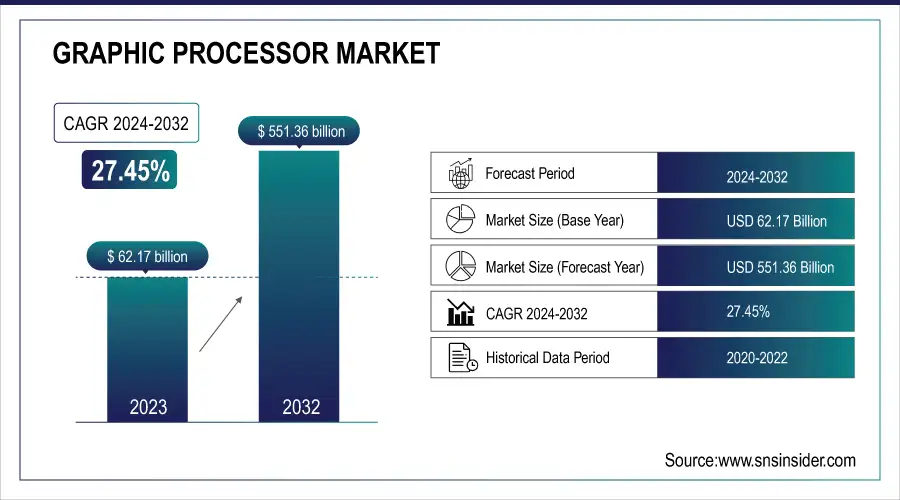

Graphic Processor Market Size & Growth:

The Graphic Processor Market was valued at 62.17 Billion in 2023 and is projected to reach USD 551.36 Billion by 2032, growing at a CAGR of 27.45 % from 2024 to 2032. This growth is primarily driven by the rising demand for high-performance GPUs in gaming, artificial intelligence (AI), data centers, and edge computing.

The rapid evolution in gamer behavior, including increasing interest in immersive graphics and real-time rendering, is pushing demand for advanced GPUs. Additionally, GPUs are becoming central to AI workloads, particularly for deep learning and inference applications. Innovations in portability and compact form factors such as mobile GPUs and external GPU solutions are expanding their presence in the consumer and enterprise space. Security and reliability have also become critical, as modern GPUs are increasingly integrated into systems requiring encrypted memory, secure boot processes, and robust thermal design. These factors collectively underscore the GPU market’s dynamic trajectory and transformative impact across sectors.

To Get more information on Graphic Processor Market - Request Free Sample Report

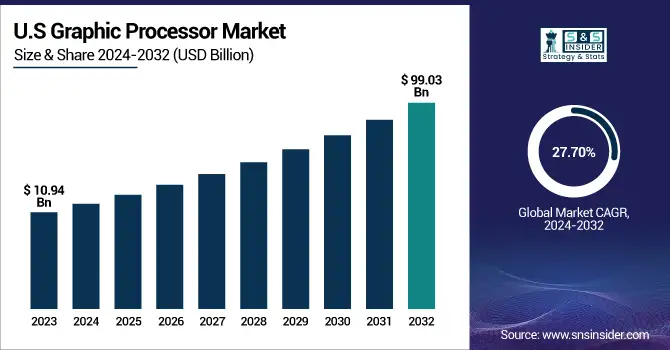

In the United States the market was valued USD 10.94 billion in 2023 and is projected to reach to USD 99.03 billion by 2032, reflecting a slightly higher CAGR of 27.70%.

Graphic Processor Market Dynamics:

U.S. tariffs could disrupt the graphic processor market, driving up prices and supply chain issues.

The U.S. semiconductor industry, especially the graphics processing unit (GPU) sector, faces uncertainty due to new tariffs imposed on Chinese imports. While GPUs were initially exempt from recent tariff announcements, this could change as the U.S. government revises its tariff framework. Previously, tariffs on Chinese-made GPUs and related components, including motherboards and SSDs, were temporarily suspended, but new rules under Executive Order 14257, effective April 2025, introduce higher rates. This order introduces a 54% tariff on Chinese goods and 46% on Vietnamese imports, which could significantly impact the GPU market. Companies like AMD, Nvidia, and TSMC, which rely on Chinese manufacturing, may face increased costs, potentially driving up GPU prices in the U.S. The situation remains fluid, with concerns about rising production costs and stock volatility among these companies, especially after Trump’s remarks on imposing steep penalties on companies not investing in U.S.-based manufacturing. The increased tariffs, alongside ongoing geopolitical tensions, could disrupt supply chains and affect the pricing and availability of GPUs, particularly in the gaming and AI sectors, while incentives like the CHIPs Act aim to bolster domestic production in the long term.

