SCARA Robot Market Size & Growth Trends:

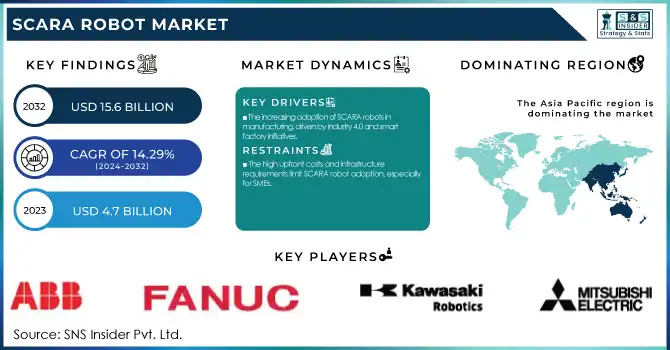

The SCARA Robot Market Size was valued at USD 4.7 Billion in 2023 and is expected to reach USD 15.6 Billion by 2032, growing at a CAGR of 14.29% from 2024-2032.

In 2023, SCARA robot deployment was prominent in automotive, electronics, and pharmaceutical industries, where precision and speed play a crucial role. Advancements in AI-driven automation have significantly enhanced operational efficiency, reducing cycle times and improving accuracy. The integration of SCARA robots into assembly lines has led to a surge in manufacturing throughput, boosting productivity while minimizing errors. Furthermore, supply chain integration metrics underscore the robots' role in smart factories, facilitating real-time tracking, predictive maintenance, and synchronized workflows for enhanced production efficiency.

Get E-PDF Sample Report on SCARA Robot Market - Request Sample Report

SCARA Robot Market Dynamics

Drivers

-

The increasing adoption of SCARA robots in manufacturing, driven by Industry 4.0 and smart factory initiatives.

The scara robots market is driven by the growing demand for automation in various industries. SCARA robots are being adopted by various industries such as automotive, electronics, and pharmaceutical, for executing precise, fast, and efficient applications in manufacturing and assembly workflow. This demand has been further fueled by the advent of Industry 4.0 as well as smart factory initiatives looking to reduce operational costs while also increasing the output of production. Moreover, predictive maintenance and real-time monitoring delivered through artificial intelligence and the Internet of Things integration will make SCARA robots efficient and cost-effective, leading them to become more mainstream in industrial automation.

Restraints

-

The high upfront costs and infrastructure requirements limit SCARA robot adoption, especially for SMEs.

Although SCARA robots or Selective Compliance Assembly Robot Arm have the advantages of providing cost-effective automation solutions, their high initial and integration costs also limit their wide-scale adoption. The purchase, installation, and maintenance of these robots comes at an overall cost, which smaller and medium-sized business units simply cannot afford. Inserting SCARA into an existing manufacturing workflow requires dedicated infrastructure and software, as well as further training for manpower to aid in implementing factory automation, all of which can be costly. Nevertheless, industries continue to face obstacles in acclimatizing their existing systems to robotic automation, hence adding to the costs. Although they offer clear savings over time, the initial cost is high and discourages use — particularly among businesses with less leeway in their budgets.

Opportunity

-

The rising demand for precision automation in electronics and semiconductor manufacturing boosts SCARA robot adoption.

Rising electronics and semiconductor industries offer growth opportunities for the SCARA robots market. With growing demand in consumer electronics, electric vehicles, and smart devices, SCARA robots are deployed by manufacturers for a variety of applications including precision assembly, pick-and-place tasks, and wafer handling. They provide high-speed and precise operation, which is very important in case of handling delicate and intricate manufacturing processes. Similarly, the miniaturization of electronic components and the growing complexity of the circuit board designs are driving the demand for SCARA robotic solutions to deliver advanced automation in electronics production. The likely increase in production volumes would ensure high demand for SCARA robots.

Challenges

-

The shortage of trained professionals in robotics and automation hinders SCARA robot deployment and efficiency.

A serious challenge the SCARA robots market faces is the need for skilled labor for the programming, operation, and maintenance of such advanced robots. Though automation minimizes labor dependence, the specific configuration and performance optimization of automation necessitate a particular set of skills in robotics, artificial intelligence, and machine learning. This proves a bigger problem; businesses struggle to get the right personnel, resulting in more downtime and higher maintenance costs. Not only that, it also takes a lot of time and money to train employees to work with robotic systems. To address this skill gap, training programs, and collaborations between industry and educational institutions are crucial for the transition and functioning of SCARA robots.

SCARA Robots Market Segmentation Analysis

By Payload Capacity

The 5 kg segment dominated the market and accounted for significant revenue share in 2023, as it is applied in industries that demand high speed, precision, and flexibility among goods. From lightweight assembly to material handling and small-part packaging, this category is popular in the electronics, pharmaceuticals, and consumer goods sectors. They provide higher precision and smaller sizes, perfect for constrained spaces where manufacturing is taking place.

The 5-15 kg payload segment is expected to register the fastest CAGR during the forecast period, owing to their increasing adoption in automotive, food & beverage, and logistics industries. Such robots are utilized to assemble mid-sized automotive parts, perform mid-range payloads for food processing plants, and palletize products in warehouses. AI and Machine Learning-based SCARA robots used for mid-weight industrial tasks are realizing the operational efficiency, which in turn is expected to provide immense growth for the SCARA robots market in the forecast period.

