Hardware Security Modules Market Size & Trends:

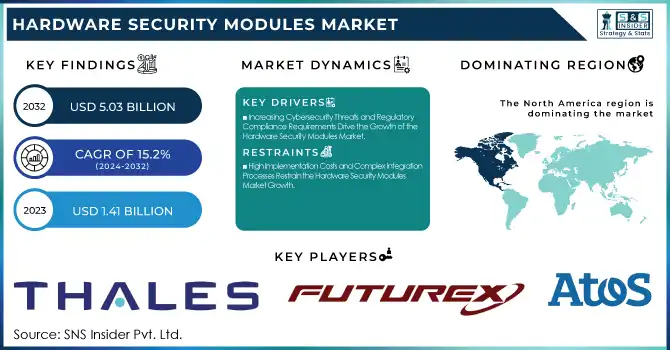

The Hardware Security Modules Market Size was valued at USD 1.41 Billion in 2023 and is expected to reach USD 5.03 Billion by 2032 and grow at a CAGR of 15.2% over the forecast period 2024-2032. The market is growing rapidly due to rising cybersecurity threats, regulatory mandates, and increasing digital transactions. HSMs provide cryptographic key management for payment security, identity authentication, and data protection across banking, government, healthcare, and cloud sectors. The demand for cloud-based HSMs is accelerating with cloud adoption. Industry players focus on innovations, partnerships, and acquisitions while emerging technologies like post-quantum cryptography and blockchain security drive future growth. Despite challenges like high costs and complex integration, the market continues expanding as organizations prioritize robust digital security solutions.

To Get more information on Hardware Security Modules Market - Request Free Sample Report

Hardware Security Modules Market Dynamics

Key Drivers:

-

Increasing Cybersecurity Threats and Regulatory Compliance Requirements Drive the Growth of the Hardware Security Modules Market

The growing prevalence of cyber threats, data breaches, and stringent regulatory mandates are major drivers of the Hardware Security Modules (HSM) market. Organizations across industries, including banking, financial services, healthcare, and government, are adopting HSMs to enhance data security, encryption, and authentication. Regulatory frameworks such as PCI-DSS, GDPR, and FIPS 140-2 mandate the use of secure cryptographic modules, further fueling demand. As businesses move towards digital transformation, securing sensitive information has become a top priority, leading to increased HSM adoption.

Additionally, the rise in cloud computing and remote operations has accelerated the need for cloud-based HSM solutions that offer scalable and cost-effective security. Enterprises are investing heavily in cybersecurity infrastructure to safeguard critical assets from data breaches and cyberattacks. This growing emphasis on data protection and regulatory compliance is expected to drive sustained demand for HSMs, making them an essential component of modern security architectures.

Restrain:

-

High Implementation Costs and Complex Integration Processes Restrain the Hardware Security Modules Market Growth

Despite the increasing demand for HSMs, high implementation costs and complex integration processes pose significant restraints on market growth. Deploying HSMs requires substantial upfront investments in specialized hardware, software, and skilled personnel for installation and maintenance. Many small and medium-sized enterprises (SMEs) find these costs prohibitive, limiting their ability to adopt HSM solutions. Additionally, integrating HSMs into existing IT infrastructure can be challenging, especially for organizations using legacy systems that lack compatibility with modern cryptographic solutions.

The implementation process often involves technical complexities, including configuring encryption protocols, managing cryptographic keys, and ensuring compliance with industry standards. This complexity increases deployment time and costs, discouraging some businesses from investing in HSM technology. Moreover, continuous advancements in cybersecurity threats necessitate regular updates and maintenance, adding to operational expenses. As a result, the high cost and complexity of HSM deployment remain key challenges, particularly for organizations with budget constraints.

Opportunities:

-

Rising Adoption of Cloud-Based Hardware Security Modules Presents Lucrative Growth Opportunities for the Market

The increasing adoption of cloud-based HSM solutions presents significant growth opportunities for the market. As organizations transition to cloud environments for data storage, processing, and application hosting, the demand for cloud-compatible security solutions is rising. Cloud-based HSMs offer scalable, cost-effective, and easily deployable security solutions compared to traditional on-premises hardware. They eliminate the need for high upfront investments in physical infrastructure while ensuring robust data encryption, authentication, and cryptographic key management. Leading cloud service providers are integrating HSM-as-a-service offerings into their platforms, enabling enterprises to enhance security without complex deployment processes.

Additionally, growing trends such as multi-cloud strategies and remote work models are further driving cloud-based HSM adoption. With businesses prioritizing security in digital operations, cloud HSMs provide a flexible and compliant solution that meets industry standards. This shift towards cloud-based security solutions is expected to create new revenue streams and accelerate market expansion in the coming years.

Challenge:

-

Rapid Advancements in Quantum Computing Pose a Significant Challenge to the Hardware Security Modules Market

The rapid advancements in quantum computing present a major challenge to the Hardware Security Modules (HSM) market. Quantum computers have the potential to break traditional encryption algorithms, rendering many existing cryptographic security mechanisms obsolete. HSMs primarily rely on public-key cryptography, which quantum computing can easily compromise using algorithms like Shor’s algorithm. As a result, enterprises and government agencies are increasingly concerned about the future security of their encrypted data.