Drivers:

-

Fueling the Future of Gaming through the Impact of Competitive Gaming and Open-World Games on GPU Demand

The increasing popularity of competitive gaming (esports) and graphically intensive, open-world games has significantly boosted demand for high-performance GPUs. As esports grows into a multi-billion-dollar industry, gamers and professional teams require top-tier GPUs to deliver smooth gameplay, high frame rates, and real-time rendering. Open-world games, with their intricate details and expansive environments, also demand powerful GPUs for seamless graphics. This shift in gaming trends, with a focus on hyper-realistic visuals and fast-paced gameplay, has accelerated the need for advanced GPU technologies. The market for GPUs is expanding rapidly as consumers and developers prioritize hardware capable of supporting these intensive gaming experiences.

Restraints:

-

Navigating the Energy Demands of High-Performance GPUs in Gaming and AI

High-performance GPUs, especially those used in gaming and AI applications, consume a significant amount of power, which drives up operational costs in data centers and gaming PCs. These energy requirements, needed for performing computations to tackle difficult problems and render impressive graphics, present problems for environmental sustainability. However, the time of powerful graphics card per capita is rolling, as the need for power-hungry GPUs is rising and the mantle is on the developers of energy-saving techniques and cooling systems that do not allow a huge cost of electricity and environmental damage from ultra-performative hardware models.

Opportunities:

-

Autonomous Vehicles and Esports Expansion Shaping the Future

The autonomous vehicle sector presents a major opportunity for the Graphics Processor Market, as GPUs are essential for processing sensor data and enabling real-time decision-making algorithms. The shift toward self-driving cars is increasing the demand for powerful GPUs. Furthermore, the esports industry is experiencing significant growth, driven by a young fan base, with 38% of fans aged 16-24 who will financially support the sector as they mature. Combined with the gaming industry's expansion, this growth supports the GPU market's potential. Edge AI computing, crucial for autonomous vehicles, requires processing data locally, enabling real-time predictions and decision-making without reliance on cloud resources. Latency is critical, as data processing in under 3ms is necessary for safety and reliability in real-time operations, such as detecting obstacles at high speeds.

Challenges:

-

The growing performance of integrated graphics is challenging discrete GPU demand, especially in entry-level markets.

As integrated graphics on CPUs continue to improve in performance, particularly for tasks such as gaming and light computational workloads, some consumers are opting for integrated solutions instead of investing in discrete GPUs. This shift has the potential to impact the demand for standalone graphic processors, particularly in budget-conscious segments where integrated graphics offer sufficient performance. While discrete GPUs remain essential for high-end gaming, AI applications, and professional workloads, the increasing efficiency of integrated graphics could limit their adoption in more casual or everyday computing scenarios. Consequently, GPU manufacturers must innovate continuously to differentiate their products and maintain demand in a competitive market, especially as integrated graphics improve in both performance and power efficiency. This growing competition challenges the traditional dominance of discrete GPUs, particularly for entry-level and mid-tier markets.

Graphic Processor Industry Segment Analysis:

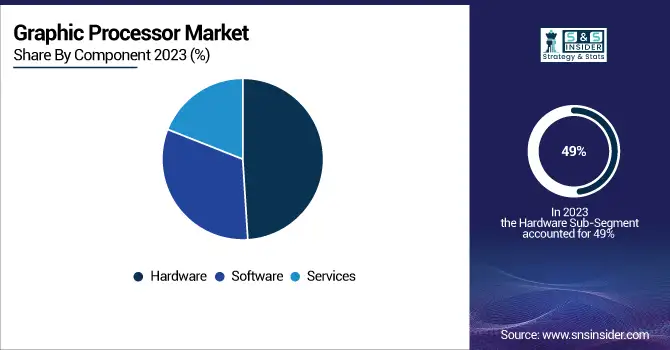

By Component

The hardware segment dominates the graphics processor market, contributing a significant share of 49% to the overall revenue in 2024. This is driven by the increasing demand for powerful, high-performance GPUs in gaming, AI workloads, and data centers. As consumer preferences lean toward more immersive gaming experiences and as industries adopt AI-driven applications, the need for advanced hardware accelerates. Graphics cards are essential in handling complex visual processing tasks and computational workloads, making them critical in sectors like gaming, automotive, and healthcare. Additionally, the push for higher resolution and real-time rendering in various applications further bolsters hardware demand, solidifying its leading position in the market. The growth in gaming and AI applications, alongside increasing device usage, fuels the hardware segment’s continued dominance.

