Swarm Robotics Market Report Scope and Overview:

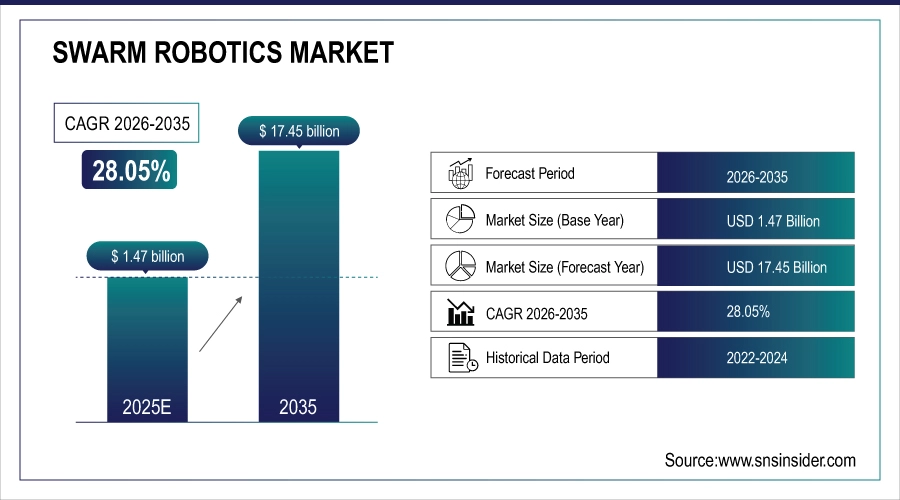

The Swarm Robotics Market Size was valued at USD 1.47 billion in 2025 and is expected to reach USD 17.45 billion by 2035 and grow at a CAGR of 28.05% over the forecast period 2026-2035.

Technology advancements and performance metrics such as real-time inter-robot communication, decentralized decision-making, and autonomous coordination have been fueling the Swarm Robotics market for the past few years. Operational and Functional metrics are on task efficiency, failure rates, power distribution, etc., and adaptability to multiple environments. Insights derived from behavioral patterns and AI concentrations highlight the need for self-learning, collective intelligence, and confluence for more effective decision-making.

Swarm Robotics Market Size and Forecast:

-

Market Size in 2025: USD 1.47 Billion

-

Market Size by 2035: USD 17.45 Billion

-

CAGR: 28.05% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Get E-PDF Sample Report on Swarm Robotics Market - Request Sample Report

Swarm Robotics Market Highlights:

-

Growing demand for autonomous systems across defense, industrial, and disaster response sectors is driving market expansion.

-

Military and defense applications increasingly invest in swarm-based surveillance, reconnaissance, and combat systems to enhance operational efficiency.

-

Integration of AI, ML, and communication technologies enables coordinated swarm operations in agriculture, logistics, and automation.

-

High development costs, limited power capacity, and lack of standard communication protocols hinder large-scale adoption.

-

Opportunities emerge in precision farming, healthcare automation, and smart manufacturing through Industry 4.0 advancements.

-

Strategic collaborations, increased R&D funding, and supportive regulations are expected to accelerate future market growth.

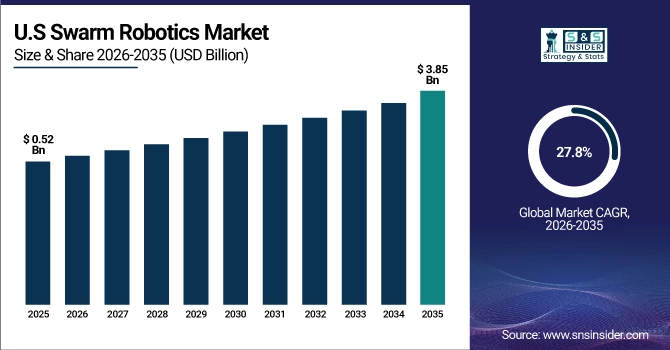

The U.S. Swarm Robotics market size was valued at an estimated USD 0.52 billion in 2025 and is projected to reach USD 3.85 billion by 2033, growing at a CAGR of 27.8% over the forecast period 2026–2033. Market growth is driven by increasing adoption of swarm intelligence across defense, logistics, agriculture, and industrial automation applications. Rising demand for decentralized, scalable, and cost-effective robotic systems capable of collaborative task execution is accelerating market expansion. Additionally, advancements in artificial intelligence, machine learning, edge computing, and communication technologies, along with growing investments in autonomous systems research and pilot deployments, further strengthen the robust growth outlook of the U.S. swarm robotics market during the forecast period.

