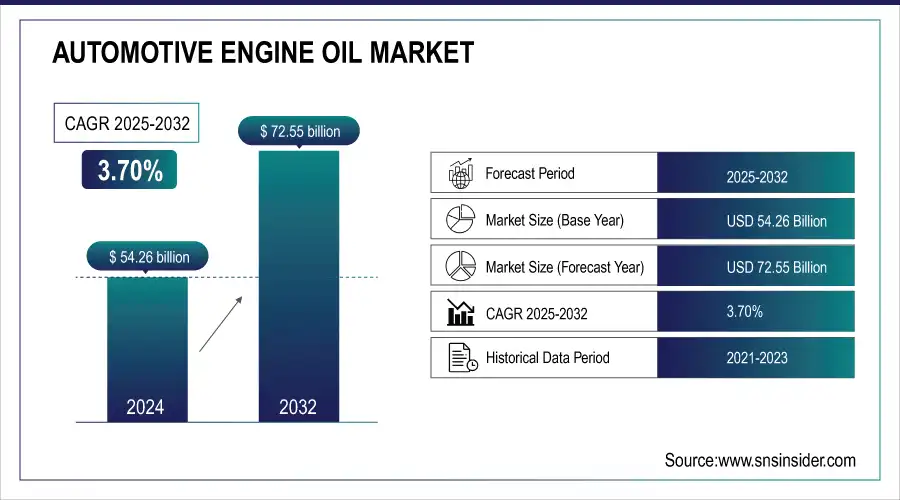

The Automotive Engine Oil Market size was valued at USD 54.26 billion in 2024 and is expected to reach USD 72.55 billion by 2032, growing at a CAGR of 3.70% over the forecast period of 2025-2032.

As the demand for synthetic lubricants and emission norms is increasing, the automotive engine oil market is transforming. The move towards synthetic engine oils speeds up with standards such as ILSAC GF-7 and API SP, while Shell Advance meets 2024 API SP standards. The growth of the automotive engine oil market is further driven by Original Equipment Manufacturers (OEM) collaborations and by the digitalization of the aftermarket.

To Get more information on Automotive Engine Oil Market - Request Free Sample Report

Significantly, Shell is continuously providing engine oils to BMW Group, bolstering its automobile engine oil market share. ExxonMobil says innovations such as Mobil 1 ESP x2 0W-20 in place of a 5W-30 can improve fuel economy up to 4%. With environmental objectives driving the re-refining trend at one end and increasing vehicle parc and e-commerce platforms making automotive motor oil more available at the other, re-refining initiatives are gaining traction around the globe.

Market Size and Forecast

-

Automotive Engine Oil Market Size in 2024: USD 54.26 Billion

-

Automotive Engine Oil Market Size by 2032: USD 72.55 Billion

-

CAGR: 3.70% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Automotive Engine Oil Market Trends

-

Rising vehicle production and growing focus on engine performance are driving automotive engine oil demand.

-

Increasing adoption of synthetic and semi-synthetic oils is enhancing engine efficiency and longevity.

-

Expansion of passenger cars, commercial vehicles, and electric vehicles is boosting market growth.

-

Stringent emission norms and environmental regulations are shaping lubricant formulation and usage.

-

Growing awareness of preventive maintenance and fuel efficiency benefits is encouraging adoption.

-

Technological advancements in high-performance additives are improving oil stability and protection.

-

Collaborations between automakers, lubricant manufacturers, and aftermarket service providers are accelerating innovation and distribution.

Automotive Engine Oil Market Growth Drivers:

-

Integration of IoT-enabled predictive maintenance accelerates demand for smart engine oils

The automotive engine oil market is changing in response to the use of IoT-based predictive maintenance systems and an increase in demand for intelligent synthetic engine oil formulations. These are based on high-performance lubricants that analyze oil quality and wear in real-time, and they help to optimize fleet performance. Vehicle engine oil manufacturers are increasingly employing this trend to provide condition-monitoring services. As per IoT Analytics, the predictive maintenance market was USD 5.5 billion in 2022, which supports a significant automotive engine oil market trend. This need for smarter lubricants is growing the automotive engine oil market size and generating competitive advantages in OEM and aftermarket automotive motor oil formulations.

-

Circular economy mandates boost re-refining and bio-based lubricant adoption

The sustainability goals are driving the automobile engine oil industry towards redefined and bio-based synthetic lubricants. Government programmes such as the EU Green Deal aim to deliver 55% lower transport emissions by 2030 and support closed-loop oil production and use. Automotive lubricant companies are adopting re-refinery plants and eco-certified blends in response. The American Petroleum Institute has published over 700 performance and environmental standards, making way for greener practices. These forces drive the long-term development of the automotive engine oil market and are consistent with the potential customer expectations. These are setting the course of the future automotive engine oils marketplace with an increasing requirement for low-carbon automotive motor oil.

