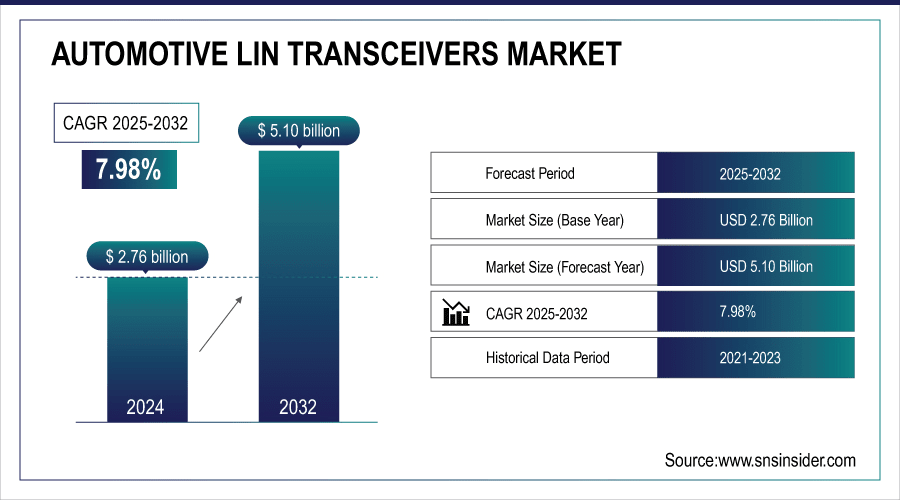

Automotive LIN Transceivers Market Size Analysis:

The Automotive LIN Transceivers Market size was valued at USD 2.76 Billion in 2024 and is projected to reach USD 5.10 Billion by 2032, growing at a CAGR of 7.98% during 2025-2032.

The Automotive LIN Transceivers market is growing rapidly due to rising demand for cost-effective in-vehicle networks, increasing vehicle electronics integration, and the expansion of electric and connected vehicles. Advances in system basis chips, microcontrollers, and transceiver ICs are enhancing safety, comfort, and infotainment functions. Technological innovation, efficiency improvements, and the push for smarter vehicle networks are driving adoption, positioning the market for significant growth and widespread deployment across automotive applications in the coming years.

August 21, 2025 – TDK Corporation received the highest “platinum” rating in the EcoVadis sustainability assessment for the first time, improving from gold in 2024, with top scores in environment, labor and human rights, ethics, and sustainable procurement.

To Get More Information On Automotive LIN Transceivers Market - Request Free Sample Report

Key Automotive LIN Transceivers Market Trends

-

Adoption of software-defined vehicles enhancing in-vehicle networking is driving market growth by reducing hardware-software complexity, improving scalability, lowering development costs, and boosting vehicle performance.

-

NXP Semiconductors’ acquisition of TTTech Auto (June 17, 2025) strengthens software-defined vehicle capabilities through CoreRide platform and MotionWise safety middleware, improving integration, scalability, cost-efficiency, and maintaining safety and data protection.

-

High implementation and production costs limit adoption, particularly among cost-sensitive vehicle manufacturers.

-

Complex integration with existing electronics and software, along with stringent safety and regulatory standards, further restrains deployment.

-

Rising demand for connected vehicles presents opportunities for low-power, high-reliability, and improved electromagnetic compatibility solutions.

-

Infineon TLE8457ALE LIN transceiver with low-power modes and enhanced electromagnetic compatibility improves performance and reliability of in-vehicle communication systems.

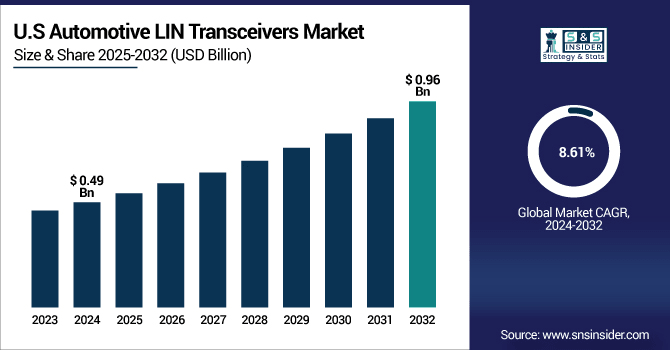

The U.S Automotive LIN Transceivers Market size was valued at USD 0.49 Billion in 2024 and is projected to reach USD 0.96 Billion by 2032, growing at a CAGR of 8.61% during 2025-2032. Automotive LIN Transceivers Market growth is driven by increasing adoption of in-vehicle electronics, rising demand for electric and connected vehicles, and advancements in system basis chips, microcontrollers, and transceiver ICs, enhancing safety, comfort, and infotainment functions.

