PONTOON MARKET KEY INSIGHTS:

Get More Information on Pontoon Market - Request Sample Report

The Pontoon Market Size was valued at USD 8.68 Billion in 2023 and is expected to reach USD 17.27 Billion by 2032 and grow at a CAGR of 8.0% over the forecast period 2024-2032.

The Pontoon Market has been growing rapidly over the last few years due to shifting consumer preferences, advancements in technology, and greater emphasis on recreational and leisure activities. Pontoons, because of their innovative design, which improves stability, spaciousness, and versatility, have become a popular choice for many applications, including fishing and cruising to luxury outings. The following overview examines the main growth drivers pushing the market forward.

The pontoon market is being supported by a healthy recreational boating industry at large. In 2023, motorized boats from 16 to 26 feet categories that also include most pontoons were nearly 55% of nearly 12 million recreational vessels registered in the U.S. It shows a demand for a versatile and space-providing boat, primarily by users who are into family or group activities. Florida is considered one of the leading boating states, with more than 1 million registered recreational boats. Pontoons are found to be highly adopted and in demand due to their sturdiness and versatility for fishing, cruising, or social events. They will benefit from the robust North American market, which realizes a high level of boating participation, with an annual participation of over 85 million Americans.

MARKET DYNAMICS

KEY DRIVERS:

-

Surge in Recreational Boating and Family-Friendly Appeal Drives Growth of the Pontoon Market

The rising popularity of recreational boating, especially among families and groups, is a key growth driver for the pontoon market. Pontoons are known for their expansive decks and stability, making them ideal for activities such as fishing, cruising, and social gatherings, hence making them a favourite for leisure outings. Over 85 million Americans participate in recreational boating every year, and the lifestyle preferences of modern consumers align well with the pontoon. Additionally, as disposable income increases, more consumers are investing in leisure activities such as boating. In 2023, a notable 5.1% increase in disposable income was reported, which typically correlates with higher spending on recreational activities like boating. This economic trend has made pontoons a more accessible choice for family-centric and social boating experiences, further boosting their market presence.

-

Rising Demand for Electric and Eco-Friendly Pontoons Drives Market Growth Amid Environmental Awareness

The integration of eco-friendly technologies into pontoons is a significant driver for market growth. Manufacturers are increasingly focusing on electric propulsion systems, solar panels, and the use of sustainable materials to appeal to environmentally conscious buyers. Electric pontoons, in particular, have gained traction due to their quiet operation, low maintenance, and reduced carbon footprint. With stricter emission regulations and rising environmental awareness, many consumers and businesses prioritize sustainability, making green technology a crucial selling point. Moreover, hybrid systems that combine traditional and electric engines are gaining popularity for their flexibility and extended range. This trend is further supported by government incentives and grants for adopting green technology in maritime applications. Electric boats, including pontoons, are gaining popularity due to their lower emissions and quieter operation. The U.S. Energy Information Administration reports that by 2030, electric vehicle adoption will reach 13%-29%, driven by decreasing battery costs, expected to drop by 51%-56% by 2050. This trend supports the increased demand for electric pontoons and other green boating options, as sustainability becomes a key factor for both consumers and manufacturers in the recreational boating market.

RESTRAIN:

-

High Initial Costs of Pontoon Boats Limit Accessibility for Price-Sensitive Consumers

The relatively high initial cost of pontoons acts as a restraint for market growth, particularly among price-sensitive buyers. Despite their appeal and versatility, pontoons are often perceived as a luxury purchase, especially the models equipped with advanced features like electric propulsion, GPS systems, and high-performance engines. For first-time boat buyers, the cost can be a barrier to entry, pushing them towards more affordable alternatives such as used boats or simpler watercraft. The relatively high initial cost of pontoons is a significant restraint for market growth, particularly among price-sensitive buyers. In the pontoon market, the cost of purchasing a new vessel, which can range between USD 20,000 and USD 60,000 for more standard models, rises with additional features like electric propulsion or luxury layouts. Financing options are available for these higher-priced boats, but many consumers are still deterred by down payment requirements. New pontoons typically require at least a 10% down payment for loans under USD 100,000, which increases to 20% for boats priced higher than USD 100,000 or for pre-owned models. For buyers with excellent credit, interest rates could range from 4% to 7%, but for those with poor credit scores, the rates could rise as high as 19%. These factors make pontoons less accessible to certain buyers, especially in emerging economies or regions with lower disposable incomes.