The transition to post-quantum cryptography requires extensive research, development, and standardization efforts, which may take years to implement across industries. Organizations that have already invested heavily in traditional HSMs may face challenges in upgrading or replacing their existing security infrastructure to withstand quantum threats. Additionally, the uncertainty surrounding quantum computing timelines makes it difficult for businesses to plan cybersecurity strategies effectively. To address this challenge, HSM providers must innovate and develop quantum-resistant encryption technologies to ensure long-term data security.

Hardware Security Modules Market Segmentation Overview

By Type

The USB-based Hardware Security Modules (HSMs) segment dominated the market in 2023, holding a 42% revenue share, driven by its compact design, ease of deployment, and high-security cryptographic capabilities. USB HSMs are widely used across banking, financial services, healthcare, and government sectors for securing sensitive data, managing cryptographic keys, and ensuring secure authentication. Leading companies such as Thales, Yubico, and Utimaco have introduced advanced USB-based HSMs to meet the rising demand for portable security solutions.

In 2023, Thales expanded its Luna USB HSM series, offering FIPS 140-2 Level 3 compliance and enhanced encryption speed, making it an attractive solution for regulatory-driven industries. Yubico’s YubiHSM 2 gained traction among small and medium-sized enterprises (SMEs) due to its cost-effectiveness and ease of integration.

The cloud-based Hardware Security Modules (HSMs) segment is witnessing the highest growth rate, with a CAGR of 16.03%, driven by increasing cloud adoption and the need for scalable cryptographic security solutions. As businesses migrate to cloud environments, cloud-based HSMs provide seamless encryption, authentication, and cryptographic key management without the need for dedicated on-premise hardware. Major cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have significantly expanded their HSM offerings to meet evolving security demands.

In 2023, AWS enhanced its CloudHSM service, integrating it with AWS Key Management Service (KMS) for streamlined enterprise encryption. Similarly, Microsoft launched Azure Dedicated HSM updates, offering FIPS 140-2 Level 3-certified security for cloud-based applications. Google Cloud introduced external key management (EKM) solutions, allowing enterprises to retain full control over cryptographic keys while securing cloud workloads.

By Application

The Payment Processing segment dominated the Hardware Security Modules (HSM) market in 2023, accounting for 42% of total revenue, driven by the increasing volume of digital transactions and stringent regulatory compliance requirements. Payment security is a critical concern for financial institutions, fintech companies, and payment service providers, as they must comply with PCI DSS (Payment Card Industry Data Security Standard) and other global regulations. HSMs play a vital role in securing payment credentials, encrypting transactions, and preventing fraud. Thales, Entrust, and Utimaco have been at the forefront of developing cutting-edge payment HSM solutions.

In 2023, Thales introduced new enhancements to its payShield HSM series, offering faster transaction processing speeds and enhanced tokenization features for fraud prevention. Similarly, entrust launched nShield HSM updates, focusing on secure cryptographic key management for e-commerce and point-of-sale (POS) systems.

The IoT security segment is experiencing the highest growth rate CAGR of 16.5% in the Hardware Security Modules (HSM) market, fueled by the rapid expansion of Internet of Things (IoT) ecosystems across industries such as smart homes, healthcare, automotive, and industrial automation. With billions of IoT devices connecting to networks, cybersecurity threats such as data breaches, unauthorized access, and ransomware attacks are escalating, creating a critical need for robust cryptographic security. Leading HSM providers, including AWS, Microsoft, and Infineon Technologies, have introduced innovative solutions to address IoT security challenges. In 2023, AWS launched IoT Device Defender with integrated CloudHSM, allowing secure cryptographic key management for large-scale IoT deployments.

By End Use

The Banking, Financial Services, and Insurance (BFSI) Segment held the largest revenue share in the Hardware Security Modules (HSM) market in 2023, driven by the rapid adoption of digital banking, online transactions, and stringent financial data security regulations. With rising cyber threats such as payment fraud, phishing attacks, and identity theft, financial institutions are heavily investing in HSM-based encryption and authentication solutions to secure sensitive customer data and financial transactions. The BFSI sector’s increasing reliance on contactless payments, blockchain-based financial services, and real-time settlement systems continues to drive demand for high-performance HSMs, reinforcing its position as the leading end-use segment in the market.

The Retail and Consumer Products Segment is witnessing the fastest CAGR in the Hardware Security Modules (HSM) market, fueled by the surge in e-commerce, digital payments, and omnichannel retailing. As retailers embrace point-of-sale (POS) encryption, mobile payment security, and customer data protection, the need for HSM-based security solutions is expanding. With cyber threats targeting retail transactions and personal consumer information, businesses are integrating HSMs for secure payment processing, inventory management, and digital loyalty programs. Major companies, including Amazon Web Services (AWS), IBM, and Futurex, have launched innovative HSM solutions for the retail sector.