Automotive Engine Oil Market Restraints:

-

Fragmented regional specifications delay global lubricant approvals, impede market growth

Variable international engine oil specifications limit product approvals in major markets and slow automotive engine oil market penetration. Different institutions: For regulatory bodies such as API, ACEA, JASO, different test protocols, viscosity degrees, or additives become necessary, which results in the development time and cost. Therefore, it takes 6 to 12 months for motor oil makers to put new products on the market, making them less flexible. This is a challenge to automotive engine oil market research and an obstacle to the extension of the international share of the automotive engine oil market. The smaller players are especially handcuffed by such requirements, which slow expansion and innovation in synthetic engine oil. It’s also critical for the long-term growth of the engine oil market that we are harmonising regulations.

Automotive Engine Oil Market Segment Analysis

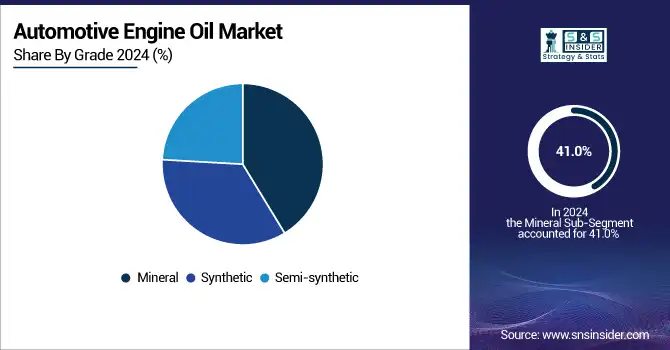

By Grade, Mineral oil dominates the automotive engine oil market. Semi-synthetic oils are expected to grow fastest.

The mineral grade segment accounted for the largest share of 41.0% in the automotive engine oil market in 2024, as it is cost-effective and compatible with most of the conventional engines. It is commercially used in passenger cars and light-duty vehicles, especially in areas with many old vehicles. Car engine oil companies such as Indian Oil Corporation and Chevron also market mineral oils under API (American Petroleum Institute) guidelines. The cost factor of the lubricant and the universal presence are key factors ensuring its continued supremacy ranking in the automotive engine oil market of the world.

On the other hand, semi-synthetic grade is the fastest-growing segment with a 3.5% CAGR in the forecast period of 2025 to 2032, as they offer the best of performance and cost-efficiency. These compositions have better thermal resistance and oxidation stability than mineral oil and are attractive for middle-class passenger car consumers. The semi-synthetic range offered by companies such as Shell and Valvoline has developed over time to become a more comprehensive and popular range. Furthermore, accreditations, like the International Lubricant Standardization and Approval Committee (ILSAC), have increased acceptance. These drivers denote significant automotive engine oil market trends and the rise in the automotive engine oil market demand in developing and cost-sensitive economies.

By Engine Type, Diesel engines dominate the automotive engine oil market. Alternative fuel engines are expected to grow fastest.

The diesel segment held the leading position in the automotive engine oil market in 2024, capturing a 45.0% market share, largely driven by the demand in heavy-duty vehicles and commercial transportation. Diesel engine oils are engineered to handle high temperatures and soot accumulation, ensuring long engine life. OEM recommendations from companies such as Cummins and Volvo Trucks enforce the use of high-performance diesel oils, particularly for low-emission engines that comply with EPA and Euro VI standards. This segment’s dominance reflects enduring automotive engine oil market trends in freight and logistics applications.

The alternative fuels registered as the fastest growing segment with a CAGR of 4.85% in the forecast period of 2025 to 2032, supported by the growing penetration of CNG, LPG, and hybrid vehicles. This trend fits with worldwide decarbonization aims and requirements for clean fuels. Oils for alternative-fuel engines need better start-up oxidation protection and deposit control. Factors like the Clean Cities initiative of the U.S. Department of Energy, which provides technical assistance and funding for fleets' switches to CNG and LNG vehicles, also drive the demand for customized synthetic lubricants. Such developments are indicative of the automotive engine oil market trends evolution & of automotive engine oil market share opportunities in the future.

By Application, Passenger cars dominate the automotive engine oil market. Motorcycles are expected to grow fastest.

