Ethernet Controller Market Size & Trends:

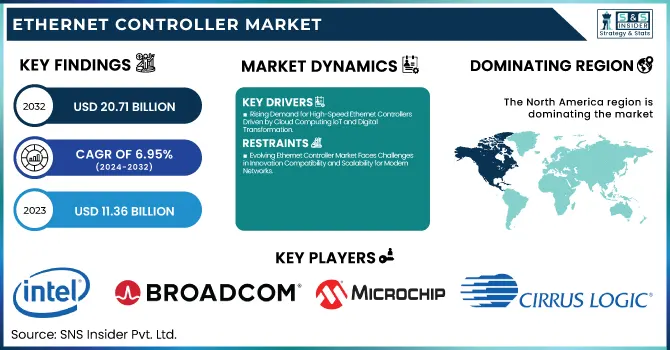

The Ethernet Controller Market Size was valued at USD 11.36 Billion in 2023 and is expected to reach USD 20.71 Billion by 2032 and grow at a CAGR of 6.95% over the forecast period 2024-2032. Ethernet Controller Market can expect to see impressive growth, as high-speed and low-latency, both of which Ethernet controller networks are known for, are becoming hotly sought features of data centers, cloud computing, and AI-driven applications. Market growth is particularly explosive due to the accelerated adoption of IoT, subsequent 5G infrastructure, and the need for smart automotive Ethernet solutions.

To Get more information on Ethernet Controller Market - Request Free Sample Report

This trend coupled with the growing demand for reliable, high-performance Ethernet controllers across a broad spectrum of industrial applications to enable the continuing shift to integrated and energy-efficient controllers in enterprise and consumer applications, and benefits from the rise of edge computing and industrial automation are driving the need for such devices across diverse industries. The United States has more than 5,380 data centers, the largest state by far is California, with 644 facilities, then Texas (576) and Illinois (459). Such a massive infrastructure creates the need for Ethernet controllers, which are critical in facilitating the transmission of high-speed data.

The U.S. market for Ethernet Controller was valued at USD 3.39 Billion in 2023 and is expected to attain a CAGR of 6.74% between 2024 and 2032. The US Ethernet Controller Market prospects are driven by high demand from AI-based data centers, cloud computing, 5G infrastructure, IoT growth, as well as continued enterprise demand for feature-rich Ethernet technologies.

Ethernet Controller Market Dynamics

Key Drivers:

-

Rising Demand for High-Speed Ethernet Controllers Driven by Cloud Computing IoT and Digital Transformation

The growth of the Ethernet controller market is mainly fueled by the growing demand for faster and more reliable solutions for networking. With the expansion of businesses and data centers, the data transferring rates are higher, and demand for higher bandwidth glory has occurred due to the huge number of data we are transferring. It is further propelled by the growth of cloud computing, IoT, and the digital transformation of industries. In addition, the market growth is driven by the high demand for Gigabit and 10-Gigabit Ethernet controllers that are required to address bandwidth-intensive applications. Another reason the demand for ethernet controllers in servers, routers, and switches grows is the increasing dependence on internet infrastructure, particularly in the remote work era.

Restrain:

-

Evolving Ethernet Controller Market Faces Challenges in Innovation Compatibility and Scalability for Modern Networks

The Ethernet Controller market report is segmented based on the nature of the product. The focus will be on technological challenges and the customer demand for continuous innovation driving the need for new solutions. With growing data traffic and evolving network speeds, the demand for higher bandwidth Ethernet controllers with improved efficiency is a continuous driving force. Still, the speed of technological advancement and compatibility issues may reduce the incentives to adapt and update existing infrastructure and could, therefore, slow the adaptation of newer Ethernet technologies. Furthermore, making Ethernet controllers reliable and scalable for data center and industrial applications is a significant engineering challenge since they have to work with legacy systems.

Opportunity:

-

Expanding Ethernet Controller Market Driven by Embedded Systems IoT Smart Cities AI and 5G Growth

The Ethernet controller market has a huge opportunity owing to the rapid advancements achieved in embedded systems along with automotive applications. With the emergence of smart cities, IoT, connected devices, and Industry 4.0, there is a growing need for Ethernet solutions in embedded systems, which is driving innovation. Furthermore, the increasing need for high-performance computing and networking in data centers and enterprise networks creates growth opportunities for manufacturers to launch next-generation Ethernet controllers. The growth of 5G networks accompanied by an increasing number of AI and machine learning applications opens up even greater opportunities to develop solutions for these sophisticated networking requirements, contributing to further growth in this market.

