Automotive Robotics Market Size & Overview

Get More Information on Automotive Robotics Market - Request Sample Report

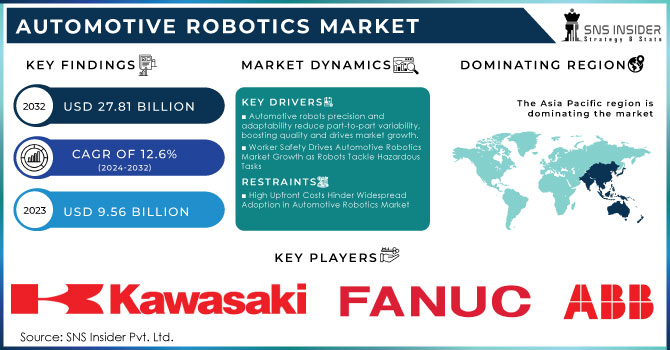

The Automotive Robotics Market Size was valued at USD 9.56 billion in 2023 and is expected to reach USD 27.81 billion by 2032 and grow at a CAGR of 12.6% over the forecast period 2024-2032.

Automotive robotics leverages robots to design, manufacture, and assemble cars. These robots excel at various tasks with precision, speed, and efficiency. Their purpose is to streamline production, boost efficiency, and guarantee worker safety by automating repetitive tasks with unmatched consistency and reliability.

From engines and transmissions to interiors and electronics, robots handle it all. Advancements in robotics, artificial intelligence, and machine learning are making these solutions even more sophisticated. Sophisticated sensors and adaptive control systems empower robots to tackle complex tasks with greater autonomy and efficiency. Advanced sensors like LiDAR and cameras help robots navigate complex environments and interact safely with humans and equipment. Additionally, AI algorithms optimize movements, improve operational efficiency, and facilitate decision-making. This allows robots to adapt to changing conditions, avoid collisions, and optimize movement, all propelling market growth.

Most trends in adoption now involve collaborative robots-that is, working robots or cobots-designed to work among human workers. For instance, cobots will comprise over 35% of the total automotive robotics installations through 2025. This indicates that they implement very vital functions regarding productivity and safety on the assembly line. One of the prominent trending features is integrating AI into robotic systems for more precise and adaptive operations. Moreover, about 60% of original equipment manufacturers in the automotive industry are bound to utilize AI-driven robotics solutions by 2026 to manage and reduce production errors and overall plant downtime. This further gets augmented by the growing pace of EV adoption-particularly in the need for specialized robotics in battery assembly and production. It is also estimated that the usage of robotics in EV manufacturing would increase by 45% over the next four years as automakers invest in automation for meeting the surging demand for electric vehicles. In addition, the push for Industry 4.0 is driving up the increased deployment of robotics in smart factories. Approximately 70% of automotive firms intend to integrate smart robotics solutions within their operations by 2027.

Automotive Robotics Market Dynamics

KEY DRIVERS:

-

Automotive robots precision and adaptability reduce part-to-part variability, boosting quality and drives market growth.

The precision and adaptability of robots in car manufacturing are revolutionizing quality control. The robots perform tasks with unwavering accuracy, leading to far less variation between car parts. This consistency minimizes defects and ensures every car rolls off the line meeting the same high standards. Additionally, robots equipped with advanced vision systems can adjust their movements based on slight variations in incoming materials. This adaptability further reduces errors and ensures a perfect fit for each component.

-

Worker Safety Drives Automotive Robotics Market Growth as Robots Tackle Hazardous Tasks

RESTRAINTS:

-

High Upfront Costs Hinder Widespread Adoption in Automotive Robotics Market

The widespread adoption of automotive robotics faces a hurdle like high upfront costs. Integrating robots requires investment in equipment, installation, and training, which can be a burden for smaller manufacturers or those in cost-conscious markets. This initial expense discourages some from adopting the technology, hindering the overall growth of the automotive robotics market.

OPPORTUNITIES:

-

The growing demand for electric and autonomous vehicles necessitates new applications for robots in assembling and testing their unique components.

-

Advancements in AI and machine learning are creating more sophisticated robots capable of complex tasks and improved decision-making, expanding their capabilities in car manufacturing.

CHALLENGES:

-

High upfront costs for equipment, installation, and worker training can discourage adoption by smaller manufacturers.

-

Programming and integrating robots with existing manufacturing processes can be complex and time-consuming.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine disrupts the automotive robotics market, already facing chip shortages. Ukraine's stalled production of wiring harnesses and neon gas, vital for chipmaking, forces automakers to find alternative sources. This could lead to 5-10% production slowdowns, potentially delaying car deliveries and raising prices. Additionally, sanctions limit access to palladium, a key component in catalytic converters, from Russia, potentially causing shortages and price hikes. With major car manufacturers halting operations in Russia, the market shrinks and established production lines are disrupted. These factors might stagnate or even decline automotive robot deployments in the short term, with automakers prioritizing existing production until the situation stabilizes.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown disrupts the automotive robotics market. Lower consumer spending could lead to a 3-7% decline in new car sales, directly impacting car manufacturer revenue. This translates to potential 5-10% cutbacks in investments for robotics upgrades, hindering advancements. Economic uncertainty can also make investors hesitant to finance the significant upfront costs of integrating new robotic solutions in car factories. Furthermore, as car sales decline, automakers might resort to production slowdowns, leading to a temporary decrease in demand for new robots or postponing planned deployments. In the short term, this slowdown might stagnate or even cause a slight decline in automotive robot sales.

