Barrier Films Market Report Scope & Overview:

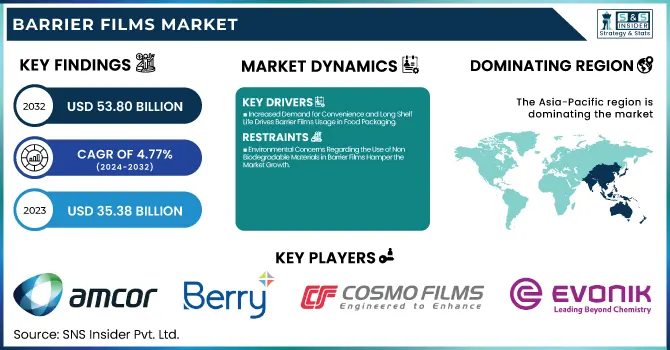

The Barrier Films Market Size was valued at USD 35.38 Billion in 2023 and is expected to reach USD 53.80 Billion by 2032, growing at a CAGR of 4.77% over the forecast period of 2024-2032.

To Get more information on Barrier Films Market - Request Free Sample Report

The Barrier Films Market is driven by the technology up-gradation and growing preference for sustainable packaging. Our report points to supply chain analysis, including the sourcing of raw materials and efficiencies in processes. It also focusses at the environmental impact of eco-friendly solutions, as well as the investment and funding trends that are shaping innovation. Moreover, our report also provides end-use industry needs in the food, healthcare, and electronics sectors, while awarding the research a focus on pricing trends/cost analysis, exposing the shifting landscape of the market.

Barrier Films Market Dynamics

Drivers

-

Increased Demand for Convenience and Long Shelf Life Drives Barrier Films Usage in Food Packaging

Growing need for convenience and long shelf-life food products is a key factor in driving the Barrier Films Market. With the fast-paced trend in consumer lifestyles, there is growing demand for packaged food products that meet the convenience factor without compromising the quality. By preventing exposure to external factors such as moisture, air, and light, Barrier Films are critical to ensuring that food products remain fresh and retain their taste and nutrition. To address the challenge of extending the shelf life of many particular products, effective barrier solutions are necessary, especially for ready-to-eat meals, snacks, and frozen foods. And the proliferation of e-commerce and food delivery is also driving this trend where the role of packaging is critical to ensure that the products reach their destination in good condition. Hence, the increasing demand for safe, high-quality and shelf-stable food products will remain a driver for Barrier Films used in the food industry.

Restraints

-

Environmental Concerns Regarding the Use of Non-Biodegradable Materials in Barrier Films Hamper the Market Growth

Barrier Films are indeed required for product safeguarding, but the detrimental effects on the environment due to the use of heavyweight plastics which are non-biodegradable. With sustainability growing in importance worldwide, both governments and environmental charities are more frequently advocating for laws that ban the use of non-recyclable packaging. Consumers also are demanding alternatives with lower pollution and waste footprints. This increasing focus on sustainability is driving manufacturers to evaluate biodegradable and recyclable alternatives, which tend to incur increased production costs or lower barrier performance. However, these challenges pertaining to the environmental impacts of non-biodegradable materials can also hinder the overall growth of the Barrier Films Market as companies might have to compromise while designing these films in terms of environmental aspects along with the workability and cost of the product.

Opportunities

-

Rising Demand for Smart Packaging Solutions Offers Significant Growth Potential for Barrier Films Market

Barrier films market is a growing opportunity as smart packaging solutions integrated with advanced technologies including sensors, temperature indicators and RFID tags. These technologies offer additional capabilities to both consumers and businesses by allowing them to track product conditions, including temperature, humidity, and freshness, at every stage in the supply chain. The growing need for packaging that safeguards the food against perishing as well as conveys vital information in applications such as food, pharmaceutical, and electronics drive demand for smart Barrier films. Integration of these technologies in base materials such as Barrier Films opens up avenues for manufacturers to provide products with higher versatility and functionality marking a path for growth in the upcoming years.

Challenge

-

Increasing Raw Material Prices and Supply Chain Disruptions Pose Challenges for Barrier Films Manufacturers

Fluctuating prices of raw materials and supply chain disruptions continue to pose challenges for manufacturers in the Barrier Films Market. Demand for packaging materials is increasing while the cost of essential raw materials such as polyethylene, polypropylene, and polyester has been fluctuating. This has posed a challenge for manufacturers who would want to stay competitive with pricing while maintaining quality production. Supply chain disruptions may complicate every production process; some are sourced from geopolitics, others, from natural disasters while others, global pandemics. These hurdles not only undermine the aggregate profit of manufacturers but can also compel them to increase cost structures for end-users, which in turn can slow the overall growth of the market.

