Cable Cars and Ropeways Market Report Scope & Overview

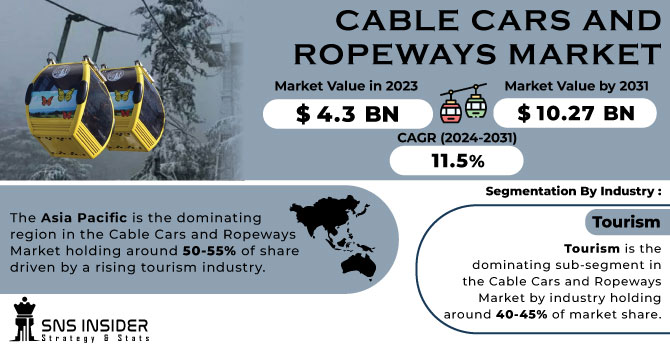

The Cable Cars and Ropeways Market Size was valued at USD 4.3 Million in 2023 and is expected to reach USD 10.27 Million by 2031 and grow at a CAGR of 11.5% over the forecast period 2024-2031.

The cable car and ropeway market caters to the design, production, and management of cable-driven transport systems like gondolas and aerial tramways. These eco-friendly networks connect cities, tourist destinations, and challenging terrains. Experts focus on engineering, planning, and safety to create efficient and dependable systems.

Get more information on Cable Cars and Ropeways Market - Request Sample Report

They consider factors like speed, capacity, and environmental impact while adhering to strict safety regulations. Quality hinges on integrating technology, sustainability, and safety. Manufacturers prioritize energy-efficient components, user experience through design, and minimal environmental footprint. This market reflects a shift towards sustainable urban mobility. Cable cars' low land use, energy efficiency, and reduced noise pollution make them attractive for both cities and mountainous areas. Government support for green infrastructure and growing eco-consciousness are expected to propel this trend. Innovation in electric propulsion, automation, and digitization is enhancing the experience, safety, and operational efficiency of these systems. These advancements are crucial for attracting new investors and sustaining market growth.

MARKET DYNAMICS:

KEY DRIVERS:

-

Cable cars are becoming popular tourist attractions, offering beautiful views and exciting rides for visitors.

Cable cars have become a major attraction in tourism and recreation. Tourists and adventure seekers crave unique experiences and stunning views. Cable car rides offer exactly that, soaring above landscapes and providing breathtaking panoramas. This popularity has led to the construction of cable car networks in beautiful locations around the world. These attractions not only enhance the tourism experience but also boost local economies by creating new revenue streams.

-

Technological Advancements in Cable Cars and Ropeways Boost Passenger Experience, Safety, and Market Growth

RESTRAINTS:

-

High Upfront Investment Costs Hinder Cable Car and Ropeway Market Expansion

A major hurdle for the cable car and ropeway market is the high initial cost. Building the infrastructure, implementing new technologies, and ensuring compliance with regulations all require significant upfront investment. This financial burden can discourage potential investors and limit the construction of new cable car systems. Thus, the overall market revenue growth can be delayed by the limited expansion of these transportation networks.

-

Unfavourable Weather Conditions creates problems for Cable Car and Ropeway Operations

OPPORTUNITIES:

-

Cable Car and Ropeway Systems Partner with Tourism for Revenue Growth Through Scenic Experiences

-

Technological Solutions Drive Revenue Growth in Evolving Cable Car and Ropeway Market

CHALLENGES:

-

High upfront costs for infrastructure, technology, and regulation compliance deter new investors.

-

Disruptions from bad weather like strong winds or heavy snowfall can halt operations and hurt ridership.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has disrupted the Cable Car and Ropeways Market in several ways. It disrupts the supply chain for key materials and components. Many cable car manufacturers rely on specific metals, electronics, and construction materials that may be sourced from or manufactured in regions impacted by the war. This can lead to delays in production, project timelines, and potentially increased costs due to fluctuations in material availability. Thus, there is seen a 10-15% rise in material costs due to the war. The war dampens investor confidence. The overall economic uncertainty and sanctions imposed on Russia can make investors hesitant to commit to large-scale infrastructure projects like new cable car systems. This could lead to a slowdown in new project announcements and market expansion.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can disrupt the Cable Car and Ropeways Market in several ways. It can lead to reduced government spending on public transportation infrastructure, potentially stalling the development of new cable car systems. This is further compounded by a decline in ridership as people, facing tighter budgets, may opt for cheaper travel options or utilize personal vehicles more frequently. The is a potential decrease in ridership by 5-10% during economic downturns. This translates to lower revenue for cable car operators, making them hesitant to invest in upgrades or new systems. With job cuts and reduced disposable income, tourist activity, a significant driver of revenue in scenic locations, may decline. This can particularly impact cable car networks in popular tourist destinations.

KEY MARKET SEGMENTS:

By Industry

-

Tourism

-

Material Handling

-

Public transportation

-

Mining industries

Tourism is the dominating sub-segment in the Cable Cars and Ropeways Market by industry holding around 40-45% of market share. The tourism industry heavily utilizes cable cars and ropeways to provide scenic transportation experiences and access to breathtaking locations. This segment thrives on leisure travel and adventure activities, generating significant revenue for cable car operators.