Automotive Robotics Market Segment Analysis

By Type

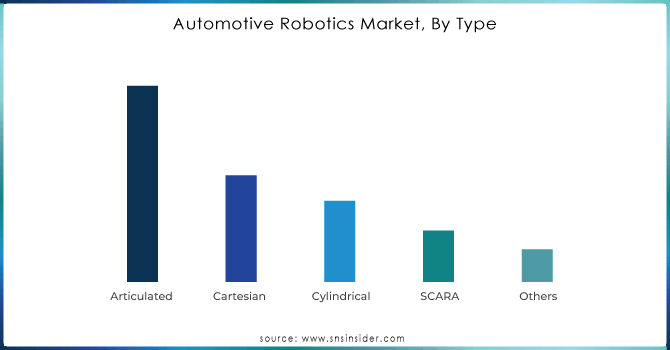

Articulated robots are the leaders in the market due to their multi-jointed arms, with about 45% of the total deployment of automotive robots. This is because they show great flexibility and precision in handling such operations as assembly and welding in such industries. They are followed by Cartesian robots, which have their characteristic linear movement, and comprise about 25%. Material handling and packaging are some of the tasks performed well by such robots and ensure that the task is done in high speeds and high-precision operations. With a rotating base, cylindrical robots provide linear motion; they account for 15% of the market. Their application is thus in processes involving combinations of rotational and linear movement, such as material dispensing and assembly. The acronym SCARA means Selective Compliance Articulated Robot Arm, and these are robots that do their movement in a horizontal way, representing about 10% of the market. They can be used for tasks that need very high speeds and accuracy; examples include pick-and-place and small component assembly. Other robot types take up another 5%, including delta robots and collaborative robots that are finding extensive use in the solution of problems which require speed, precision, and safety of human-robot collaboration.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

Welding robots lead the market by about 40% of robotic applications in industry. The accuracy and reliability in the execution of complicated welding tasks make them very important to ensure the integrity of vehicles. Material-handling robots constitute the second most significant group with about 30% of the market share. These robots play a crucial role in material transferring, loading, and positioning, among other activities, greatly promoting production efficiency and reducing human labor. Assembly/Disassembly robots are also applied in the complex tasks of assembling and/or disassembling several automotive components. They are fitted with 15% of the market shares in the order of world importance. Painting robots are noted for their consistent, high-quality finishing. Paint spraying robots account for approximately 10% of total robots used in the automotive industry. This implies that standardization is assured because there will be no waste production, hence improved quality and reduced costs.

Automotive Robotics Market Regional Overview

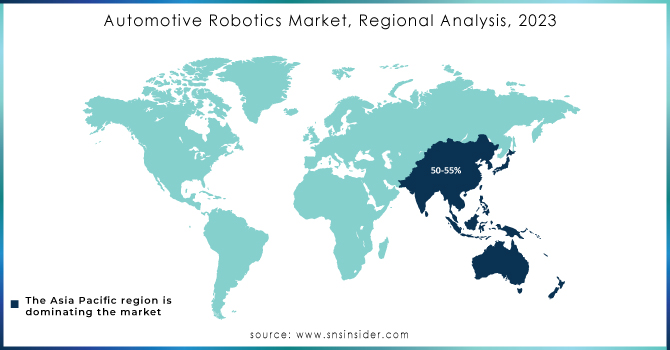

The Asia Pacific is the dominating region in the automotive robotics market holding around 50-55% of share due to its growing car manufacturing industry in China, Japan, and South Korea. Government support for automation and rising labour costs further fuel this dominance.

Europe is the second highest region in this market driven by luxury car giants in Germany and Italy who rely on robotics for precision and meeting strict safety regulations.

North America experiences the fastest growth due to the resurgence of muscle cars requiring advanced manufacturing techniques and a focus on performance enhancement. This region is also a hub for technological innovation in robotics for car manufacturing.

KEY PLAYERS

The major key players are FANUC Corporation (Japan), Kawasaki Heavy Industries, Yaskawa Electric Corporation (Japan), KUKA AG (Germany), ABB (Switzerland), Comau, DENSO WAVE INCORPORATED, NACHI-FUJIKOSHI CORP., Rockwell Automation, Inc., Seiko Epson Corporation, and other key players.

RECENT DEVELOPMENT

-

In Sept. 2023: OTTO Motors introduces the OTTO 1200, a powerful AMR designed for tight spaces. This heavyweight robot boasts a 1,200 kg payload capacity and safe navigation around people using patented technology.

-

In Nov. 2023: ABB Robotics launched the IRB 930, a new SCARA robot with three variants for 12kg and 22kg payloads. This addition aims to address new growth opportunities in both traditional and emerging markets.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.56 Bn |

| Market Size by 2032 | US$ 27.81 Bn |

| CAGR | CAGR of 12.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Articulated, Cartesian, SCARA, Cylindrical, Others) • By Component (Controller, End effector, Robotic arm, Drive, Sensors, Others) • By Application (Welding, Painting, Cutting, Material Handling, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | FANUC Corporation, Kawasaki Heavy Industries, Yaskawa Electric Corporation, KUKA AG, ABB, Comau, DENSO WAVE INCORPORATED, NACHI-FUJIKOSHI CORP., Rockwell Automation, Inc., Seiko Epson Corporation |

| Key Drivers | • The use of automation to ensure excellent manufacturing. • The growing reliance on articulated robots to ensure production efficiency. |

| Challenges | • Concerns regarding worker safety are growing. • The worldwide automotive robot industry faces a considerable upfront investment. |