Barrier Films Market Segmental Analysis

By Type

In 2023, Metalized Barrier Films dominated the barrier films market and accounted for the largest share of around 45%. Due to their superior moisture, oxygen, and light barrier properties, these films can preserve product’s quality and shelf-life and are therefore extensively used across food and beverage packaging among other industries. Metalized films made from aluminum or other metals are common for the cost-effective packaging of snack foods, ready-to-eat meals, and for use in other applications. Reports issued by organizations such as the Flexible Packaging Association have stated that the preference for Metalized Barrier Films continues to teach new levels; with the enhanced level of product protection achieved by metalized films, the region has maintained a healthy position in the food packaging market.

By Material

In 2023, Polyethylene (PE) dominated the Barrier Films Market, accounting for 35% market share. PE films are most widely used, as they are flexible, easy to process, and have shock resistance and moisture barrier properties, resulting in application in packaging for food, beverages, and personal care goods. Other factors contributing to the massive PE adoption are the lower costs achieved with this material and the possibility of recycling, which would cover the increasing need for sustainable packaging designs. Polyethylene has been credited by the American Chemistry Council with enhancing efficiency in packaging and minimizing waste of material, which are contributing factors to its market dominance.

By Technology

In 2023, Blown Film technology dominated and held 55% of the market share in the Barrier Films Market. It is a favoured technology for fabrication of films with superior thickness control and mechanical properties. The process begins by blowing a tube of molten plastic that is cooled and flattened into film. Excellent for multi-layered Barrier Films used in food, medical and industrial flexible packaging addressed by Blown Film. According to recent reports from the Packaging Machinery Manufacturers Institute, Blown Film technology remains in reporters' fortunes due to its effectiveness in volume and durability and because it is cost-effective for producing tough, high-quality films.

By End-Use Industry

In 2023, food & beverage sector dominated and accounted for the maximum market share in barrier films market with a share of 47.3%. The growth of the Barrier Films market in the food packaging sector is propelled by the need to preserve the shelf-life of products and maintain freshness and safety of food products during transit and storage. Ready-to-eat meals, snacks and beverages demand packaging solutions with enhanced barrier features to ensure that products are fully protected from moisture, oxygen and light. According to industry organizations such as the Food Packaging Forum, the growing need for high-performance films in food packaging demonstrates that this sector is leading the market.

Barrier Films Market Regional Outlook

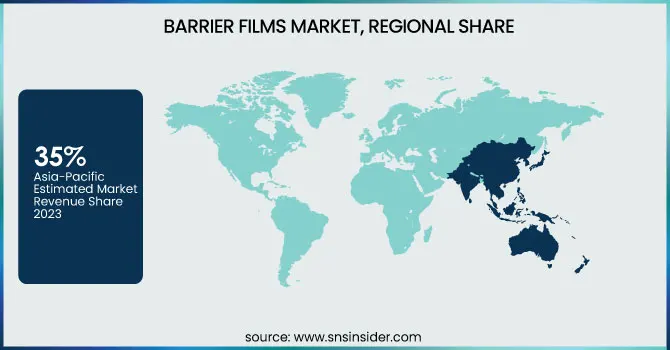

The Asia Pacific region dominated the Barrier Films Market and held the largest market share of around 35% in the year 2023. The dominance can be attributed to rapid growth in manufacturing industries of the regions such as China and India, where the demand for flexible packaging solutions is witnessed in high numbers. This boom has been due to the region's low wage rates, large-scale production potential, and the burgeoning sector of e-commerce packaging. For example, China is the biggest consumer and producer of packaging materials globally, and needs to act as a very important player for the regional market to be the leading market in barrier films, as per China National Packaging Association report which projects that demand for barrier films will continue to expand. This increase in demand for barrier films to improve product shelf life has also been spurred by India’s burgeoning food processing sector, according to the Ministry of Food Processing Industries. Among all these regions, Japan and South Korea along with the growing automotive and electronics industries and the pharmaceutical sector strengthens the overall position of the region in the Barrier Films Market.

