Aviation Blockchain Market Report Scope & Overview:

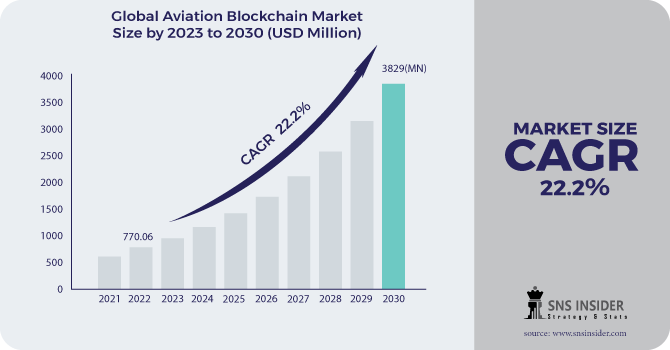

The Aviation Blockchain Market Size was valued at USD 770.06 million in 2022 and is expected to reach USD 3829 million by 2030 with a growing CAGR of 22.2% over the forecast period 2023-2030.

Blockchain is a new system-divided system, which eliminates the risks associated with the information held in between. In line with these lines, organizations working with the aeronautics business are anxious to bring blockchain development to their current operations in the store network. This includes sophisticated materials, a comprehensive production network, and decades-old second sales with moving members.

To get more information on Aviation Blockchain Market - Request Free Sample Report

In addition, a major component of the aviation industry considers blockchain innovation as a viable way to track and provide predictable aircraft design information across a multidisciplinary innovation network. Alternatively, Blockchain may change to transfer significant benefits to many providers operating a single aircraft integration function.

The Aviation Blockchain Market size players are subject to a few government orders and guidelines aimed at ensuring the safety and security of passengers and other associated partners. The use of aviation blockchain technology ensures powerful aviation exchanges, optimal functional adequacy, and simplicity for aviation business clients. The aviation blockchain is finding use in the fields of airlines, airports, lessors, and MRO associations.

MARKET DYNAMICS

KEY DRIVERS

-

Reduced Transnational Complexities and Costs

-

Transparency and traceability have improved.

RESTRAINTS

-

Regulations and common standards are lacking.

-

High installation cost

OPPORTUNITIES

-

Blockchain Integration with Other Upcoming Aviation Technologies

-

In the aviation industry, artificial intelligence/machine learning is used for track recording.

CHALLENGES

-

The Aviation Industry's Slow Integration and Reluctance to Change

-

Blockchain Technology is in its early stages.

THE IMPACT OF COVID-19

The spread of the COVID-19 pandemic has had a negative impact on the global aeronautics blockchain market, owing to supply constraints and market participants' predicted weak financial execution in 2020. Administrative and strategy changes, reliance on work, working capital administration, and executive liquidity and dissolvability are all key risk factors for members of the aeronautics blockchain industry. The second rush of COVID-19 hit hard a far larger number than the previous strain of COVID-19 in February 2021 and is expected to have an obviously negative impact on the overall financial position. Following the COVID-19 health catastrophe, the global commercial landscape has shifted dramatically.

Aircraft remaining on the ground for an extended amount of time is a serious problem for the airline, which operates with a narrow profit margin and hence may incur operating losses. A clear picture of an aircraft's setup and maintenance could assist cut costs and losses associated with downtime and unplanned repair. As a result, by utilizing blockchain technology, these losses can be prevented.

Aviation blockchain are widely and significantly desired by commercial and general aviation players, MRO organization, and airport operators for effective aviation transaction recording. This technology acquisition and procurement is marked by open contracts and agreements between aviation players, MRO organizations, airport operators, and aviation blockchain developers. Contracts and agreements between end users and aviation blockchain developers will be used to launch the aviation blockchain solution. These contracts specify a set of requirements that must be met within a specific time range. These contracts and agreements are related with long-term business potential with end customers. To obtain a competitive advantage and keep long-term business, market participants must focus on gaining contracts and agreements.

During the forecast period, the smart contract segment is estimated to account for the majority of the aviation blockchain market. Smart contracts can provide automated payment upon task completion. A smart contract can be developed with the help of a computer algorithm that gets real-time data. This data can be validated and kept in the blockchain. Smart contracts can be utilized in ticketing, aeroplane refueling, leasing, and supply chain management, among other things.

KEY MARKET SEGMENTATION

By Application

-

Cargo and Baggage Tracking

-

Passenger Identity Management

-

Flight and Crew Data Management

-

Supply Chain Management

-

Others

By End Use

-

Airlines

-

Airports

-

Others

By Function

-

Record Keeping

-

Transactions

By Deployment:

-

Public

-

Private

-

Hybrid

.png)

Need any customization research on Aviation Blockchain Market - Enquiry Now

REGIONAL ANALYSIS

North America dominates the flight blockchain market. This pattern is expected to persist over the forecast period due to the presence of notable players such as IBM, Microsoft Corporation, Moog Inc., and Sweetbridge, Inc., as well as their high expectations for the advancement of blockchain innovation. The growing acceptance of UAVs by tactical powers for strategic missions is expected to drive the development of the European market in the survey time frame. During the forecast time frame, the market in this area is expected to grow at a rapid pace. The growing interest in new planes and rising protection consumption in countries such as India and China are expected to drive market development.

The increased use of safeguards by countries such as Saudi Arabia, the United Arab Emirates, and Israel is driving market development in the Middle East and Africa. In Latin America, there has been an increase in the utilisation of UAVs for intelligence gathering on drug dealing and radical gatherings, deforestation checking, and control of illegal movement, which is expected to drive the development of the aviation blockchain market.

Asia-Pacific is the primary customer of the avionics blockchain in the global market, and it is expected to maintain its dominance by the end of the figure time frame. North America is expected to drive the market by growing at the fastest CAGR. One of the major drivers influencing development in this region is the growing acceptance of innovation via aircraft, air terminals, and MRO specialist co-ops. The presence of major air terminals and key industry participants in the area is expected to drive the aeronautics blockchain market.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Zamna Technologies, Aeron Labs, Winding Tree, Volantio Inc, Filament, Infosys, Insolar Technologies, LeewayHertz Technologies, and Moog Inc.,IBM, Microsoft Corporation and Other Players

Zamna Technologies-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 770.05 Million |

| Market Size by 2030 | US$ 3829 Million |

| CAGR | CAGR of 22.2% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End Use (Airlines, Airports, and Others) • By Function (Record Keeping, and Transactions) • By Application (Cargo and Baggage Tracking, Passenger Identity Management, Flight and Crew Data Management, Supply Chain Management, and Others) • By Deployment(Public, Private, Hybrid) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Zamna Technologies, Aeron Labs, Winding Tree, Volantio Inc, Filament, Infosys, Insolar Technologies, LeewayHertz Technologies, and Moog Inc.,IBM, Microsoft Corporation |

| DRIVERS | • Reduced Transnational Complexities and Costs • Transparency and traceability have improved. |

| RESTRAINTS | • Regulations and common standards are lacking. • High installation cost |