In 2024, the passenger cars segment dominated the automotive engine oil market with a 52.0% market share, driven by the sheer volume of privately owned vehicles worldwide. OEMs such as Toyota, Hyundai, and Volkswagen continue to influence oil formulation preferences through warranty and fuel-efficiency requirements. Regulatory standards, including U.S. CAFE and EU CO₂ emission targets, further encourage the use of optimized oils for better engine performance. This has reinforced the segment’s leadership in overall automotive engine oil market analysis and sustained automotive engine oil market growth in the light-duty sector.

However, motorcycle applications recorded the highest growth, with a CAGR of 4.94% during the year 2024, driven primarily by growing two-wheeler ownership in Asia-Pacific and Latin America. Urban mobility trends and a preference for fuel-efficient commuting also further boost this growth. In particular, motorcycle lubricants, especially those suitable for JASO MA and MA2 standards. Motul, Castrol, etc, also made their products more robust in this area. These trends denote a strong expansion automotive engine oil market, as well as a shifting automotive engine oil market share of synthetic and semi-synthetic motorcycle oils.

By Sales Channel, OEM segment dominates the automotive engine oil market. Aftermarket is expected to grow fastest.

The OEM segment dominated the automotive engine oil market in 2024, due to pre-filling of engine oils during vehicle production. As a result, major automotive engine oil suppliers such as Shell, TotalEnergies, and ExxonMobil each have their supply relationships with vehicle manufacturers so that oils are configured to the particular engine technologies used. This factory-fill setup is said to meet the U.S. EPA and European emissions requirements. OEM dominance is the manifestation of the long-term relationships and trust built on brand-certified synthetic engine oils, which in turn is expected to boost the automotive engine oil market growth and brand-focused automotive engine oil market trends.

Furthermore, the aftermarket is the fastest growing in the forecast period of 2025 to 2032 with 4.06% CAGR, owing to growing vehicle lifespan and the emergence of independent service stations. The average age of vehicles on the road was climbing to a high of 12.8 years, and that was increasing oil replacement cycles, the U.S. Department of Transportation said. The e-commerce space has also made premium-quality lubricants even more reachable to consumers. Companies like Valvoline and AMSOIL are taking advantage of this trend by growing their direct-to-consumer branches. This trend further underscores the automotive engine oil market trends, and a substantial automotive engine oil market trend that is driven by demand.

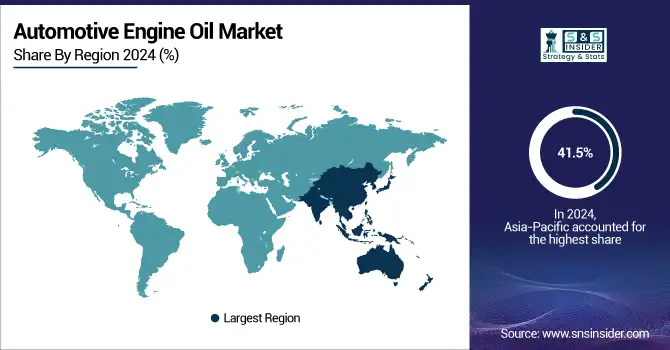

Automotive Engine Oil Market Regional Analysis

Asia Pacific Automotive Engine Oil Market Insights

Asia Pacific dominated the automotive engine oil market with 41.5% of the total market share in 2024, as a result of China’s high automobile manufacturing and sales of 31.4 million units in 2024. Growing disposable income and urbanization in India and Southeast Asia have spurred demand for synthetic and semi-synthetic lubricants. Automobile oil manufacturers are collaborating with carmakers such as Toyota and Hyundai to create the best engine oils suited to the region's high temperatures and humidity. These developments are indicative of the region leading growth in the automotive engine oil market and the move to high-performance, low-viscosity grades.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Automotive Engine Oil Market Insights

The automotive engine oil market in North America is growing faster, with a CAGR of 4.49% in the forecast period 2025 to 2032. The United States and Canada are some of the main contributors, as there is an aging vehicle park, with the average age standing at 12.6 years, driving repeated oil changes. North America automotive engine oil Market in the US dominated the market and is valued at USD 9.28 billion in 2024 and is likely to continue with its dominance over the forecast period as well. The U.S. is driven by a large vehicle base, high oil consumption, and enforced regulations for synthetic engine oils. Tightening of Vehicle Emission Standards According to the Environmental Protection Agency (EPA) Tier 3 and API SP Engine Oil Standards, Synthetics Promote Better Emission Control And Fuel Efficiency. Canada’s Clean Fuel Regulations offer an avenue for increasing demand for low-carbon lubricants, encouraging market expansion while also motivating automotive engine oil producers to ensure their formulations are tailored to regional needs.