Swarm Robotics Market Drivers:

-

Swarm Robotics Market Booms with Rising Demand for Autonomous Systems in Defense, Industry, and Disaster Response

The global swarm robotics market is growing rapidly, driven by the rise in demand for drone-launched autonomous systems across different sectors. One of the largest propelling features is Military & defense applications accelerate their investment in autonomous, surveillance, reconnaissance, and combat swarm systems to maximize operational effectiveness while minimizing exposure to human risk. Moreover, emerging technologies such as artificial intelligence (AI), machine learning (ML), and communication technology are conducting swarm cooperation for reliable service within industrial automation, agriculture, and logistics. An increase in the demand for the use of Unmanned Aerial Vehicles (UAV) and unmanned ground vehicles (UGVs) in inspection, search & rescue process, and disaster relief have continued to complement the market growth.

Swarm Robotics Market Restraints:

-

High Costs, Power Limitations, and Lack of Standardization Challenge Swarm Robotics Adoption

Numerous challenges can limit the adoption of swarm robots shortly. The high initial investment & development cost of swarm robotics technology is a significant restraint. While advanced AI, real-time communication, and sensor technologies increase overall system complexity and require significant R&D investments. Another important problem is the limited power and battery life, which is a serious problem for many swarm robots that are typically deployed in harsh environments that are not suitable for easily recharging or replacing the batteries. However, swarm coordination communication protocols are not standardized, and thus, interoperability of various robotic platforms is limited.

Swarm Robotics Market Opportunities:

-

Swarm Robotics Unlocks New Opportunities in Agriculture Healthcare and Smart Manufacturing

Such emerging opportunities include applying swarm robotics to various use cases such as precision farming and crop monitoring as well as within the agriculture and healthcare domains swarm robotics have endless possibilities, like reimagining the future of autonomous medical delivery systems. Moreover, the growing emphasis on Industry 4.0, particularly the collaborative robotics in smart manufacturing and warehouse automation creates high revenue generation opportunities. This low-cost and power-efficient robotic swarm will drive its adoption across various industries. Appropriate strategic partnerships and research funding, as well as regulatory support, will be key to the future of swarm robotics.

Swarm Robotics Market Segment Highlights:

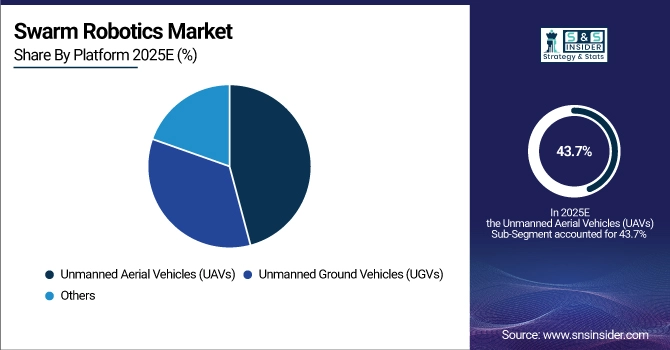

By Platform

In 2025, Unmanned Aerial Vehicles BU (UAVs) led the share market with 43.7% of the total market. This was driven by their extensive utilization of military surveillance, environmental monitoring, disaster response, and industrial inspections. Due to their mobility, ability to collect data in real-time, and relatively cheapness concerning the large area that they can cover, UAVs are very popular.

From 2026 to 2035, Unmanned Ground Vehicles are expected to grow at the quickest CAGR owing to increasing use in the military, warehouse automation, agricultural vehicles, and search & rescue missions. Improvements in Artificial intelligence, sensor technology, and autonomous navigation will accelerate UGV adoption.

By Application

In 2025, Security, Inspection & Monitoring segment accounted for a leading share of 38.3% of the total market. This segment encompasses the largest revenue share due to the growing utilization of autonomous drones and ground robots for surveillance of borders, inspection of industries, and security of critical infrastructures. More and more swarm robotics has started to help governments and private organizations through their use in real-time monitoring, and threat detection and to make operations more efficient.