Challenges:

-

Ethernet Controller Market Faces Security Challenges with Cyber Threats Encryption Needs and Interoperability Issues

Networks are also becoming much more complex, creating another major challenge they face with security. With the increasing adoption of Ethernet networks, the chances of cyber threats increase. To solve these challenges, Ethernet controllers need to add new features such as built-in encryption for confidentiality and encryption-based protection against data breaches and other network risks. Now, if you have multiple vendors, the absence of standardization across various Ethernet controller technologies could also limit interoperability. This can create problems with the integration of devices and the performance of the network as a whole. The challenge for players in this space is to address these security concerns without compromising the seamless integration of existing systems, which is a fundamental requirement of modern networking environments.

Ethernet Controller Industry Segmentation Analysis

By Function

The PHY (Physical Layer) Ethernet controller segment accounted for 63.7% of the total share of the market in 2023. This is being led by the mass adoption of discrete PHY Controllers across network devices such as Routers, Switches, and Industrial Equipment. As Ethernet is a physical topology of some logical bits, these drivers are necessary for providing routes through the actual physics to the logical interface of the Ethernet, corresponding with any physical topology of Ethernet (and therefore their definition). Combined with a high level of robustness and compatibility with many Ethernet standards, this makes for a persistent demand for PHY controllers.

Integrated Ethernet controller is expected to have the highest CAGR over the forecasted time frame, from 2024 to 2032. It is propelled by the continued demand for high-density, low-power devices that integrate multiple networking functions on a single chip. Integrated controllers are on the rise in embedded systems, automotive applications, and high-performance computing, where space-saving form factor and energy efficiency are necessary. The increasing implementation of these in next-gen networking solutions will further the market growth.

By Packaging

The Flip-Chips and Grid Array segment led the Ethernet controller market with a 47.5% share in 2023. An increasing adoption of high-performance networking solutions, which require advanced packaging technologies, is driving this dominance. Data centers, enterprise networking, and high-speed computing applications requiring better thermal management, high signal integrity, and improved electrical performance, can benefit from flip-chip and grid array packaging. This is one of the reasons we found these devices are widely used in high-end Ethernet controllers that require high-frequency operation and compact circuitry.

The QFN (Quad Flat No-lead) segment is expected to grow at the fastest CAGR from 2024 to 2032. This growth is attributed to increasing demand for small-factor, low-price Ethernet controllers found in consumer electronics, embedded systems, and industrial automation. The QFN packaging offers good electrical features, high thermal dissipation, and small size which make it a popular choice in the age of modern networking where devices with reduced size are preferred.

By Bandwidth

The Fast Ethernet segment led the Ethernet controller market in 2023, capturing 45.7% of the overall share. The farm self is primarily because it has been used in legacy puppy networking infrastructure, industrial automation, and other price-sensitive packages. Fast Ethernet (100 Mbps) is still widely used in offices of up to medium size, embedded systems, and consumer networking devices that don't need ultra-high speed. Its cheap price, reliability, and backward compatibility continue to lead it in the market.

From 2024 to 2032, the Gigabit Ethernet segment is expected to grow at the highest CAGR. This growth is being driven by the growing need for faster data transmission for cloud computing, data centers, and enterprise networks. Gigabit Ethernet (1 Gbps) is now the new normal for much of modern networking infrastructure, as necessary bandwidth for applications is tenfold. This accelerating growth in the market will be mirrored in smart devices, AI-driven applications, and next-generation connectivity solutions.

By Application

The Servers segment dominated the Ethernet controller market in 2023, accounting for 35.7% of the total share of the market. The latter is attributed to the growing need for high-performance computing, data centers, and cloud services. To ensure smooth data transfer, network efficiency, and latency, servers need Ethernet controllers that are reliable and high-speed. Growing enterprise digital transformation, artificial intelligence-driven workloads, and data aggregation have increased demand for innovative Ethernet solutions in server infrastructure. Growth in this area is solid as businesses’ demand for cloud and storage capabilities continues to grow for them to accommodate more storage, services, and capabilities in-house.