Moreover, North America is projected as the fastest-growing region with a significant growth rate during the forecast period. Such growth is attributed to rising needs for sustainable, high-performance packaging solutions across sectors such as food & beverages, pharmaceuticals, and personal care, among others. According to the Sustainable Packaging Coalition, as the largest market for packaging in the region, the United States is experiencing an increase in the implementation of eco-friendly and innovative packaging technology. The demand for barrier films is also being driven in Canada by the government’s efforts to minimize plastic waste and encourage recyclable packaging. The rapid growth of the market in the region has been supported by Mexico’s increasing manufacturing capabilities and the expansion of the food packaging sector. Thus, technological innovations and increasing sustainability concerns are anticipated to keep the North American market growing.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Amcor Plc (AmLite, Ultra Pouch, Formpack)

-

Berry Global Inc. (ClearSeal Barrier Films, Optym™ Pure, NorDiVent FFS Film)

-

Cosmo Films Ltd. (Barrier Metalized BOPP Film, High Barrier Transparent Film, Heat Resistant Barrier Film)

-

Dow Chemical Company (INNATE Precision Packaging Resins, SURLYN Ionomers, ELITE Polyethylene Resins)

-

DuPont Teijin Films (Melinex Polyester Films, Mylar Polyester Films, Cronar Polyester Films)

-

Evonik Industries AG (VESTOPLAST Amorphous Polyalphaolefins, VESTAMID Polyamide Resins, VISIOMER Methacrylate Monomers)

-

ExxonMobil (Vistamaxx Performance Polymers, Enable Performance PE Polymers, Exceed XP Performance Polymers)

-

Flair Flexible Packaging Corporation (CLEAR-TITE High Barrier Films, INNOVAC Foil Replacement Films, ENVi Recyclable Films)

-

HPM Global Inc. (High Barrier Retort Films, Vacuum Skin Packaging Films, Anti-Fog Lidding Films)

-

INEOS Group Limited (SURLYN Ionomers, BAREX Polyacrylonitrile Resins, ELITE Enhanced Polyethylene)

-

Jindal Poly Films Ltd. (BOPP Barrier Films, Metalized Polyester Films, Coated Films)

-

Mondi Plc (BarrierPack Recyclable, FunctionalBarrier Paper, PerFORMing Paper-Based Trays)

-

PJSC Nizhnekamskneftekhim (Polyethylene Films, Polypropylene Films, Polystyrene Films)

-

Qatar Chemical Company (QAPCO LDPE Barrier Films, Q-Chem HDPE Films, Qatofin LLDPE Films)

-

Royal Dutch Shell (Carilon Polyketone Films, Kraton Polymers, High-Performance Polyethylene Films)

-

SABIC (LLDPE Barrier Films, BOPP Films, Polyamide Films)

-

Sasol Limited (Low-Density Polyethylene Films, Linear Low-Density Polyethylene Films, High-Density Polyethylene Films)

-

Sealed Air Corporation (Cryovac Barrier Films, OptiDure High-Performance Films, Darfresh Vacuum Skin Packaging Films)

-

Toppan Inc. (GL Barrier Films, Toppan TLB Barrier Films, Transparent Barrier Films)

-

Chevron Phillips Chemical Company (Marlex Polyethylene Films, MarFlex Polypropylene Films, High-Density Polyethylene Barrier Films)

Recent Highlights

-

October 2024: Klöckner Pentaplast introduced recyclable barrier films that help enable more sustainable food packaging by improving recyclability without compromising product quality or shelf life.

-

March 2024: At CFIA 2024, Jindal Films launched a new mono-material barrier film that they said will provide a fully recyclable packaging alternative to meet a growing demand for sustainable solutions.

-

March 2024: Toppan announced its development of a new barrier film that helps extend the shelf-life of food products and enhances the durability of medical packaging.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 35.38 Billion |

| Market Size by 2032 | USD 53.80 Billion |

| CAGR | CAGR of 4.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Metalized Barrier Films, Transparent Barrier Films, White Barrier Film) •By Material (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polyamides (PA), Ethylene Vinyl Alcohol (EVOH), Linear Low-Density Polyethylene (LLDPE), Others) •By Technology (Blown Film, Cast Film, Others) •By End-Use Industry (Food & Beverage, Pharmaceutical & Healthcare, Electronics, Agriculture, Personal Care & Cosmetics, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amcor Plc, Berry Global Inc., Cosmo Films Ltd., DuPont Teijin Films, Jindal Poly Films Ltd., Mondi Plc, Sealed Air Corporation, Toppan Inc., Flair Flexible Packaging Corporation, HPM Global Inc. and other key players |