Europe Automotive Engine Oil Market Insights

The Europe region has a 20.0% value market share in the automotive engine oil market due to the strict Euro 6 and ACEA C6 regulations requiring low-SAPS, low-viscosity oils. Germany leads the pack with an average fleet age of 9.7 years, focusing on fuel-efficient oils to achieve EU CO2 targets moving forward. With over 70% of new cars requiring synthetic lubricants, automotive engine oil companies are expanding in the region. This trend is also associated with the support of the government by France and Italy in the form of incentives, where advanced oils are promoted, boosting general market growth in Europe.

Middle East & Africa and Latin America Automotive Engine Oil Market Insights

The Middle East & Africa and Latin America are emerging markets for automotive engine oil, supported by growing vehicle sales, expanding automotive aftermarket, and increasing demand for high-performance lubricants. Rising awareness of engine maintenance and fuel efficiency, coupled with partnerships between local distributors and global oil manufacturers, is driving adoption. Countries like Brazil, Mexico, UAE, and Saudi Arabia are witnessing increased consumption, positioning these regions as high-growth areas in the global automotive engine oil market.

Automotive Engine Oil Market Competitive Landscape:

Motul S.A

Motul S.A is a French company specializing in high-performance lubricants and engine oils for automotive, motorcycles, marine, and industrial applications. Renowned for its advanced synthetic formulations, Motul focuses on enhancing engine efficiency, durability, and performance. The company invests heavily in research and development, collaborating with motorsport teams and OEMs to deliver innovative products that meet evolving regulatory standards and performance expectations across global markets.

-

September 2024: Motul launched a new TV campaign showcasing its synthetic engine oils, emphasizing race-like performance for everyday driving conditions.

BP p.l.c. (Castrol)

BP p.l.c., through its Castrol brand, is a global leader in automotive and industrial lubricants, offering high-quality engine oils, transmission fluids, and specialty lubricants. Castrol emphasizes innovation in performance, fuel efficiency, and sustainability, serving passenger cars, commercial vehicles, and industrial machinery. With a strong global presence and collaborations with OEMs and motorsport partners, Castrol continuously develops advanced solutions to meet modern engine and environmental requirements.

-

June 2024: Castrol India introduced three new passenger car engine oil variants, offering improved performance with PowerBoost Technology™ for hybrid and SUV engines.

Shell plc

Shell plc is a multinational energy and petrochemical company providing a wide range of fuels, lubricants, and motor oils globally. Its Helix line of automotive engine oils delivers advanced protection, performance, and fuel efficiency for modern engines. Shell invests in research and development to create innovative formulations, focusing on sustainability, engine longevity, and meeting stringent environmental and performance standards in passenger, commercial, and industrial applications.

-

June 2023: Shell launched Helix HX6 and Helix SUV 5W-30 synthetic oils in India, ensuring longer engine life and fuel efficiency.

Key Players

Some of the Automotive Engine Oil Market Companies

-

Shell plc

-

Exxon Mobil Corporation

-

BP p.l.c. (Castrol)

-

Chevron Corporation

-

TotalEnergies SE

-

Sinopec Lubricant Company

-

Fuchs Petrolub SE

-

LUKOIL Oil Company

-

Indian Oil Corporation Limited

-

Motul S.A

-

Valvoline Inc.

-

PetroChina Lubricant Company

-

Idemitsu Kosan Co., Ltd.

-

Pertamina Lubricants

-

Gulf Oil International

-

Kendall Motor Oil (FUCHS Group)

-

Royal Dutch Shell – Helix Brand

-

Amsoil Inc.

-

Repsol S.A.

-

Sinopec Shanghai Petrochemical Company

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 54.26 Billion |

| Market Size by 2032 | USD 72.55 Billion |

| CAGR | CAGR of 3.70% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Mineral, Synthetic, Semi-synthetic) •By Engine Type (Diesel, Petrol, Alternative Fuels) •By Application (Passenger Cars, Commercial Vehicles, Motorcycles) •By Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Shell plc, Exxon Mobil Corporation, BP p.l.c. (Castrol), Chevron Corporation, TotalEnergies SE, Sinopec Lubricant Company, Fuchs Petrolub SE, LUKOIL Oil Company, Indian Oil Corporation Limited, Motul S.A, Valvoline Inc., PetroChina Lubricant Company, Idemitsu Kosan Co., Ltd., Pertamina Lubricants, Gulf Oil International, Kendall Motor Oil (FUCHS Group), Royal Dutch Shell – Helix Brand, Amsoil Inc., Repsol S.A., Sinopec Shanghai Petrochemical Company |