Ball Lenses Market Report Scope & Overview:

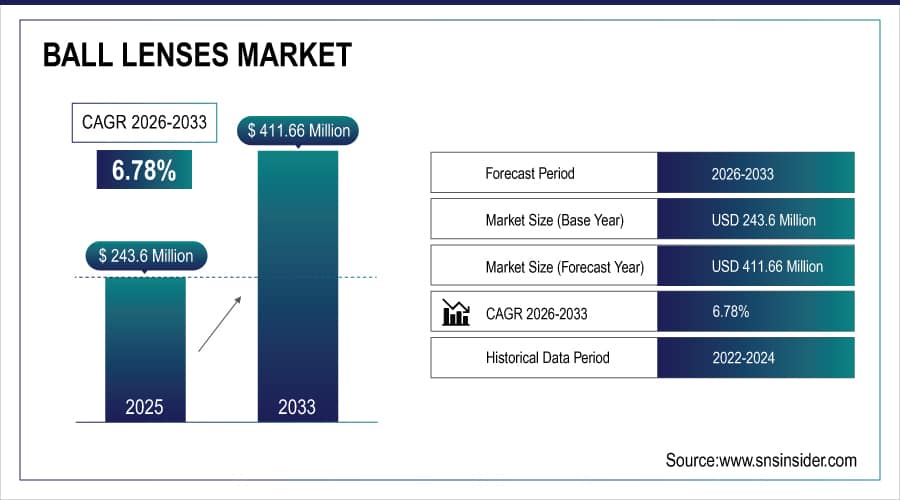

The Ball Lenses Market size was valued at USD 243.6 Million in 2025E and is projected to reach USD 411.66 Million by 2033, growing at a CAGR of 6.78% during 2026–2033.

The ball lenses market is witnessing strong growth due to rising demand for high-precision optical components across applications such as medical imaging, fiber optics, laser systems, and industrial sensors. Ball lenses are essential for superior light collection, focusing, and minimal aberration. Manufacturers are investing in advanced materials, miniaturization, and precision fabrication techniques to meet increasing performance requirements. Key end-user industries include healthcare, telecommunications, aerospace & defense, consumer electronics, and research & development. The market is driven by innovation, technological advancements, and the need for reliable, high-performance optical solutions in increasingly complex imaging and photonics applications.

In July 2025, the Vera C. Rubin Observatory in Chile unveiled the world’s largest digital camera, capable of capturing a golf ball on the Moon, designed to study stars, galaxies, and cosmic phenomena with unprecedented detail.

Ball Lenses Market Size and Forecast:

-

Market Size in 2025E: USD 243.6 Million

-

Market Size by 2033: USD 411.6 Million

-

CAGR: 6.78% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Ball Lenses Market - Request Free Sample Report

Ball Lenses Market Highlights:

-

Rising adoption of miniature optical components in fiber optic communications, biomedical imaging, laser processing, and consumer electronics is boosting demand for high-precision ball lenses

-

Ability to efficiently focus, collimate, and couple light in compact designs enhances performance in single-mode fiber modules, endoscopic systems, and laser micro-processing

-

Use of high-refractive-index materials and precision fabrication improves signal coupling, wider field-of-view imaging, and accurate laser patterning

-

Growing demand for portable, high-resolution, and energy-efficient optical devices in telecommunications, medical devices, and industrial sensors supports market growth

-

High manufacturing costs, complex micron-scale fabrication, and strict quality control requirements can limit adoption in cost-sensitive applications

-

Increasing popularity of AR applications drives demand for miniaturized, high-precision lenses for immersive gaming, education, sports training, and advanced 3D imaging technologies

The U.S. Ball Lenses Market size was valued at USD 160.69 Million in 2025E and is projected to reach USD 267.72 Million by 2033, growing at a CAGR of 6.59% during 2026–2033. Growth is driven by increasing adoption of precision optical components in medical devices, telecommunications, aerospace, and defense applications. Rising demand for miniaturized, high-refractive-index ball lenses in fiber optics, laser systems, and industrial sensors further supports market expansion. Technological advancements, coupled with investments in research and development by key manufacturers, are enhancing product performance and reliability.

