Base Oil Market Report Scope & Overview:

Get E-PDF Sample Report on Base Oil Market - Request Sample Report

Base Oil Market Size was valued at USD 20.86 billion in 2023. It is projected to reach USD 33.20 billion by 2032 and grow at a CAGR of 5.3% over the forecast period 2024-2032.

The base oil market is experiencing growth due to the expanding automotive and manufacturing sectors, which demand lubricants for machinery and vehicle maintenance. Additionally, the increasing focus on energy efficiency and sustainability drives the demand for high-quality base oils. Technological advancements in production processes enable the manufacturing of superior base oils with improved properties, meeting evolving industry standards. The kind of base oil used for refining and/or the process of base oil manufacture might affect the quality of a lubricant. As base oils typically make up between 70 and 97 percent of lubricant formulations, it is crucial for the grade of the industrial lubricant. Furthermore, stringent environmental regulations promoting the use of eco-friendly lubricants further boost market growth. Overall, these factors contribute to the expansion of the base oil market.

Base Oil Market Dynamics

Drivers

-

Increasing vehicle production and sales globally

-

Expansion in industrial sectors such as manufacturing, construction, and mining

-

Advancements in base oil refining technologies enable the production of high-quality lubricants

-

Rising marine industry demand for base oils

The growing demand for base oils from the marine industry is a significant factor shaping the base oil market. The marine sector relies on base oils for various lubrication needs, including engine oils, hydraulic fluids, and gear oils. With increasing maritime activities, such as shipping, offshore exploration, and cruise tourism, the need for effective lubrication solutions to ensure smooth operations and prevent equipment wear is driving the demand for base oils. This trend underscores the market's responsiveness to industry-specific requirements and its role in supporting diverse sectors like the marine industry.

Restraint

-

Fluctuations in crude oil prices directly impact the production cost of base oils

Opportunities

-

Rising Demand for Bio-based Lubricants

-

Increasing preference for Group II and Group III base oils over conventional base oils

The growing preference for Group II and Group III base oils over conventional options presents a significant opportunity in the base oil market. These advanced base oils offer superior performance characteristics, including better oxidation stability, higher viscosity index, and reduced volatility, meeting the evolving demands of end-users for higher-quality lubricants. As industries prioritize efficiency and sustainability, the adoption of Group II and Group III base oils is expected to increase, driving market growth and expanding the market share of these premium products.

Challenges

-

Competition from Synthetic Lubricants

Synthetic lubricants, which encompass synthetic base oils, provide benefits like improved performance, increased longevity, and longer intervals between oil changes. With ongoing advancements and growing acceptance, synthetic lubricants create competition for conventional base oils. This competition could potentially curtail the market share of traditional base oils as more industries opt for the advantages offered by synthetic alternatives.

Base Oil Market Segmentation Analysis:

By Group

Group I dominated the group segment of the base oil market with a revenue share of more than 42% in 2023 primarily due to its cost-effectiveness and widespread availability. With a relatively simpler refining process compared to other groups, Group I base oils are more economically viable for a range of applications, driving their widespread adoption across various industries. Additionally, their compatibility with additives enhances their versatility, further solidifying their market dominance.

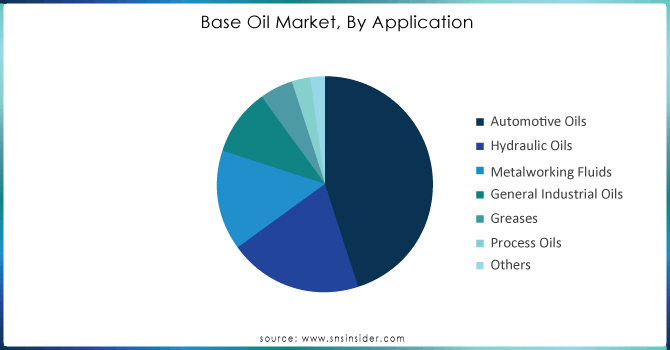

By Application

By application, the automotive oils held the highest revenue share of more than 40% in 2023 primarily attributed to the continued growth of the automotive industry worldwide. With increasing vehicle production and maintenance needs, demand for automotive oils remains robust. Additionally, stringent performance standards and specifications necessitate high-quality lubricants, further driving the adoption of base oils in this sector. Moreover, technological advancements in automotive lubricants enhance engine efficiency and durability, contributing to their dominant market position.