The Automotive LIN Transceivers market Trends include increasing integration of electronics in vehicles, rising adoption of electric and connected vehicles, growing use of system basis chips and microcontrollers, focus on safety and infotainment features, advancements in transceiver IC technology, and emphasis on energy efficiency and cost-effective in-vehicle networking solutions driving smarter, more reliable automotive communication systems.

Automotive LIN Transceivers Market Growth Drivers:

-

Adoption and Growth of Software-Defined Vehicles Enhancing In-Vehicle Networking

The shift toward software-defined vehicles is driving the Automotive LIN Transceivers market by enabling advanced integration of safety and communication systems. This trend reduces hardware-software complexity, improves scalability, lowers development costs, and enhances overall vehicle performance, fueling demand for sophisticated in-vehicle networking solutions to support next-generation connected, autonomous, and intelligent automotive systems.

June 17, 2025 – NXP Semiconductors completed the acquisition of TTTech Auto to enhance software-defined vehicle capabilities, combining NXP’s CoreRide platform with TTTech’s MotionWise safety middleware to improve scalability, cost-efficiency, and integration while maintaining safety, performance, and data protection across an open automotive ecosystem.

Automotive LIN Transceivers Market Restraints:

-

High Costs and Complex Integration Limiting Market Adoption

The Automotive LIN Transceivers market is restrained by high implementation and production costs, which can limit adoption among cost-sensitive vehicle manufacturers. Additionally, complex integration of transceivers with existing vehicle electronics and software systems poses technical challenges, requiring specialized expertise. Stringent safety, performance, and regulatory standards further increase development timelines and expenses. These factors collectively slow the deployment of advanced in-vehicle networking solutions, particularly in smaller or budget-focused automotive segments, impacting overall market growth.

Automotive LIN Transceivers Market Opportunities:

-

Rising Demand for Connected Vehicles Drives Growth in Automotive LIN Transceivers

The rising demand for connected and software-defined vehicles creates a strong market opportunity for automotive LIN transceivers. Enhanced features like low-power operation, improved electromagnetic compatibility, and high reliability allow OEMs and suppliers to develop robust in-vehicle communication systems. This trend supports innovation in automotive networking solutions, offering potential for growth in performance, safety, and connectivity across next-generation vehicles.

Infineon unveiled the TLE8457ALE, a LIN transceiver with low-power modes and improved electromagnetic compatibility, enhancing performance and reliability in automotive in-vehicle communication systems.

Automotive LIN Transceivers Market Segment Highlights:

-

By Component – Dominating: Transceiver ICs (61.25% in 2024), Fastest: System Basis Chips (12.05% CAGR)

-

By Application – Dominating: Passenger Vehicles (69.88% in 2024), Fastest: Electric Vehicles (18.47% CAGR)

-

By Function – Dominating: Body Control & Comfort (38.25% in 2024), Fastest: Infotainment (10.15% CAGR)

-

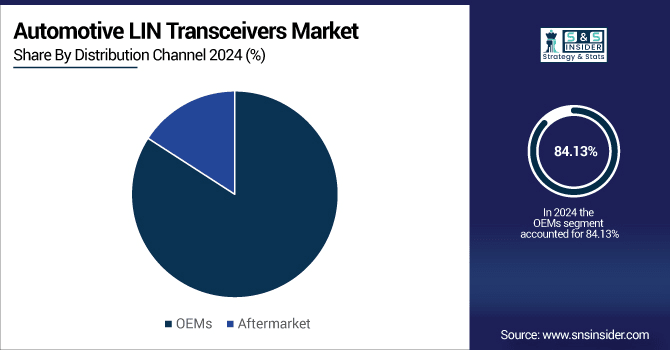

By Distribution Channel – Dominating: OEMs (84.13% in 2024), Fastest: Aftermarket (11.83% CAGR)

By Distribution Channel, OEMs Lead While Aftermarket Grow Fastest

OEMs lead the automotive LIN transceivers market, supplying integrated components directly to vehicle manufacturers, while the Aftermarket segment is growing fastest due to rising demand for upgrades, replacements, and enhancements in existing vehicles. This trend reflects the expanding opportunities for suppliers to cater to both new vehicle production and post-sale automotive electronics markets.