Ball Lenses Market Drivers:

-

Rising Demand for High-Precision Ball Lenses in Advanced Optical Systems

The ball lenses market is driven by increasing adoption of miniature optical components across diverse applications, including fiber optic communications, biomedical imaging, laser processing, and consumer electronics. Their ability to efficiently focus, collimate, and couple light in compact designs enhances performance in single-mode fiber modules, endoscopic systems, and laser micro-processing. High-refractive-index materials and precision fabrication allow improved signal coupling, wider field-of-view imaging, and accurate laser patterning. Growing demand for portable, high-resolution, and energy-efficient optical devices in telecommunications, medical devices, and industrial sensors is accelerating market growth, positioning ball lenses as indispensable components in modern photonics and sensing technologies.

In Apr 2025, ball and half‑ball lenses were highlighted for their roles in fiber optics, biomedical imaging, laser processing, and consumer electronics, enabling efficient light coupling, high-resolution imaging, and compact optical designs across advanced photonics applications.

Ball Lenses Market Restraints:

-

High Manufacturing Costs and Complex Fabrication Limit Growth in the Ball Lenses Market

The ball lenses market faces several challenges that may hinder growth. High manufacturing costs, especially for lenses made from sapphire, lanthanide glass, or infrared materials, can limit adoption in cost-sensitive applications. Precision fabrication at micron-scale tolerances requires advanced equipment and skilled labor, raising production complexity. Additionally, integration with fiber optics, sensors, or medical devices demands strict quality control and alignment accuracy, increasing development timelines. Limited standardization across sizes and materials can create compatibility issues. Finally, competition from alternative optical components, such as aspheric lenses or micro-lenses, may restrict market penetration, particularly in emerging sectors or low-budget projects.

Ball Lenses Market Opportunities:

-

AR Applications Are Driving Growth in the Optical Lenses Market

The market for optical lenses is expanding as augmented reality (AR) applications gain traction, driving demand for miniaturized, high-precision lenses that enhance device performance, enable immersive gaming, sports training, and educational experiences, and support advanced machine learning and 3D imaging technologies. This trend opens avenues for optical component manufacturers to innovate and capture value in consumer electronics and interactive media sectors.

In Nov 2024, Snap launched Snap OS v5.58, featuring the Ball Game Lens that tracks physical ball movements for interactive AR experiences

Ball Lenses Market Segment Highlights:

-

By Material Type: Dominant – Glass (39.25% in 2025 → 34.75% in 2033); Fastest-Growing – Plastic (CAGR 8.27%)

-

By Diameter Size: Dominant – Under 5 mm (34.38% in 2025 → 30.63% in 2033); Fastest-Growing – 10–20 mm (CAGR 7.73%)

-

By Application: Dominant – Medical Devices (29.75% in 2025 → 28.25% in 2033); Fastest-Growing – Aerospace & Defense (CAGR 8.60%)

-

By End-User Industry: Dominant – Healthcare (34.63% in 2025 → 32.38% in 2033); Fastest-Growing – Automotive (CAGR 8.60%)

Ball Lenses Market Segment Analysis:

By Material Type, Glass Dominating and Plastic Fastest-Growing

Glass remains the dominant material type in the ball lenses market, holding the largest share due to its superior optical clarity, high refractive index, and widespread use in medical devices, fiber optics, and precision instruments. Plastic, on the other hand, is the fastest-growing segment, driven by demand for lightweight, cost-effective, and easily manufacturable lenses in consumer electronics, optical modules, and compact devices, offering flexibility and scalability to meet evolving application requirements across healthcare, telecommunications, and industrial sectors.

