Battery Coating Market Report Scope & Overview:

Get More Information on Battery Coating Market - Request Sample Report

The Battery Coating Market Size was valued at USD 325 million in 2023 and is expected to reach USD 1130 million by 2032 and grow at a CAGR of 14.8% over the forecast period 2024-2032.

The battery coating market is driven by the rapid expansion of renewable energy sources, namely solar and wind, there is an increasing need for efficient energy storage systems, leading to a growing demand for advanced battery coatings. When countries focus on meeting their renewable goals, energy storage systems become critical for grid stabilization and ensuring a reliable energy supply.

For example, according to the U.S. Department of Energy, the battery storage capacity has increased substantially and exceeded 1,650 megawatts at the end of 2020. The rapid expansion with no signs of a slowdown is projected for the future. The same can be observed in the European Union with a 32% commitment to energy from renewables by 2030 and sizeable investments in large-scale battery storage projects. Battery coatings are crucial for these systems as they improve stability and energy density, which allows storing the energy generated by solar panels and wind turbines when it is produced and efficiently utilizing it when needed and driving the market growth.

Moreover, the range of consumer electronics, i.e. smartphones, laptops, and wearable devices, emerging in the market is expanding, and all of them require higher density and longer life span. The demands drive the necessity for advanced types of coatings for marine batteries. For instance, in 2023, Samsung SDI reported on the development of a novel coating technology for lithium-ion cells. It has been reported that a product allows for a double increase of the energy density for batteries, reduces the risk of degradation, enhances life span, and, as a result, guarantees longer times of battery operation at the devices.

Additionally, LG Energy Solution has created a high-performing coating for batteries that also provides increased thermal stability of the batteries. Coatings ensuring better performance of lithium-ion batteries play an important role in meeting the requirements of the expanding consumer electronics sector.

Market Dynamics

Drivers

-

Technological Advancements to Enhanced Battery Performance in battery industry

The growing popularity of electric vehicles (EVs) in the battery coating market, which ditch fossil fuels like gas, petrol, and diesel for a greener future. This increased demand for EVs is to be a major growth driver for the global battery coating market in the coming years. Further fueling this growth is the influx of powerful new players in the EV manufacturing space. These companies are strategically targeting all consumer segments, effectively expanding the market reach and creating a much larger consumer base for EVs.

In 2023, Tesla unveiled a new technology for the coating of batteries that will improve the performance and longevity of lithium-ion batteries produced and used by the company. In this way, a direct response is made to one of the primary concerns in the industry, which is the need for more durable and efficient batteries to store and transfer energy in electric vehicles.

Similarly, BYD, a major Chinese producer of EVs, implemented advanced coatings into the batteries of its cars starting from 2022, significantly improving the thermal management and energy density of the battery, which allows for longer driving range and increased safety. In 2021, there were also notable achievements by new entrants, such as Rivian, and 2023 saw a development of a new battery coating by Lucid Motors designed to support ultra-fast charging to cater to the high-performance segment of the market. All of the examples serve to demonstrate that key players are making calculated moves that will allow them to cater to different consumer segments and expand the presence of the market, thus making the total number of customers for EVs even more substantial. Such an influx in innovation is likely to create an increased demand for advanced battery coatings, as the route of growth of the EV market is likely to also witness an upshift.

Restrain

-

Limited Availability of Skilled Labor may pose a challenge for the future growth.

Advanced battery coating techniques, like Chemical Vapor Deposition (CVD), Plasma-Enhanced CVD (PECVD), and Atomic Layer Deposition (ALD), come at a premium price. This leads to higher costs for the final batteries, as these technologies are used to coat critical components like anodes, cathodes, and electrolytes. When raw materials are also expensive, the price of the finished product rises, and this automatically affects the global battery coating market growth.

Opportunities

-

Developing specialized coatings for the Recycling of battery materials

Intensive research and development (R&D) are focused on technologies like Atomic Layer Deposition (ALD) and Chemical Vapor Deposition (CVD) – these hold immense promise for creating batteries with superior durability and performance. The incorporation of nanotechnology in battery coatings offers improved performance and safety. Nanoscale materials can enhance the conductivity, stability, and lifespan of batteries, leading to more efficient energy storage systems.

Market segmentation

By Type

Atomic layer deposition (ALD) dominated the battery coating market and held the market share of around 38.23% in 2023 by type. This dominance is fueled by its growing use in both battery manufacturing and research. ALD stands out as a thin-film deposition technique because it can create incredibly uniform and precise coatings on battery electrodes. Unlike other methods, ALD allows for coatings as thin as a few nanometers; while ensuring they flawlessly cover the entire surface (conformal). This exceptional control over thickness and uniformity translates to better battery performance and a longer lifespan. The demand for electric vehicles with high-performance batteries is a key driver for the ALD segment's growth, especially in the automotive industry.

By Battery Component

The Electrode coating segment has grown within the battery component market in 2023. This boom is driven by the 65% market share due to growing popularity of advanced electrode materials by battery components. These materials, including silicon, graphene, and carbon nanotubes, unlock new possibilities for battery performance. However, they require specialized coatings to reach their full potential. Battery electrodes are the workhorses of the battery world, constantly storing and releasing electrical energy. By applying thin-film coatings, manufacturers can significantly enhance their performance and lifespan, further fueling the demand for electrode coatings in the battery industry.