Get Customized Report as per your Business Requirement - Request For Customized Report

Base Oil Market Regional Outlook:

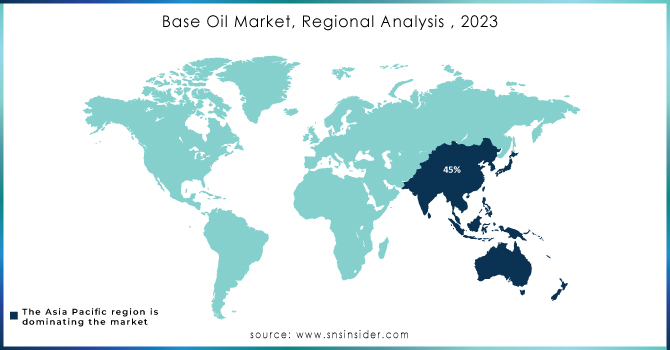

Asia Pacific dominated the Base Oil Market with the highest revenue share of more than 45% in 2023 owing to the region's robust industrial growth and expanding automotive sector. The region's flourishing manufacturing activities, particularly in countries like China and India, fuel the demand for base oils in various applications. Additionally, rapid urbanization and infrastructural development further stimulate base oil consumption, consolidating Asia Pacific's leading position in the market.

Europe is the second largest region in the Base Oil Market due to its mature automotive and manufacturing sectors, which drive substantial demand for lubricants and base oils. The region's stringent regulatory environment promotes the adoption of high-quality lubricants, supporting market growth. Additionally, the presence of key market players and advanced technological capabilities further strengthens Europe's position in the base oil market, ensuring continued prominence in the industry.

Key Players:

The Key Players are Petroliam Nasional Berhad (PETRONAS) (Malaysia), Repsol S.A. (Spain), Hindustan Petroleum Corporation Limited (India), Rosneft (Russia), China National Offshore Oil Corporation (China),Royal Dutch Shell plc (The Netherlands), Saudi Aramco (Saudi Arabia), GS Caltex Corporation (U.S.), Chevron Corporation (U.S.), Exxon Mobil Corporation (U.S.), Abu Dhabi National Oil Company (ADNOC) (UAE), Petrochina Company Limited China), Sinopec Corp (China) & Other Players.

Recent Development -

-

In March 2024, the Chinese state-owned oil and gas giant CNOOC Ltd (0883. HK) made a significant discovery in the South China Sea. They found a new reserve containing over 100 million tons of oil equivalent proved place.

-

In January 2024, Hindustan Petroleum Corp. Ltd. (HPCL) awarded a contract to Chevron Lummus Global LLC (CLG) to license technologies for a proposed grassroots unit at their 9.5-million tonne/year (tpy) refinery in Mumbai, Maharashtra, India.

-

In October 2023, Idemitsu Kosan Co., Ltd. partnered with Saudi Aramco Base Oil Company - Luberef. They signed an MOU regarding the supply of refined lubricant base oil Gr.III.

-

In May 2023, Shell Plc (SHEL.L) announced that they will be utilizing AI-based technology from big-data analytics firm SparkCognition in their deep-sea exploration and production. This partnership aims to boost offshore oil output.

-

In September 2022- Indian Oil Corporation Limited (IOCL) awarded ThyssenKrupp Industrial Solutions India Private Ltd. an engineering, procurement, and construction contract valued at USD 75 million. The contract involves setting up a Catalytic Dewaxing Unit (CDWU) with a capacity of 270 kilotons per annum (KTPA) for the production of lube base oils at its Gujarat refinery in India

-

In April 2022 - Chevron Global Energy Inc., a subsidiary of Chevron Corporation, successfully acquired the NEXBASE brand from Neste Corporation. This strategic move enhances Chevron's standing as a prominent global supplier of base oils. The acquisition of the NEXBASE brand bolsters Chevron's position in the base oil market, reinforcing its ability to offer a wider range of base oil products and solutions to customers worldwide.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 20.86 Billion |

| Market Size by 2032 | US$ 33.20 Billion |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Group (Group I, Group II, Group III, Group IV, and Group V) • By Application (Automotive Oils, Hydraulic Oils, Metalworking Fluids, General Industrial Oils, Greases, Process Oils, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sumitomo Heavy Industries, Ltd. (Japan), Veolia Water Technologies (France), Saltworks Technologies Inc. (Canada), JEOL Ltd. (Japan), Colmac Coil Manufacturing, Inc. (US), GEA Group AG (Germany), De Dietrich Process Systems (France), Coilmaster Corporation (US), SPX Flow Inc. (US), Belmar Technologies Ltd. (England), SUEZ Water Technologies & Solutions (France) |

| Key Drivers | • Increasing vehicle production and sales globally • Expansion in industrial sectors such as manufacturing, construction, and mining • Advancements in base oil refining technologies enable the production of high-quality lubricants • Rising marine industry demand for base oils |

| Restraints | • Fluctuations in crude oil prices directly impact the production cost of base oils |