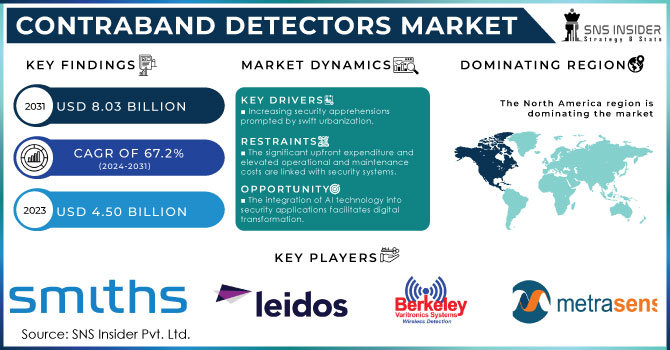

Contraband Detectors Market Size & Overview:

The Contraband Detectors Market Size was valued at USD 4.55 Billion in 2023 and is expected to reach USD 8.51 Billion by 2032 and grow at a CAGR of 7.22% over the forecast period 2024-2032.

The Contraband Detectors Market has grown enormously over the last few years, especially in the context of rising security threats and policy shifts by the governments to effectively deter illegal trading and smuggling practices. As of 2023, the US, China, and India, among others, are focusing significantly on the deployment of sophisticated technologies related to contraband detection, with an increasing budget being allotted by governments for strengthening airport security, seaport security, and border crossings.

Get more information on Contraband Detectors Market - Request Sample Report

For instance, the U.S. Department of Homeland Security provided with an increased budget for the detection systems in 2023. India, too, undertook policies that transformed its customs. It issued handheld detectors to all its checkpoints to check the increasing trend of smuggling. In a major move to improve security in correctional facilities, the Hubbard County Sheriff’s Office has adopted the innovative CLEARPASS® C.i. partial body scanner, created by LINEV Systems® in Conroe, Texas, to thwart the smuggling of illegal items like drugs and firearms into their jail.

Advancements in technology have contributed the most in determining the Contraband Detectors Market. The addition of AI into the contraband detectors has maximized their performance and accuracy. Real-time scanning of images using AI-powered systems helps reduce false positives by as much as 15%, according to the leading industry experts. The new portable X-ray scanners and trace detection systems now come with IoT capabilities that can be monitored and data shared from a distance, which is useful in big operations. One of the development highlights in 2023 was a new sophisticated handheld detector featuring advanced deep-learning algorithms in its detection for uncovering concealed items by a U.S.-based company.

The future holds great opportunities for the Contraband Detectors Market, due to the growth in demand for non-invasive detection technologies, as well as the need for rapid and efficient screening systems in dense population areas. Governments and private organizations are combining their efforts to improve R&D, which allows for innovative solutions to be adapted to specific security challenges. Another initiative is that of public-private partnerships and funding programs, that make advanced detection technologies more available in emerging economies.

Data from different government agencies such as the U.S. Department of Homeland Security and the European Border and Coast Guard Agency has pointed out that the use of contraband detectors is becoming increasingly essential to counter the smuggling activities. This aspect, along with others, explains why the market for contraband detectors is expected to remain on the growth trajectory in the near future.

Contraband Detectors Market Dynamics

Key Drivers:

-

Global Efforts to Combat Smuggling through Strengthened Security and Advanced Detection Technologies for Public Safety

Governments worldwide have strengthened security protocols, especially at borders, airports, and seaports, in response to rising smuggling activities. According to the U.S. Department of Homeland Security, 2023 saw increase in investment towards contraband detection systems, with border control agencies prioritizing mobile X-ray units and advanced scanners. These policies highlight the importance of contraband detectors in public safety and the reduction of risks associated with illegal trade.

-

Growing Demand for AI-Powered Detection Systems Enhancing Accuracy and Efficiency in Smuggling Prevention

The demand is significantly driven by cutting-edge innovations, such as AI-powered detection algorithms and portable devices. For example, industry research indicate that X-ray imaging systems with machine learning witnessed a 30% increase in adoption in 2023. Real-time analytics and remote monitoring capabilities have improved operational efficiency, reducing false alarms by 15% compared to conventional systems. This trend indicates the market's preference for smart, user-friendly solutions that optimize detection accuracy and performance.

Restrain:

-

Challenges of High-Cost Contraband Detection Equipment in Small Enterprises and Developing Countries

The price of contraband detection equipment, especially ones with more complex features such as AI and IoT, is highly prohibitive to small enterprises and developing countries. For example, portable X-ray machines can be as expensive as $20,000 to $50,000, thus are not very accessible.

Furthermore, the maintenance and operational expenses add to the burden of organizations, especially in low-income regions. Governments in emerging economies such as Africa and Southeast Asia are addressing this issue by offering subsidies and initiating public-private partnerships to reduce financial constraints. However, the overall adoption rate remains slower in cost-sensitive markets, which impacts the global expansion of the contraband detectors industry.

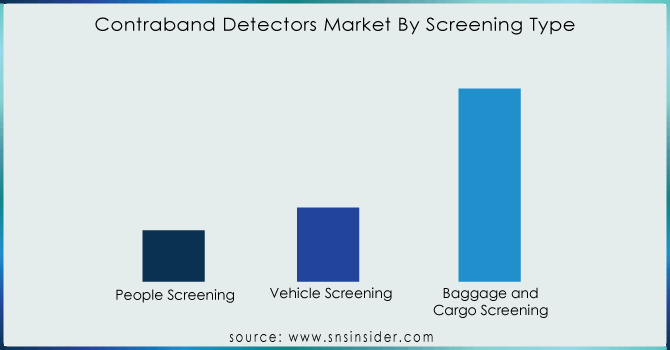

Contraband Detectors Market Segment Outlook

By Deployment Type

The portable segment dominated in 2023, holding 58% of the market share. Portable contraband detectors offer unparalleled flexibility, enabling swift and efficient deployment across diverse environments such as airports, ports, and high-traffic public spaces. These devices are lightweight, easy to operate, and equipped with cutting-edge technologies like AI-driven analytics, making them indispensable for on-the-go security checks.