By Battery Type

Lithium-ion batteries are taking the lead in the global battery coating market as they continue to dominate all kinds of batteries based on their use. These batteries are highly prevalent across many industries comprising electric vehicles, consumer electronics, and renewable energy storage systems, and have been proven to offer great levels of duty. Complementing this is their higher energy density, longer cycle life, and lighter weight compared to other battery types, such as lead-acid or nickel-cadmium. This makes the use of lithium-ion batteries a feasible choice for applications that require high efficiency, compactness, and longevity.

By Material Type

Polyvinylidene fluoride (PVDF) sub- segment has led the market in 2023 and has captured around 55% of the market share by material type. This growing popularity within lithium-ion batteries across various applications, from electric vehicles powering our commutes to consumer electronics keeping us connected and renewable energy systems storing clean energy. PVDF, Thermoplastic fluoropolymer combination of properties it's highly resistant to chemicals, can withstand high temperatures, and boasts remarkable mechanical strength.

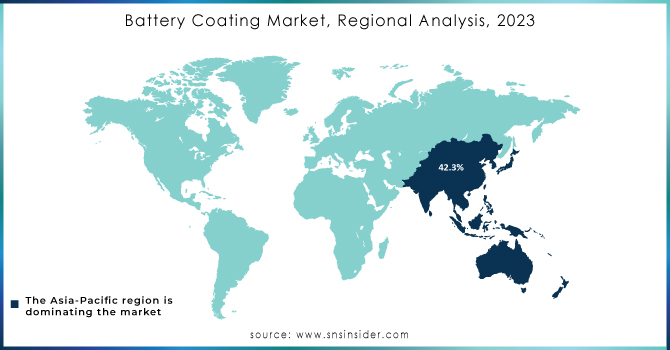

Regional Analysis

The Asia-Pacific region dominated the battery coating market, held over 42.3% market share in both value and volume in 2023. This dominance stems from a powerful combination of factors. Firstly, the region boasts a powerhouse lineup of battery giants – CATL, BYD, LG Chem, and Panasonic all fueling the demand for cutting-edge battery coatings. These industry titans are pouring resources into R&D, striving to develop high-performance, cost-conscious battery technologies. For instance, in 2022, CATL, a leading Chinese battery manufacturer, announced the expansion of its battery production capacity with the integration of new coating technologies that enhance battery efficiency and lifespan, catering to the booming EV market.

Moreover, major electronics manufacturers in the region and the expanding renewable energy sector have fueled the demand for high-performance batteries, driving the need for advanced coating solutions. The region's rapid economic growth, increasing urbanization, and the adoption of cutting-edge technologies ensure that Asia-Pacific remains at the forefront of the global battery coating market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The major key players listed in the Battery Coating Market are KEYENCE CORPORATION, APV Engineered Coatings, Asahi Kasei Corporation, Arkem SA, Axalta Coating Systems Ltd, Nano Solutions, Durr, Ube industries Ltd, Tanaka Chemical Corporation, Solvay, SK innovation and other players.

Recent Developments

In October 2023, Xerion Advanced Battery Corp. secured the top prize in the U.S. Department of Energy's American-Made Geothermal Lithium Extraction, thanks to their innovative technology.

In March 2023, Solvay's Xydar® LCP portfolio gained a safety game-changer with the introduction of a new high-heat and flame-retardant grade specifically designed for EV battery components

In April 2024, UBE Corporation has introduce U-BE-INFINITY™! This brand signifies a commitment to developing and delivering cutting-edge eco-friendly products and technologies. U-BE-INFINITY™ products are designed to make a significant positive impact. They offer innovative solutions to combat pressing global environmental challenges.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 325 Million |

| Market Size by 2032 | US$ 1130 Million |

| CAGR | CAGR of 14.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Atomic Layer Deposition (ALD), Plasma Enhanced Chemical Vapor Deposition (PECVD), Chemical Vapor Deposition (CVD), Dry Powder Coating, Physical Vapor Deposition (PVD)) • By Battery Component (Electrode Coating, Separator Coating, Battery Pack Coating) • By Battery Type, Lithium-Ion Battery, Lead-Acid Battery, Nickel-Cadmium Battery, Graphene Battery) • By Material Type (Polyvinylidene Fluoride (PVDF), Ceramic, Alumina, Oxide, Carbon, Polyurethane (PU), Epoxy, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | KEYENCE CORPORATION, APV Engineered Coatings, Asahi Kasei Corporation, Arkem SA, Axalta Coating Systems Ltd, Nano Solutions, Durr, Ube industries Ltd, Tanaka Chemical Corporation, Solvay, SK innovation |

| DRIVERS | • Consumer demand for Electric vehicle drives battery coating market • Technological Advancements to Enhanced Battery Performance in battery industry |

| Restraints | • High costs of battery coating technologies could stall market growth • Limited Availability of Skilled Labor may pose a challenge for the future growth. |