KEY SEGMENTATION ANALYSIS

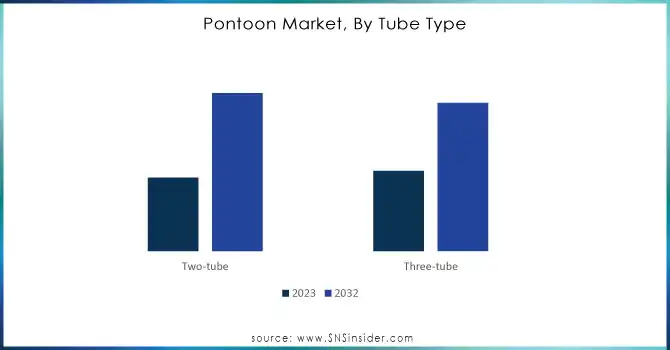

BY TUBE TYPE

The Three-Tube segment of the pontoon market remains the largest in terms of market share at 53% in 2023, with its inherent superior stability, performance, and capacity. Companies like Bennington and Sun Tracker have moved the needle with innovations, including Bennington's 25 L-Series, which comes with a triple-tube configuration to further improve speed, handling, and ride quality. This has made the three-tube model popular for luxury cruising and water sports.

The Two-Tube segment of the pontoon market is the fastest-growing market, with a projected CAGR of 8.9% during the period of forecast. This can be attributed to the high demand for more affordable and versatile pontoons that cater to casual leisure and fishing. Other models have also been introduced that combine two tubes, such as Avalon LS and Harris Cruiser LX, which cost a little less than three tubes but give more stability and performance.

Need Any Customization Research On Pontoon Market - Inquiry Now

BY APPLICATION

The Recreational segment leads the pontoon market, taking 32% of the market share in 2023, which is fueled by increased consumer interest in recreational boating activities. Companies like Bennington and Sun Tracker have introduced new models targeting recreational boaters, such as the Bennington 23SSBXP, which is designed for family outings and water sports. According to the U.S. The Bureau of Economic Analysis reported that outdoor recreation was 2.3% of the U.S. GDP in 2023, worth USD 639.5 billion. Boating and fishing were the leading drivers in the industry for bigger outdoor activities, which represented USD 36.8 billion. This is important for the recreational pontoon market, which leverages the same activities.

Luxury segments in the pontoon market grow at the fastest CAGR of 10.02%. This is because most people would like a luxury boating experience. Companies like Bennington, Premier, and Crest developed very pricey pontoon models, such as the QX Series of Bennington or Grand Majestic of Premier that may feature luxurious seating arrangements with higher-level sound systems and great performances, because, highly growing in terms of young people. According to recent statistics, 44% of Gen Z consumers and 37% of millennials will drive the growth of the luxury market until 2025.

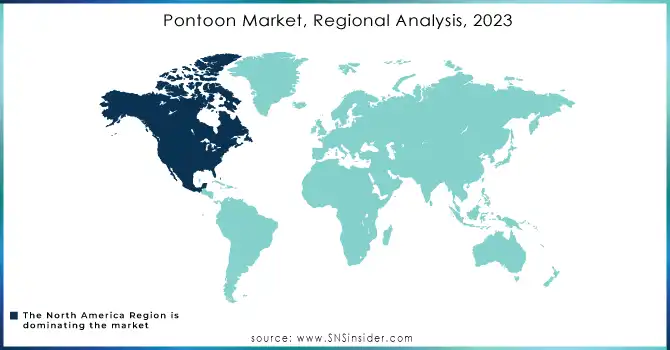

REGIONAL ANALYSIS

In 2023, North America held the largest market share 35% of the global pontoon boat market, driven by the strong interest of the region for recreational water activities. Such activities include boating, fishing, and water sports, especially pontoons. Pontoons are a favorite among many because they are stable, spacious, and versatile. It is no wonder that the United States was one of the strong contributors to this trend. In 2023, the United States also played a significant role in this dominance. The region reported a 15% jump in boat sales in the overall number, with the largest category being pontoon boats, accounting for nearly 40% of all boat sales. This is driven by an increase in recreational water activities, particularly by families, and increasing demand for eco-friendly and high-tech boating options, including electric pontoons.

Asia-Pacific region emerged as the fastest-growing pontoon boats market, driven by an increasing interest in recreational boating and water sports. The estimated CAGR for this region is projected to be around 9.75% over the forecasted year 2024-2032. This growth is driven by increasing disposable incomes, urbanization, and a shift in leisure boating activities among countries like China, India, and Australia. Brunswick is strengthening its boat brands with advanced technologies. The latest Harris pontoon models with CZone digital switching comprise the 230 and 250. They give boaters more control of onboard electrical systems with these pre-programmed and one-touch modes. This innovation attempts to elevate the consumer experience, blending modern luxury with improved ease of use.