The Consumer Applications segment is anticipated to be the fastest growing throughout the forecast period 2024 to 2032. This growth is being primarily powered by the quick uptake of smart home gadgets, gaming consoles, and connected devices. Fast internet and high in-house connectivity are now a consumer demand as well, streaming, gaming, or IoT-based apps have become more common, and seem reliant. With Ethernet continuing to supplement Wi-Fi with better and faster links in consumer applications, Ethernet will see a much broader scope of usage in consumer electronics, giving a boost to market growth.

Ethernet Controller Market Regional Overview

North America captured the largest share of the Ethernet controller market with 36.6% share, due to the presence of vast data centers, cloud service providers, and other sophisticated networking segments in the region. The region's leadership is a result of the increased adoption of high-speed Ethernet solutions across enterprises, financial institutions, and hyperscale data centers. If you notice, many companies such as Intel, Broadcom, and Marvell are doing yeomen service on the front of advances in Ethernet controller technologies with a focus on AI-driven workloads, readiness for 5G networks, and enterprise digital transformation. North America leads the overall high-performance computing market as the region is witnessing a rise in demand for high-performance computing and government programs to fortify networking and cloud services.

The Asia Pacific region is anticipated to expand at the highest CAGR between 2024 and 2032 due to accelerated industrialization, rising access to the internet, and developments in cloud infrastructure. Driven by 5G rollout, smart city initiatives, and connected devices, countries such as China, Japan, and India are investing significantly in next-generation networking solutions. With continued demand in telecom along with the fast-growing automotive and industrial automation sectors, chip companies like Huawei, MediaTek, and Realtek are driving innovation in Ethernet controllers. Due to the rise in investments in the manufacturing of semiconductors and data centers, Asia Pacific is expected to hold the highest share of the Ethernet controller market across the world.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Ethernet Controller Market are:

-

Intel Corporation (Intel Ethernet Controller I225)

-

Broadcom Inc. (Broadcom NetXtreme BCM5720)

-

Microchip Technology Inc. (LAN7430 Ethernet Bridge)

-

Cirrus Logic Inc. (CS8900A Ethernet Controller)

-

Texas Instruments Incorporated (DP83867 Gigabit Ethernet PHY)

-

Silicon Laboratories Inc. (Si3460 Power over Ethernet Controller)

-

Marvell Technology Group (Marvell Alaska C 88E2180)

-

Realtek Semiconductor Corp. (Realtek RTL8111)

-

Cadence Design Systems Inc. (Cadence Ethernet MAC IP)

-

Futurlec Inc. (Futurlec ENC28J60 Ethernet Module)

-

Qualcomm Atheros (Qualcomm Atheros AR8131 Ethernet Controller)

-

Arista Networks (Arista 7500R Series Ethernet Switch)

-

Pica8 (Pica8 PicOS® Network Operating System)

-

QorIQ (QorIQ P1020 Processor with Integrated Ethernet)

-

NVIDIA Corporation (NVIDIA Mellanox ConnectX-6 Dx Ethernet Adapter)

Recent Trends

-

In February 2025, Intel introduced the Ethernet E830 and E610 controllers alongside Xeon 6 processors, enhancing data center connectivity with high-performance, energy-efficient networking solutions.

-

In August 2024, Microchip Technology expanded its Single Pair Ethernet (SPE) portfolio with the LAN887x transceivers, supporting 100BASE-T1 and 1000BASE-T1 for high-speed, long-distance connectivity. These energy-efficient PHYs enhance network interoperability in automotive and industrial applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.36 Billion |

| Market Size by 2032 | USD 20.71 Billion |

| CAGR | CAGR of 6.95% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Function (PHY, Integrated) • By Packaging (Flip-chips and grid array, QFN, QFP, Others) • By Bandwidth (Ethernet, Fast Ethernet, Gigabit Ethernet) • By Application (Servers, Embedded systems, Consumer applications, Routers and Switches, Desktop systems, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Intel Corporation, Broadcom Inc., Microchip Technology Inc., Cirrus Logic Inc., Texas Instruments Incorporated, Silicon Laboratories Inc., Marvell Technology Group, Realtek Semiconductor Corp., Cadence Design Systems Inc., Futurlec Inc., Qualcomm Atheros, Arista Networks, Pica8, QorIQ, NVIDIA Corporation. |