By Application

The material handling segment dominated the market and accounted for significant revenue share in 2023, which is primarily focused on the pick-and-place, sorting, palletizing, and depalletizing tasks in various industries due to the extensive use of SCARA robots. This is in high demand, especially for logistics, e-commerce, electronics and automotive industries, where rapid and precise movement of materials is essential to fuse the operations. These improve speed while minimizing human error; it is one of the essentials responsible for warehouse automation and high-speed assembly lines.

The Assembling & disassembling segment is expected to register the fastest CAGR during the forecast period, which is attributed to the growing focus on automating the process in automotive, electronics, and medical device manufacturing. SCARA robots are taking the place of human labor for the detailed assembly of circuit boards, sensors, and microelectronics, as well as components for automobiles. The SCARA robot is gaining traction in this application due to the rapid development of industry 4.0, the emergence of collaborative robots and the need for value-driven manufacturing processes.

By End-Use

The automotive manufacturing segment dominated the market and accounted for significant revenue share in 2023, SCARA robots are widely used in automotive manufacturing for part assembly, quality inspection, welding, as well as parts and material handling. Automakers are investing more and more money for electric vehicles, autonomous driving technologies, and smart factories, and SCARA robots are being integrated to increase production efficiency and maintain manufacturing consistency. Demand is also being driven by the sector's focus on cutting down cycle times and increasing the quality of their products.

The electrical & electronics segment is expected to register the fastest CAGR during the forecast period. They are used specifically for PCB assembly, chip manufacturing, soldering, and semiconductor fabrication. Increasing implementation of consumer electronics, 5G infrastructure, and IoT devices has led to a significant rise in automation demands, which is expected to drive the need for SCARA robots for accurate and high-speed production. The increasing trend of miniaturization of electronic components is another driving factor of this segment.

SCARA Robot Market Regional Landscape

The Asia-Pacific dominated the market and accounted for significant revenue share in 2023. Massive investments in industrial automation, the presence of automotive and electronics manufacturers, and government initiatives promoting smart manufacturing are driving the dominance of the region. With Japan and China having the highest density of industrial robots globally, the Asia-Pacific region is anticipated to hold the largest market share for SCARA robots.

North America is expected to register the fastest CAGR during the forecast period, as rise in adoption of AI-powered robotics, increasing focus on industrial automation, and government support for advanced manufacturing technologies are some of the driving factors for this growth. SCARA robots are being deployed very quickly in the USA in logistics, e-commerce fixtures centers, and semiconductor Processing. The North America market is expected to witness impulsive growth during the forecast period owing to increasing investment by the companies on automation and robotics driven by the AI in the region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

The major key players along with their products are

-

ABB Ltd – IRB 910SC

-

Fanuc Corporation – SR Series

-

Yaskawa Electric Corporation – Motoman SG Series

-

KUKA AG – KR SCARA Series

-

Epson Robots – LS-B Series

-

Mitsubishi Electric Corporation – RH Series

-

Omron Corporation – i4L SCARA

-

Stäubli International AG– TS2 SCARA Series

-

DENSO Corporation (DENSO Robotics)– HS Series

-

Kawasaki Robotics (Kawasaki Heavy Industries, Ltd.)– RS Series

-

Yamaha Motor Co., Ltd. – YK-XG Series

-

Nachi-Fujikoshi Corp. – EZ SCARA Series

-

Toshiba Machine Co., Ltd. – THE Series

-

HIWIN Technologies Corp. – RA Series

-

Delta Electronics, Inc. – DRS60L Series

Recent Developments

-

January 2024 – Fanuc Corporation: Launched a new SCARA robot series with enhanced AI-powered vision systems to improve precision and speed in assembly operations.

-

March 2024 – ABB Robotics: Expanded its SCARA robot lineup with energy-efficient models designed for sustainable manufacturing.

-

May 2024 – Yaskawa Electric Corporation: Announced a strategic partnership with NVIDIA to develop AI-powered collaborative robot solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.7 Billion |

| Market Size by 2032 | USD 15.6 Billion |

| CAGR | CAGR of 14.29% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Payload Capacity (Up to 5 kg, 5-15 kg, Above 15 kg) • By Application (Material Handling, Assembling & Disassembling, Welding & Soldering, Dispensing, Processing) • By End-User (Automotive, Metal & Machinery, Rubber & Plastic, Food & Beverage, Electrical & Electronics, Consumer Goods, Pharmaceuticals & Medical Devices, Others) • By Industry (Banking, Financial Services & Insurance (BFSI), Retail & Consumer Goods, Healthcare, Education, Manufacturing, Travel & Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Ltd, Fanuc Corporation, Yaskawa Electric Corporation, KUKA AG, Epson Robots, Mitsubishi Electric Corporation, Omron Corporation, Stäubli International AG, Denso Corporation, Kawasaki Robotics, Yamaha Motor Co., Ltd., Nachi-Fujikoshi Corp., Toshiba Machine Co., Ltd., HIWIN Technologies Corp., Delta Electronics, Inc. |