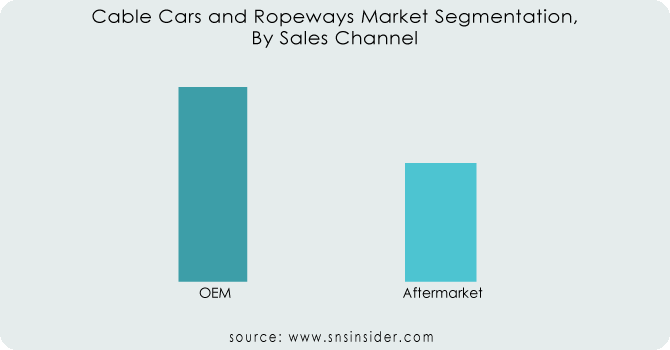

By Sales Channel

-

OEM (Original Equipment Manufacturer)

-

Aftermarket

OEM (Original Equipment Manufacturer) is the dominating sub-segment in the Cable Cars and Ropeways Market by sales channel holding around 55-60% of market share. OEMs design, manufacture, and supply new cable car and ropeway systems. This segment represents the initial investment for new infrastructure projects and plays a crucial role in driving market growth.

Get Customized Report as per your Business Requirement - Ask For Customized Report

By Type

-

Fixed grip installations

-

Drag lifts

-

Fixed grip chairlifts

-

Pulsed gondola ropeways

-

Detachable installations

-

Detachable chairlifts

-

Mono cable detachable gondola lifts

-

Telemix combined detachable chairlift and gondola lift

-

Bicable (2S) & Tricable (3S) Gondola lifts

-

Aerial tramway

-

Funicular

Detachable Chairlifts is the dominating sub-segment in the Cable Cars and Ropeways Market by type holding around 30-35% of market share. Detachable chairlifts offer a balance between affordability, capacity, and passenger comfort. They are well-suited for various applications, including tourism and skiing, making them a popular choice for operators.

REGIONAL ANALYSES

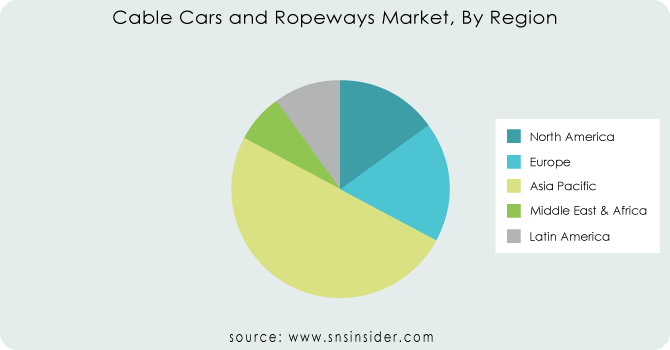

The Asia Pacific is the dominating region in the Cable Cars and Ropeways Market holding around 50-55% of share, driven by a rising tourism industry. Scenic locations leverage cable cars as unique travel experiences, while government investments in public transportation and ski resorts create opportunities for new installations.

Europe holds the second-highest region in this market capitalizing on its established winter sports tradition and mountain tourism focus. A mature cable car infrastructure, particularly concentrated in the Alps, positions Europe as a leader.

North America is the fastest growing region with the growth rate of 5-8%. The congested cities are exploring cable cars to improve public transportation efficiency. The environmental benefits of cable cars, including lower energy consumption, are gaining traction in North America.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Damodar Ropeways, Vergokan, Bullwheel International Cable Car Top, Doppelmayr/Garaventa Group, Kreischberg Cableways, Dubrovnik Cableways Pvt Ltd, Kropivnik Cableways Pvt Ltd and other key players.

Doppelmayr/Garaventa Group-Company Financial Analysis

RECENT DEVELOPMENTS

-

In Aug. 2023: Doppelmayr, a leading cable car manufacturer, announced the successful installation of a new eight-seater gondola lift in Choquequirao, Peru. This new system aims to improve accessibility and boost tourism for this historical Inca site.

-

In May 2024: Leitner Poma, another major industry player, introduced a revolutionary high-speed detachable gripper technology for cable car systems. This innovation promises faster speeds, increased passenger capacity, and enhanced operational efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.3 Million |

| Market Size by 2031 | US$ 10.27 Million |

| CAGR | CAGR of 11.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Industry (Tourism, Material Handling, Public transportation, Mining industries) • By Sales Channel (OEM, Aftermarket) • By Type (Fixed grip installations, Drag lifts, Fixed grip chairlifts, Pulsed gondola ropeways, Detachable installations, Detachable chairlifts, Mono cable detachable gondola lifts, Telemix combined detachable chairlift and gondola lift, Bicable (2S) & Tricable (3S) Gondola lifts, Aerial tramway, Funicular) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Damodar Ropeways, Vergokan, Bullwheel International Cable Car Top, Doppelmayr/Garaventa Group, Kreischberg Cableways, Dubrovnik Cableways Pvt Ltd, Kropivnik Cableways Pvt Ltd |

| Key Drivers | • Increasing urban transportation utilization is predicted to fuel the growth of the market. • Ropeway safety and reliability are projected to drive the market during the forecast period. |

| RESTRAINTS | • The extended payback time period of cable cars is expected to hinder the growth of the market. • Ropeway construction necessitates complex structural technologies. |