AUTOMOTIVE RAIN SENSOR MARKET REPORT SCOPE & OVERVIEW:

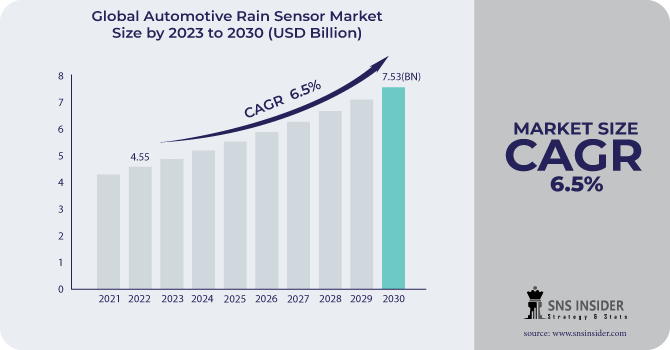

The Automotive Rain Sensor Market was valued at USD 4.38 billion in 2023 and is expected to reach USD 7.81 billion by 2032, growing at a CAGR of 6.67% over the forecast period 2024-2032.

An increase in demand for high-end vehicle safety and comfort features will act as the key growth driving factor of the automotive rain sensor market. As more and more consumers become aware of safety while driving and the convenience of drivers, demand for vehicles equipped with features such as rain sensors that make uncomfortable conditions more bearable in adverse weather conditions is also increasing. This means a wiper can make itself go faster or slower according to the amount of rain falling outside, keeping the driver in a clearer effort in heavy rain. Secondly, the high proliferation of advanced driver-assistance systems (ADAS) that require rain sensors to bring visibility and control to the vehicle in such situations is another contributing factor fuelling the market growth. More than 30% of new passenger vehicles worldwide were fitted with rain sensors in 2023 as part of an advanced driver assistance system (ADAS). About 45% of annual sales of electric vehicles featured rain-sensing systems as they became more integrated with safety technologies. In Asia-Pacific, more than 70 Billion rain-sensing wipers appeared on cars produced in 2023 and in North America, nearly 40% of mid-range and premium vehicles offered the feature as standard. European surveys have found that over 60% of car buyers value rain-sensing wipers highly when selecting a vehicle.

Get more information on Automotive Rain Sensor Market - Request Sample Report

The production of electric vehicles (EVs) and the growing automotive production on a global scale also support the growth of the market. As a part of the overall plan to improve vehicle function and experience, rain sensors are more commonly manufactured in EVs and also traditional vehicles. The need for new vehicles with safety technology is on the rise in Asia Pacific, especially China and India, owing to higher disposable incomes and regulatory pressure for the improvement of vehicle safety. Technological advancements in sensor technologies are further augmenting the market growth by increasing the efficiency and cost-efficiency of the rain sensors which is encouraging the widespread adoption of rain sensors. There was a total of 13.7 Billion EVs produced around the world in 2023, with 7.6 Billion of those (or 55.5% of total EVs) produced in China. In 2024, EV production will hit 17.5 Billion units or a 27% year-over-year growth. While India saw an 8.3% increase in passenger vehicle production for 2023, 80% of EVs in China donned ADAS inclusions such as rain sensors. In the US, 60% of premium passenger cars manufactured in 2023 were equipped with rain sensors.

MARKET DYNAMICS

KEY DRIVERS:

-

Rising Demand for Electric Vehicles Driving Growth in Rain Sensors and Advanced Automotive Safety Features

The increasing emphasis on environmental sustainability and electric vehicles (EVs) is one of the major factors driving the automotive rain sensor market. With the world becoming more and more environmentally conscious, governments are enforcing stricter emissions regulations and administrating the adoption of cleaner technologies in the form of EVs. With the world moving to EVs, manufacturers are integrating rain sensors and other types of advanced safety features into these vehicles to offer more efficiency and effective consumer buying. Amid this development, the pace of EV adoption is seeing its steepest rise in regions around Europe and parts of Asia where governments have committed to EVs through incentives and environmental legislation. With the increasing number of electric and hybrid vehicles, the market for rain sensors provides clear growth potential as this technology is one of the ways to optimize and enhance wiper performance and safety on the road. BEVs and PHEVs represented 23% of new car registrations in the EU last year, with their split at 15% and 8% respectively. BEVs were first in Norway with 83% of new car sales, while Germany, France, and Norway accounted for 54% of EU BEV registrations. Europe had 630,000 public EV charging points, up over 100% from 2021. In 2023, China surpassed 7 Billion EVs produced to retain its pole position globally, putting the target of 30% electrification of new vehicle sales by 2030 within the reach of the Indian government through various incentives.