By Diameter Size, Under 5 mm Dominating and 10–20 mm Fastest-Growing

In the ball lenses market, lenses under 5 mm dominate, accounting for 34.38% in 2025 and expected to decrease slightly to 30.63% by 2033, due to their widespread use in compact optical systems, fiber coupling, and precision devices. The 10–20 mm segment is the fastest-growing, with a CAGR of 7.73%, driven by increasing demand for larger lenses in laser processing, industrial imaging, and high-power optical applications, where improved light collection, focusing efficiency, and durability are critical for enhanced system performance and reliability.

By Application, Medical Devices Dominating and Aerospace & Defense Fastest-Growing

In the ball lenses market, medical devices remain the dominant application, holding 29.75% of the market in 2025 and slightly declining to 28.25% by 2033, driven by their critical role in endoscopic imaging, diagnostics, and precision optical instruments. Aerospace & defense is the fastest-growing segment, expanding at a CAGR of 8.60%, fueled by increasing adoption of high-precision optical systems in navigation, surveillance, and laser-based technologies, where advanced ball lenses enhance imaging accuracy, signal coupling, and reliability under demanding operational conditions.

By End-User Industry, Healthcare Dominating and Automotive Fastest-Growing

In the ball lenses market, the healthcare industry remains the dominant end-user, accounting for 34.63% in 2025 and projected to slightly decline to 32.38% by 2033, driven by extensive use in medical imaging, diagnostics, and precision optical instruments. The automotive sector is the fastest-growing, with a CAGR of 8.60%, fueled by rising demand for advanced driver-assistance systems (ADAS), LIDAR, and other sensor-based applications where ball lenses enhance detection accuracy, reliability, and overall system performance in autonomous and connected vehicles.

Ball Lenses Market Regional Highlights:

-

North America: In 2025E 34.63% → 32.38%, Significant Market (CAGR 5.88%)

-

Asia-Pacific: In 2025E 30.63% → 34.38%, Dominating Region (CAGR 8.32%)

-

Europe: In 2025E 24.75% → 23.25%, Moderate Growth (CAGR 5.95%)

-

Latin America: In 2025E 5.13% → 5.88%, Steady Growth (CAGR 8.60%)

-

Middle East & Africa: In 2025E 4.88% → 4.13%, Stable Share (CAGR 4.55%)

Ball Lenses Market Regional Analysis:

North America Ball Lenses Market Insights:

North America dominates the ball lenses market due to strong demand from healthcare, automotive, and telecommunications sectors. High adoption of advanced optical components, precision manufacturing capabilities, and continuous R&D investments drive market growth, while increasing use in sensors, imaging systems, and industrial applications further supports expansion and innovation across the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Ball Lenses Market Insights:

The U.S. dominates the ball lenses market, driven by advanced healthcare, automotive, and telecom sectors, high adoption of precision optical components, and ongoing R&D fostering innovation and market growth.

Asia-Pacific Ball Lenses Market Insights:

Asia-Pacific is the fastest-growing region in the ball lenses market, fueled by rapid industrialization, rising adoption of advanced optical systems in telecommunications, consumer electronics, and healthcare. Increasing investments in research, manufacturing capabilities, and smart technologies drive demand, creating significant growth opportunities for ball lens manufacturers across the region.

China Ball Lenses Market Insights:

China dominates the ball lenses market, driven by extensive manufacturing capabilities, high demand in consumer electronics, telecommunications, and healthcare, and rapid adoption of advanced optical components across various industrial and commercial applications.

Europe Ball Lenses Market Insights:

The Europe ball lenses market is witnessing emerging trends driven by innovations in medical imaging, aerospace, and industrial automation. Growing adoption of miniaturized optical components, advanced manufacturing technologies, and research initiatives fosters market growth, while sustainability and high-precision applications create new opportunities for manufacturers and technology developers across the region.

Germany Ball Lenses Market Insights:

Germany dominates the Europe ball lenses market, supported by advanced manufacturing infrastructure, strong R&D in optics and photonics, and high demand from healthcare, industrial, and precision technology sectors.