The services segment in the graphics processor market is expected to experience the fastest growth from 2024 to 2032, mainly because of the growing adoption of GPU-as-a-Service (GPUaaS) and cloud-centric GPU solutions. The demand for GPU cloud services is booming, especially for powerful computing resources in industries like gaming, AI, and data analytics. That segment benefits from the proliferation of remote computing, as businesses and consumers alike tap into the cloud for high-performance graphics rendering and AI model training. Another factor that is a catalyst for the growth of this market is the demand for efficient and affordable solutions, especially for companies that do not want to spend on their in-house GPU hardware. The growing adoption of cloud gaming, edge computing, and machine learning applications complements this acceleration in the service segment.

By Type

The integrated graphics segment dominates the graphics processor market, accounting for 54% of the total revenue in 2023. This is primarily due to the growing demand for cost-effective and energy-efficient solutions. Integrated graphics, embedded within CPUs, offer adequate performance for basic gaming, multimedia applications, and general computing needs, making them popular among budget-conscious consumers. The segment is seeing increased adoption in laptops, desktops, and mobile devices as manufacturers focus on providing all-in-one solutions. Additionally, integrated graphics benefit from ongoing advancements in CPU architectures, which continuously improve their processing power, making them suitable for a wider range of applications. The combination of affordability and improved performance positions integrated graphics as a dominant player in the market.

The hybrid graphics segment is experiencing the fastest growth in the graphics processor market between 2024 and 2032. Hybrid GPUs combine the benefits of integrated and discrete graphics, offering enhanced performance while maintaining power efficiency. This makes them an ideal choice for devices that require both high computational power and energy conservation, such as gaming laptops, ultra-books, and mobile workstations. As gaming and AI applications continue to demand more graphics power, hybrid solutions are becoming increasingly popular, allowing users to toggle between power-efficient integrated graphics and more powerful discrete GPUs. The growing adoption of hybrid configurations, particularly in portable devices, is driving the segment's rapid growth during this period.

By Deployment

The cloud segment dominated the graphics processor market in 2023, accounting for a significant 52% of total revenue. This dominance is largely driven by the increasing adoption of cloud gaming, cloud-based AI workloads, and edge AI processing, which require high-performance GPUs. As businesses and consumers move towards cloud solutions for flexibility, scalability, and cost-effectiveness, the demand for powerful GPUs in the cloud continues to rise. Cloud gaming, in particular, is seeing rapid growth as users opt for remote gaming experiences without the need for high-end hardware on their personal devices. Furthermore, cloud-based AI applications, ranging from machine learning to deep learning, rely heavily on GPUs to process massive datasets. The segment is expected to experience the fastest growth over the forecast period from 2024 to 2032, with increased investments in cloud infrastructure and a surge in demand for GPU-powered services.

By Application

The consumer electronics segment dominated the graphics processor market in 2023, accounting for 39% of the total revenue. This segment's strong performance is driven by the increasing integration of high-performance GPUs in devices such as smartphones, tablets, smart TVs, and wearable technology. As consumer demand for enhanced visual experiences grows, particularly in gaming, streaming, and augmented reality (AR), the role of GPUs has become crucial in delivering superior graphics and processing power. The continuous advancements in display technologies, such as 4K and 8K resolutions, also contribute to the rising demand for high-end GPUs in consumer devices. The segment is expected to continue dominating the market, with the rapid evolution of consumer electronics fueling the demand for more powerful and efficient graphic processors in the coming years.

The Media & Entertainment segment is expected to experience the fastest growth in the graphics processor market from 2024 to 2032. The Art of Best Graphics Transformation The rapid growth of streaming services, video production, virtual reality (VR), and augmented reality (AR) is the primary driver of this growth. As the content creators increasingly push for more immersive experiences, demand for advanced GPUs to process high-definition content, special effects, and real-time rendering is on the rise. In addition, the growth of 4K and 8K video formats, along with the proliferation of VR/AR technologies in gaming and entertainment all contribute to driving this demand. Technological developments: The availability of platforms that allow for special interactive content like e-sports, gaming consoles, and virtual event experiences also drive the need for powerful graphics processing units (GPUs) to deliver high-quality visual experiences to consumers. Expect this trend to persist as the entertainment industry is adopting the latest technology.