In 2023, AWS enhanced its CloudHSM services, enabling retailers to secure customer transactions across multiple digital platforms. IBM introduced a retail-focused HSM-as-a-service solution, providing end-to-end encryption for in-store and online purchases.

Hardware Security Modules Market Regional Analysis

In 2023, North America led the Hardware Security Modules (HSM) market, holding an estimated market share of around 37%, driven by strong cybersecurity regulations, high adoption of digital payment systems, and the presence of key industry players. The region has stringent data protection laws such as the California Consumer Privacy Act (CCPA), PCI DSS, and FIPS 140-2, mandating organizations to implement robust encryption and key management solutions using HSMs.

Additionally, major tech giants such as Thales, Entrust, IBM, and Futurex are headquartered in North America, continuously innovating and expanding their HSM product lines. In 2023, IBM launched a next-gen cloud-based HSM-as-a-Service solution, catering to financial institutions and enterprises migrating to hybrid cloud environments. Furthermore, AWS expanded its CloudHSM offerings, providing scalable encryption solutions for businesses transitioning to digital infrastructures.

The Asia-Pacific (APAC) region is experiencing the fastest growth rate in the Hardware Security Modules (HSM) market, with an estimated CAGR of 16.4%, driven by rapid digitalization, increasing cybersecurity threats, and government-led data protection initiatives. Countries like China, India, Japan, and South Korea are witnessing a surge in digital banking, e-commerce, and cloud adoption, necessitating robust cryptographic security solutions. The region’s push for data sovereignty laws, such as China’s Cybersecurity Law and India’s Personal Data Protection Bill, is compelling businesses to deploy HSMs for regulatory compliance. In 2023, Thales launched new HSM models tailored for fintech and cloud service providers in APAC, while Futurex partnered with regional banks to deploy payment security HSMs. The region’s increasing investments in cloud security, smart city projects, and blockchain technology are further accelerating HSM adoption, making APAC the fastest-growing market in the industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Hardware Security Modules Market are:

-

Thales (Luna HSM, payShield HSM)

-

Utimaco Management Services GmbH (SecurityServer HSM, PaymentServer HSM)

-

Futurex (Vormetric Data Security Manager, Excrypt SSP Enterprise v.2)

-

Entrust Corporation (nShield Connect HSM, nShield Edge HSM)

-

IBM (IBM Cloud HSM, IBM z16 Crypto Express HSM)

-

Atos SE (Trustway HSM, Bull Hoox HSM)

-

Infineon Technologies AG (OPTIGA TPM, SLE 97 Secure HSM)

-

STMicroelectronics (STSAFE-A110, STM32Trust TEE Security Suite)

-

Microchip Technology Inc. (CryptoAuthentication HSM, CryptoMemory Secure ICs)

-

Yubico (YubiHSM 2, YubiKey 5 Series)

-

DINAMO NETWORKS (DINAMO HSM, DINAMO Key Manager)

-

Securosys (Primus HSM, CloudsHSM)

-

Spyrus (Rosetta HSM, Secure Digital Identity HSM)

-

Adweb Technologies (Adweb Cloud HSM, Adweb SecureKey HSM)

-

Lattice Semiconductor (MachXO3D Secure Control HSM, ECP5 Cryptographic Security HSM)

-

ellipticSecure (ellipticSecure Key Manager, ellipticSecure Encryption Engine)

-

Amazon Web Services, Inc. (AWS CloudHSM, AWS Key Management Service)

-

ETAS (ESCRYPT CycurHSM, ESCRYPT Key Management HSM)

Recent Trends

-

In February 2025, Quantum Dice and Thales launched a Hardware Security Module (HSM) enhanced with a Quantum Random Number Generator (QRNG), integrating Thales' Luna HSM with Quantum Dice's Quantum Entropy-as-a-Service (QEaaS) and DISC™ protocol. This collaboration aimed to provide real-time verification of cryptographic key security, supporting the transition to post-quantum security by ensuring high-quality entropy for encryption keys.

-

In February 2023, Utimaco and Digital Realty partnered to offer joint data center security solutions, aiming to enhance mission-critical cybersecurity services by integrating Utimaco's Hardware Security Modules with Digital Realty's infrastructure. This collaboration sought to provide secure and compliant environments for sensitive data, addressing the increasing demand for robust cybersecurity measures in data centers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.41 Billion |

| Market Size by 2032 | USD 5.03 Billion |

| CAGR | CAGR of 15.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (LAN Based, PCIE Based, USB Based, Cloud-Based HSMs) • By Deployment (Cloud, On-premises) • By Application (Payment Processing, Authentication, Public Key Infrastructure (PKI) Management, Database Encryption, IoT Security, Others) • By End Use (BFSI, Government, Healthcare and Life Sciences, Retail and Consumer Products, Technology and Communication, Industrial and Manufacturing, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thales, Utimaco Management Services GmbH, Futurex, Entrust Corporation, IBM, Atos SE, Infineon Technologies AG, STMicroelectronics, Microchip Technology Inc., Yubico, DINAMO NETWORKS, Securosys, Spyrus, Adweb Technologies, Lattice Semiconductor, ellipticSecure, Amazon Web Services, Inc., ETAS. |