-

Rising Investment in Autonomous Vehicles Driving Demand for Advanced Rain Sensors and Sensor Technologies

The other major driver is the growing need for investments in autonomous and semi-autonomous driving. Thus, rain sensors are essentially an important part of the autonomous sensors, pushing them to perform at their best whenever the visibility threshold goes down due to rain. With the continued development of self-driving vehicles by both automakers and technology companies, rain sensors represent an integral element of the wider range of sensor, camera, and radar-based technology required for safe autonomous performance. The demand for rain sensors is caused by the development of autonomous driving activities, particularly in North America and Europe. Windscreen wipers can also be set to automatically adjust the speed at which they operate in response to the amount of rainfall, using sensors that go a long way in reducing the need for human involvement by improving visibility and enabling autonomous vehicles to run smoothly even under fluctuating weather conditions. Total investment in Level 4/5 autonomous vehicles grew above USD 5 billion in 2023, with USD 2 billion more for Level 3 highway applications. We also saw more than 1,400 self-driving cars tested on U.S. roads and given the green light in certain states California came out on top in deployments. In Europe, about 20 Billion vehicles that were produced in 2023 incorporated ADAS incorporating rain sensors due to regulatory pressures to have additional safety features by 2024 (the cars produced in 2023 were required to meet/comply with the 2024 mandates). Sensor technology alone is expected to achieve margins above 15% and combined with AV software systems represent some of the most valuable systems (in terms of margin) in a vehicle.

RESTRAIN:

-

Challenges in Adoption of Rain Sensors Due to Cost Compatibility and Environmental Impact on Performance

An important limitation comes in cost: the price of new vehicle models will likely increase due to the high cost of advanced sensor systems. That can be especially difficult in places where pricing is king for buying decisions, such as emerging markets. Furthermore, the coupling of rain sensors with other sophisticated tech, for example, autonomous driving, demands extensive research and development funding, which can restrict adoption in frugal markets. Additionally, rain sensor technologies are not standard, which makes it a challenge. Though several manufacturers offer alternative sensor solutions, variability in reliability and compatibility with other vehicle systems can hinder widespread adoption. What's more, environmental conditions like coated dirt, snow, or ice will accumulate on sensors disrupting their functionality thereby changing the intended experience provided to the user. That might be fine for nice days but can be a bit problematic for reliability, at least in areas of extreme weather.

KEY MARKET SEGMENTS

BY VEHICLE TYPE

In 2023, passenger cars accounted for the largest market share of around 71.2% in terms of application contributing to the global automotive rain sensor market however, the segment is anticipated to grow at the fastest CAGR during the forecast period ranging from 2024 to 2032. The key factors that contribute to this when it comes to comfort, safety, and technological adoption and advancement are some of the most common reasons why these designs dominate. Manufacturers are also eyeing the integration of rain sensors, which sense the amount of raindrop intensity and adjust wiper speeds as per the requirement, as a part of the advanced driver-assistance systems (ADAS) that consumers are increasingly prioritizing for safer and comfortable driving. The increasing consumer awareness regarding the advantages of active safety features is driving this trend in North America, Europe, and other countries that want to enhance vehicle safety. Additionally, the expansion of passenger vehicle production around the world, particularly electric and hybrid cars, drives this phenomenon even further. Growth of the passenger car segment will be further driven by strong demand for smart vehicle technologies enabling amenities such as rain sensors in newer models across the automotive sector. Such innovations as adaptive wipers that change with the weather and better sensor performance even in severe weather are making these sensors attractive. Moreover, the increasing regulatory nudge for safer vehicles with automated systems is fuelling the widespread adoption of rain sensors which will continue to drive their growth in the passenger car segment.

BY CHANNEL TYPE

The OEM segment generated a significant share of about 61.4% in 2023, as these components are a part of new vehicle production. OEM rain sensors are installed on vehicles from the manufacturing stages, which provides seamless integration and compatibility with vehicle systems, such as advanced driver-assistance systems (ADAS). OEMs account for a large majority of the market share due to increased adoption by automakers of offering high-tech features, such as rain sensors, as standard equipment in new vehicles, in response to consumer preferences for increased safety and convenience.

The Aftermarket segment is forecasted to grow at the fastest CAGR between 2024 and 2032. The growth in the automotive aftermarket is due to a growing need for existing vehicles to be upgraded, repaired, or replaced, especially in large vehicle park regions such as the US and Europe. Plug & Play After rock bezoar rain sensors come with hermit crab assembly components fitted into pre-designed adhesive patches, they are cheap nearby harbor aboard name components, & many auto-mechanics spare more either new round vehicular parts require exorbitant prices searches so thence called vain houses. In addition, growing automotive customization and rising availability of aftermarket parts on online platforms and auto-parts retailers are supporting the rapid growth of this particular segment. With an increase in the need for vehicle maintenance and repairs, the aftermarket will experience faster-growing trends in the coming years.