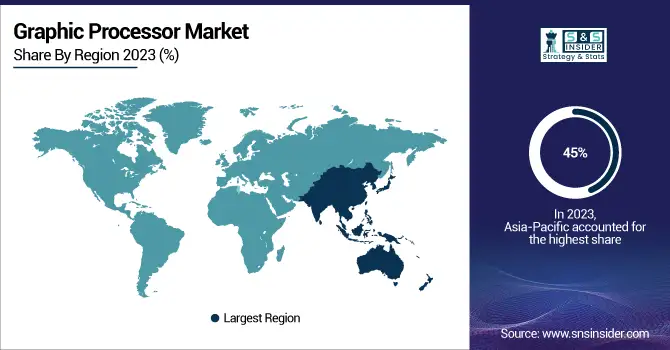

Graphic Processor Market Regional Outlook:

In 2023, the Asia-Pacific region dominated the global graphics processor market with an estimated revenue share of around 45%, driven by rapid technological adoption, expanding gaming communities, and robust electronics manufacturing capabilities. Countries like China, Japan, South Korea, and Taiwan are at the forefront of GPU development and integration, with China and Taiwan playing critical roles in semiconductor manufacturing and chip design. South Korea's strong electronics sector and Japan’s innovation in imaging and automotive systems further contribute to GPU demand. The region also has a booming consumer base for high-end gaming and mobile devices, pushing manufacturers to produce more advanced graphics processors. Government initiatives, such as China’s “Made in China 2025” and South Korea’s investments in AI and smart mobility, further accelerate GPU market growth. The increasing popularity of e-sports, online streaming, and digital content creation across the region amplifies the need for high-performance GPUs, solidifying Asia-Pacific’s leadership position in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America is projected to be the fastest-growing region in the graphics processor market over the forecast period 2024–2032, driven by the rapid adoption of AI, machine learning, autonomous vehicles, and high-performance gaming. The U.S. is a global hub for technological innovation, housing major GPU developers like NVIDIA, AMD, and Intel. Increased investments in data centers, cloud computing, and defense applications further boost demand. Additionally, the growing popularity of esports and immersive digital content fuels GPU adoption across consumer and enterprise segments.

Key Players Listed in the Graphic Processor Market are:

-

NVIDIA Corporation (USA) – Discrete GPUs (GeForce, Quadro), AI & data center processors

-

Advanced Micro Devices, Inc. (AMD) (USA) – Radeon GPUs, APUs, custom graphics chips

-

Intel Corporation (USA) – Integrated GPUs (Iris Xe), discrete Arc GPUs

-

Qualcomm Technologies, Inc. (USA) – Adreno GPUs for mobile and embedded systems

-

Samsung Electronics Co., Ltd. (South Korea) – Integrated GPUs for Exynos chipsets

-

Imagination Technologies Group plc (UK) – PowerVR GPUs for mobile and automotive

-

VIA Technologies, Inc. (Taiwan) – Integrated graphics processors for embedded systems

-

Matrox Electronic Systems Ltd. (Canada) – Multi-display and video wall GPUs

-

IBM (USA) – Custom graphics and AI accelerators

-

ARM Limited (UK) – Mali GPUs for mobile and embedded platforms

-

Silicon Integrated Systems Corp. (SiS) (Taiwan) – Integrated graphics chipsets for PCs

-

Broadcom Inc. (USA) – Graphics and multimedia processors for embedded systems

-

Xilinx, Inc. (USA) – FPGA-based graphics accelerators and embedded solutions

List of Suppliers who Provide Raw Material and component in Graphic Processor Market:

-

TSMC

-

ASML

-

Applied Materials

-

Tokyo Electron

-

SUMCO Corporation

-

Shin-Etsu Chemical Co., Ltd.

-

GlobalWafers

-

Linde plc

-

Heraeus Holding

-

Micron Technology

-

SK hynix

-

Samsung Electronics

-

UMC (United Microelectronics Corporation)

Recent Development:

-

7 JAN 2025, NVIDIA introduces GeForce RTX 5090 with groundbreaking AI capabilities for PC gaming. Built on the Blackwell architecture, it delivers 92 billion transistors and over 3,352 TOPS, setting a new standard in GPU performance.

-

14 Aug 2024, Intel unveils Arc A760A GPU to power next-gen autonomous and connected vehicles. Built on Arc-Alchemist architecture, it delivers up to 229 TOPS of AI power and 14 TFLOPS performance for automotive applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 62.17 Billion |

| Market Size by 2032 | USD 551.36 Billion |

| CAGR | CAGR of 27.45% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Type (Integrated, Discrete, Hybrid) • By Deployment (On-premise, Cloud) • By Application (Consumer Electronics, IT & Telecommunication, Healthcare, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NVIDIA Corporation (USA), Advanced Micro Devices, Inc. (AMD) (USA), Intel Corporation (USA), Qualcomm Technologies, Inc. (USA), Samsung Electronics Co., Ltd. (South Korea), Imagination Technologies Group plc (UK), VIA Technologies, Inc. (Taiwan), Matrox Electronic Systems Ltd. (Canada), IBM (USA), ARM Limited (UK), Silicon Integrated Systems Corp. (SiS) (Taiwan), Broadcom Inc. (USA), Xilinx, Inc. (USA). |