By Component, Transceiver ICs Leads Market While System Basis Chips Fastest Growth

Transceiver ICs dominate the automotive LIN transceivers market due to their widespread use in vehicle communication systems, while System Basis Chips are experiencing the fastest growth, driven by increasing demand for integrated and efficient in-vehicle networking solutions. This trend highlights the shift toward advanced, compact, and high-performance automotive electronics supporting next-generation connected vehicles.

By Application, Passenger Vehicles Leads Market While Electric Vehicles Fastest Growth

Passenger Vehicles dominate the automotive LIN transceivers market, reflecting their extensive adoption in conventional vehicles, while Electric Vehicles are witnessing the fastest growth due to rising EV production and the increasing need for advanced in-vehicle networking. This trend underscores the expanding role of LIN transceivers in supporting efficient, reliable, and connected vehicle systems across diverse automotive segments.

By End User Body Control & Comfort Dominate Infotainment Rapid Growth

Body Control & Comfort dominates the automotive LIN transceivers market, driven by the widespread integration of electronic control systems, while Infotainment is experiencing rapid growth due to increasing demand for connected, feature-rich in-vehicle entertainment and information systems. This trend highlights the rising importance of advanced communication technologies in enhancing both vehicle functionality and passenger experience.

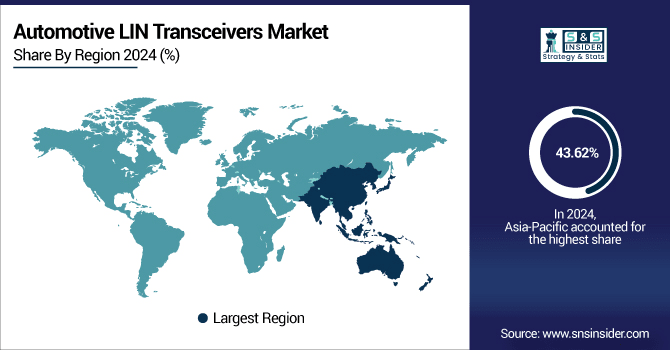

Automotive LIN Transceivers Market Regional Highlights:

-

By Region – Dominating: Asia-Pacific (43.62% in 2024), Fastest: North America (25.99% in 2024 to 29.44% in 2032, CAGR 9.67%)

-

Europe: 18.40% → 19.78% (CAGR 8.96%)

-

South America: 7.20% → 7.89% (CAGR 9.22%)

-

Middle East & Africa: 4.80% → 4.11% (CAGR 5.88%, declining)

Asia-Pacific Automotive LIN Transceivers Market Insights

The Asia-Pacific Automotive LIN Transceivers market dominates, driven by rapid vehicle production, increasing electric vehicle adoption, and widespread integration of in-vehicle electronics. Strong demand from the region, along with government initiatives supporting connected and software-defined vehicles, fuels market growth. This region remains a key hub for innovation and advanced automotive networking solutions.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

China Automotive LIN Transceivers Market Insights

China leads the Asia-Pacific Automotive LIN Transceivers market, due to its large automotive manufacturing base, rapid adoption of electric vehicles, and growing integration of in-vehicle electronic systems, driving strong demand and market expansion in the region.

North America Automotive LIN Transceivers Market Insights

North America is the fastest-growing Automotive LIN Transceivers market, driven by increasing adoption of connected and software-defined vehicles, rising demand for advanced in-vehicle networking, and strong automotive electronics innovation. Growth is supported by major OEMs investing in next-generation vehicle technologies, expanding production of electric and hybrid vehicles, and integrating high-performance LIN transceivers to enhance safety, reliability, and connectivity.

-

U.S. Automotive LIN Transceivers Market Insights

The U.S. Automotive LIN Transceivers market is experiencing rapid growth, due to rising adoption of connected vehicles, increasing electric vehicle production, and the integration of advanced in-vehicle communication systems.

Europe Automotive LIN Transceivers Market Insights

The Europe Automotive LIN Transceivers market is witnessing steady growth, driven by increasing demand for advanced driver-assistance systems, connected vehicles, and efficient in-vehicle communication networks. Strong automotive manufacturing in Germany, France, and the UK, coupled with regulatory support for vehicle electrification and smart mobility solutions, is fostering market expansion and encouraging OEMs to integrate high-performance LIN transceivers in next-generation vehicles.

-

Germany Automotive LIN Transceivers Market Insights

Germany dominates the European Automotive LIN Transceivers market, due to its strong automotive industry, high adoption of advanced vehicle electronics, and leadership in connected and electric vehicle technologies.