REGIONAL ANALYSIS

Asia Pacific accounted for the largest automotive rain sensor market share of 54.7% in 2023 driven by the strong automotive manufacturing presence in the region led by countries such as China, Japan, and South Korea. This is inherent for most of the biggest car manufacturers who have their base located in these nations, for instance, Toyota, Honda, Hyundai, and Nissan, who have been fast bringing vehicles the newest and advanced safety technologies like rain sensors increasingly. Moreover, as per the information available, rising disposable incomes, increasing urbanization, and government incentives for greener technologies are attracting passenger vehicles rapidly. China is concentrating on smart vehicle technologies, such as rain sensors, and bringing them to market by major domestic manufacturers such as BYD and Geely to create safety and convenience for consumers.

North America is projected to experience the highest CAGR between 2024 and 2032 The growth is driven by the rise in North American demand for advanced driver-assistance systems (ADAS) as well as the rising production of electric vehicles (EVs) in the U.S. and Canada. Electric and hybrid carmakers such as Tesla, Ford, and General Motors are placing a greater emphasis on developing advanced safety and comfort features, including the use of rain sensors, for their EV and hybrid vehicle lineups. Tesla, for example, packs its Model 3 with a suite of ADAS technologies that could soon include rain sensors offered on other vehicles and Ford has also confirmed similar plans for its upcoming electric vehicles to deliver safer and more user-friendly driving experiences. This drive towards the adoption of advanced technologies and EVs is likely to fuel North America's automotive rain sensor market expansion.

KEY PLAYERS

Some of the major players in the Automotive Rain Sensor Market are:

-

HELLA GmbH & Co. KGaA (Rain Light Sensor, Optical Rain Sensor)

-

Hamamatsu Photonic K.K. (Photodiodes for Rain Sensors, Silicon Photodiodes)

-

KOSTAL Automobil Elektrik GmbH & Co. KG (Rain Sensor Module, Wiper Control System)

-

Melexis (IR-based Rain Sensor, Radar Sensors)

-

Xenso (Rain Sensor System, Optical Sensor Technology)

-

Casco (Rain Sensor Modules, Automatic Wiper Control)

-

Denso Corporation (Rain Sensors, Climate Control Sensors)

-

Valeo SA (Ultrasonic and Rain Sensors, Automotive Wiper Systems)

-

Vishay Intertechnology Inc. (Silicon Photodiodes, Rain Sensing Systems)

-

Ford Motor Company (Integrated Rain Sensors, Wiper Systems)

-

Semiconductor Components Industries LLC (Microphotodiodes, Rain Sensor ICs)

-

BAE Systems (Optical Rain Sensors, Environmental Sensors)

-

3M (Sensor Components, Adhesives for Sensor Integration)

-

Leonardo DRS (Rain Sensor Technology, Automotive Vision Systems)

-

L3Harris Technologies (Environmental Sensors, Advanced Rain Detection)

-

Axis Communications AB (Vision-Based Sensors, Wiper Control Technology)

-

ams-OSRAM AG (Optical Sensors, Advanced Light and Rain Sensors)

-

STMicroelectronics (Optical Rain Sensing ICs, Sensor Control Systems)

-

Bosch (Rain Sensors, Integrated Car Sensors)

-

Continental AG (Rain and Light Sensors, Driver Assistance Sensors)

Some of the Raw Material Suppliers for Automotive Rain Sensor companies:

-

BASF

-

Dow Chemical

-

Samsung SDI

-

Sumitomo Chemical

-

Mitsubishi Chemical

-

Covestro

-

3M

-

Nippon Steel

-

LG Chem

-

Huntsman Corporation

Ford Motor Company (Dearborn, Michigan ,U.S.)-Company Financial Analysis

RECENT TRENDS

-

In April 2023, Magna International acquired Gentex Corporation, a US-based supplier specializing in rain sensors. This acquisition enhances Magna's capabilities in automotive sensor technologies and advanced driver assistance systems.

-

In September 2023, HELLA launched a rain sensor with an integrated camera and microprocessor for better wiper control. The compact design enhances ADAS functionality.

-

In June 2023, Robert Bosch GmbH announced a EUR 10 Billion investment to expand its rain sensor production in China, creating 100 new jobs. This move supports increased demand in the automotive sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.38 Billion |

| Market Size by 2032 | USD 7.81 Billion |

| CAGR | CAGR of 6.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle) • By Channel Type (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | HELLA GmbH & Co. KGaA, Hamamatsu Photonic K.K., KOSTAL Automobil Elektrik GmbH & Co. KG, Melexis, Xenso, Casco, Denso Corporation, Valeo SA, Vishay Intertechnology Inc., Ford Motor Company, Semiconductor Components Industries LLC, BAE Systems, 3M, Leonardo DRS, L3Harris Technologies, Axis Communications AB, ams-OSRAM AG, STMicroelectronics, Bosch, Continental AG. |

| Key Drivers | • Rising Demand for Electric Vehicles Driving Growth in Rain Sensors and Advanced Automotive Safety Features • Rising Investment in Autonomous Vehicles Driving Demand for Advanced Rain Sensors and Sensor Technologies |

| RESTRAINTS | • Challenges in Adoption of Rain Sensors Due to Cost Compatibility and Environmental Impact on Performance |