Mapping & Surveying holds the fastest CAGR from 2026 to 2035, owing to an increase in demand for precision mapping applications in the agriculture, construction, mining, and smart city domains. Will make growth even faster with improved accuracy imaging using an AI-based automation process established process.

By End Use

The Military & Defense segment accounted for 42.8% of the overall swarm robotics market in 2025. Part of this leadership stems from autonomous drones and ground robots, being increasingly used for surveillance, reconnaissance, operation on the battlefield, and to detect threats. Across the globe, we are seeing a massive investment by governments to incorporate AI into robotic swarms for a few basic purposes increased operational efficiency, reduction of human risk, and domestic and international defense power.

The fastest CAGR From 2026 to 2035 is anticipated to be in agriculture, driven by the growing need for precision farming, automated pest control & crop monitoring. The growing adoption of swarm robotics in farming operations will be enhanced with the developments in AI, IoT, and sensor technologies.

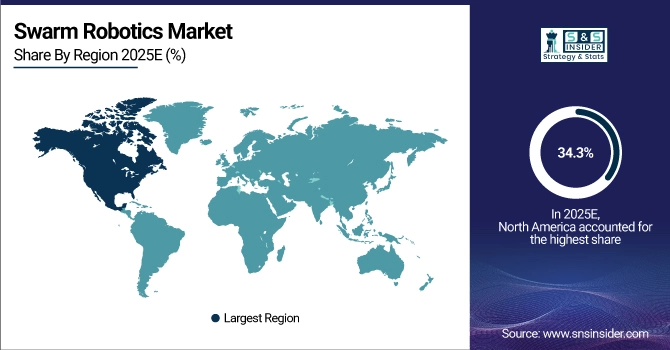

Swarm Robotics Market Regional Analysis:

North America Swarm Robotics Market Insights:

North America emerged as the largest market for swarm robotics in 2025, garnering a market share of 34.3% in the same year, and is expected to grow faster during the forecast period from 2026 to 2035. The rapid growth is attributed to surging investments in military, industrial automation, agriculture, and logistics. The U.S. Department of Defense has been putting money into swarm technology for military uses swarm drones for surveillance and on the battlefield. Advanced autonomous drone systems developed by companies such as Shield AI and Anduril Industries are used for military surveillance and combat scenarios.

In the industrial segment, big companies like Amazon Robotics and Boston Dynamics are using swarm robotics to automate warehouse and last-mile delivery. Autonomous robots are used by Amazon in their fulfillment centers to improve the supply chain. In the same vein, John Deere is leveraging warm robotics in precision agriculture by deploying fleets of autonomous tractors and drones for increased farming efficiency. NASA and DARPA are also pouring money into robotic swarms used in search of rescue after natural disasters.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Europe Swarm Robotics Market Insights

Europe accounted for a significant share of the swarm robotics market in 2025 and is projected to expand steadily through 2035. The growth is driven by strong government support for robotics research, increasing adoption in industrial manufacturing, and advancements in collaborative robotics. The European Union has invested heavily in R&D programs under Horizon Europe to accelerate autonomous systems and swarm intelligence innovations. Countries such as Germany, France, and the U.K. are at the forefront, integrating swarm robotics into automotive, logistics, and aerospace applications. Leading firms like ABB Robotics, KUKA, and Siemens are developing swarm-based automation systems to enhance productivity, flexibility, and safety in smart factories. In addition, the growing use of autonomous drones and robotic systems for environmental monitoring, precision agriculture, and infrastructure inspection is further supporting market growth across Europe.

Asia Pacific Swarm Robotics Market Insights

Asia Pacific is anticipated to witness the fastest growth in the swarm robotics market from 2026 to 2035. The region’s expansion is driven by robust manufacturing sectors, growing defense modernization programs, and increasing demand for automation in agriculture and logistics. China, Japan, South Korea, and India are key contributors to market growth. China’s heavy investments in AI-driven robotics and drone swarms for defense and commercial applications are shaping the regional landscape.