Battery technology advancement and device miniaturization is fast, and at the same time, the portable segment is expected to grow with the fastest CAGR of 7.38% during the forecast period from 2024 to 2032. Government initiatives for enhancing border security and curbing illegal activities in regions such as Asia-Pacific and the Middle East fuel the increasing adoption of portable detectors. With mobility forming the backbone of organizations and striving to reduce costs, the portable segment is bound to grow aggressively in comparison to the fixed one.

By Technology

In 2023, the X-ray imaging emerged with the highest market share of 51%. The systems have a good reputation for high accuracy in detection of concealed items, making them preferred in the applications of airports, customs, and military. Further advancement in the technology of dual-energy and 3D X-ray systems is capable of cutting scanning time down to 25%.

The X-ray imaging segment is expected to grow at the fastest CAGR of 7.33% between 2024 and 2032, driven by the integration of AI and machine learning algorithms. These advancements enable real-time anomaly detection, significantly improving operational efficiency. Further, governments in nations like the U.S. and Germany are pushing mandatory installations of next-generation X-ray scanners into significant infrastructure areas expected to make it even stronger within the region within the years ahead.

Contraband Detectors Market Regional Analysis

North America led the Contraband Detectors Market in 2023, capturing 39% of the market share, with strong security policies and huge investments in R&D. The U.S. increased funding for contraband detection by 15% in 2023, according to Homeland Security.

Meanwhile, the Asia-Pacific region is expected to be the fastest-growing region, with a CAGR of 7.74% during the forecast period from 2024 to 2032. This growth is driven by the increasing cross-border trade activities, rising smuggling incidents, and government efforts to improve security infrastructure. China is also a major contributor, with innovations in portable and AI-integrated technologies driving market expansion across the continent.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the Major Players in the Contraband Detectors Market Are

-

Smiths Detection (HI-SCAN 6040aTiX, HI-SCAN 100100T-2is)

-

OSI Systems, Inc. (Rapiscan 620DV, Rapiscan 920CT)

-

Leidos (Soter RS, Soter X)

-

Nuctech Company Limited (MVT-1000, MVT-2000)

-

Metrasens (Ferromagnetic Detection System, M-Vision)

-

ADANI (ADANI X-ray Inspection System, ADANI Cargo Inspection System)

-

CEIA S.p.A. (THS/21, THS/21M)

-

Berkeley Varitronics Systems, Inc. (BVS-01, BVS-02)

-

Godrej Security Solutions (G-Secure, G-Safe)

-

Campbell/Harris Security Equipment Company (HDS-100, HDS-200)

-

Garrett Metal Detectors (PD 6500i, MZ 6100)

-

PKI Electronic Intelligence GmbH (PKI 6800, PKI 6800i)

-

Vidisco Ltd. (Eagle, Eagle X)

-

Astrophysics Inc. (XIS-1800, XIS-1000)

-

Autoclear LLC (ACX 100, ACX 200)

-

Gilardoni S.p.A. (G-Scan 100, G-Scan 200)

-

Aventura Technologies, Inc. (AVT-1000, AVT-2000)

-

Ranger Security Detectors (RSD-100, RSD-200)

-

Global Security Solutions, Inc. (GSS-1000, GSS-2000)

-

L3Harris Technologies (HI-SCAN 6040aTiX, HI-SCAN 100100T-2is)

Major Suppliers (Components, Technologies)

-

3M Company

-

Honeywell International Inc.

-

General Electric Company

-

Siemens AG

-

Schneider Electric SE

-

ABB Ltd.

-

Rockwell Automation, Inc.

-

Emerson Electric Co.

-

Mitsubishi Electric Corporation

-

Panasonic Corporation

Recent Trends

-

April 2024: Smiths Detection, a worldwide frontrunner in security screening and threat detection technologies, and a division of Smiths Group plc, today unveils its innovative X-ray Diffraction (XRD) technology scanner, the SDX 10060 XDi. Designed for deployment in numerous high-traffic global airports, express forwarding stations, and customs checkpoints, Smiths Detection’s latest scanner is a groundbreaking solution that is set to be a vital player in the ongoing rapid battle against illegal drugs and other forms of contraband.

-

January 2025: OSI Systems, based in the US, has announced an order worth around USD27 million to deliver checkpoint and hold baggage screening solutions to a confidential airport client.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 4.55 Billion |

|

Market Size by 2032 |

USD 8.51 Billion |

|

CAGR |

CAGR of 7.22% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Screening Type (People Screening, Vehicle Screening, Baggage and Cargo Screening) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Smiths Detection, OSI Systems, Inc., Leidos, Nuctech Company Limited, Metrasens, ADANI, CEIA S.p.A., Berkeley Varitronics Systems, Inc., Godrej Security Solutions, Campbell/Harris Security Equipment Company, Garrett Metal Detectors, PKI Electronic Intelligence GmbH, Vidisco Ltd., Astrophysics Inc., Autoclear LLC, Gilardoni S.p.A., Aventura Technologies, Inc., Ranger Security Detectors, Global Security Solutions, Inc., L3Harris Technologies. |

|

Key Drivers |

• Global Efforts to Combat Smuggling through Strengthened Security and Advanced Detection Technologies for Public Safety. |

|

Restraints |

• Challenges of High-Cost Contraband Detection Equipment in Small Enterprises and Developing Countries. |