Latin America Ball Lenses Market Insights:

The Latin America ball lenses market is steadily expanding, driven by growing demand in healthcare, automotive, and industrial applications. Increasing adoption of advanced optical components, investments in manufacturing capabilities, and technological innovations are supporting market growth, creating opportunities for regional and international ball lens manufacturers.

Brazil Ball Lenses Market Insights:

Brazil is the dominant country in the Latin America ball lenses market, driven by strong demand in healthcare, automotive, and industrial sectors, supported by growing adoption of advanced optical technologies.

Middle East & Africa Ball Lenses Market Insights:

The Middle East and Africa ball lenses market is witnessing moderate growth, driven by increasing adoption in healthcare, telecommunications, and industrial applications. Investments in optical technologies, rising infrastructure development, and growing demand for precision components contribute to steady market expansion across the region.

Saudi Arabia Ball Lenses Market Insights:

Saudi Arabia is the leading country in the Middle East & Africa ball lenses market, driven by increasing demand in healthcare, industrial, and telecommunications sectors. Investments in advanced optical technologies and precision manufacturing are supporting market growth, positioning the country as a regional hub for ball lens applications.

Ball Lenses Market Competitive Landscape:

Edmund Optics Founded in 1942, is a global manufacturer and supplier of optical components and assemblies. The company specializes in lenses, ball lenses, prisms, and precision optical systems. In 2025, it acquired son‑x to enhance high‑precision manufacturing, strengthen diamond‑cutting capabilities, and provide innovative solutions across medical, industrial, and telecom sectors.

-

In Jan 2025, Edmund Optics acquired German high‑precision optics firm son‑x to expand manufacturing capabilities and enhance its position as a provider of innovative optical solutions worldwide.

Thorlabs Inc. Founded in 1989 is a global leader in the design and manufacturing of photonics equipment and optical components. The company offers lasers, lenses, microscopes, and imaging systems, including the Mini2P two-photon microscope. Thorlabs collaborates with research institutes to advance neuroscience, life sciences, and precision optical technologies worldwide.

-

In April 2025, Thorlabs partnered with the Max Planck Florida Institute for Neuroscience to deploy its Mini2P two-photon imaging system, advancing high-resolution brain research and enabling real-time neuronal activity observation for improved diagnostics and neurological studies.

Ball Lenses Market Key Players:

-

Schott AG

-

Union Optic Inc.

-

Doric Lenses

-

ILLUCO

-

Tower Optical Corporation

-

Industrial Technologies

-

II‑VI Incorporated

-

Swiss Jewel Company

-

Knight Optical Ltd

-

West Coast Tech Limited

-

Tecnottica Consonni

-

Z‑Optics

-

UNI Optics Co.

-

Changchun Sunday Optoelectronics Co.

-

UltiTech Sapphire

-

Fuzhou Alpha Optics Co.

-

Chengdu Yasi Optoelectronics Co.

-

Shanghai Optics Inc.

-

Edmund Optics Inc.

-

Thorlabs Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 243.6 Million |

| Market Size by 2033 | USD 411.6 Million |

| CAGR | CAGR of 6.78% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Glass, Plastic, Silicate and Optical Fiber) • By Diameter Size (Under 5 mm, 5–10 mm, 10–20 mm and Above 20 mm) • By Application (Medical Devices, Optics & Photonics, Aerospace & Defense, Consumer Electronics and Industrial Applications) • By End-User Industry (Healthcare, Telecommunications, Automotive, Manufacturing and Research & Development) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Schott AG, Union Optic Inc., Doric Lenses, ILLUCO, Tower Optical Corporation, Industrial Technologies, II‑VI Incorporated, Swiss Jewel Company, Knight Optical Ltd, West Coast Tech Limited, Tecnottica Consonni, Z‑Optics, UNI Optics Co., Changchun Sunday Optoelectronics Co., UltiTech Sapphire, Fuzhou Alpha Optics Co., Chengdu Yasi Optoelectronics Co., Shanghai Optics Inc., Edmund Optics Inc., Thorlabs Inc. |