Japanese and South Korean companies are integrating swarm robotics in industrial automation and smart mobility systems. In agriculture, startups in India and Southeast Asia are adopting robotic swarms for precision farming, pest control, and yield optimization. The strong presence of electronics and robotics manufacturers, coupled with government incentives for AI and automation technologies, is boosting market development in the region.

Latin America Swarm Robotics Market Insights

Latin America’s swarm robotics market is in an early but growing phase, supported by increasing adoption of automation in agriculture, logistics, and public safety. Countries like Brazil, Mexico, and Argentina are leading the adoption, with applications focusing on crop monitoring, autonomous surveillance, and warehouse automation.

Brazil’s agritech sector is utilizing drone swarms for real-time crop mapping and pesticide management, while logistics firms in Mexico are exploring robotic swarms to streamline warehouse operations. Government initiatives promoting digital transformation and the presence of local robotics startups are likely to accelerate regional market growth during the forecast period.

Middle East & Africa (MEA) Swarm Robotics Market Insights

The Middle East & Africa market for swarm robotics is gradually expanding, driven by investments in smart infrastructure, defense, and oil & gas automation. The UAE and Saudi Arabia are leading the adoption of advanced robotics under their national visions for economic diversification and smart city development.

Swarm robotics is being deployed for border surveillance, search-and-rescue operations, and infrastructure inspection in challenging environments. In Africa, emerging applications in agriculture and mining are gaining traction, particularly in South Africa and Kenya. Government support for AI integration, coupled with rising private investments in automation technologies, is expected to strengthen the swarm robotics market across the MEA region through 2033.

Swarm Robotics Market Competitive Landscape:

Boston Dynamics was established in 1992 in the United States and is a leading robotics company specializing in advanced mobility, perception, and intelligence systems. Known for robots like Spot and Atlas, the company pioneers dynamic, agile machines used in industrial inspection, defense, logistics, and research applications worldwide.

- In February 2025, Boston Dynamics and the Robotics & AI Institute partnered to advance humanoid robots using reinforcement learning, enhancing Atlas's mobility and manipulation skills.

Anduril Industries was established in 2017 in the United States and focuses on defense technology and autonomous systems. The company develops advanced AI-powered solutions such as Ghost Shark and Dive-LD, enhancing military surveillance, border security, and underwater defense capabilities through cutting-edge hardware and software integration.

OpenAI was established in 2015 in the United States and specializes in artificial intelligence research and development. It is known for creating advanced AI models like GPT and DALL·E, aiming to ensure that artificial general intelligence (AGI) benefits humanity through safe, ethical, and accessible AI innovations.

- In December 2024, Anduril and OpenAI formed a strategic partnership to integrate AI into counter-drone defense systems for the U.S. military. This collaboration aims to enhance real-time threat detection and autonomous response against aerial threats.

Swarm Robotics Market Key Players:

-

Boston Dynamic

-

Universal Robots

-

Anduril Industries

-

TOSY Robotics

-

Swarm Technology

-

KUKA Robotics

-

Clearpath Robotic

-

DJI Innovations

-

iRobot Corporation

-

FANUC

-

ABB Robotics

-

Blue Ocean Robotics

-

Parrot Drones

-

Roboteam

-

Opteran

-

Amazon Robotics

-

NVIDIA

-

Autonomous Solutions Inc.

-

DroneSwarm

-

Fetch Robotics

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.47 Billion |

| Market Size by 2035 | USD 17.45 Billion |

| CAGR | CAGR of 28.05% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Unmanned Ground Vehicles (UGVs), Unmanned Aerial Vehicles (UAVs), Others) • By Application (Security, Inspection & Monitoring, Mapping & Surveying, Search & Rescue and Disaster Relief, Supply Chain and Warehouse Management, Others) • By End Use (Military & Defense, Industrial, Agriculture, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Boston Dynamics, Universal Robots, Anduril Industries, TOSY Robotics, Swarm Technology, KUKA Robotics, Clearpath Robotics, DJI Innovations, iRobot Corporation, FANUC Corporation, ABB Robotics, Blue Ocean Robotics, Parrot Drones, Roboteam, Opteran Technologies, Amazon Robotics, NVIDIA, Autonomous Solutions Inc., DroneSwarm, Fetch Robotics. |