Latin America Automotive LIN Transceivers Market Insights

The Latin America Automotive LIN Transceivers market is expanding steadily, driven by growing vehicle production, increasing demand for automotive electronics, and rising adoption of connected vehicle technologies. Investments in automotive manufacturing in Brazil and Mexico, along with the integration of advanced in-vehicle communication systems, are supporting market growth and creating opportunities for suppliers to cater to both new and existing vehicles.

-

Brazil Automotive LIN Transceivers Market Insights

Brazil leads the Latin America Automotive LIN Transceivers, due to its large automotive industry, growing vehicle production, and increasing integration of advanced in-vehicle electronic systems.

Middle East & Africa Automotive LIN Transceivers Market Insights

The Middle East & Africa Automotive LIN Transceivers market is growing steadily, driven by increasing adoption of connected and luxury vehicles, rising demand for advanced in-vehicle electronics, and expanding automotive manufacturing in the region. Investments in smart mobility and vehicle safety systems are supporting market growth, creating opportunities for suppliers to provide high-performance LIN transceivers for next-generation automotive applications.

-

United Arab Emirates Automotive LIN Transceivers Market Insights

United Arab Emirates leads the Middle East Automotive LIN Transceivers market due to rising luxury vehicle adoption and growing demand for connected in-vehicle electronics.

Competitive Landscape for Automotive LIN Transceivers Market:

Texas Instruments is a global semiconductor leader specializing in analog and embedded processing solutions. Founded in 1930 and headquartered in Dallas, Texas, the company designs and manufactures innovative products for automotive, industrial, personal electronics, and communication markets, focusing on high-performance, energy-efficient, and reliable semiconductor technologies worldwide.

-

In 2024, Texas Instruments – TLIN2024A-Q1 Quad LIN Transceiver TLIN2024A-Q1 integrates dual LIN transceiver blocks with wake-up, fault protection, and ultra-low power sleep mode, supporting 12V/24V applications, LIN data rates up to 100kbps, and a wide 4–48V supply, ensuring reliable, safe, and efficient in-vehicle communication for automotive networks.

STMicroelectronics is a global semiconductor leader headquartered in Geneva, Switzerland, specializing in microelectronics and MEMS technologies. Founded in 1987, the company provides innovative solutions for automotive, industrial, and consumer electronics, focusing on energy efficiency, safety, and connectivity. STMicro drives technological advancements through integrated circuits, sensors, and microcontrollers worldwide.

-

In July 2025, STMicroelectronics Acquires Part of NXP Semiconductors’ Sensor Business STMicroelectronics announced the acquisition of a portion of NXP Semiconductors’ sensor business for up to USD 950 million, including an initial payment of USD 900 million and USD 50 million contingent on technical milestones, aiming to strengthen its MEMS-based sensor portfolio in automotive and industrial applications.

Automotive LIN Transceivers Companies are:

-

NXP Semiconductors N.V.

-

Texas Instruments Incorporated

-

ON Semiconductor Corporation

-

STMicroelectronics N.V.

-

Renesas Electronics Corporation

-

Analog Devices, Inc.

-

Maxim Integrated Products, Inc.

-

Rohm Semiconductor

-

Melexis NV

-

Elmos Semiconductor AG

-

Diodes Incorporated

-

Broadcom Inc.

-

Qualcomm Technologies, Inc.

-

Toshiba Corporation

-

Continental AG

-

Robert Bosch GmbH

-

Denso Corporation

-

Valeo S.A.

| Report Attributes | Details |

| Market Size in 2024 | USD 2.76 Billion |

| Market Size by 2032 | USD 5.10 Billion |

| CAGR | CAGR of 7.98% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component(Transceiver ICs, Microcontrollers and System Basis Chips) • By Application(Passenger Vehicles, Commercial Vehicles and Electric Vehicles) • By Function(Body Control & Comfort, Powertrain, Infotainment and Safety & Security) • By Distribution Channel(OEMs and Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Infineon Technologies AG, NXP Semiconductors N.V., Texas Instruments Incorporated, ON Semiconductor Corporation, Microchip Technology Inc., STMicroelectronics N.V., Renesas Electronics Corporation, Analog Devices, Inc., Maxim Integrated Products, Inc., Rohm Semiconductor, Melexis NV, Elmos Semiconductor AG, Diodes Incorporated, Broadcom Inc., Qualcomm Technologies, Inc., Toshiba Corporation, Continental AG, Robert Bosch GmbH, Denso Corporation, Valeo S.A. |