Key Players

Some of the major players in the Pontoon Market are:

-

Polaris (Polaris Sportsman XP 1000, Polaris RZR XP 1000)

-

Winnebago Industries, Inc. (Winnebago Voyage, Winnebago Micro Minnie)

-

Brunswick Corporation (Bayliner Element E16, Lund 1875 Crossover XS)

-

BRP (Sea-Doo Switch, Evinrude E-TEC G2)

-

Avalon Pontoon Boats (Avalon Excalibur, Avalon Venture)

-

MasterCraft Boat Holdings (MasterCraft X24, MasterCraft NXT22)

-

Envision Company (Envision 2900 R, Envision 2700 SR)

-

Sylvan Marine (Sylvan Mirage 8522, Sylvan M3 CRS)

-

White River Marine Group (Tracker Sun Tracker Party Barge 22 DLX, Ranger Reata 220F)

-

Bennington (Bennington 23 L Series, Bennington 25 QX Series)

-

Manitou Group (Manitou Oasis 23 VP, Manitou Aurora LE 23 RF)

-

Sun Tracker Pontoon Boats (Sun Tracker Party Barge 22 DLX, Sun Tracker Fishin’ Barge 22 XP3)

-

Superior Pontoon (Superior 2200 Series, Superior 2400 Series)

-

G3 Boats (G3 Sun Catcher V22 DLX, G3 Angler V16 C)

-

Forest River (Forest River Sun Tracker Party Barge 24 DLX, Forest River Xpress XP7)

-

Tahoe (Tahoe 2150, Tahoe 2385)

-

Smoker Craft (Smoker Craft 162 Pro Angler, Smoker Craft 172 Pro Angler)

-

Larson Escape (Larson Escape 23′ Sport, Larson Escape 21′ LS)

-

Silver Wave (Silver Wave 2210 Island, Silver Wave 2300 SW6)

-

Crest Marine LLC (Crest Classic 220 SLR, Crest Savannah 230 SLR)

SUPPLIERS

-

Alcoa Corporation

-

3M

-

Owosso Motor Car Company

-

Huntsman Corporation

-

Hexcel Corporation

-

DuPont

-

Toray Industries

-

BASF

-

Johns Manville

-

Sika AG

RECENT TRENDS

-

In September 2024, the MasterCraft company displayed a positive performance, as it had strong revenue growth supported by strong demand in the product categories offered, such as pontoons. Even though MasterCraft faced some production and logistical challenges, it was still optimistic about its market position, focusing on developing product offerings and expanding its presence.

-

In August 2024, Winnebago Industries announced a new president to lead its operations. This move was part of the company's strategy to drive future growth, particularly within its motorhome and pontoon boat sectors, reinforcing Winnebago's commitment to maintaining its leadership position in the RV industry.

-

In June 2024, Manitou Pontoon Boats joined forces with NFL quarterback Kirk Cousins in a collaboration designed to enhance the boating experience. The combination focuses on bringing the energy of professional football into the recreation of pontoon boating. Endlessly enthused about boating, Kirk Cousins will feature Manitou Explore Switchback 24' MAX luxury, performance, and family-friendly features.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.68 Billion |

| Market Size by 2032 | US$ 17.27 Billion |

| CAGR | CAGR of 8.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Tube Type (Two-tube, Three-tube) • By Engine Horsepower (<100 HP, 100 HP to 200 HP, 200 HP to 300 HP, 300 HP to 400 HP, >400 HP) • By Size (Small, Medium, Large) • By Application (Recreational, Fishing, Water sports, Entertainment, Luxury) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Polaris, Winnebago Industries, Inc., Brunswick Corporation, BRP, Avalon Pontoon Boats, MasterCraft Boat Holdings, Envision Company, Sylvan Marine, White River Marine Group, Bennington, Manitou Group, Sun Tracker Pontoon Boats, Superior Pontoon, G3 Boats, Forest River, Tahoe, Smoker Craft, Larson Escape, Silver Wave, Crest Marine LLC. |

| Key Drivers | • Surge in Recreational Boating and Family-Friendly Appeal Drives Growth of the Pontoon Market • Rising Demand for Electric and Eco-Friendly Pontoons Drives Market Growth Amid Environmental Awareness |

| Restraints | • High Initial Costs of Pontoon Boats Limit Accessibility for Price-Sensitive Consumers |